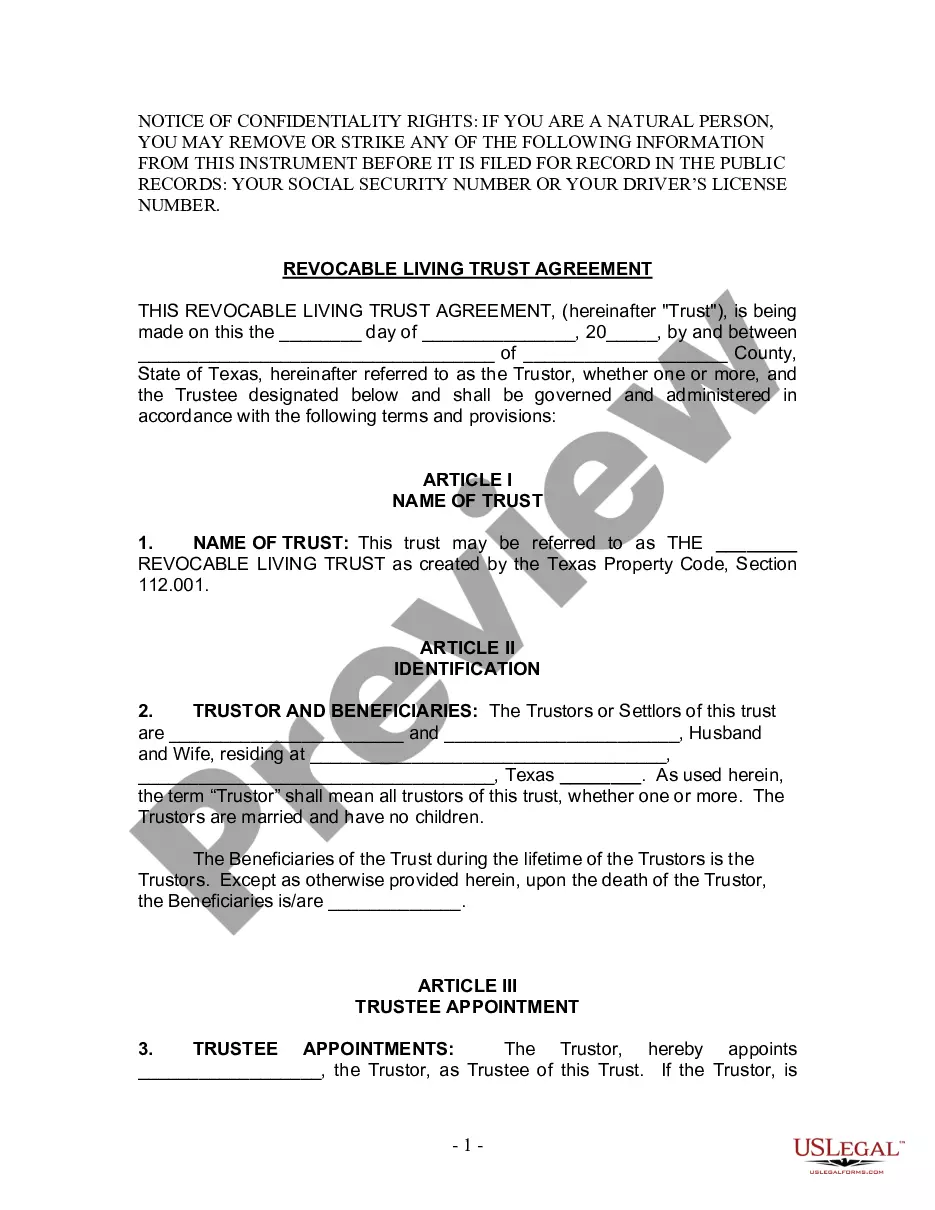

Texas Living Trust With Multiple Beneficiaries

Description

How to fill out Texas Living Trust For Husband And Wife With No Children?

It’s widely known that you cannot instantly become a legal expert, nor can you quickly learn how to draft a Texas Living Trust With Multiple Beneficiaries without possessing a specific skill set.

Assembling legal paperwork is a lengthy process that demands particular education and abilities. So why not entrust the creation of the Texas Living Trust With Multiple Beneficiaries to the professionals.

With US Legal Forms, featuring one of the most extensive legal document collections, you can find everything from court documents to templates for internal communication.

If you require a different form, start your search again.

Create a free account and choose a subscription plan to purchase the form. Select Buy now. After the payment is processed, you can download the Texas Living Trust With Multiple Beneficiaries, fill it out, print it, and send or mail it to the intended recipients or organizations.

- We recognize the importance of compliance and adherence to federal and state laws and regulations.

- That’s why, on our platform, all templates are location-specific and current.

- Here’s how to begin on our website and obtain the form you need in just a few minutes.

- Locate the form you’re searching for using the search bar at the top of the page.

- View it (if this option is available) and review the accompanying description to see if Texas Living Trust With Multiple Beneficiaries is what you need.

Form popularity

FAQ

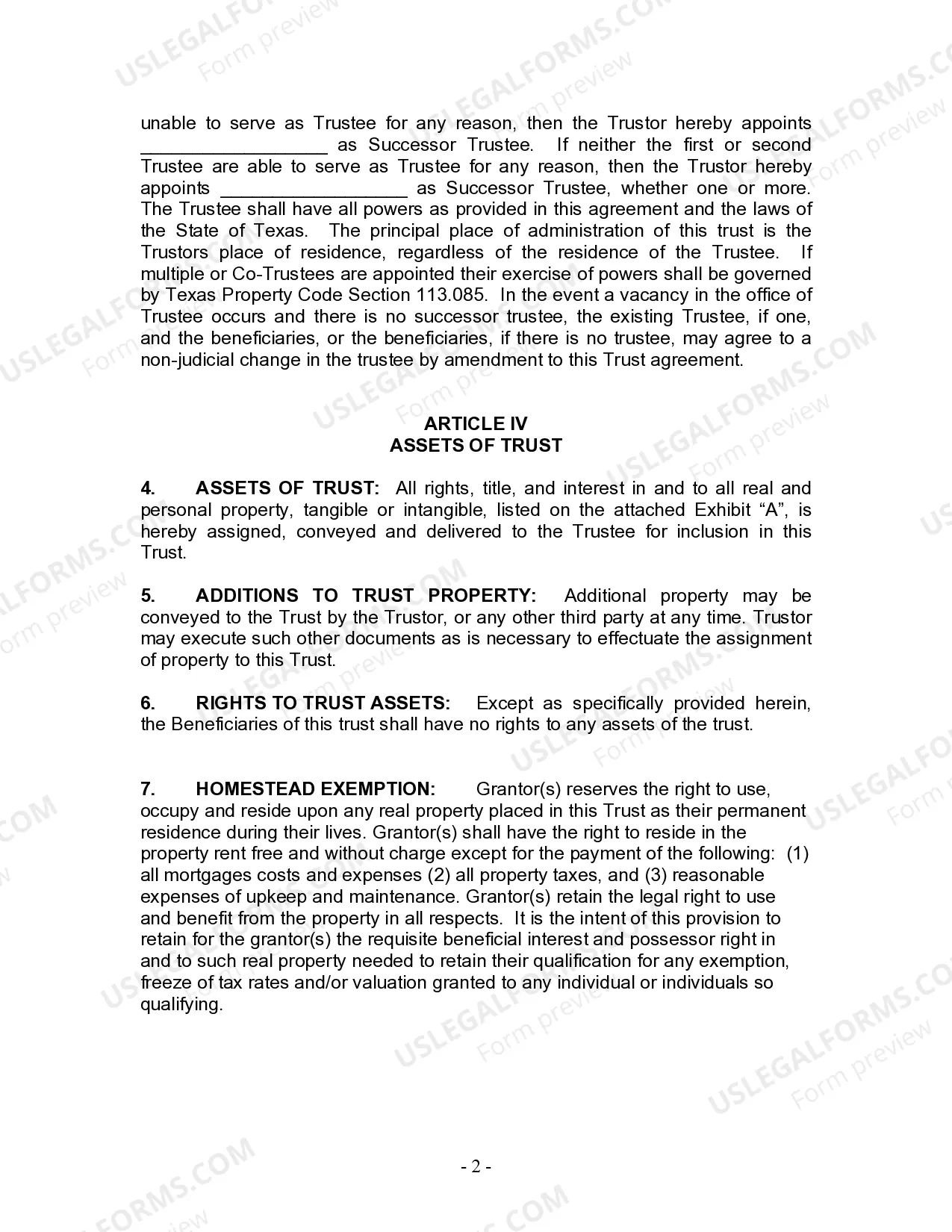

How Do You Want Your Property Distributed? We'll ask you first whether you want to leave all your trust property to one beneficiary (or more than one, to share it all) or leave different items to different beneficiaries. Many couples want to leave all trust property to the survivor.

Limitations: Requires adherence to trust document's instructions on asset assignments. Joint assets, including certain IRAs and retirement plans, cannot be placed into a one-person trust. No complete tax avoidance: Total avoidance of taxes is rarely possible with living trusts, though there may be ways to reduce them.

To make a living trust in Texas, you: Choose between establishing an individual or shared trust. Determine which assets will be included in the trust. Select a successor trustee. Determine the trust's beneficiaries or those who will receive the trust's assets. Create the trust document.

To create a living trust in Texas, you must find a licensed attorney familiar with the laws of trusts in Texas. The attorney will advise you on how best to manage your property through the trust and help you develop a document that outlines your wishes.

Upfront and ongoing costs: Setting up a living trust can be expensive, as it typically requires the help of an attorney. Not only is there the cost of drafting the trust document, but also if real estate is going into the trust, new deeds must be prepared and notarized. There are filing fees to record the deeds.