Subordination Agreement Texas With Us

Description

How to fill out Texas Lease Subordination Agreement?

The Subordination Agreement Texas With Us you see on this page is a reusable formal template drafted by professional lawyers in compliance with federal and regional regulations. For more than 25 years, US Legal Forms has provided people, organizations, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal occasion. It’s the fastest, easiest and most reliable way to obtain the paperwork you need, as the service guarantees bank-level data security and anti-malware protection.

Obtaining this Subordination Agreement Texas With Us will take you only a few simple steps:

- Browse for the document you need and review it. Look through the file you searched and preview it or review the form description to verify it satisfies your requirements. If it does not, utilize the search option to find the appropriate one. Click Buy Now once you have located the template you need.

- Subscribe and log in. Select the pricing plan that suits you and register for an account. Use PayPal or a credit card to make a quick payment. If you already have an account, log in and check your subscription to proceed.

- Obtain the fillable template. Pick the format you want for your Subordination Agreement Texas With Us (PDF, Word, RTF) and save the sample on your device.

- Complete and sign the paperwork. Print out the template to complete it by hand. Alternatively, utilize an online multi-functional PDF editor to rapidly and accurately fill out and sign your form with a eSignature.

- Download your papers one more time. Use the same document once again anytime needed. Open the My Forms tab in your profile to redownload any previously purchased forms.

Subscribe to US Legal Forms to have verified legal templates for all of life’s circumstances at your disposal.

Form popularity

FAQ

An example is a trust document that includes a subordinate clause. This requires it to state that once the primary lien becomes active, a secondary lien becomes automatically subordinate. For instance, if a trust pays education funding as a first priority, the first lien is tuition.

Subordination agreements are prepared by your lender. The process occurs internally if you only have one lender. When your mortgage and home equity line or loan have different lenders, both financial institutions work together to draft the necessary paperwork.

A subordination agreement prioritizes debts, ranking one behind another for purposes of collecting repayment from a debtor in the event of foreclosure or bankruptcy. A second-in-line creditor collects only when and if the priority creditor has been fully paid.

If the subordination request is approved, the agreement will be executed by the home equity lender and recorded in the applicable land records. The subordination agreement serves to make the home equity line of credit subordinate to the newly obtained mortgage even though the new mortgage was recorded after it.

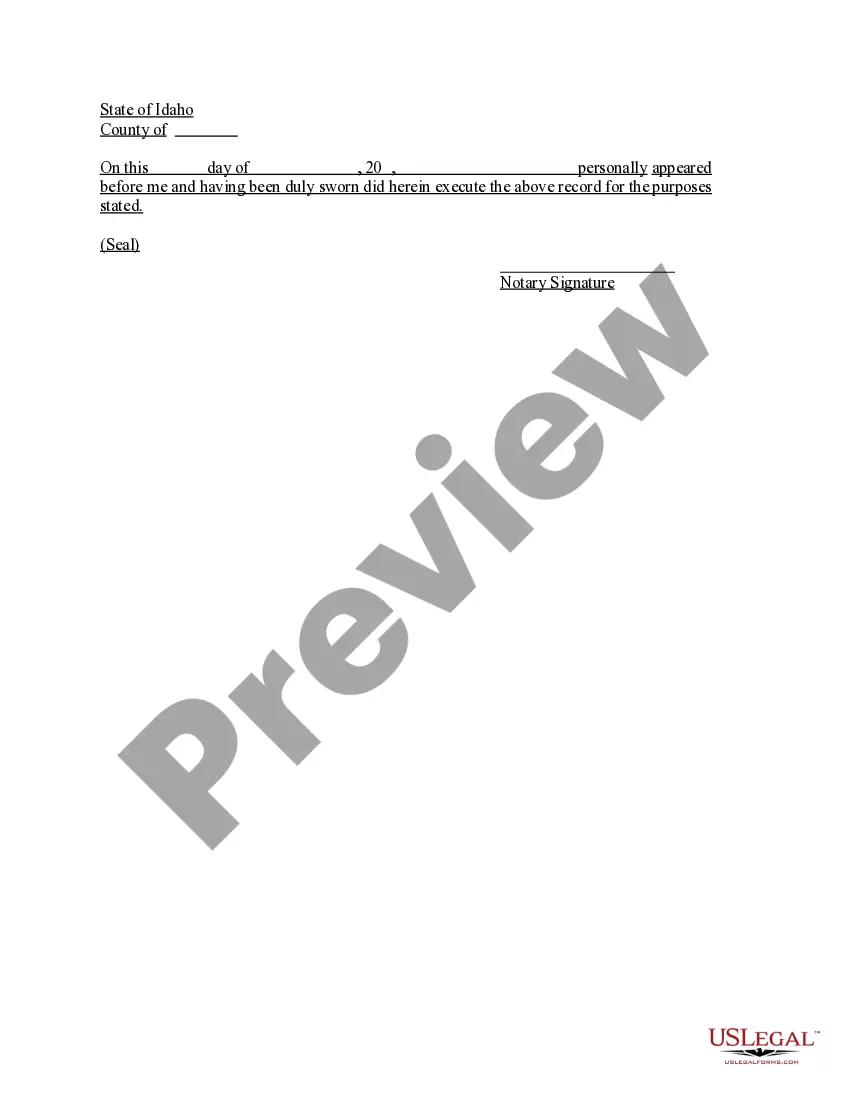

A subordination agreement must be signed and acknowledged by a notary and recorded in the official records of the county to be enforceable.