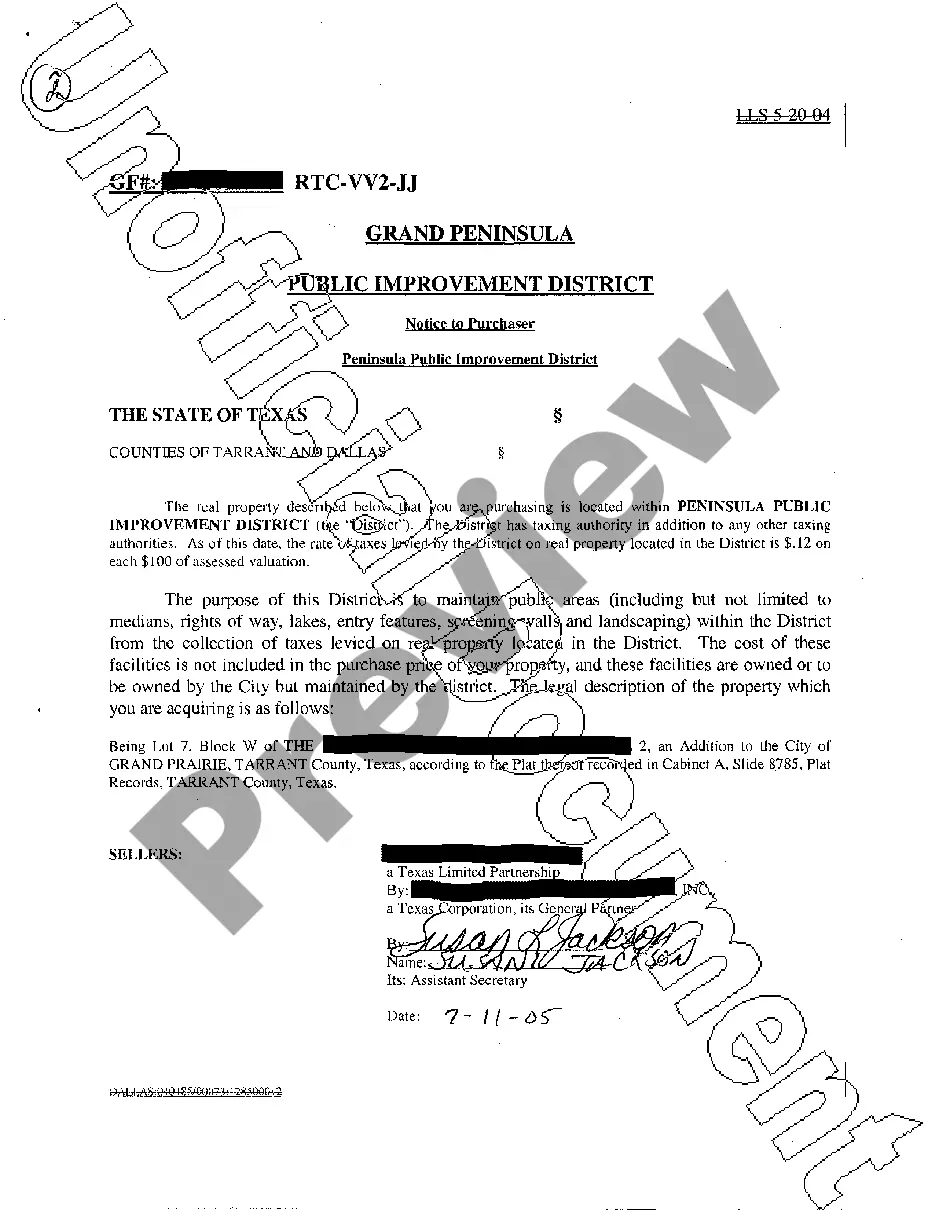

Notice To Purchaser District 12 Form With Decimals

Description

How to fill out Notice To Purchaser District 12 Form With Decimals?

Properly prepared official documentation is among the essential safeguards against challenges and legal disputes, though acquiring it without legal assistance can require time.

Whether you're looking to swiftly locate a current Notice To Purchaser District 12 Form With Decimals or other templates related to employment, family, or business matters, US Legal Forms is consistently available to assist.

The process is even more straightforward for current users of the US Legal Forms library. If your subscription is active, you only need to Log In to your account and click the Download button next to the chosen document. Furthermore, you'll have access to the Notice To Purchaser District 12 Form With Decimals at any time in the future, as all documents ever obtained on the platform are kept available in the My documents section of your profile. Conserve time and money on preparing official documents. Experience US Legal Forms today!

- Confirm that the form meets your needs and locality by reviewing the description and preview.

- If necessary, search for another example using the Search bar in the page header.

- When you discover the suitable template, click on Buy Now.

- Select the pricing option, sign in to your account, or establish a new one.

- Choose your preferred payment method to purchase the subscription plan (using a credit card or PayPal).

- Select PDF or DOCX format for your Notice To Purchaser District 12 Form With Decimals.

- Hit Download, then print the form to complete it or upload it to an online editor.

Form popularity

FAQ

Yes, a buyer can be unrepresented in Texas, meaning they may choose not to hire a real estate agent or attorney during a property transaction. While it is legal to proceed without representation, it is often not advisable due to the complexities involved in real estate deals. Buyers should ensure they fully understand their rights and obligations. Utilizing resources like the Notice to purchaser district 12 form with decimals can help buyers navigate their responsibilities effectively.

A notice to purchaser in Texas is a crucial document that provides buyers with important information related to properties in a Municipal Utility District. This notice outlines the financial obligations a buyer may incur after purchasing the property. Familiarity with this notice is essential for safeguarding the buyer's interests. Using the Notice to purchaser district 12 form with decimals can ensure that all relevant information is thoroughly communicated.

Section 49.452 of the Texas Water Code pertains to the disclosure requirements related to a buyer's interest in property located in a Municipal Utility District. This section mandates that sellers inform buyers about any financial obligations tied to the property. Understanding this code is critical for both buyers and sellers, as it protects their legal rights. The Notice to purchaser district 12 form with decimals can facilitate compliance with these regulations.

Yes, a mud notice is required in Texas when properties fall under a Municipal Utility District (MUD). This notice informs buyers about any additional tax obligations that may arise from the district's services. Understanding this notice is crucial for making informed decisions about purchasing real estate in the district. Using the Notice to purchaser district 12 form with decimals can help ensure compliance and transparency.

Yes, you can handwrite 1099-NEC forms; however, it is not advisable due to the potential for errors. Typed forms tend to be clearer and usually preferred by the IRS. Furthermore, keeping accurate records and details in forms such as the Notice to purchaser district 12 form with decimals can prevent issues during your tax filings.

While it is possible to handwrite 1096 forms, it is recommended to submit printed forms to ensure clarity and accuracy. Handwritten submissions can lead to misinterpretation by the IRS. For consistent record-keeping, creating electronic versions along with forms like the Notice to purchaser district 12 form with decimals could streamline your filing process.

If you have made a non-deductible contribution to a Roth IRA, you must file form 8606 to report it. This is important for tracking your contributions and avoiding unnecessary taxes. Additionally, utilizing supportive documents, such as the Notice to purchaser district 12 form with decimals, can help clarify your contributions related to property purchases or investments.

Reading a W-2 involves understanding its various boxes. Each box indicates specific information, such as your earnings, taxes withheld, and contributions to retirement plans. Start by reviewing your total wages and the federal tax withheld. For a thorough understanding, comparing it with any related documents like the Notice to purchaser district 12 form with decimals aids in clarifying financial transactions.

Yes, the name on your W-2 should precisely match the name on your Social Security card to avoid any processing delays. This alignment is crucial for accurate tax reporting and benefits eligibility. If you have changes in your name, ensure that your employer updates their records prior to issuing the W-2. Keeping detailed records, such as those in the Notice to purchaser district 12 form with decimals, can help maintain consistency.

Filling out a W-2 can seem complex, but breaking it down helps. Start with your employer's name and their EIN, directly followed by your details. Make sure to include gross earnings and the taxes withheld accurately. If you encounter any confusion, utilizing resources like the Notice to purchaser district 12 form with decimals can guide the process and clarify earnings related to property purchases.