Promissory Note Template Texas With Signature

Description

How to fill out Texas Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

Whether for commercial goals or for private issues, everyone must confront legal circumstances eventually in their lifetime.

Completing legal documents requires meticulous care, beginning with selecting the correct form template.

Choose your payment method: utilize a credit card or PayPal account. Opt for the file format you desire and download the Promissory Note Template Texas With Signature. After it is downloaded, you can complete the form using editing software or print it to finish manually. With an extensive US Legal Forms catalog at your disposal, you never have to waste time searching for the suitable template online. Utilize the library’s straightforward navigation to locate the right template for any situation.

- For example, if you select an incorrect version of a Promissory Note Template Texas With Signature, it will be rejected upon submission.

- Hence, it is crucial to have a reliable source of legal documents such as US Legal Forms.

- If you need to acquire a Promissory Note Template Texas With Signature template, follow these straightforward steps.

- Retrieve the template you require using the search field or catalog browsing.

- Review the form’s description to verify it corresponds to your situation, state, and area.

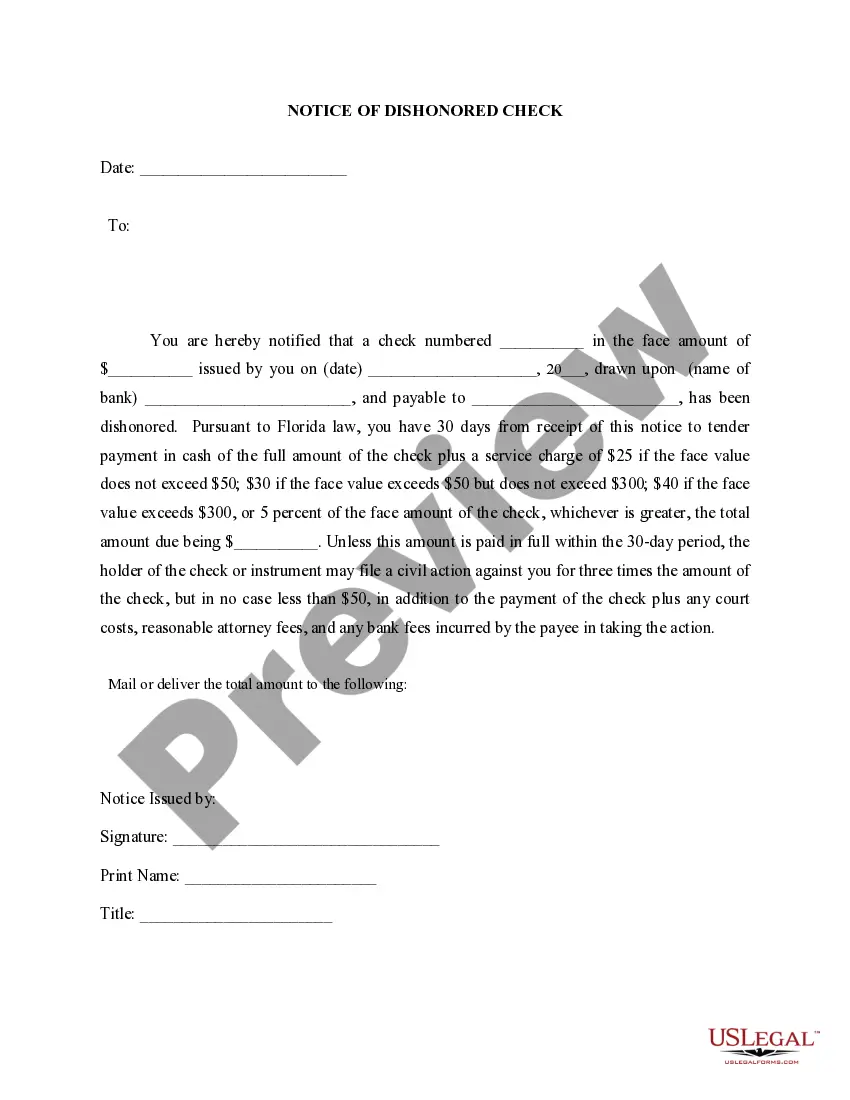

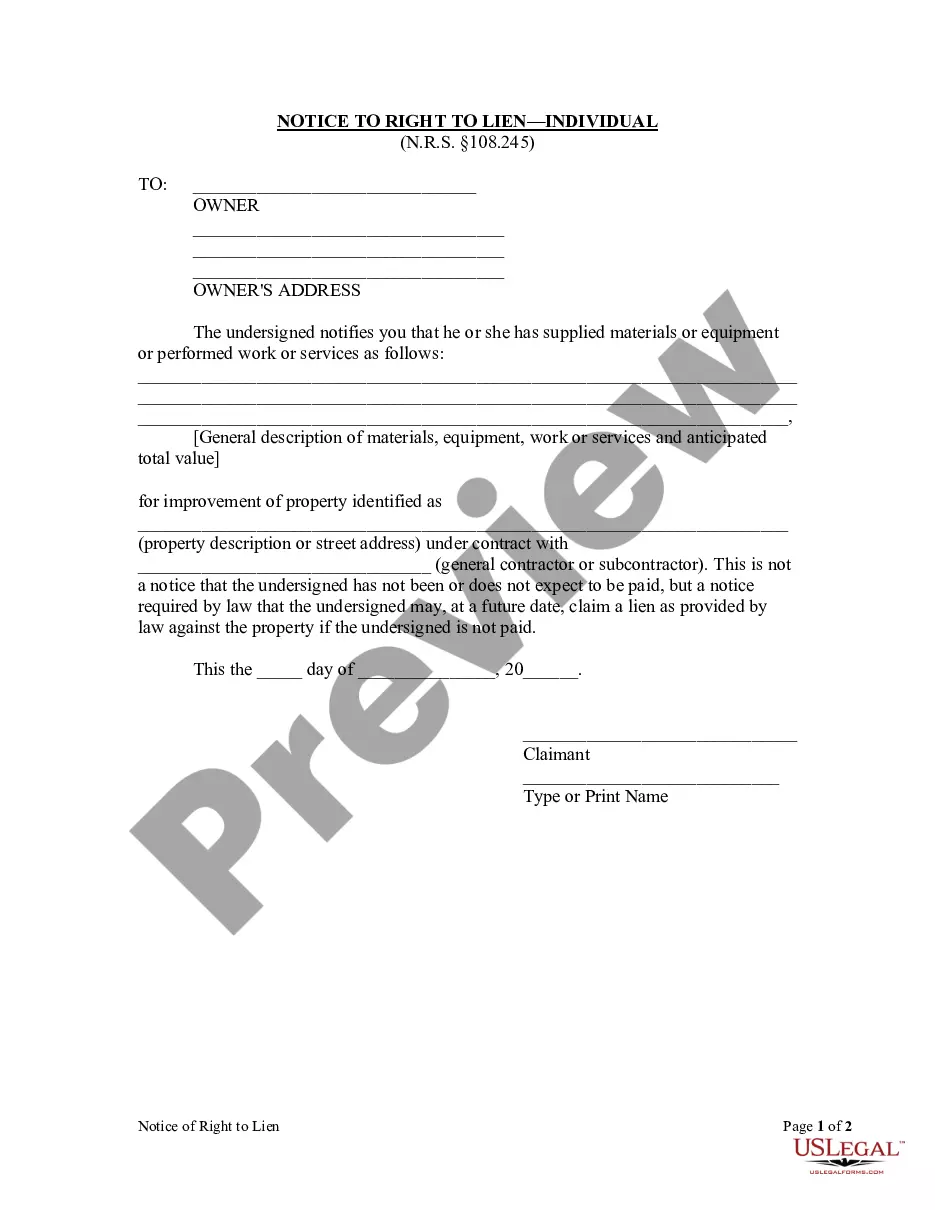

- Click on the form’s preview to examine it.

- If it is not the correct document, return to the search feature to find the Promissory Note Template Texas With Signature version you need.

- Obtain the template when it fulfills your requirements.

- If you already possess a US Legal Forms account, click Log in to access previously saved documents in My documents.

- If you have not created an account yet, you can acquire the form by clicking Buy now.

- Select the relevant pricing option.

- Fill out the account registration form.

Form popularity

FAQ

A promissory note could become invalid if: It isn't signed by both parties. The note violates laws. One party tries to change the terms of the agreement without notifying the other party.

The promissory note could be declared invalid if it doesn't reveal the amount that the borrower owes the lender, or what installments are due. If there are multiple installments, then include each installment's due date.

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral? ... Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

No. Promissory notes do not need to be notarized. The borrower only needs to sign the document to make it legally enforceable.

Texas Secured Promissory Note The date of inception of the note. The names and addresses of all the parties involved as well as the information of the witness that gives the document validity. The loan amount and the details of how and when payment will occur.