Entertainment Contract Document For Construction In Nevada

Description

Form popularity

FAQ

Here are four main construction contracts to choose from, plus their pros and cons: Lump-Sum Contracts. Cost-Plus-Fee Contracts. Guaranteed Maximum Price Contracts. Unit-Price Contracts.

You can sue a contractor for breach of contract, even without a written contract. (Actually, the contractor can sue you as well, for failing to uphold your end of the oral agreement.)

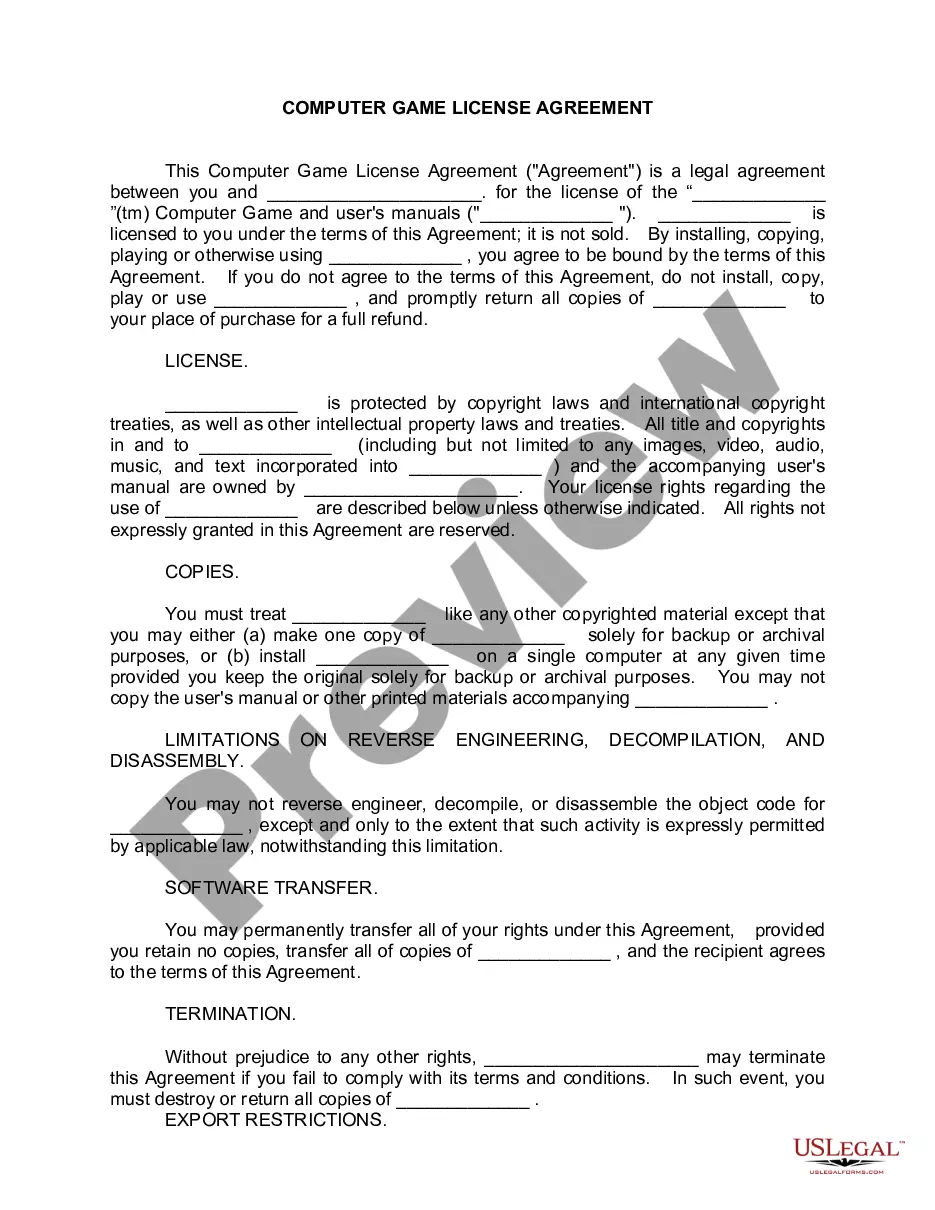

Key elements of an entertainment contract Parties involved. Clearly identify all parties involved in the contract. Scope of work. Detail the specific services or performances expected. Compensation. Duration of contract. Intellectual property rights. Confidentiality. Termination clauses. Indemnity and liability.

Does a 1099 contractor need a business license? Whether you need a business license as an independent contractor depends on your state and local laws. Most state laws don't require independent contractors to have a business license, except for Alaska and Washington state.

How To Write A Construction Contract With 7 Steps Step 1: Define the Parties Involved. Step 2: Outline the Scope of Work. Step 3: Establish the Timeline. Step 4: Determine the Payment Terms. Step 5: Include Necessary Legal Clauses. Step 6: Address Change Orders and Modifications. Step 7: Sign and Execute the Contract.

Top 10 Common Mistakes that We See in Construction Contracts It's not written down. Both parties haven't signed the contract. Not all of the terms of the agreement are in writing and in the contract. The timeline is unclear. Particular terms aren't defined. There's no written approval of any changes to the contract.

Other types of organizations and companies are exempt from filing for a business license, including government entities, non-profit organizations (religious groups, fraternal organizations, and charitable organizations), a person who is a natural citizen and operates a business from their home if the business does make ...

If you receive a 1099 form for any work performed in Nevada, or if you are an owner of a business, you need a state business license. DO I QUALIFY FOR AN EXEMPTION? license requirement. Exemptions are listed in Nevada Re- vised Statutes 76.020(2) and Nevada Administrative Code 76.

You don't necessarily have to have a business for payments for your services to be reported on Form 1099-NEC. You may simply perform services as a nonemployee. The payer has determined that an employer-employee relationship doesn't exist in your case.

WHO NEEDS A BUSINESS LICENSE? If you receive a 1099 form for any work performed in Nevada, or if you are an owner of a business, you need a state business license.