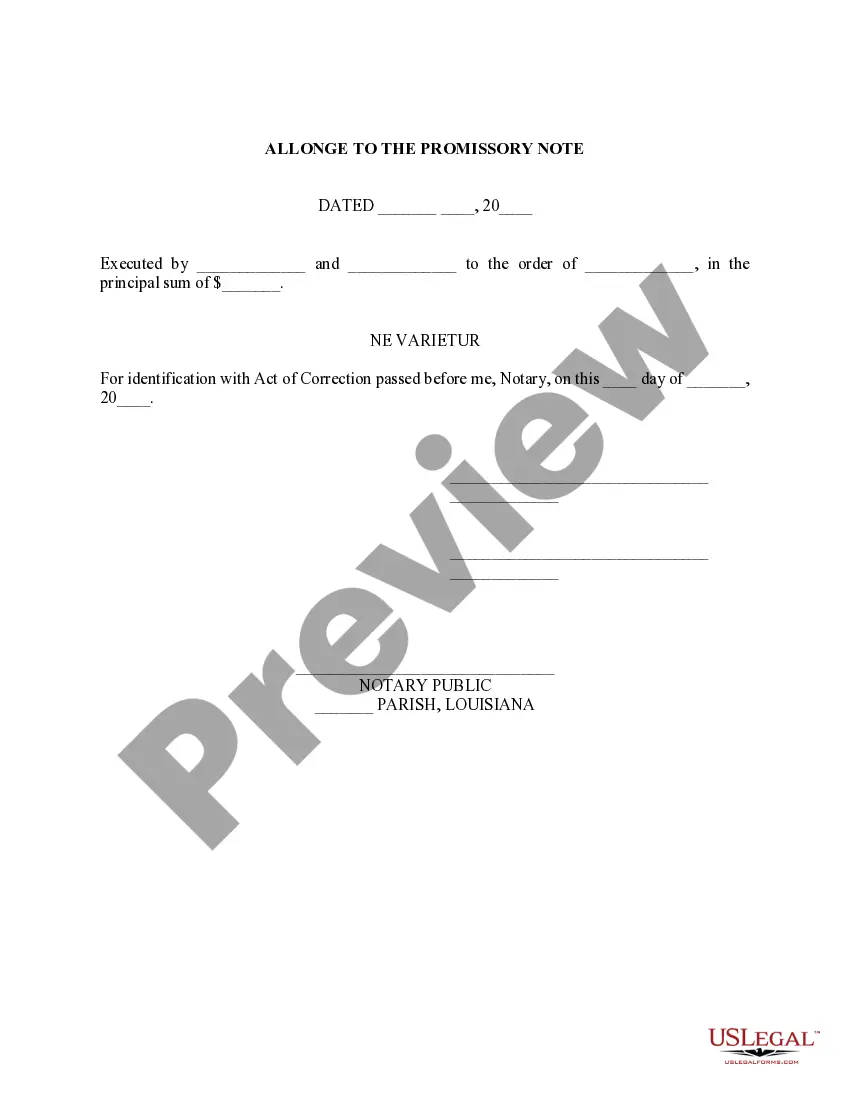

Louisiana Allonge to Promissory Note

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

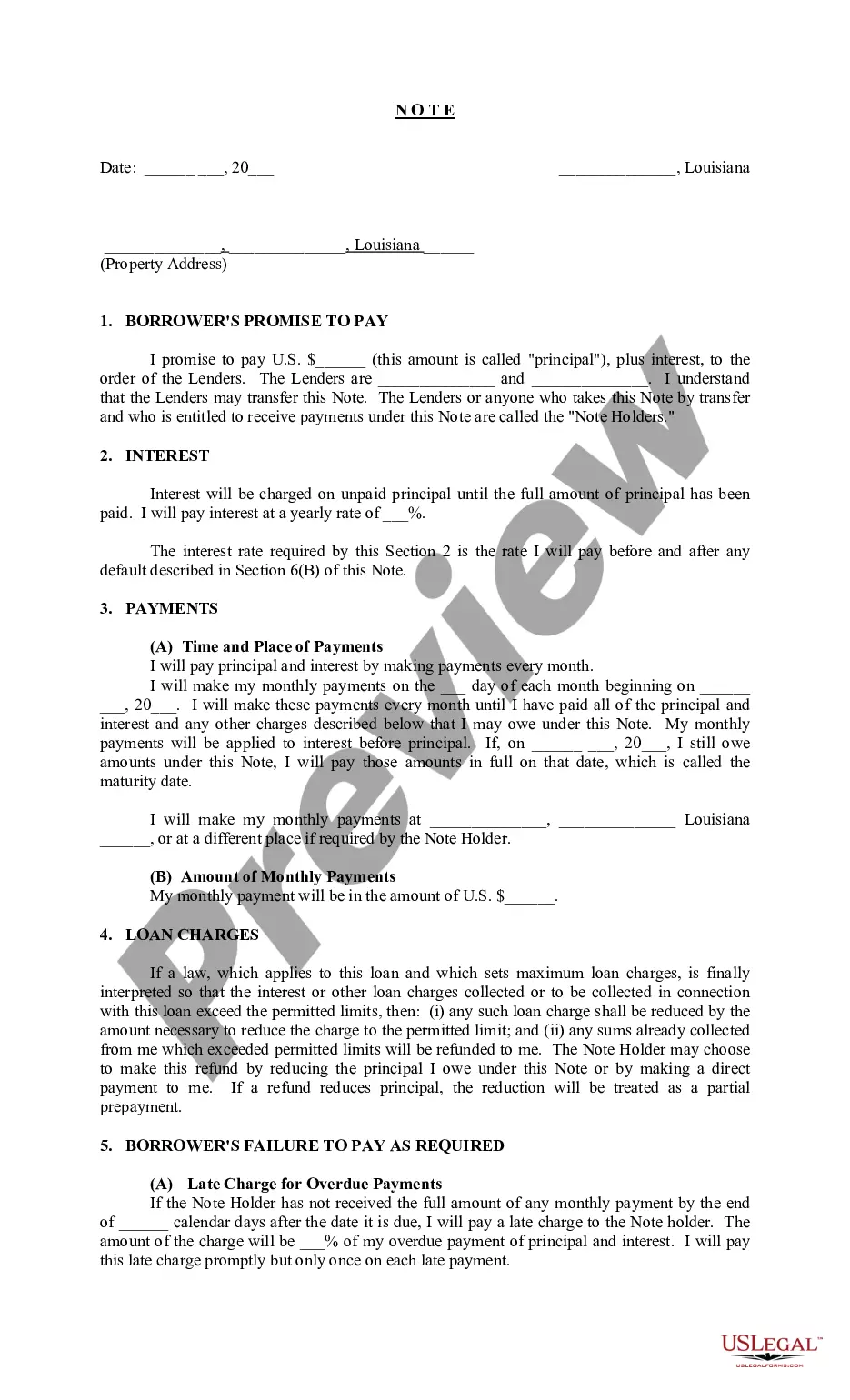

How to fill out Louisiana Allonge To Promissory Note?

Searching for Louisiana Allonge to Promissory Note forms and completing them can be quite daunting.

To conserve a significant amount of time, expenses and effort, utilize US Legal Forms and locate the appropriate sample specifically for your state in just a few clicks.

Our legal experts prepare every document, so you only need to complete them.

Select your payment method, whether by card or PayPal, and download the sample in your desired file format. You can now print the Louisiana Allonge to Promissory Note form or fill it out using any online editor. No need to fret about typographical errors as your form can be utilized and sent multiple times, and printed out as often as needed. Explore US Legal Forms to gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and navigate back to the form's webpage to download the document.

- All saved templates are stored in My documents and are available at any time for future use.

- If you haven’t signed up yet, you need to register.

- Review our comprehensive instructions on how to acquire the Louisiana Allonge to Promissory Note template within a few minutes.

- To obtain a valid sample, verify its applicability for your state.

- Examine the example using the Preview feature (if available).

- If there’s a description, read it to understand the specifics.

- Click on the Buy Now button if you found what you need.

Form popularity

FAQ

"A promissory note is enforceable through an ordinary breach of contract claim." In other words, it's not required that the loan be secured; an unsecured loan is still enforceable as long as the promissory note is fully completed. Lender and borrower information.

Generally, promissory notes do not need to be notarized. Typically, legally enforceable promissory notes must be signed by individuals and contain unconditional promises to pay specific amounts of money. Generally, they also state due dates for payment and an agreed-upon interest rate.

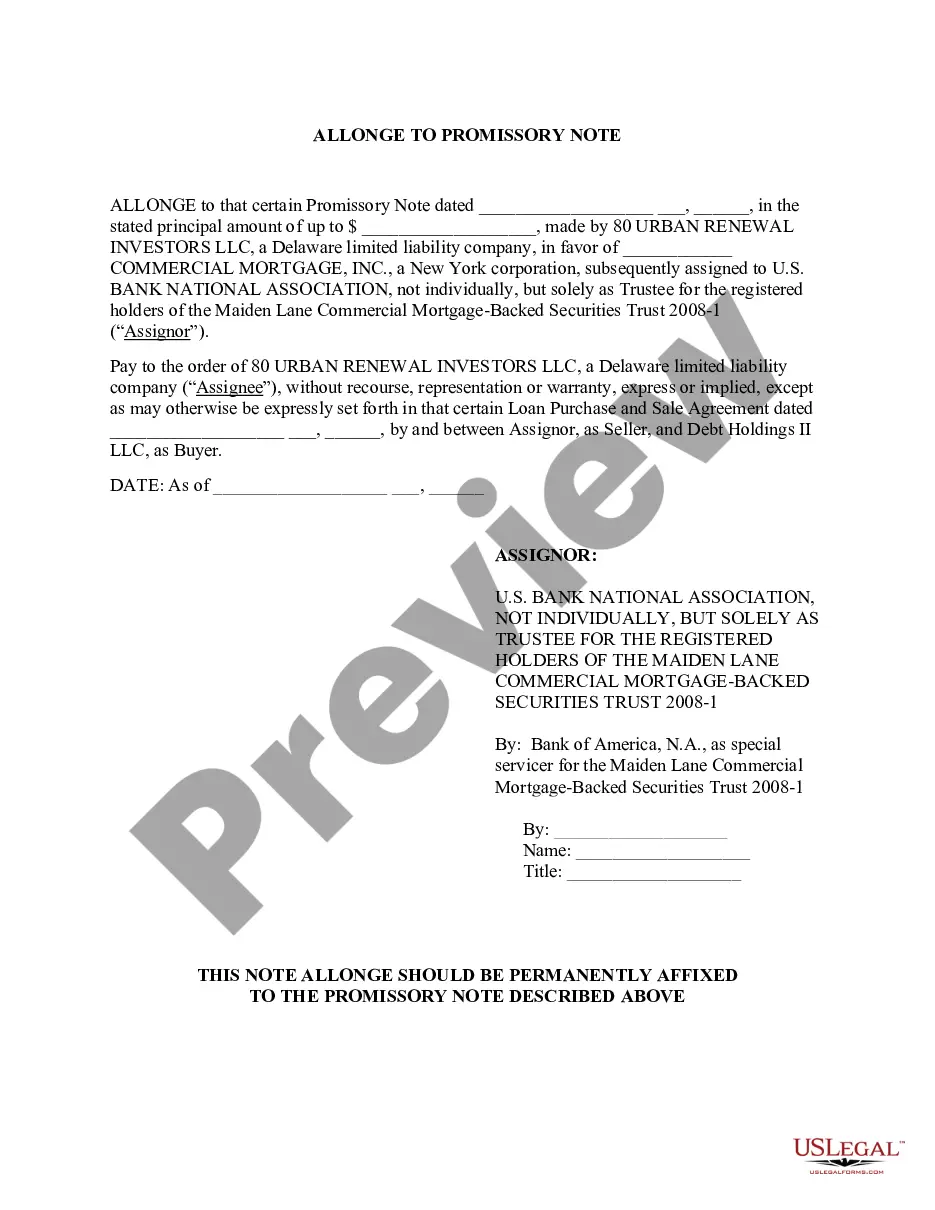

To transfer a promissory note, it must be negotiable and/or have a provision that allows and explains transfer. In addition, it must comply with state statutes governing promissory notes and assignments thereof. Create a Promissory Note Transfer Agreement.

Who must sign the promissory note? A loan agreement is signed by both parties but only the borrowing party needs to sign a promissory note. A witness need not sign but the note can be notarized as evidence that the borrower did sign the document.

Generally speaking, there is no requirement for a witness or notary public to witness the signing of the Promissory Note.Even if it is not required, having an objective third party witness the signing of the note will be better evidence when you need to enforce the repayment of the note.

So, when a loan is sold both the Promissory Note and Mortgage need to be conveyed to the new Note owner.The endorsement on the Promissory Note is called an Allonge. The endorsement on a Mortgage is called an Assignment of Mortgage.

A promissory note is valid only if it is a promise to pay money. It must be unconditional - The borrower's payment cannot depend on an event or any other possibility. It must be unconditional. There should be a specific Amount - The note must indicate a specific amount owed that will be paid.

A promissory note is a contract, a binding agreement that someone will pay your business a sum of money. However under some circumstances if the note has been altered, it wasn't correctly written, or if you don't have the right to claim the debt then, the contract becomes null and void.