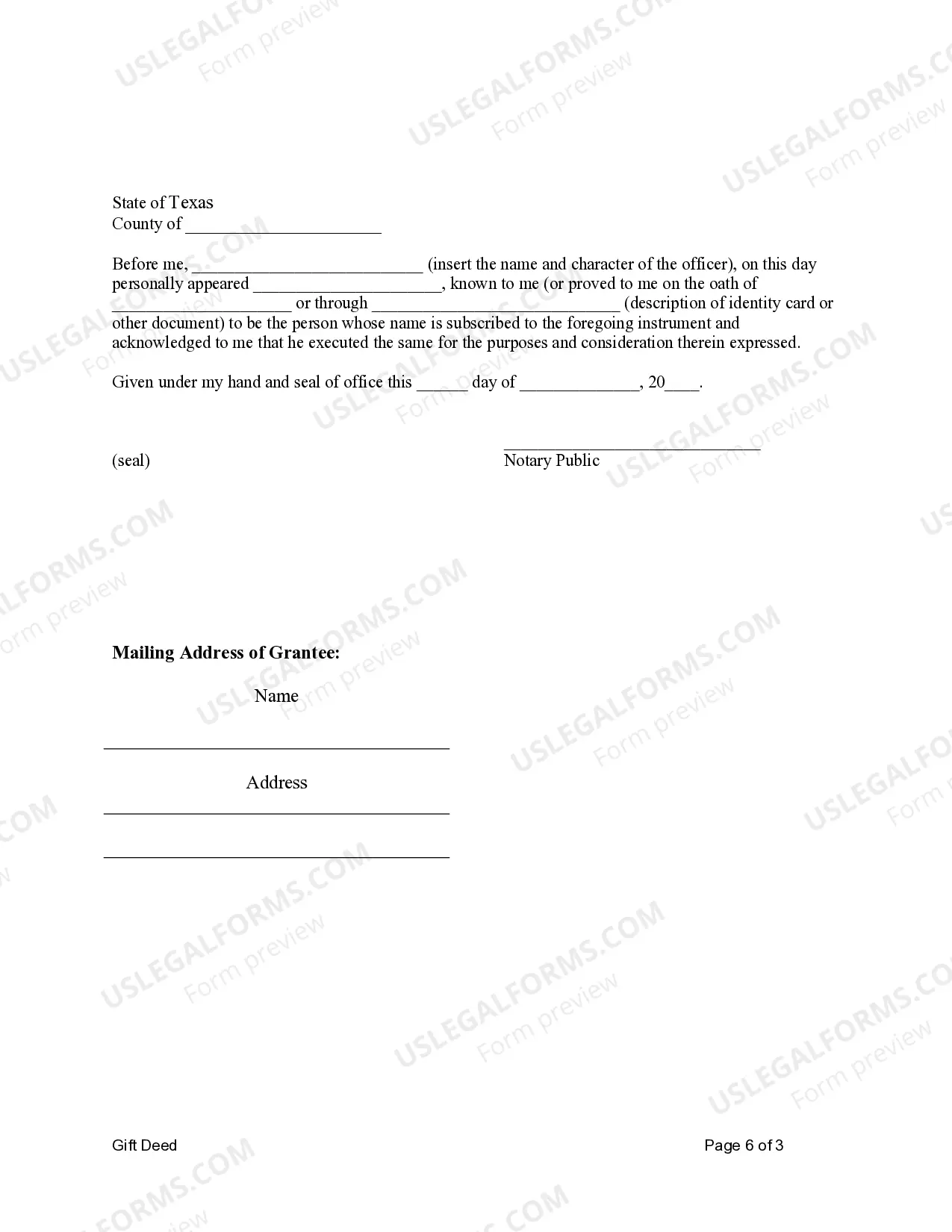

Gift Deed Format For Immovable Property

Description

How to fill out Texas Gift Deed For Individual To Individuals As Joint Tenants?

Handling legal documents and processes can be a lengthy addition to your day.

Gift Deed Format For Immovable Property and similar forms generally necessitate that you locate them and figure out how to fill them out correctly.

As a result, whether managing financial, legal, or personal issues, possessing a comprehensive and easily accessible online directory of forms at your fingertips will greatly assist.

US Legal Forms is the leading online platform for legal templates, providing over 85,000 state-specific documents and various tools to help you complete your forms swiftly.

Simply Log In to your account, search for Gift Deed Format For Immovable Property, and download it directly from the My documents section. You can also retrieve previously saved forms.

- Explore the collection of relevant documents available to you with a single click.

- US Legal Forms provides state- and county-specific documents ready for download at any time.

- Protect your document management practices by utilizing a reliable service that enables you to create any form within minutes without additional or undisclosed charges.

Form popularity

FAQ

To establish that an owner is a New Mexico resident or maintains a principal place of business in New Mexico and that the PTE thus has reasonable cause not to withhold, the PTE may rely on an owner's New Mexico address on Form 1099Misc or RPD-41359, Annual Statement of Pass-Through Entity Withholding.

Taxpayers, tax professionals and others can access the new forms and instructions at tax.newmexico.gov by opening the Forms & Publications page and then the Income Taxes folder.

Check out the easy steps to download ITR forms in PDF from the official website of the Income Tax department: Log in to the official website of .incometaxindia.gov.in. Select the year on the right side of the page.

Personal Income Tax and Corporate Income Tax forms for the 2021 tax year are now available online. Taxpayers, tax professionals and others can access the new forms and instructions at tax.newmexico.gov by opening the Forms & Publications page and then the Income Taxes folder.

New Mexico requires anyone engaged in business in New Mexico to register with the Taxation and Revenue Department. During registration, each business will be provided with a State Tax ID number, also known as a Combined Reporting System (CRS) ID Number.

Every person who is a New Mexico resident or has income from New Mexico sources. Every person who is required to file a federal income tax return.

1-866-285-2996. Call Center hours are Monday through Friday, a.m. to p.m, taking new calls from 8 a.m. to p.m and returning calls during the extended hours.

If you are already registered with the New Mexico Taxation and Revenue Department,, you can find your CRS Identification Number and filing frequency online or on correspondence from the New Mexico Taxation and Revenue Department.