Notice Beneficiaries Form With Two Points

Description

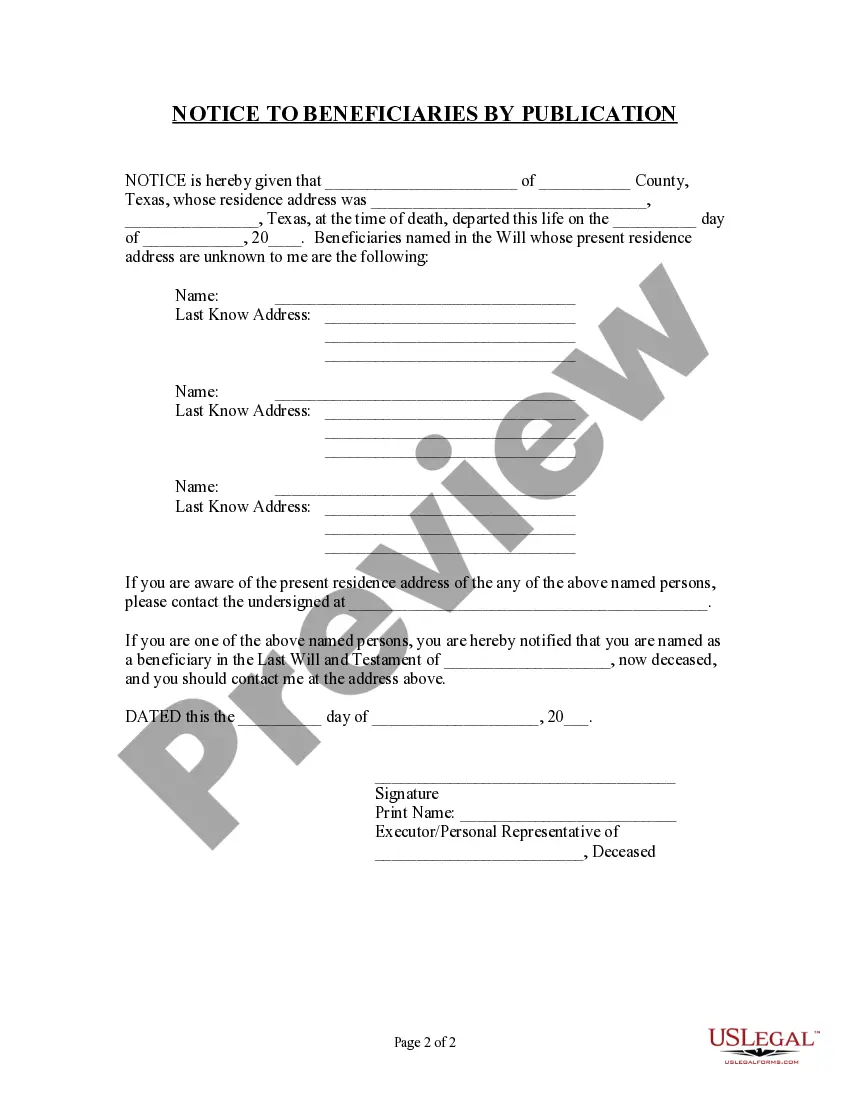

How to fill out Texas Notice To Beneficiaries Of Being Named In Will?

Dealing with legal documentation and processes can be a lengthy addition to the day.

Notice Beneficiaries Form With Two Points and forms similar to it typically require you to locate them and comprehend how to finish them efficiently.

As a result, whether you are managing financial, legal, or personal issues, having a comprehensive and user-friendly online repository of forms at your disposal will be extremely beneficial.

US Legal Forms is the leading online source of legal templates, featuring over 85,000 state-specific documents and a variety of tools to assist you in completing your paperwork swiftly.

Is this your first experience with US Legal Forms? Sign up and create an account in a matter of minutes to gain access to the form library and Notice Beneficiaries Form With Two Points. Then, follow the steps below to complete your document: Ensure you have identified the correct form using the Review feature and examining the form description. Select Buy Now when ready, and opt for the monthly subscription plan that suits your requirements. Click Download, then fill out, eSign, and print the form. US Legal Forms has twenty-five years of experience helping clients manage their legal documentation. Find the form you require today and streamline any process effortlessly.

- Explore the collection of pertinent documents available to you with just a single click.

- US Legal Forms provides state- and county-specific documents accessible at any time for download.

- Safeguard your document management procedures using a premium service that allows you to compile any form within moments without additional or concealed fees.

- Simply Log In to your account, locate Notice Beneficiaries Form With Two Points, and retrieve it instantly from the My documents section.

- Additionally, you can access previously downloaded documents.

Form popularity

FAQ

Life insurance beneficiaries can be individuals, such as a spouse or adult child, or entities, such as a trust. For example, if you have minor children, you may choose to establish a trust and name it as the beneficiary of your life insurance policy.

If you decide to have more than one beneficiary, you will allocate a percentage of the death benefit for each, so that the total allocation equals 100%. A simple example of this would be allocating 50% to your partner, and 25% to each of your two children, for a total of 100%.

Name only living persons as beneficiaries, unless you are naming a trust, your estate or an organization. Do not name the same person or organization as both a primary and secondary beneficiary. Do not use the word ?or? when designating multiple beneficiaries. Do not impose any conditions on payment.

When deciding upon beneficiaries, the more specific you are, the better. Describe beneficiaries by name instead of by group. For example, if you want all your children to inherit, name them individually. Stepchildren aren't beneficiaries unless they're specifically named in your will or other estate documents.

Beneficiary designations allow you to transfer assets directly to individuals, regardless of the terms of your will. Beneficiary designations are often made when a financial account, retirement account, or life insurance policy is established.