Texas Secretary Of State Llc Forms With Nonprofit

Description

Form popularity

FAQ

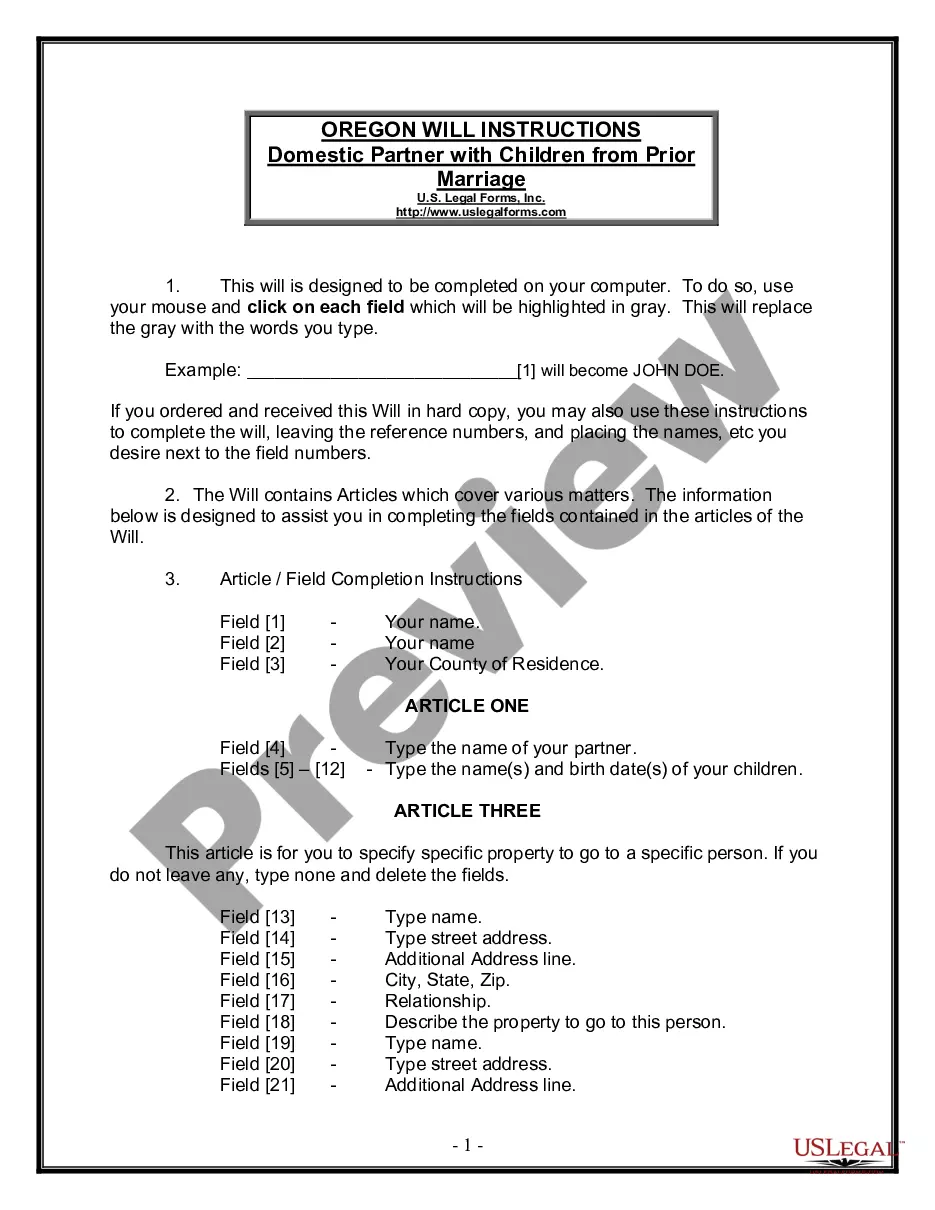

In Texas, a nonprofit organization must have at least three directors on its board. These directors cannot all be from the same household, ensuring a diverse range of perspectives. When filing the necessary Texas secretary of state LLC forms with nonprofit status, having the right number of board members is essential for compliance and effective governance. For your convenience, USLegalForms can guide you through the process, helping you gather the required documentation.

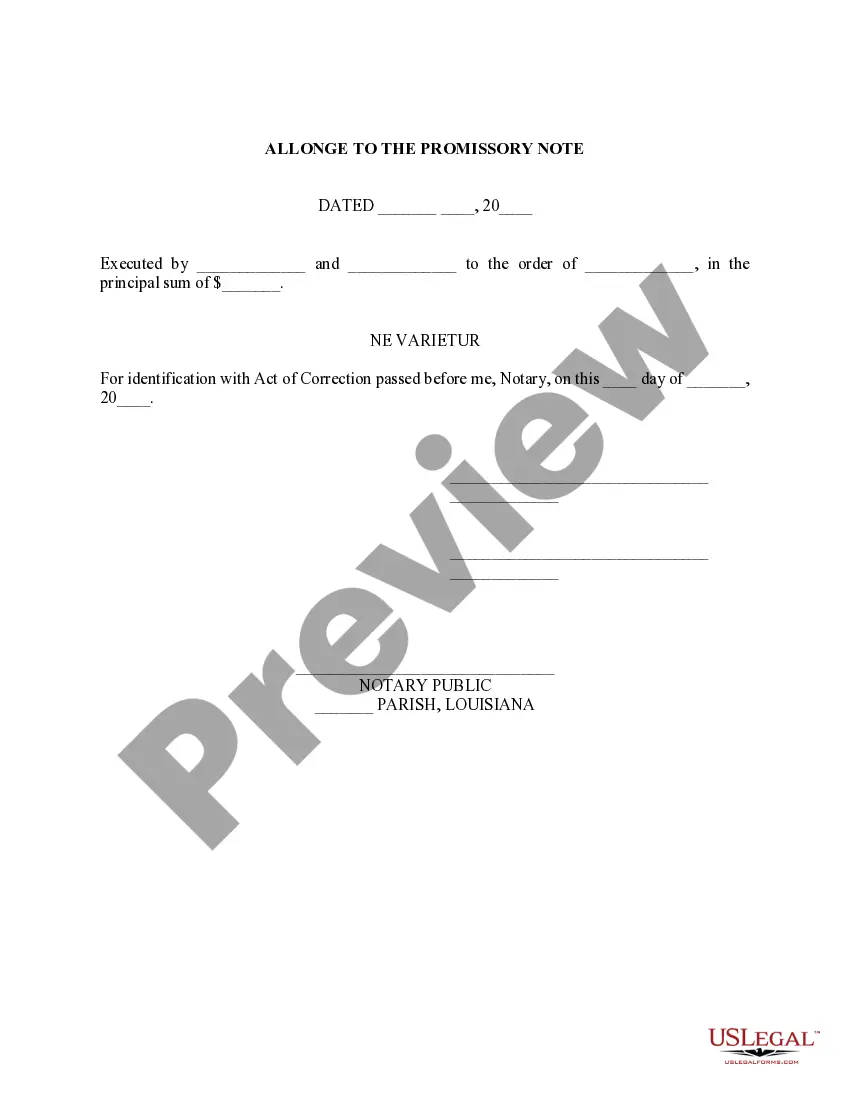

After forming your LLC in Texas, consider obtaining any necessary business licenses and permits, opening a business bank account, and establishing a clear operational structure. Also, review your nonprofit status to ensure compliance with regulations. You can turn to USLegalForms for assistance with your Texas secretary of state LLC forms with nonprofit and other essential documentation.

In Texas, LLCs are not required to file an annual report, but they must file a franchise tax if their revenue exceeds a certain threshold. It's crucial to stay compliant by renewing your permits and licenses as required. Utilizing USLegalForms can help ensure that your Texas secretary of state LLC forms with nonprofit are always up-to-date.

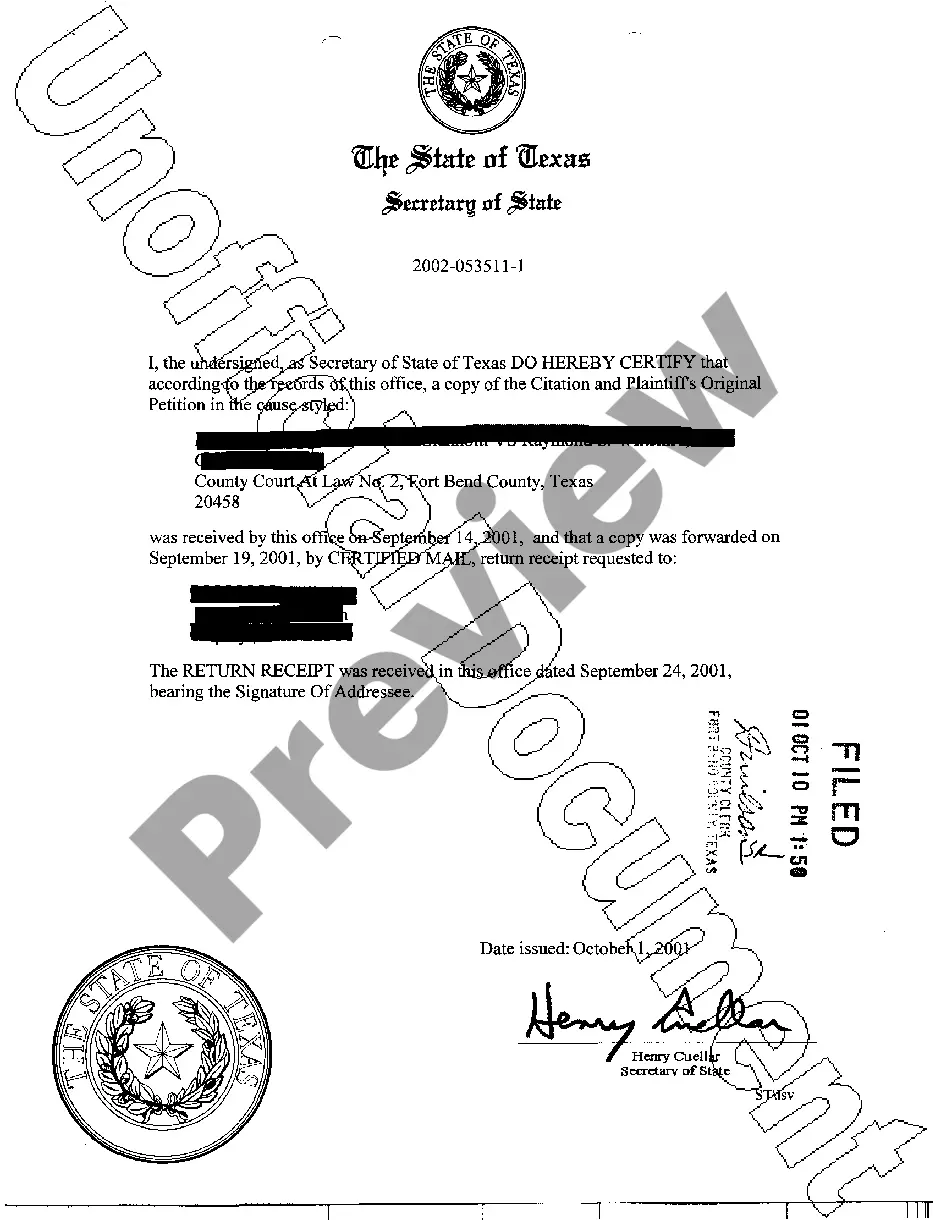

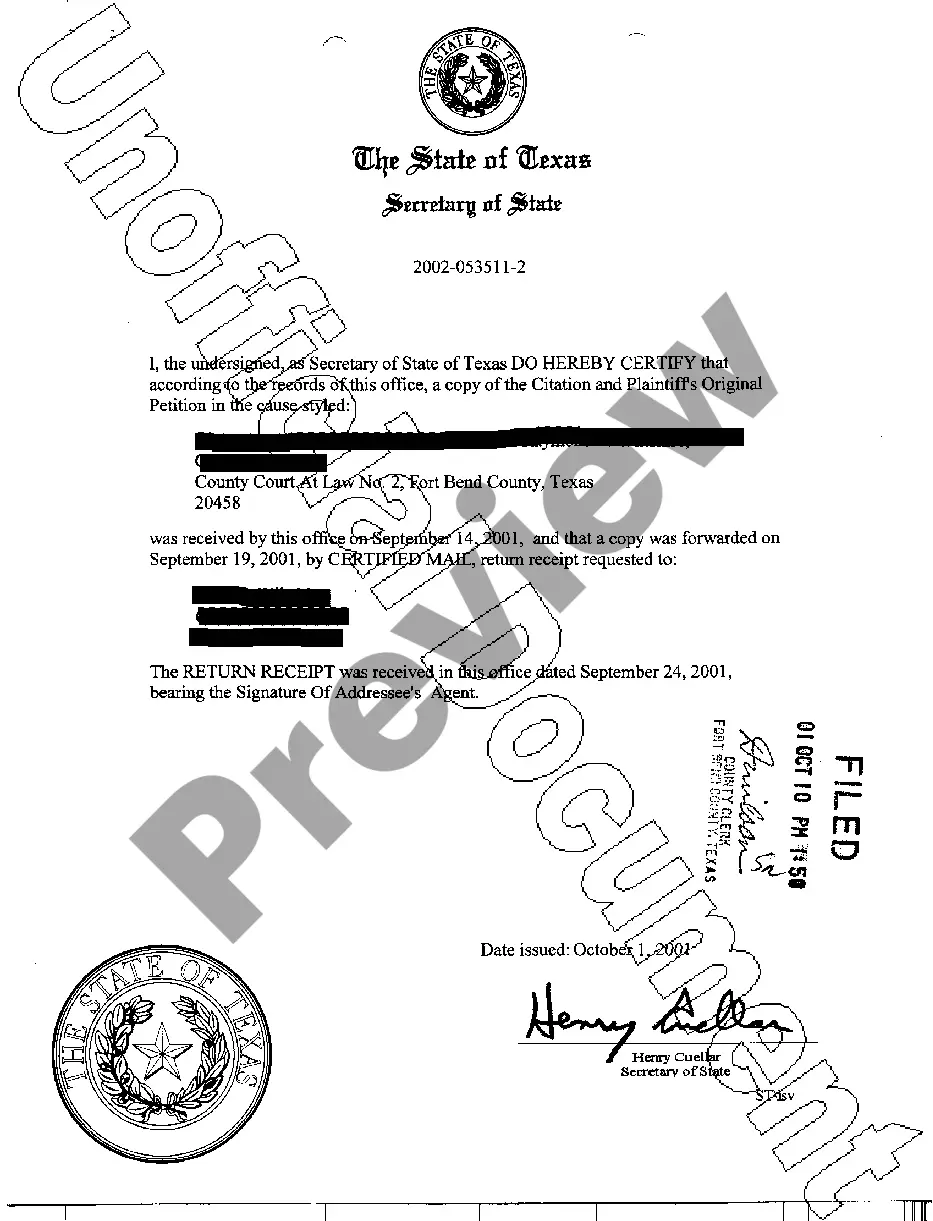

Yes, Texas requires you to file Articles of Organization to form an LLC. This document outlines essential details about your business and must be submitted to the Texas Secretary of State. Additionally, if your LLC has a nonprofit purpose, make sure your Articles reflect this status by using the appropriate Texas secretary of state LLC forms with nonprofit.

The approval time for an LLC by the Texas Secretary of State usually ranges from a few business days to a few weeks, depending on the volume of applications received. Filing online often speeds up the process compared to paper submissions. Using a reliable platform like USLegalForms can help streamline your Texas secretary of state LLC forms with nonprofit designation.

To maintain your LLC in Texas, you must keep business records, file your franchise tax and any required reports, and comply with state regulations. Regularly review your LLC's operating agreement to ensure it aligns with your business practices. You may also want to update your Texas secretary of state LLC forms with nonprofit status to reflect any changes in your organization.

Yes, an LLC can serve as a nonprofit organization in Texas, provided it adheres to the necessary requirements. It is important for the LLC to operate with the intention of serving the public good and not profit distribution, which aligns with nonprofit standards. Additionally, you should file the appropriate application with the IRS for tax-exempt status. The Texas Secretary of State LLC forms with nonprofit can guide you in filing the correct paperwork.

Absolutely, a nonprofit can choose to form as an LLC in Texas. This option provides organizational flexibility and can limit personal liability for its members. However, it is vital to ensure compliance with nonprofit regulations and to specify the nature of the organization in its formation documents. When considering this route, explore the resources available through the Texas Secretary of State LLC forms with nonprofit.

To file an LLC in Texas, you generally need to complete Form 205, which is the Certificate of Formation. This form includes crucial information such as the LLC's name, duration, and registered agent. Additionally, depending on your business type, you may need to submit other forms. For nonprofit LLCs, you should specifically refer to the Texas Secretary of State LLC forms with nonprofit to ensure you meet all requirements.

Yes, a nonprofit can be structured as an LLC in Texas if it meets the state's requirements for nonprofit status. This structure can offer flexibility regarding management and operations while limiting liability for its members. However, it is essential to designate the organization clearly as a nonprofit to align with regulations. To learn more about the specific forms, refer to the Texas Secretary of State LLC forms with nonprofit.