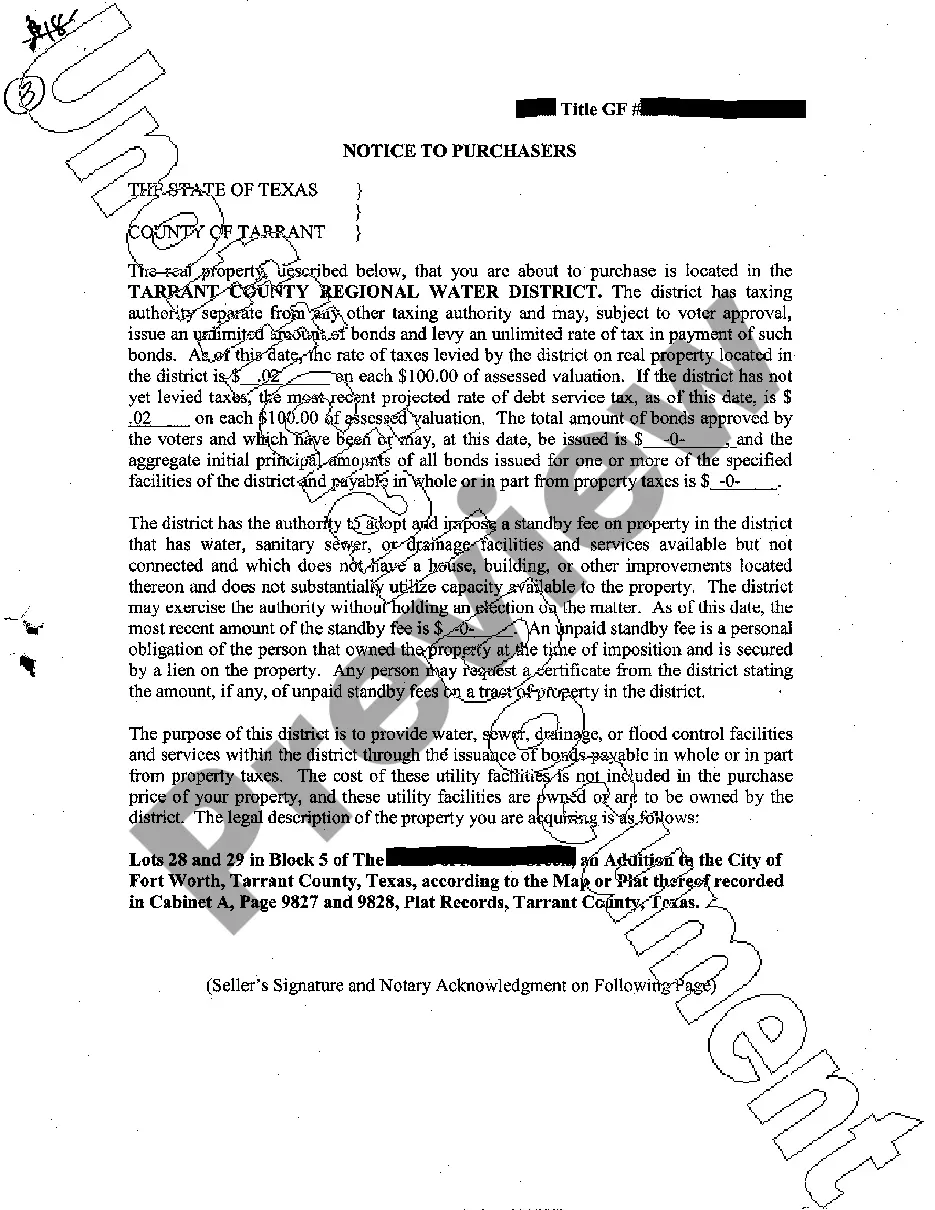

Mud Disclosure Notice Form Texas

Description

How to fill out Texas Notice To Purchasers?

Accessing legal templates that meet the federal and state regulations is essential, and the internet offers a lot of options to choose from. But what’s the point in wasting time searching for the correctly drafted Mud Disclosure Notice Form Texas sample on the web if the US Legal Forms online library already has such templates collected in one place?

US Legal Forms is the biggest online legal catalog with over 85,000 fillable templates drafted by lawyers for any professional and life case. They are easy to browse with all files collected by state and purpose of use. Our experts keep up with legislative updates, so you can always be sure your form is up to date and compliant when obtaining a Mud Disclosure Notice Form Texas from our website.

Getting a Mud Disclosure Notice Form Texas is quick and easy for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you require in the right format. If you are new to our website, adhere to the guidelines below:

- Analyze the template utilizing the Preview feature or via the text outline to make certain it fits your needs.

- Locate a different sample utilizing the search tool at the top of the page if necessary.

- Click Buy Now when you’ve found the suitable form and select a subscription plan.

- Create an account or log in and make a payment with PayPal or a credit card.

- Choose the right format for your Mud Disclosure Notice Form Texas and download it.

All templates you find through US Legal Forms are multi-usable. To re-download and complete earlier saved forms, open the My Forms tab in your profile. Take advantage of the most extensive and simple-to-use legal paperwork service!

Form popularity

FAQ

Ing to Texas House Bill 2815 which became effective on June 18, 2023, the law covering notice required to a purchaser of property in a MUD changed. This change to the law made form 400 obsolete and no longer useable under the new law and its notice provision.

MUD: Municipal Utility District This same law states that the notice must be given to the buyer prior to the buyer entering into the contract OR as an addendum to the contract at the time the contract is negotiated. If the notice is not timely provided, the buyer can terminate the contract at any time.

The seller is required by the Texas Water Code to provide a buyer a notice to purchasers indicating that property is located within a MUD prior to the buyer entering into a sales contract. The notice must provide information regarding the tax rate, bonded indebtedness, and fees, if any, of the MUD.

The seller is required by the Texas Water Code to provide a buyer a notice to purchasers indicating that property is located within a MUD prior to the buyer entering into a sales contract. The notice must provide information regarding the tax rate, bonded indebtedness, and fees, if any, of the MUD.

Unlike a MUD, a PID is not a political entity. Some developments use a PID instead of a HOA since PID assessments are tax deductible. Unlike tax rates for MUDs, these assessments are fixed once the bonds are sold. PIDs are funded through bonds secured by liens against the property.