Rule 106 Texas Withdrawal

Description

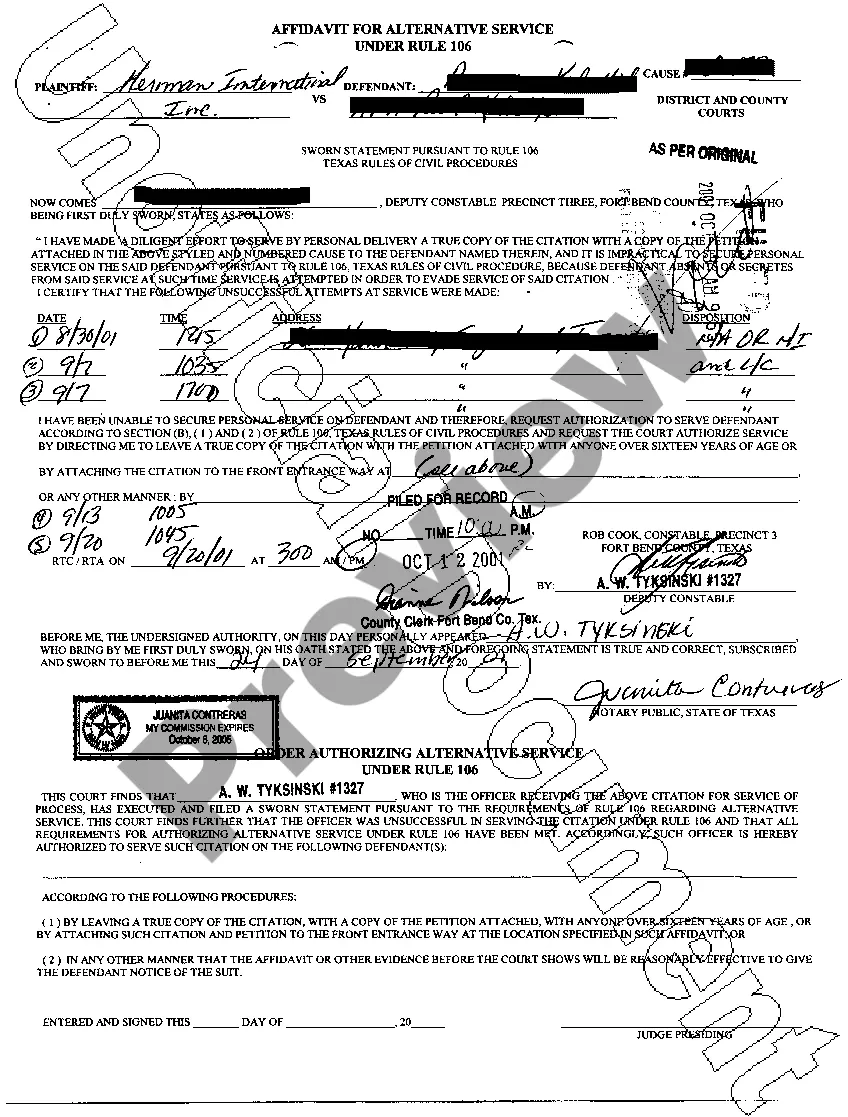

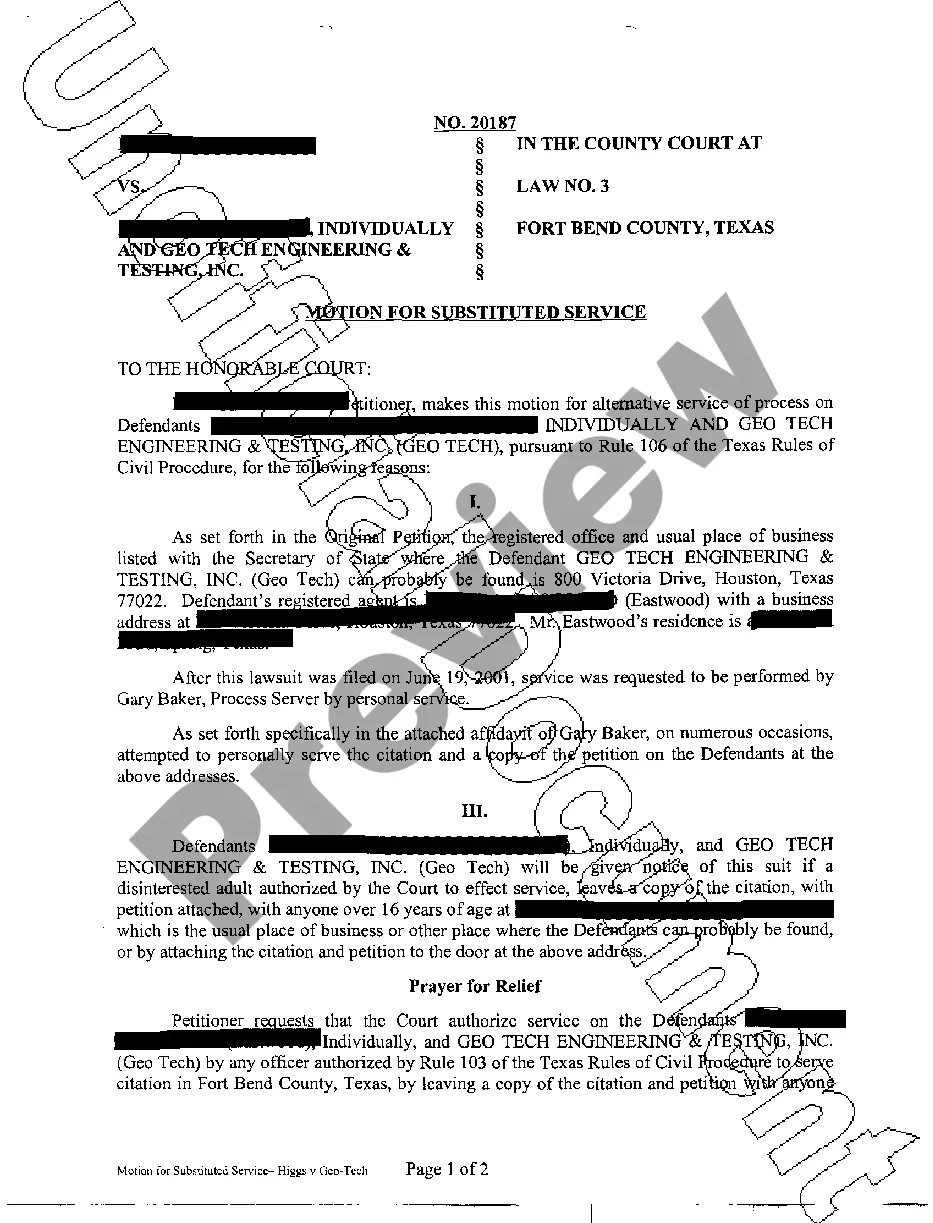

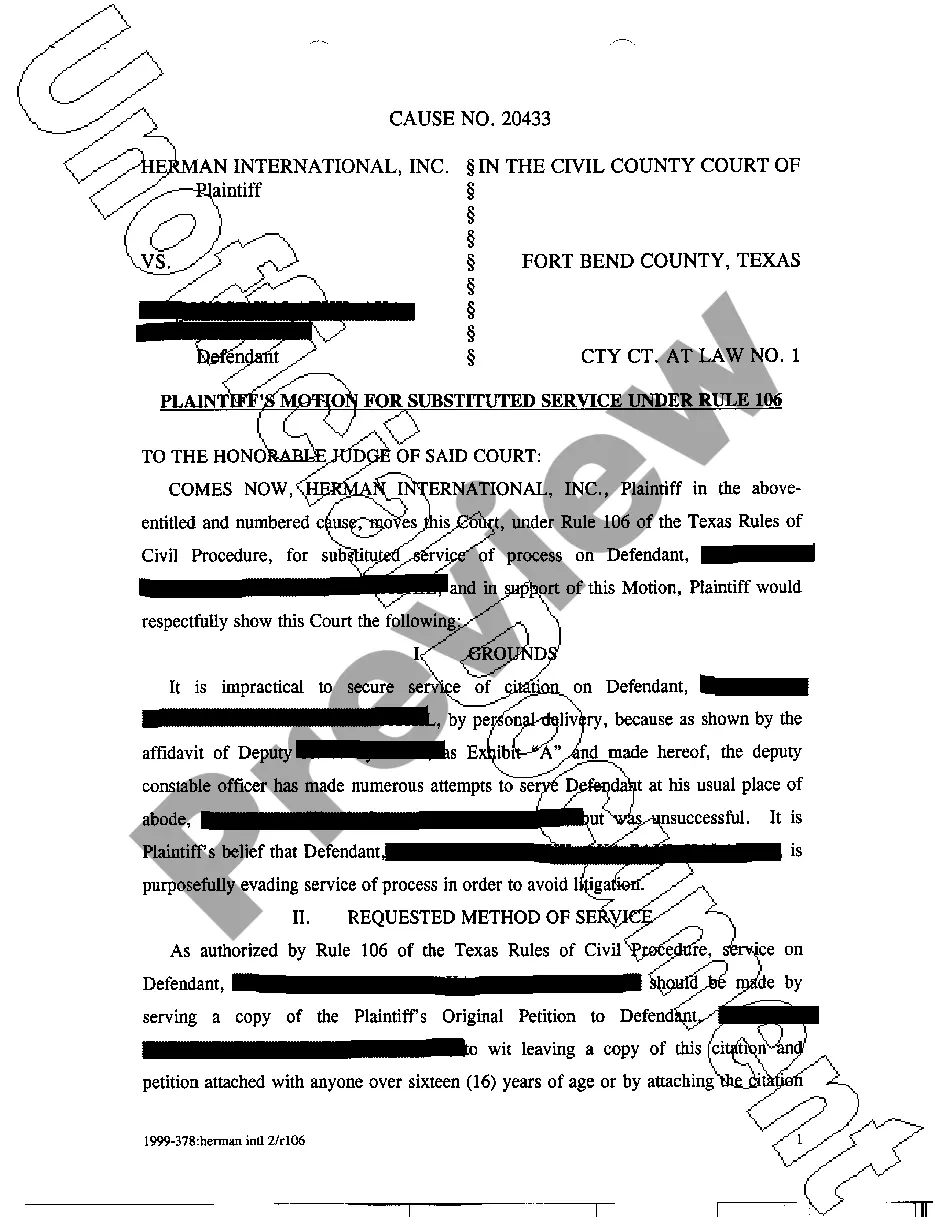

How to fill out Texas Order Of Substituted Service Under Rule 106?

Managing legal matters can be exasperating, even for the most seasoned professionals.

When you seek a Rule 106 Texas Withdrawal and lack the chance to dedicate time to find the correct and updated version, the processes can be overwhelming.

Utilize cutting-edge tools to complete and oversee your Rule 106 Texas Withdrawal.

Access a valuable repository of articles, guides, and manuals relevant to your situation and requirements.

Ensure that the sample is recognized in your state or county and select Buy Now when you're ready. Choose a monthly subscription option, decide on the file format you need, and Download, complete, sign, print, and forward your document. Take advantage of the US Legal Forms online directory, backed by 25 years of expertise and reliability. Streamline your everyday document management in a seamless and user-friendly manner today.

- Conserve time and effort looking for the documents you need, and leverage US Legal Forms’ advanced search and Preview feature to find Rule 106 Texas Withdrawal and obtain it.

- If you have a monthly subscription, Log In to your US Legal Forms account, search for the form, and acquire it.

- Check the My documents section to see the documents you have previously downloaded and to organize your folders as desired.

- If this is your first experience with US Legal Forms, create an account for unlimited access to all the platform's benefits.

- Once you have located the necessary form, verify it is the correct one by reviewing it and checking its details.

- Implement a comprehensive online form directory that could revolutionize how individuals handle these scenarios effectively.

- Access state- or county-specific legal and organizational documents.

- US Legal Forms addresses any needs you might have, from personal to corporate paperwork, all in one location.

Form popularity

FAQ

Rule 167 in Texas pertains to the use of discovery tools in pre-trial proceedings, allowing parties to obtain relevant information to prepare for trial. This rule is crucial for ensuring all parties have the necessary information to present their case effectively. Understanding how Rule 106 Texas withdrawal interacts with Rule 167 can enhance your legal strategy.

A single member LLC is required by law to file a Kentucky Single Member LLC Individually Owned Income and LLET Return (Form 725) or; if eligible, a Kentucky Single Member LLC Individually Owned LLET Return (Form 725-EZ). Forms and instructions are available at all Kentucky Taxpayer Service Centers (see page 17).

How to Form a Kentucky Limited Partnership (in 6 Steps) Step One) Choose an LP Name. ... Step Two) Designate a Registered Agent. ... Step Three) File the Certificate of Limited Partnership. ... Step Four) Create a Limited Partnership Agreement. ... Step Five) Handle Taxation Requirements. ... Step Six) Obtain Business Licenses and Permits.

Form 1065, U.S. Return of Partnership Income, is a tax form used by partnerships to provide a statement of financial performance and position to the IRS each tax year. The form includes information related to a partnership's income and deductions, gains and losses, taxes and payments during the tax year.

A Kentucky Form 4562 must be filed for each year even if a federal Form 4562 is not required. Determining and Reporting Differences in Gain or Loss From. Disposition of Assets?If during the year the partnership. disposes of assets on which it has taken the special.

An authorized representative of the entity and the electronic return originator (ERO) shall use Form 8879(C)-K as a declaration document and signature authorization for an electronic filing (e-file) of a Kentucky Form 720, 720S, 725, 765 or 765-GP filed by an ERO.

Form 720EXT grants an automatic 6-month extension of time to file Form 720. Kentucky State General Business S Corporation tax extension Form 720EXT is due within 4 months and 15 days following the end of the corporation reporting period.

These partnerships are required by law to file a Kentucky Partnership Income and LLET Return (Form 765).

These instructions have been designed for pass-through entities: S-corporations, partnerships, and general partnerships , which are required by law to file a Kentucky income tax and LLET return. Form PTE is complementary to the federal forms 1120S and 1065. .revenue.ky.gov.