Texas Estate Form For Everything

Description

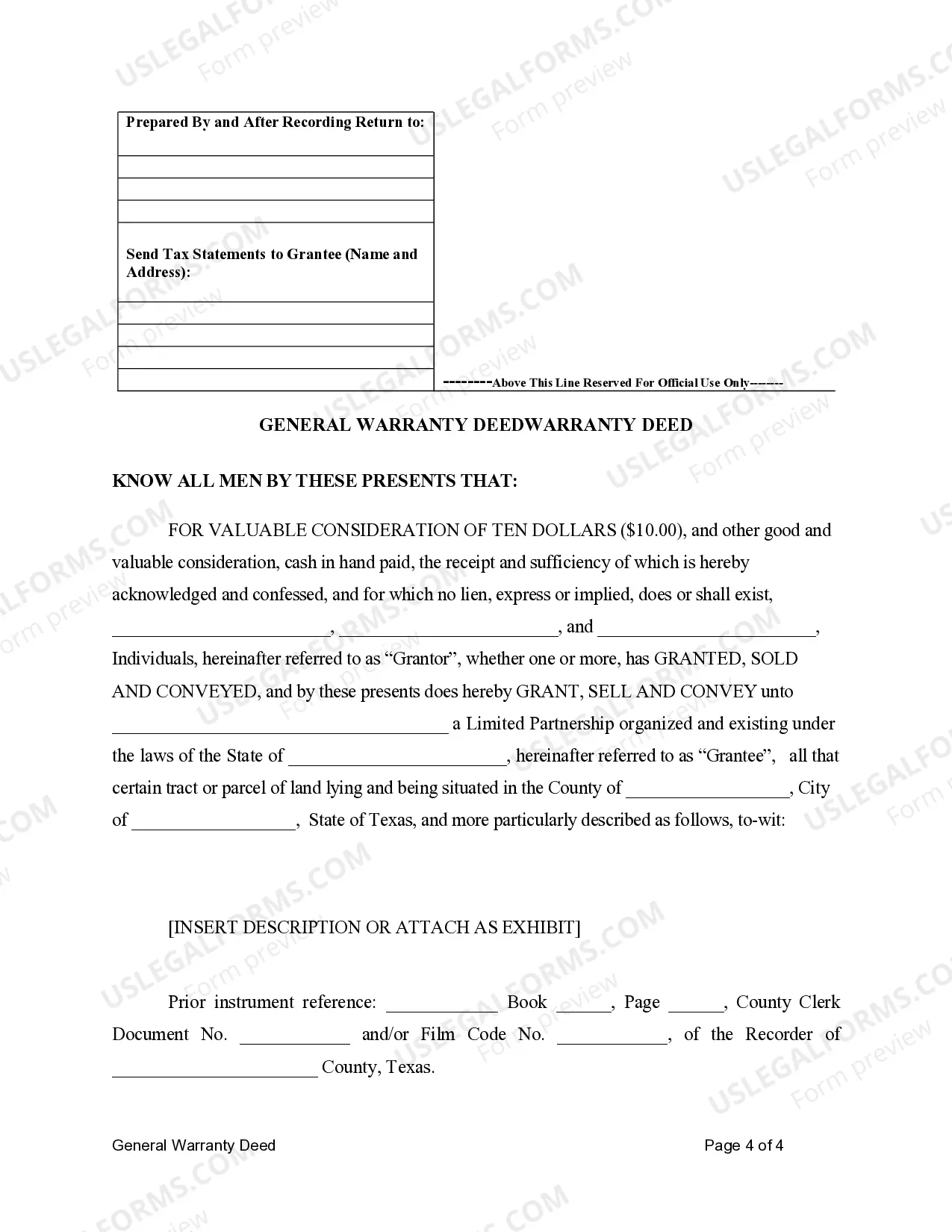

How to fill out Texas General Warranty Deed For Three Individuals To Limited Partnership?

- Log in to your US Legal Forms account if you're a returning user. Click the Download button for the form template you need. Ensure your subscription is active; renew if necessary.

- If you’re new to US Legal Forms, start by checking the Preview mode and reading the form description to confirm that it meets your requirements.

- If the form doesn't suit your needs, utilize the Search feature to find an appropriate template that aligns with your state’s legal standards.

- Once you identify the correct document, click the Buy Now button, select your subscription plan, and create an account to access the entire library.

- Complete your purchase by entering your payment details or using PayPal for a secure transaction.

- Download your form to your device, and access it anytime through the My Forms section in your profile.

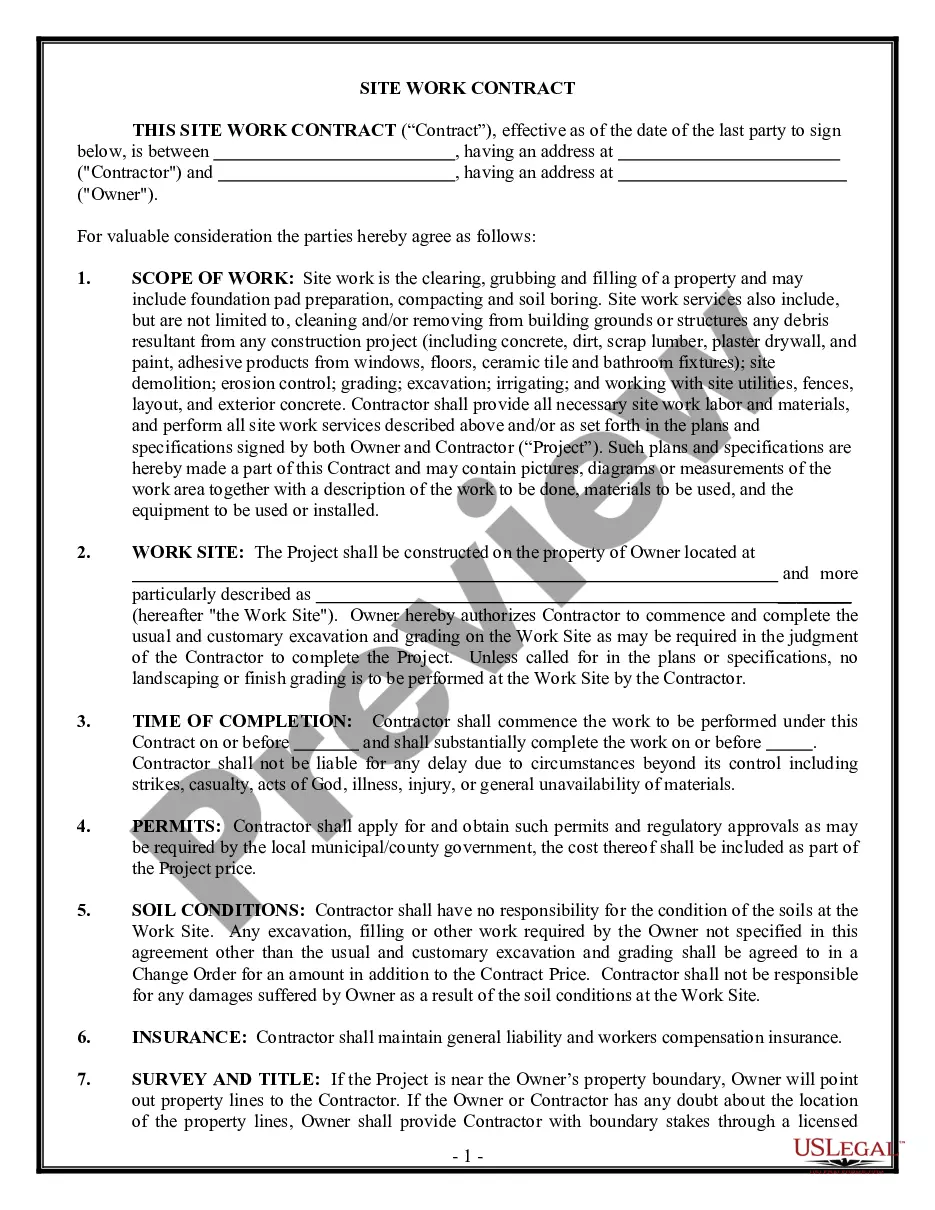

US Legal Forms offers a robust collection of legal documents, with more options than any competitor at a similar price. Their extensive library includes over 85,000 templates tailored for various legal needs.

With access to premium experts, you can ensure your legal documents are completed accurately and are legally sound. Start planning your estate today with US Legal Forms!

Form popularity

FAQ

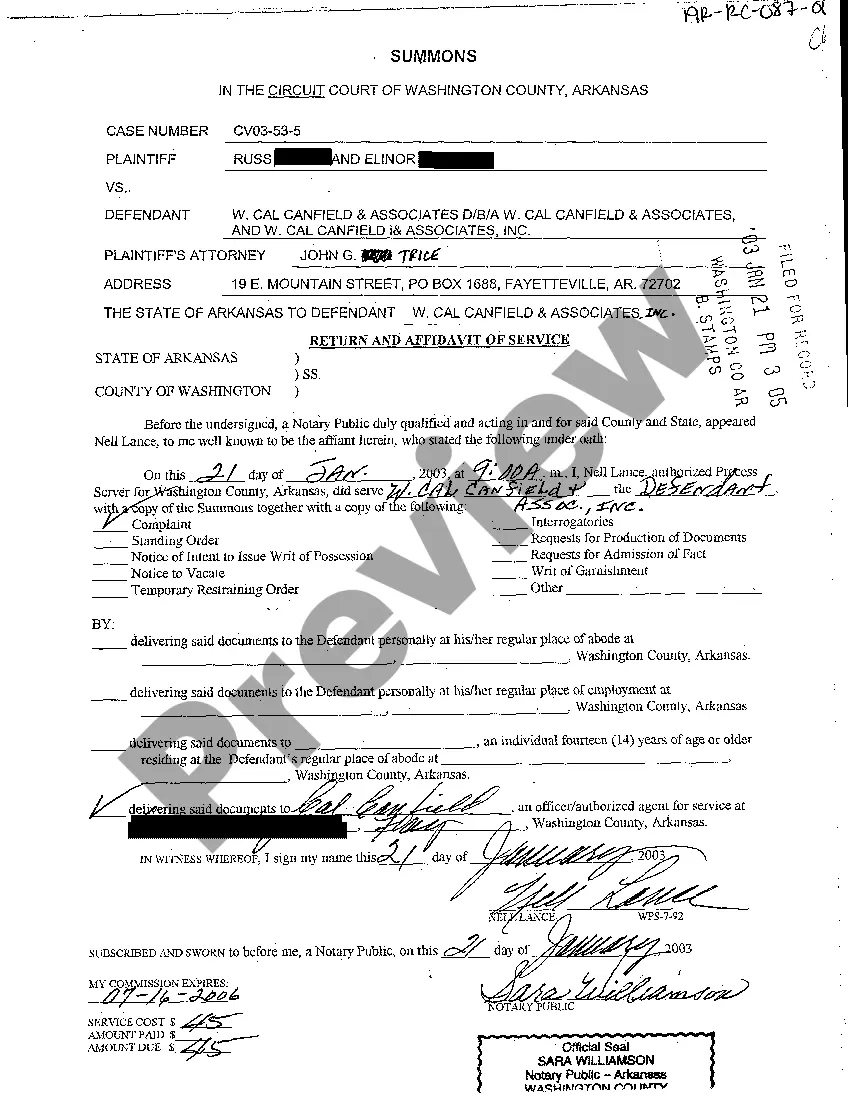

Yes, you can probate an estate without a lawyer in Texas. While handling probate matters on your own may save you legal fees, it is crucial to approach the process with care and attention to detail. A Texas estate form for everything can provide helpful templates and guides, making it more manageable to navigate the necessary legal pathways.

No, hiring an attorney to probate a will in Texas is not mandatory. Many individuals choose to represent themselves, especially in straightforward cases. By utilizing a Texas estate form for everything, you can access the essential tools and information needed to manage the probate process on your own.

Yes, you can file probate yourself in Texas if you feel confident handling the paperwork and court procedures. While it is entirely possible, ensure that you are aware of all essential requirements to avoid mistakes. Using a Texas estate form for everything can be a vital resource to guide your filing process smoothly and efficiently.

To probate a will in Texas, you will typically need several key forms, including the application for probate and the original will. Additionally, other forms may be required depending on the specifics of the estate. Accessing a Texas estate form for everything can help ensure you have all the necessary documentation ready and organized.

Yes, you can file probate in Texas without hiring a lawyer. However, navigating the process can be complex, so it is important to understand the necessary steps and forms required. To help streamline your experience, you can utilize a Texas estate form for everything, which offers clear guidance and simplifies the paperwork involved.

Filling out an estate inventory involves listing all assets owned by the deceased, along with their estimated values. You first need to gather necessary documents such as property deeds, bank statements, and investment records. Once you have this information, you can use a Texas estate form for everything, which simplifies the process and ensures compliance with state requirements. This form helps you organize details systematically to make the probate process smoother.

Texas does not have a strict minimum estate value for probate, but smaller estates may qualify for expedited procedures. Generally, if the estate is valued at less than $75,000, it may avoid probate through simpler means. To explore how to manage your estate effectively, a Texas estate form for everything can provide guidance and help you navigate state requirements easily.

When handling an estate in Texas, you will need several important documents. The primary items include the deceased's will, a death certificate, and any documents related to assets such as titles and bank statements. Having a Texas estate form for everything can help you gather and organize these necessary documents, ensuring a smoother process for settling the estate.

In Texas, assets that must generally go through probate include real estate and personal property solely owned by the deceased. Bank accounts, vehicles, and valuable collectibles typically require probate if they exceed specific thresholds. To manage the process effectively, consider using a Texas estate form for everything, which can streamline asset distribution and compliance with state laws.

Several factors determine whether a will goes to probate in Texas. The type of assets left by the deceased and the clarity of the will play significant roles. If the estate includes property owned solely by the deceased, probate is likely required. Utilizing a Texas estate form for everything helps clarify the situation and eases the overall transition.