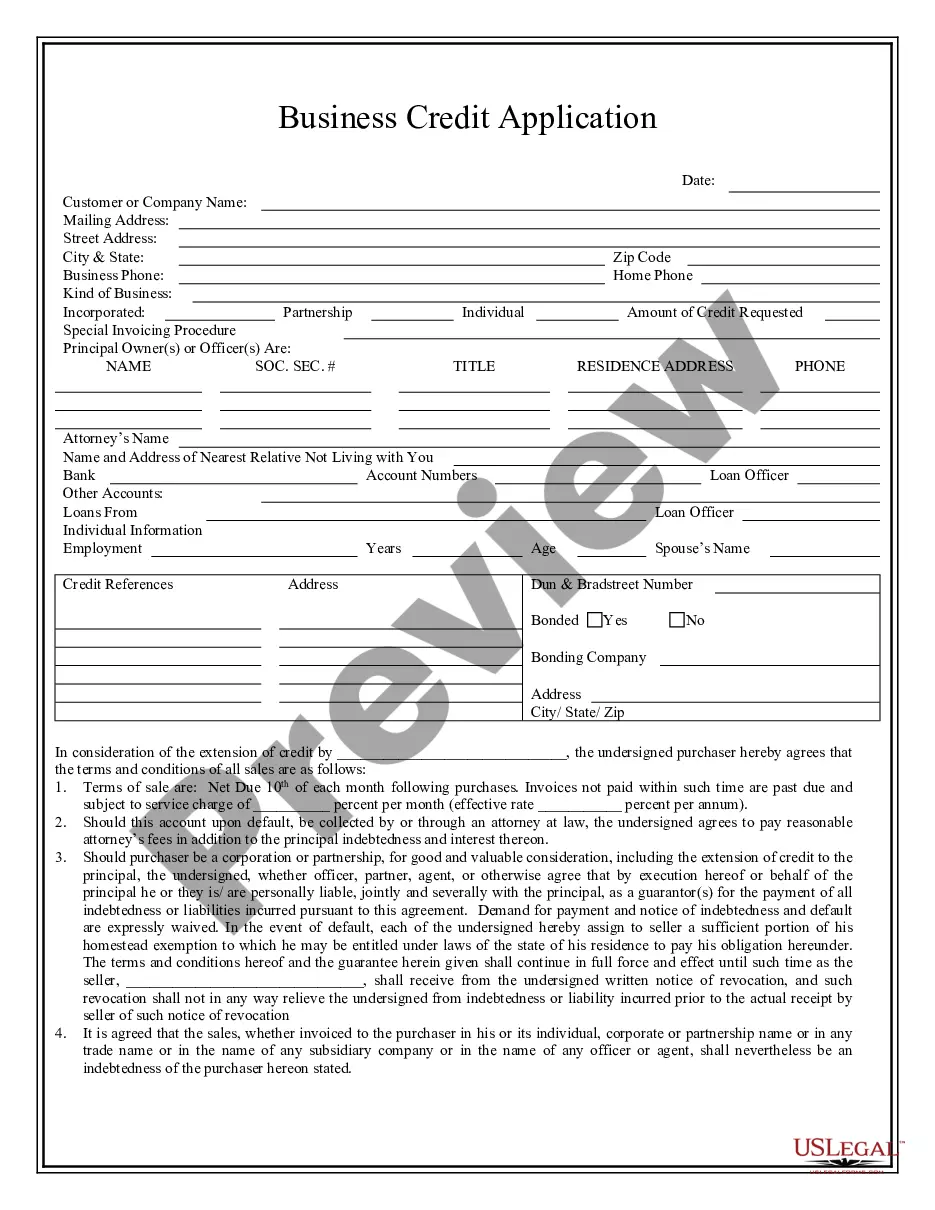

Business Credit Application Form Anz

Description

How to fill out Texas Business Credit Application?

It’s clear that you cannot transform into a legal expert instantly, nor can you understand how to efficiently fill out the Business Credit Application Form Anz without a unique skill set.

Drafting legal documents is a lengthy undertaking that necessitates specific training and expertise. So why not entrust the assembly of the Business Credit Application Form Anz to the experts.

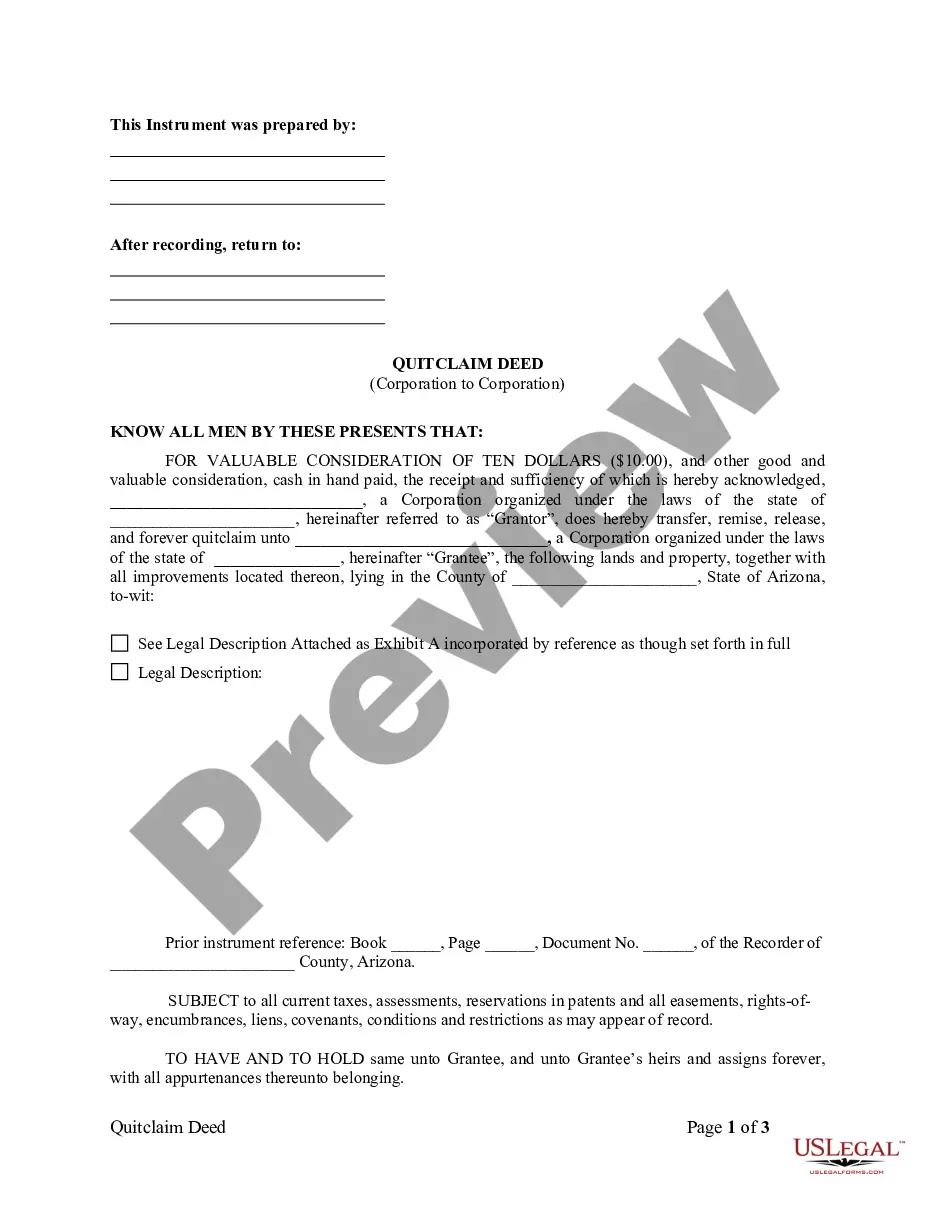

With US Legal Forms, featuring one of the most comprehensive legal document collections, you can discover everything from court documentation to templates designed for office communication.

You can access your forms again from the My documents tab at any time. If you're a returning customer, you can simply Log In and locate and download the template from the same tab.

No matter the objective of your documentation—whether financial, legal, or personal—our platform is here for you. Try US Legal Forms today!

- Utilize the search bar at the top of the page to locate the form you require.

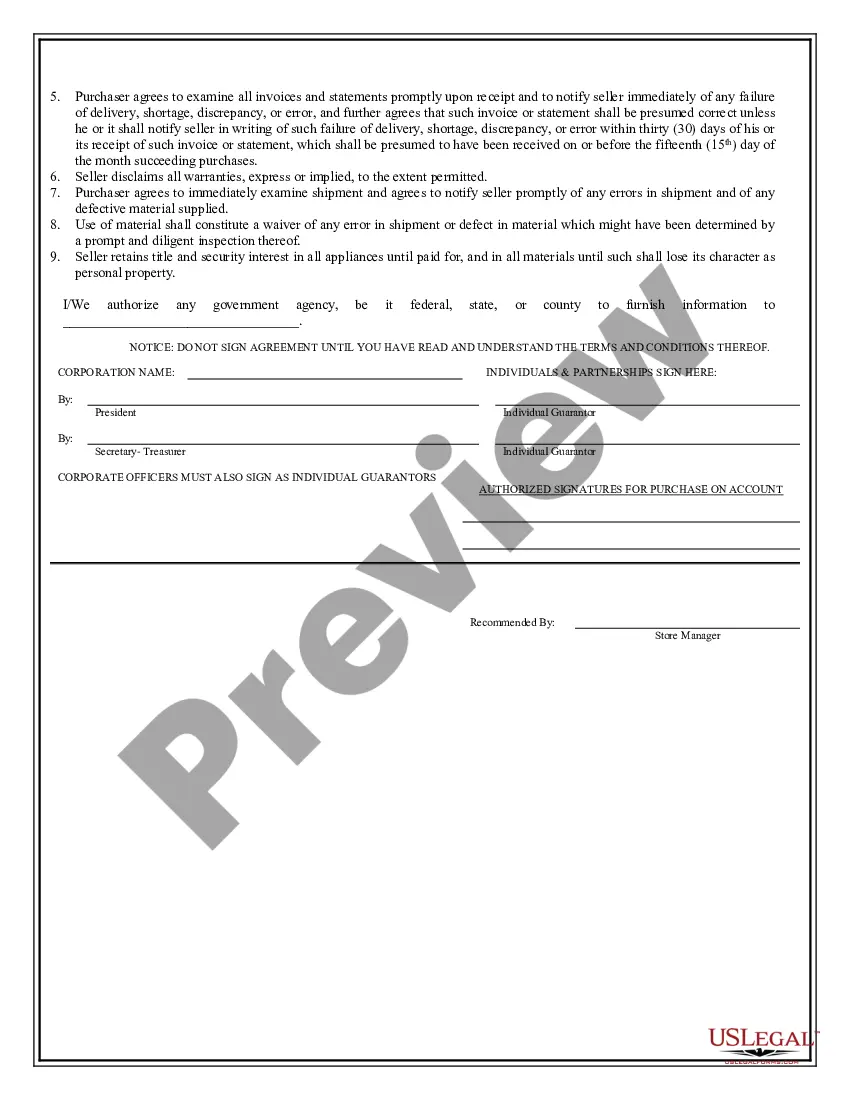

- If available, preview it and review the accompanying description to ascertain if the Business Credit Application Form Anz is what you seek.

- If you need another template, restart your search.

- Create a free account and choose a subscription plan to purchase the form.

- Select Buy now. Once the payment is processed, you can obtain the Business Credit Application Form Anz, fill it out, print it, and send or mail it to the appropriate individuals or organizations.

Form popularity

FAQ

Establishing business credit begins with setting up your business legally and obtaining an Employer Identification Number (EIN). After that, open a business bank account and apply for a business credit card using a business credit application form anz. Regular and responsible use of credit accounts will gradually build your credit history.

A credit application for a business account is a document you complete to request credit from lenders. This form typically requires key information, such as your business name, financial details, and ownership structure. Completing a business credit application form anz provides the lender with a clear view of your financial standing, enabling them to make informed decisions.

To begin building credit for your business, first, make sure you have a dedicated business bank account. This helps separate personal and business finances. Next, apply for a business credit card using a business credit application form anz, and use it for regular purchases. Consistently paying off the balance can help establish a positive credit profile.

Creating a business credit file requires registering your business with a credit bureau. Start by obtaining an EIN and opening a business bank account to reflect your business transactions. Regularly fill out a Business credit application form anz to establish new credit lines, as these will all contribute to building a robust credit file.

To create a business credit application form, include fields that capture necessary business information, such as ownership structure, financial history, and credit references. Simplifying the form keeps it user-friendly for applicants. Utilizing a template from USLegalForms can speed up this creation process and ensure comprehensiveness in your Business credit application form anz.

The fastest way to build credit for your LLC is to ensure timely payments on your business debts. Establish relationships with suppliers and creditors who report to credit bureaus. Additionally, your LLC should apply for a business credit card and fill out a Business credit application form anz to start building a solid credit profile quickly.

Creating a credit application form involves gathering essential information about your business. You should include sections for business name, EIN, address, and financial details. A well-structured Business credit application form anz facilitates smoother processing and enhances your credibility with lenders. Consider using USLegalForms for customizable templates.

Yes, you can use your Employer Identification Number (EIN) to build business credit. When you apply for credit using your EIN, lenders will check your business's credit history and its ability to repay. This can be an effective way to establish credit under your business name. Make sure to fill out a Business credit application form anz accurately to optimize your chances.

The credit approval process for a business includes several important stages. First, you fill out a business credit application form anz, which requires detailed information about your business and finances. The lender reviews your business's credit history, financial performance, and might request additional documents. The entire process is designed to assess risk, ensuring that both parties engage in an informed agreement.

Establishing credit for your business involves several straightforward steps. Start by applying for a business credit application form anz and securing a small line of credit with suppliers or vendors that report to credit bureaus. Make consistent payments to build a positive credit history, and also consider obtaining a business credit card for regular expenses. Consistency and responsible credit use will positively impact your creditworthiness.