Quit Claim Deed Form For Ohio

Description

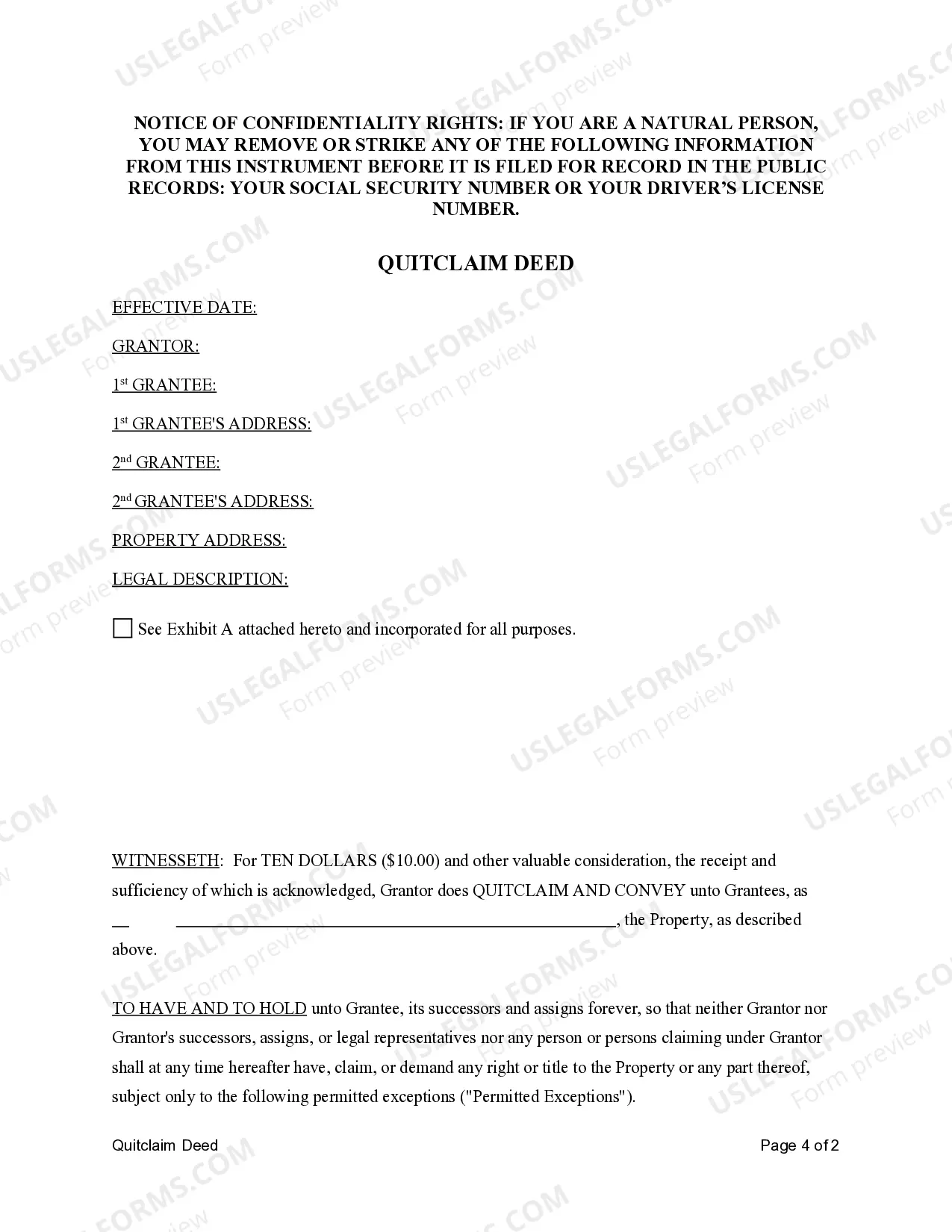

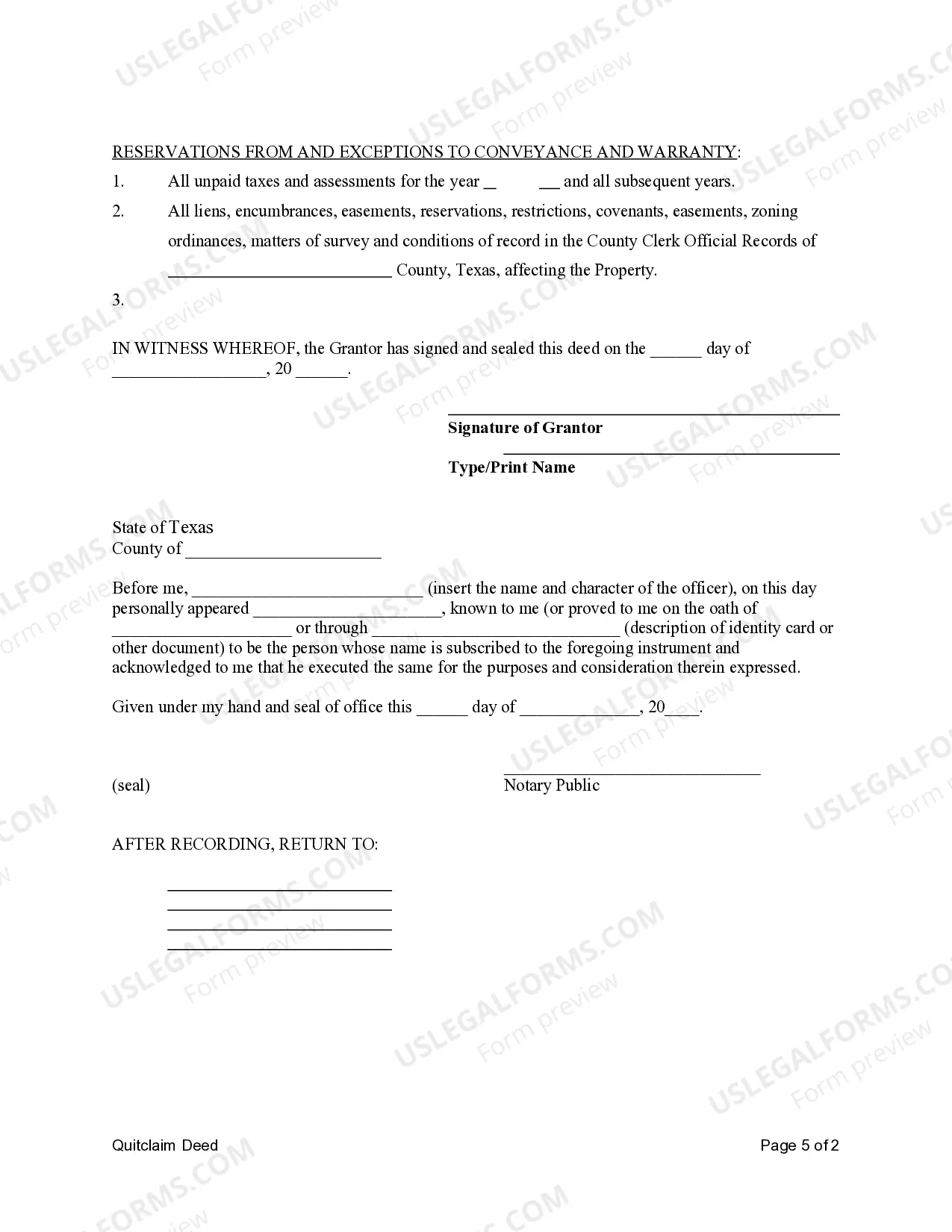

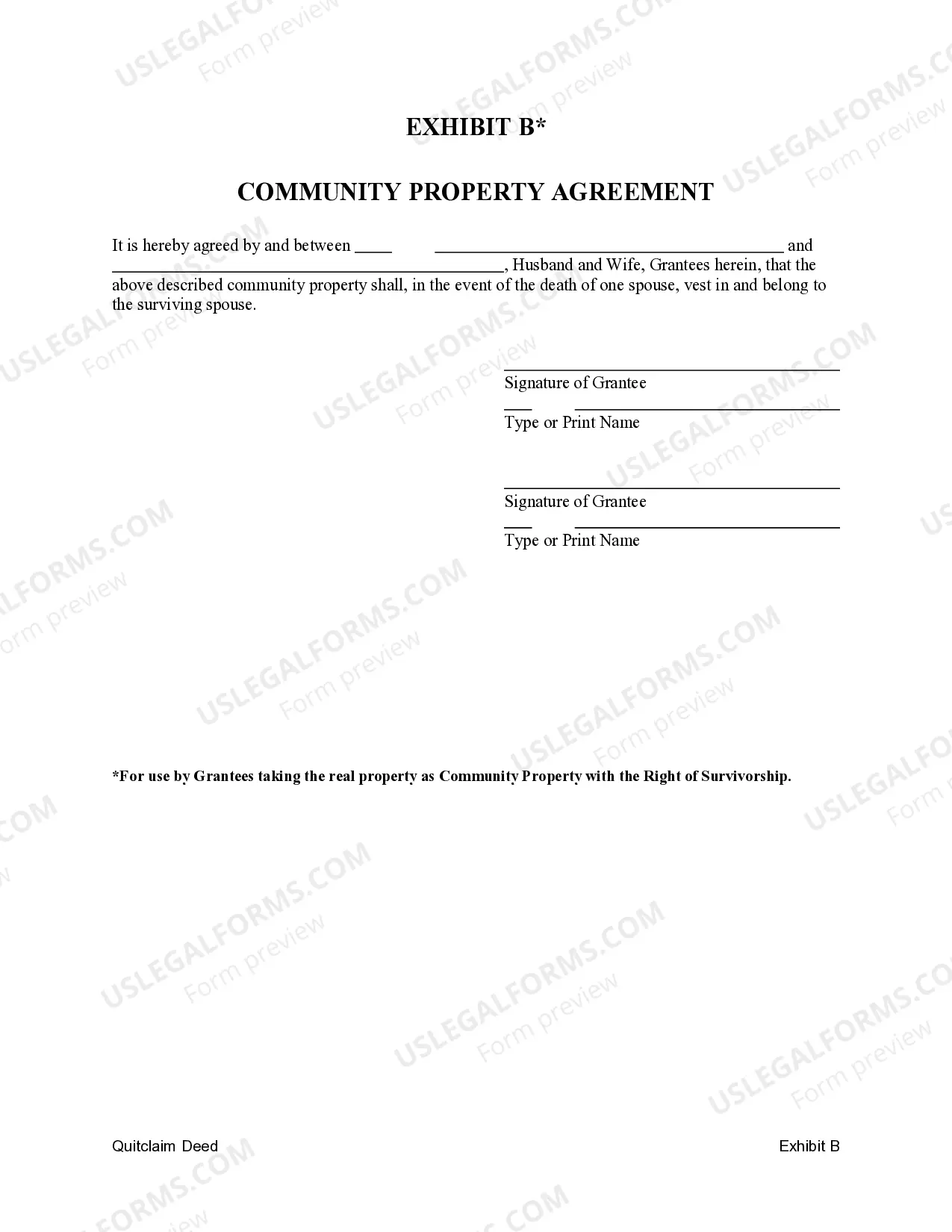

How to fill out Texas Quitclaim Deed For Husband To Husband And Wife As Community Property Or Community Property With Right Of Survivorship?

- Log into your US Legal Forms account. If you're a first-time user, create an account to start accessing our huge library.

- Search for the quit claim deed form specific to Ohio. Use the Preview mode to confirm that you have selected the correct template that complies with local requirements.

- If the template is not a perfect fit, utilize the Search tab to find any alternative forms that may suit your needs better.

- Purchase the form by clicking the Buy Now button. Choose the subscription plan that best meets your requirements.

- Complete your transaction by entering your payment details through a credit card or PayPal account.

- Download the form to your device, allowing you to fill it out at your convenience. You can also access it anytime through the My Forms section in your profile.

In conclusion, US Legal Forms streamlines the process of obtaining essential legal documents like the quit claim deed form for Ohio. With a vast library and expert support available, users can ensure they have the right tools to fulfill their legal needs effectively. Start your journey with us today!

Get started by visiting US Legal Forms now!

Form popularity

FAQ

People often use a quit claim deed form for Ohio to clarify ownership or transfer property between family members or friends. This deed allows one party to relinquish any claim they have on a property, making it a practical choice for informal transactions. It’s commonly used in divorce settlements, transferring property to heirs, or adding a spouse to a title. Always ensure that proper documentation accompanies any quit claim deed to protect all parties involved.

Yes, you can file a quit claim deed form for Ohio yourself. The process is straightforward, and you can easily obtain the necessary form from online resources or your local government office. Fill it out carefully, have it notarized, and submit it to your county recorder's office. However, consider consulting with a legal professional if you have complex situations or questions.

To transfer a property title to a family member in Ohio, you can use a quit claim deed form for Ohio. Begin by filling out the deed with the relevant property information and details about the family member receiving the title. Sign the document in front of a notary, then file it with your local county recorder’s office. This step will officially update the property records to reflect the new ownership.

To file a quit claim deed form for Ohio, first, you need to complete the form with accurate property details and the names of the parties involved. Next, sign the document in front of a notary public to ensure its validity. After that, you must submit the completed quit claim deed to your county recorder's office, along with any required fees. Make sure to keep a copy for your records.

Certainly, you can do a quit claim deed yourself, provided that you follow the necessary steps. Completing a quit claim deed form for Ohio requires filling out the form correctly, signing it, and filing it with the appropriate county office. Using resources like US Legal Forms simplifies your task by offering clear instructions and valid templates that can help you avoid mistakes.

Yes, you can complete a quit claim deed form for Ohio on your own, but it involves understanding the legal process. If you feel confident in your ability to handle documentation and state requirements, you can fill out the form and submit it to the county recorder's office. However, consider using US Legal Forms for guided templates to ensure that you meet all legal standards.

A quit claim deed form for Ohio can transfer property ownership, but it does come with risks. One major disadvantage is that it conveys no guarantees about the property's title; if issues arise with the title, the grantee could face complications. Additionally, using a quit claim deed does not provide the protection found in warranty deeds, making it crucial to understand the implications before proceeding.

You can obtain a quit claim deed form for Ohio at various locations, including county clerk offices and online legal service platforms. US Legal Forms offers user-friendly access to the necessary quit claim deed form specific to Ohio. Simply visit their website to download the form you need quickly and efficiently.

The main disadvantage of a quitclaim deed is that it does not assure the recipient of clear title to the property. If there are existing liens or title issues, the recipient may face unforeseen challenges after the transfer. This lack of protection can deter some people from using a quit claim deed form for Ohio. It is advisable to conduct a title search before using this option or consult with a legal expert for guidance.

Quitclaim deeds are often seen in a negative light because they offer no guarantees about the property title. When you use a quit claim deed form for Ohio, you essentially convey whatever interest you have, which can lead to potential legal disputes if issues arise after the transfer. This lack of warranty means that the recipient assumes the risk, prompting many to prefer traditional methods of transferring property that provide more protection.