Revocation Living Trust With A Beneficiary

Description

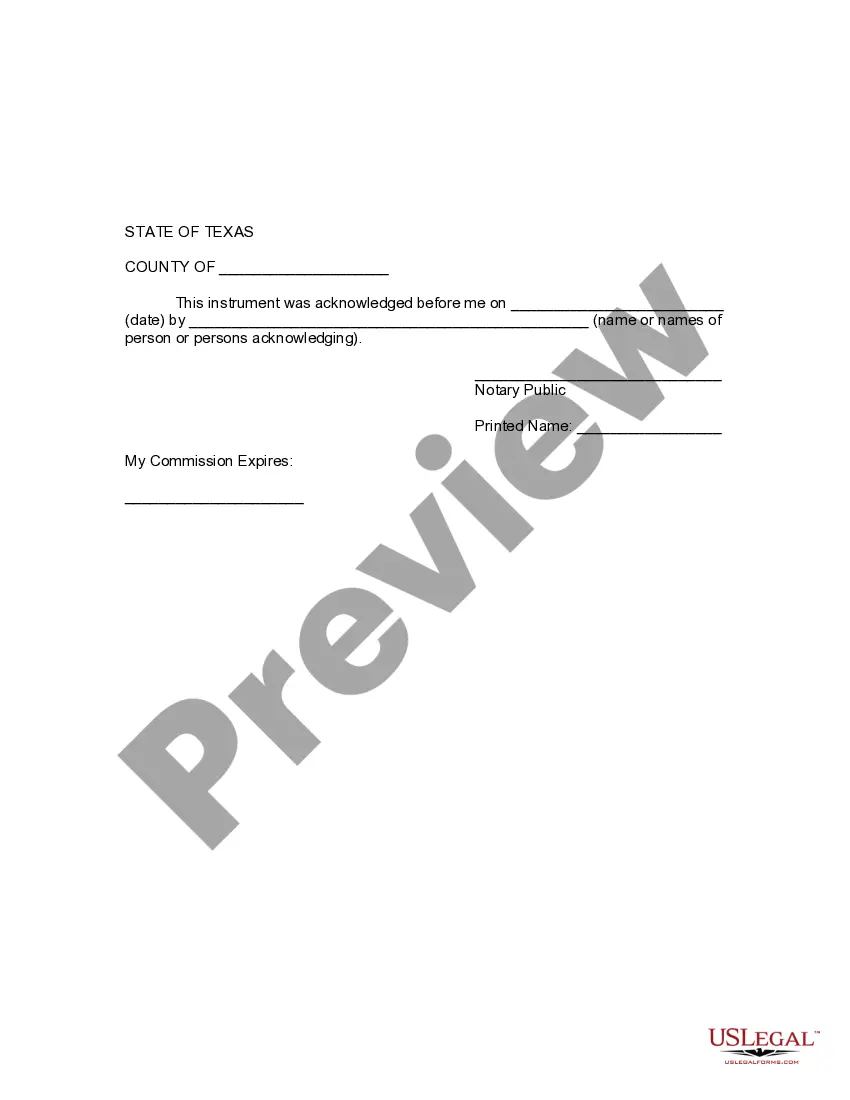

How to fill out Texas Revocation Of Living Trust?

- If you are a returning user, log into your account and find the revocation form template. Ensure your subscription is active; if not, renew as needed.

- For first-time users, start by checking the Preview mode and description of the revocation form to confirm it meets your local jurisdiction and requirements.

- If the form doesn't suit your needs, utilize the Search tab to locate an alternative template that fits your requirements.

- To proceed, click the Buy Now button and select the subscription plan that works best for you. You'll need to create an account for access to the full library.

- Make your purchase by entering your credit card information or using your PayPal account.

- Finally, download the revocation form to your device for completion, accessible later in the My Forms section.

By using US Legal Forms, you gain access to an extensive selection of over 85,000 fillable legal documents, ensuring that you find the exact form you need.

Take control of your estate planning today by utilizing our services for your legal document needs. Start your journey by exploring our library now!

Form popularity

FAQ

In general, a nursing home cannot take your revocable trust while you are alive, provided that the assets are validly placed in the trust. However, the assets may be counted towards your eligibility for Medicaid if you need nursing care. It’s crucial to understand how trusts affect your financial planning. For clarity and peace of mind, explore US Legal Forms to find documents and information that can aid in protecting your assets.

A revocable trust becomes irrevocable when the grantor passes away or decides to relinquish control over the trust. This change is significant as it often alters how the assets are managed and distributed. Understanding this transition helps you plan better for your beneficiaries. Make sure to consult resources such as US Legal Forms for detailed guidelines on handling transitions in trust status.

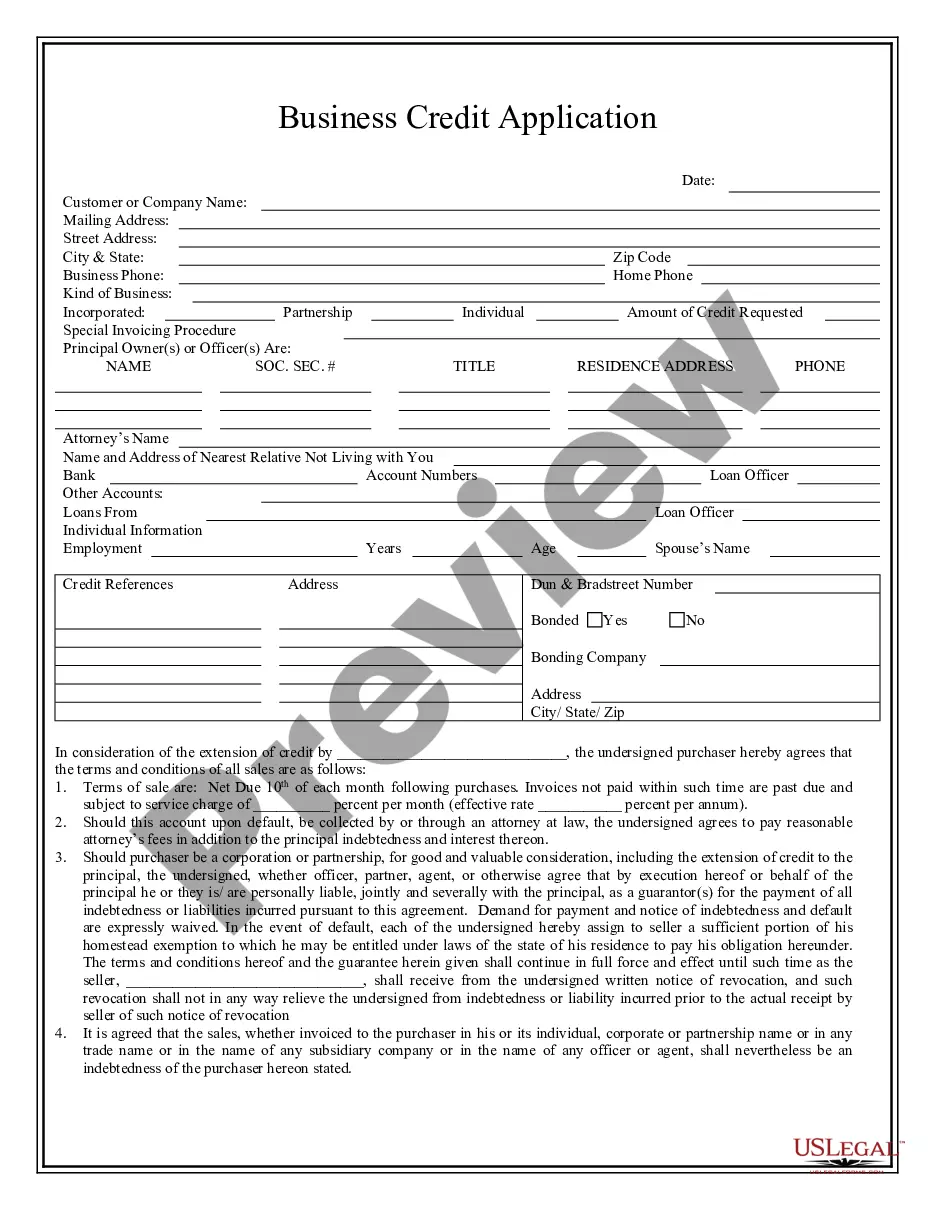

Revocation of a revocable trust with a beneficiary typically involves a formal document. You will need to create a revocation document that explicitly states your intention to cancel the trust. It’s essential to notify any beneficiaries and possibly follow state laws to ensure the process is valid. For a seamless revocation experience, consider using a platform like US Legal Forms, which can guide you through the necessary steps.

A sample of a revocation of a living trust may include a written document stating the intentions of the trust creator to revoke the trust. This document should specify which trust is being revoked, the date it was created, and the names of all beneficiaries involved. Utilizing a revocation living trust with a beneficiary can streamline this process and provide a formal method to communicate changes to all parties concerned.

Yes, a beneficiary of a trust can be removed, typically through the process of modifying or revoking the trust. When dealing with a revocation living trust with a beneficiary, it's essential to follow legal procedures to ensure the removal is valid and enforceable. Consult with a legal expert for guidance, as this process varies based on individual cases and state laws.

A revocation of a trust occurs when the trust creator decides to cancel the trust entirely or change its terms. For instance, if a parent initially designated their children as beneficiaries but later decides to change the beneficiaries to other family members, they must execute a revocation living trust with a beneficiary. This formal process helps ensure that changes reflect the current wishes of the trust creator.

One significant mistake parents often make when establishing a trust fund is not clearly defining the beneficiaries and their roles. This lack of clarity can lead to confusion, disputes, and challenges later on. A revocation living trust with a beneficiary allows families to modify or remove beneficiaries as needed, but it is crucial to have a clear plan from the start to avoid complications.

Revoking a trust beneficiary typically involves making formal amendments to your trust documents. You might need to consult with a legal professional to ensure compliance with state regulations. By strategically managing your revocation living trust with a beneficiary, you can effectively update who will receive your assets while avoiding potential disputes down the line.

The revocation of a living trust refers to the legal process where the grantor cancels or terminates the trust. This is commonly done when circumstances change or objectives shift, particularly when the trust has designated beneficiaries. Understanding how to manage your revocation living trust with a beneficiary is vital to ensure your assets are handled according to your current wishes.

A trust can become null and void for several reasons, such as lack of proper execution or revocation by the grantor. If a revocation living trust with a beneficiary does not meet legal formalities, it may not be enforceable. Additionally, if the trust’s purpose becomes illegal or impossible, it may also lead to its invalidation.