Buyer Seller Affidavit Texas

Description

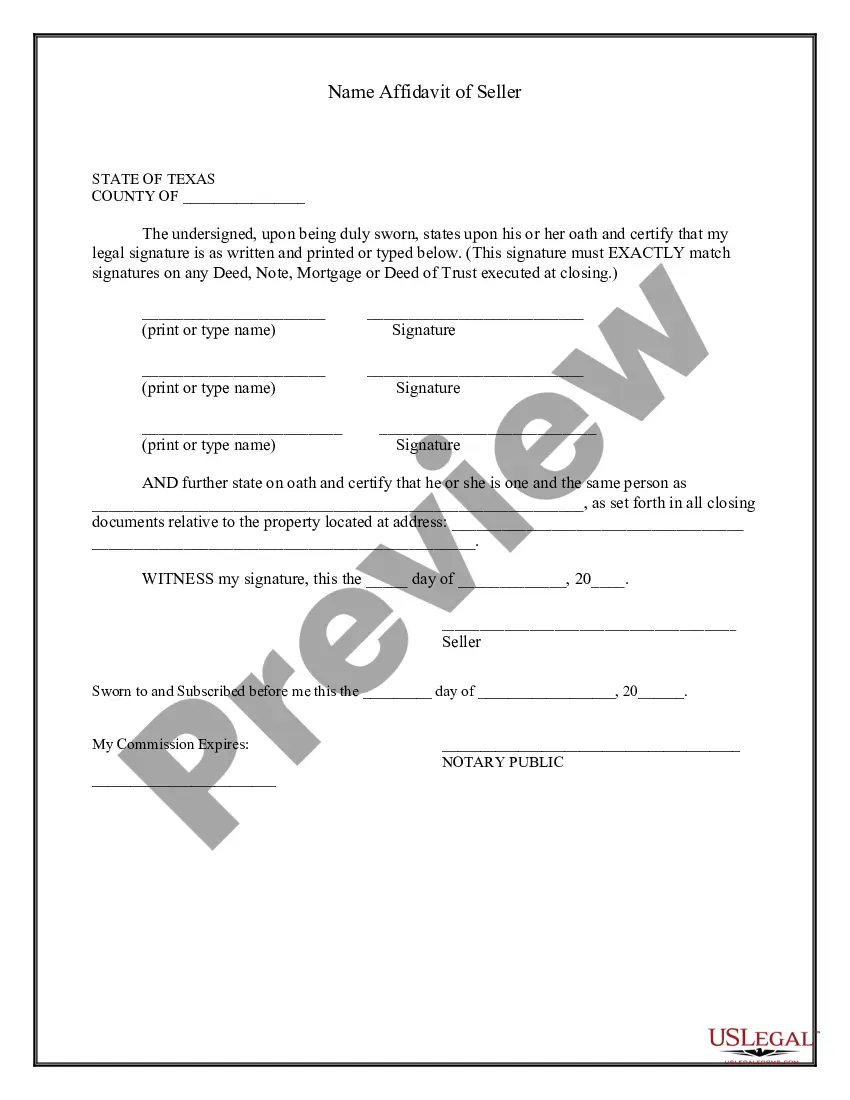

How to fill out Texas Name Affidavit Of Seller?

There's no longer a need to dedicate time searching for legal documents to fulfill your local state obligations.

US Legal Forms has gathered all of them in one location and made their accessibility easier.

Our platform offers over 85k templates for both business and personal legal matters categorized by state and area of application. All forms are expertly drafted and verified for legitimacy, ensuring that you receive an updated Buyer Seller Affidavit Texas.

Fulfilling official documentation following federal and state regulations is quick and straightforward with our library. Experience US Legal Forms today to maintain your paperwork organized!

- If you are acquainted with our service and possess an account, ensure that your subscription is active prior to acquiring any templates.

- Log In to your account, choose the document, and click Download.

- You can also revisit all obtained documents anytime by selecting the My documents tab in your profile.

- If you've never utilized our service before, the process will involve a few additional steps to finish.

- Here's how new users can get the Buyer Seller Affidavit Texas from our collection.

- Examine the page content thoroughly to confirm it includes the sample you require.

- To assist, use the form description and preview options if available.

- Employ the Search field above to look for another template if the previous one did not meet your needs.

- Once you find the correct template, click Buy Now next to its name.

- Select the most appropriate subscription plan and either create an account or sign in.

- Proceed with payment for your subscription using a card or via PayPal.

- Select the file format for your Buyer Seller Affidavit Texas and download it to your device.

- Print your form to complete it manually or upload the example if you prefer using an online editor.

Form popularity

FAQ

Form 130-UThe application is used by the County Tax Assessor-Collector (CTAC) and the Comptroller's office to calculate the amount of motor vehicle tax due. The application includes a motor vehicle tax statement section to document the following: the motor vehicle sales tax due on a Texas sale of a motor vehicle.

Buyer/Seller: Carefully fill out and complete the Application for Texas Certificate of Title (VTR Form 130-U). Buyer will fill out most of the form but Seller MUST fill in the vehicle sales price and sign the form.

The signed negotiable title and completed Application for Texas Title and/or Registration (Form 130-U), must be provided to the county tax office to title the vehicle. The title application must be accompanied by Affidavit of Motor Vehicle Gift Transfer (Texas Comptroller of Public Accounts Form 14-317).

The title application must be accompanied by Affidavit of Motor Vehicle Gift Transfer (Texas Comptroller of Public Accounts Form 14-317). The Donor and Recipient must both sign the affidavit and title application. Either the donor or recipient must submit all forms and documents in person to the county tax office.

You will need to have a valid license, along with some sort of proof that you own the car. That would be the bill of sale you got when you purchased the car originally, providing the proof that you need to be able to sell the car without registration.