Texas Settlement Statement With Join

Description

How to fill out Texas Closing Statement?

Regardless of whether it is for professional activities or personal matters, everyone must handle legal situations at some stage in their life.

Completing legal documents demands meticulous care, starting from choosing the right form template.

Once downloaded, you can complete the form using editing software or print it out and finish it by hand. With a vast US Legal Forms catalog available, you do not need to waste time searching for the suitable sample across the internet. Take advantage of the library's simple navigation to find the right form for any situation.

- For instance, if you select an incorrect version of the Texas Settlement Statement With Join, it will be denied upon submission.

- Thus, it is vital to find a reliable source for legal documents such as US Legal Forms.

- If you need to acquire a Texas Settlement Statement With Join template, adhere to these straightforward steps.

- Locate the sample you require by utilizing the search box or browsing through the catalog.

- Review the form's description to confirm it aligns with your case, region, and county.

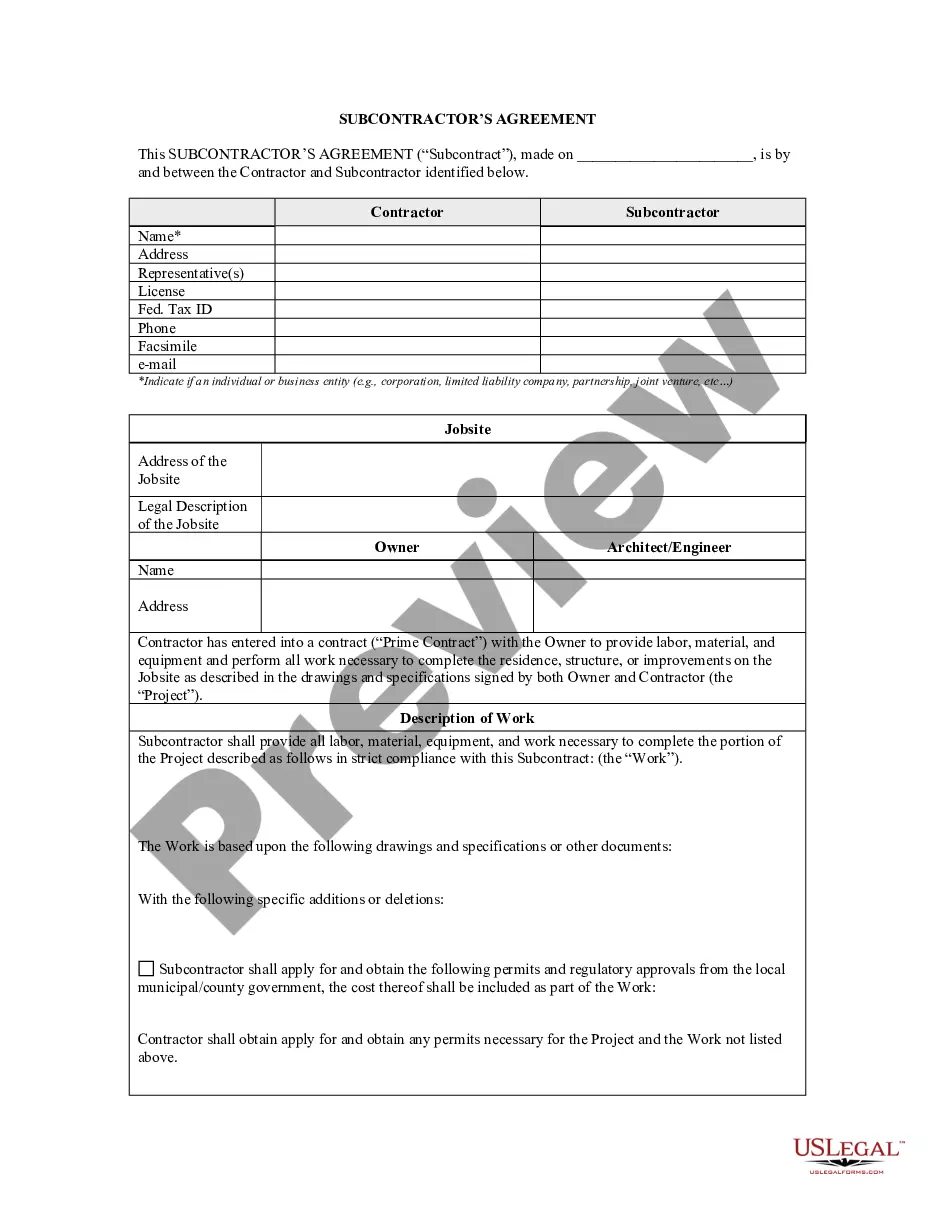

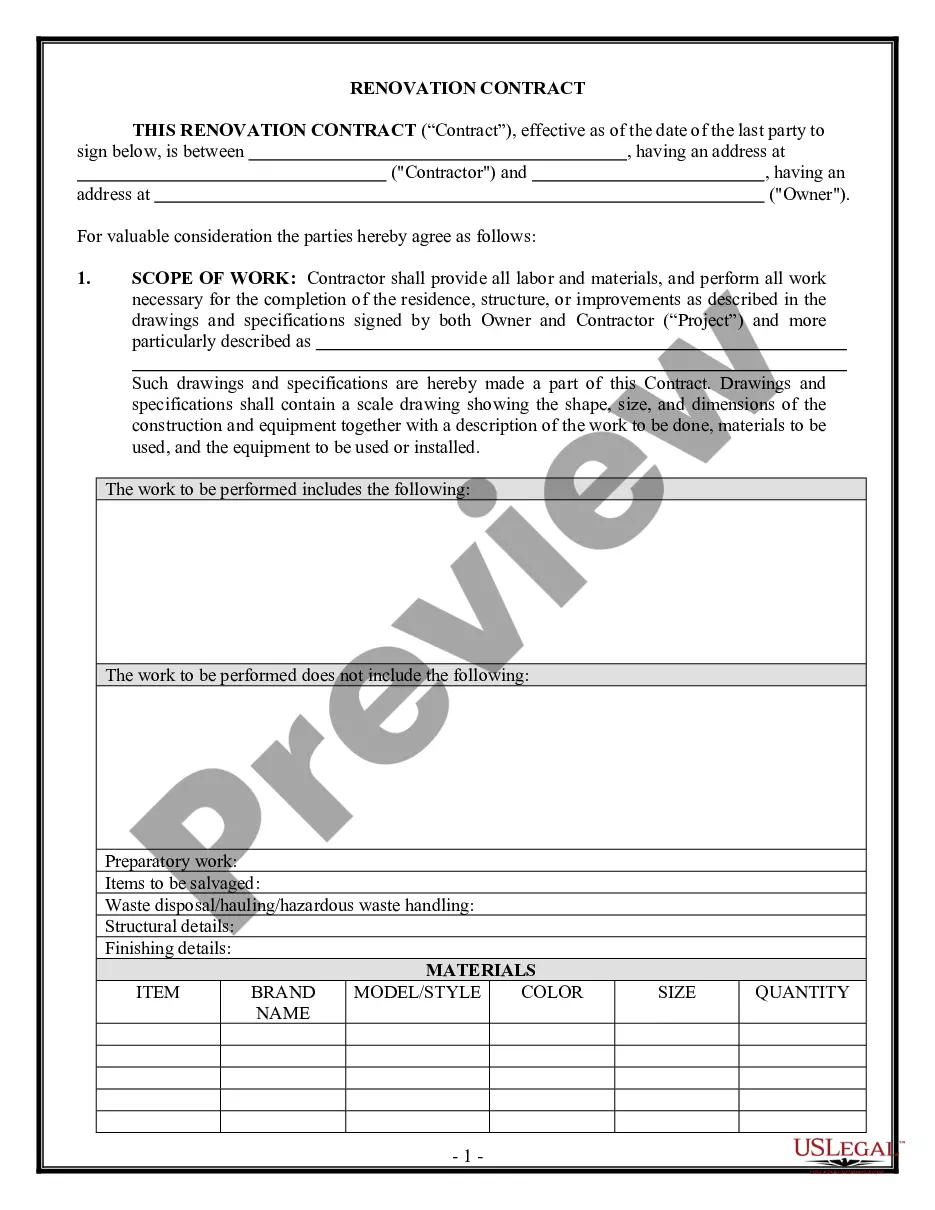

- Press on the form’s preview to take a look at it.

- If it is the wrong document, return to the search option to find the Texas Settlement Statement With Join sample you are looking for.

- Obtain the template when it fulfills your needs.

- If you already possess a US Legal Forms account, simply click Log in to access previously stored templates in My documents.

- If you have not created an account yet, you can acquire the form by clicking Buy now.

- Select the appropriate pricing choice.

- Fill out the profile registration form.

- Choose your payment method: utilize a credit card or a PayPal account.

- Select the file format you wish and download the Texas Settlement Statement With Join.

Form popularity

FAQ

In Texas, after signing a release, it typically takes about 4 to 6 weeks to receive your settlement check. However, this time frame can fluctuate based on the defendant's insurance company or other parties involved. For accurate tracking and understanding of this timeline, examining Texas settlement statements with join may provide clarity.

This document was created when a mortgagee wished to recover his money, but the mortgagor could not pay it back. The mortgagee would assign the mortgage to another person, who would pay him the money he was owed.

Assignments Generally: Lenders, or holders of mortgages or deeds of trust, often assign mortgages or deeds of trust to other lenders, or third parties. When this is done the assignee (person who received the assignment) steps into the place of the original lender or assignor.

Under an assignment of loan, a lender (the assignor) assigns its rights relating to a loan agreement to a new lender (the assignee). Only the assignor's rights under the loan agreement are assigned. The assignor will still have to perform any obligations it has under the facility agreement.

An assignment of mortgage documents the transfer of a mortgage from an original lender or borrower to another person or entity. Lenders regularly sell mortgages to other lenders. Less often, a borrower transfers the mortgage to someone else who assumes the mortgage.

The purpose of the mortgage or deed of trust is to provide security for the loan that's evidenced by a promissory note. Loan Transfers. Banks often sell and buy mortgages from each other. An "assignment" is the document that is the legal record of this transfer from one mortgagee to another.