Trustees Deed Form Florida

Description

How to fill out Texas Trustee's Deed?

Whether for business purposes or for personal affairs, everyone has to deal with legal situations at some point in their life. Completing legal papers needs careful attention, starting with choosing the proper form template. For instance, if you select a wrong version of the Trustees Deed Form Florida, it will be turned down once you send it. It is therefore important to have a trustworthy source of legal files like US Legal Forms.

If you have to get a Trustees Deed Form Florida template, stick to these easy steps:

- Get the sample you need by using the search field or catalog navigation.

- Check out the form’s description to ensure it matches your case, state, and county.

- Click on the form’s preview to see it.

- If it is the incorrect form, return to the search function to locate the Trustees Deed Form Florida sample you require.

- Download the template when it meets your needs.

- If you have a US Legal Forms account, click Log in to access previously saved files in My Forms.

- In the event you don’t have an account yet, you may obtain the form by clicking Buy now.

- Select the proper pricing option.

- Complete the account registration form.

- Choose your transaction method: you can use a credit card or PayPal account.

- Select the document format you want and download the Trustees Deed Form Florida.

- When it is downloaded, you are able to fill out the form by using editing software or print it and finish it manually.

With a large US Legal Forms catalog at hand, you don’t have to spend time looking for the right sample across the internet. Take advantage of the library’s easy navigation to get the proper template for any situation.

Form popularity

FAQ

1. Unless specifically disqualified by the terms of the trust instrument, any person, regardless of state of residence and including family members, friends, and corporate fiduciaries, is eligible to serve as a trustee.

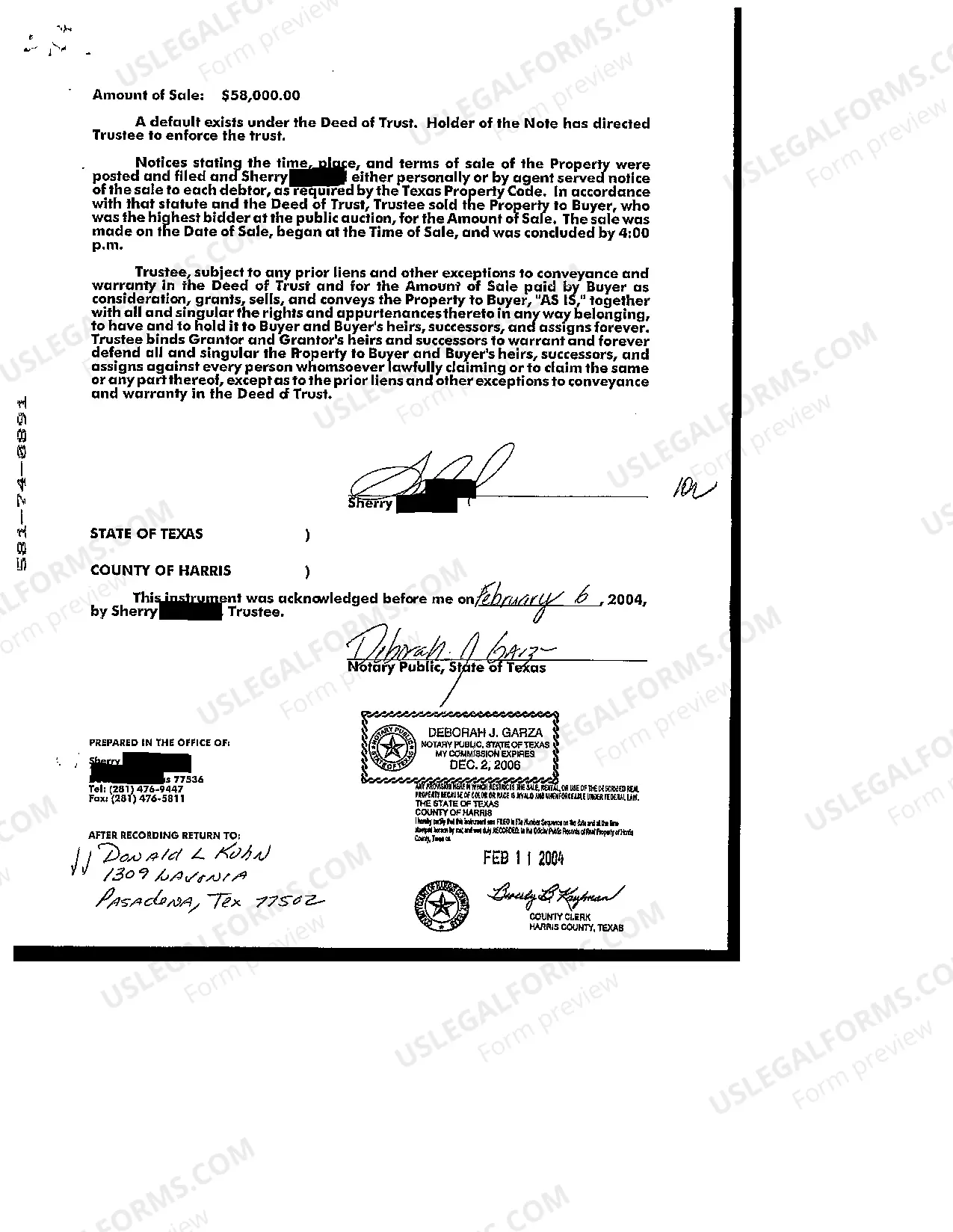

Howa trustee deed works A trust deed is used in place of a mortgage. A person (the lendee) buys a home and finances it through a bank (the lender). A third party?the trustee, usually an escrow company?legally holds title to the home for the lender as security against the loan.

This Deed of Trust (the ?Trust Deed?) sets out the terms and conditions upon which: [Settlor Name] (the ?Settlor?), of [Settlor Address], settles that property set out in Schedule A (the ?Property?) upon [Trustee Name] (the ?Trustee?), being a Company duly registered under the laws of [state] with registered number [ ...

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.

Instead of an agreement directly between a lender and a borrower, a trust deed places the title of a property in the hands of a third party, or trustee. Only after the borrower has satisfied the terms of their debt to the lender will the property be fully transferred to the borrower.