Sublease Homes For Rent In Middlesex

Description

Form popularity

FAQ

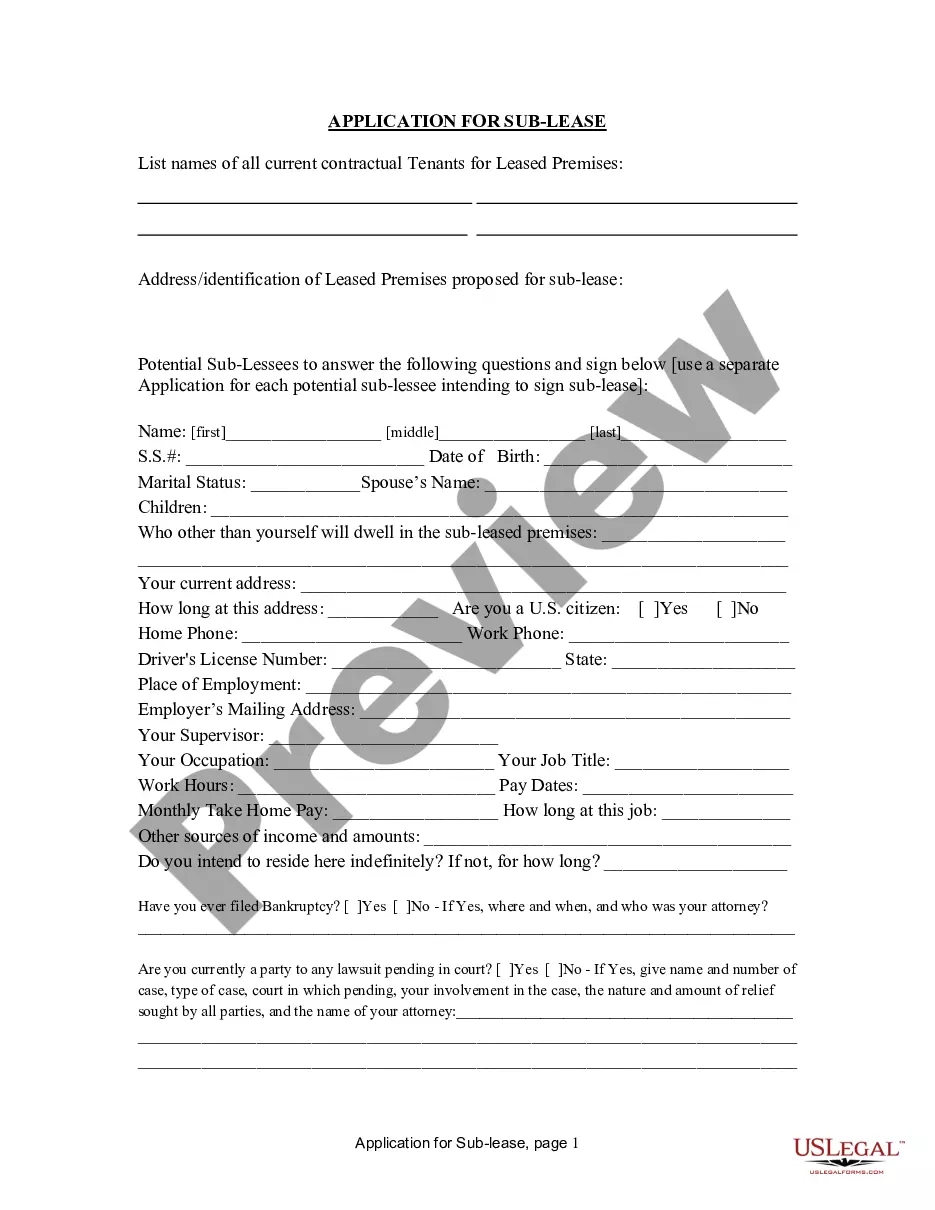

How to Write One Identify all parties to the contract. Define the lease term. Identify the terms and rent amount. Address any other financial responsibilities. Discuss the terms of the security deposit. List any other restrictions. Date and sign the agreement. Attach a copy of the original lease.

How to Write One Identify all parties to the contract. Define the lease term. Identify the terms and rent amount. Address any other financial responsibilities. Discuss the terms of the security deposit. List any other restrictions. Date and sign the agreement. Attach a copy of the original lease.

The Landlord hereby consents to the Tenant's sublease of the Lease to the New Tenant on the terms of the sublease of the Lease, a copy of which is attached as Exhibit B (the "Sublease"). The Landlord's consent to the sublease does not constitute consent to any subsequent subleases or assignments of the Property.

Lessee shall not assign this Lease or sublet any portion of the Premises without prior written consent of the Lessor, which shall not be unreasonably withheld. Any such assignment or subletting without consent shall be void and, at the option of the Lessor, may terminate this Lease.

You can generally use Schedule E (Form 1040), Supplemental Income and Loss to report income and expenses related to real estate rentals.

Subletting Can Impact Property Values Parking becomes difficult, there are higher utility costs, and the neighborhood won't be as appealing to prospective buyers.

Real Property Law Section 226-b in conjunction with the Rent Stabilization Law gives tenants the right to sublease their apartment for a period of two out of every four years. In order to sublease an apartment, it is necessary that prior to the subleasing that the apartment be the tenants' primary residence.

Subletting is risky. It comes with the same risks as taking on a roommate, except both people won't be there to deal with problems as they arise. If a tenant's subletter skips town or damages the apartment, the tenant is jointly and severally liable with them and could get stuck with the bill.

You can generally use Schedule E (Form 1040), Supplemental Income and Loss to report income and expenses related to real estate rentals.