Fha Financing Canada

Description

How to fill out Texas Financing?

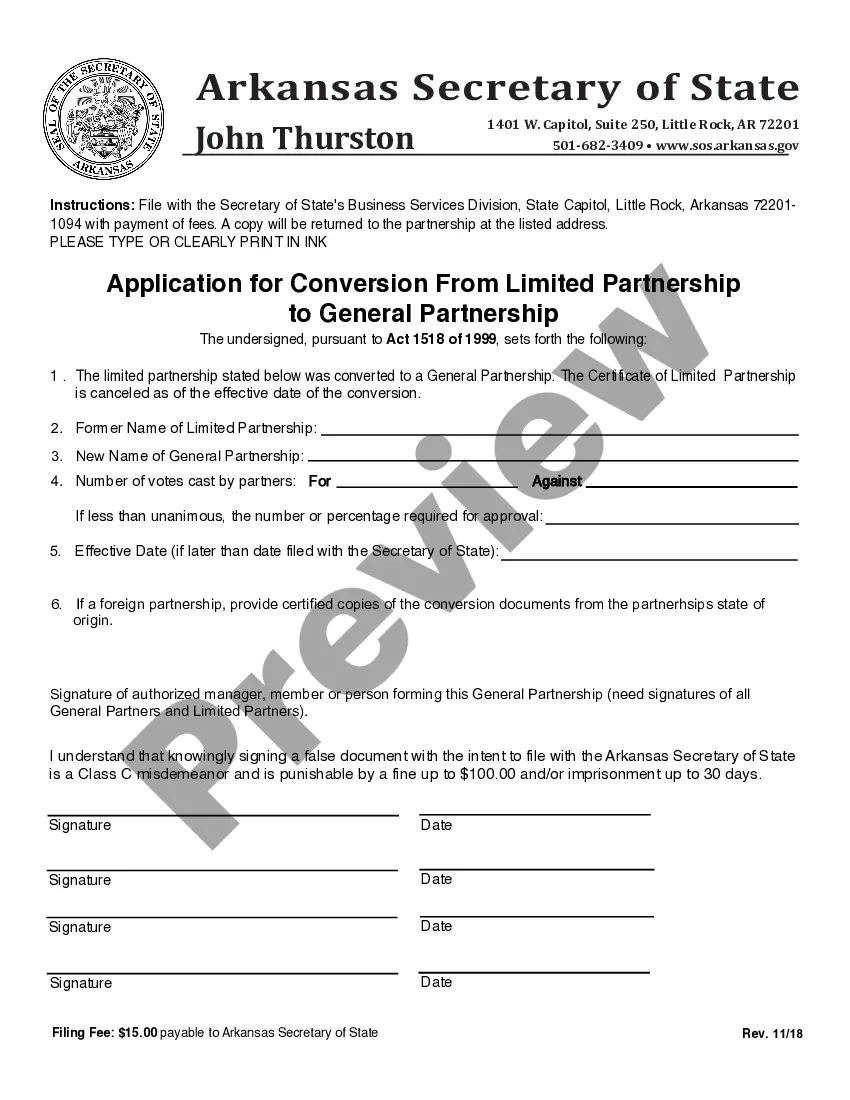

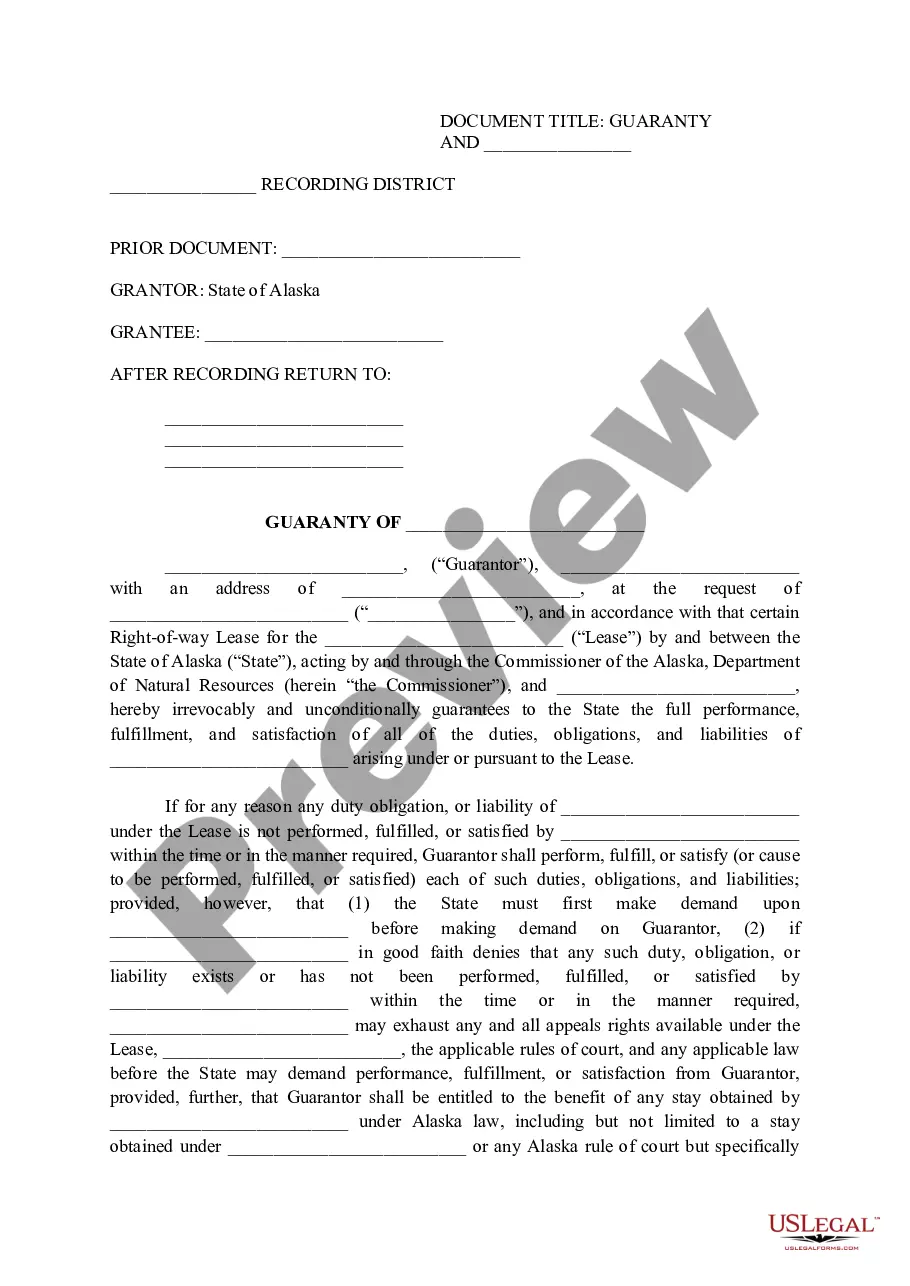

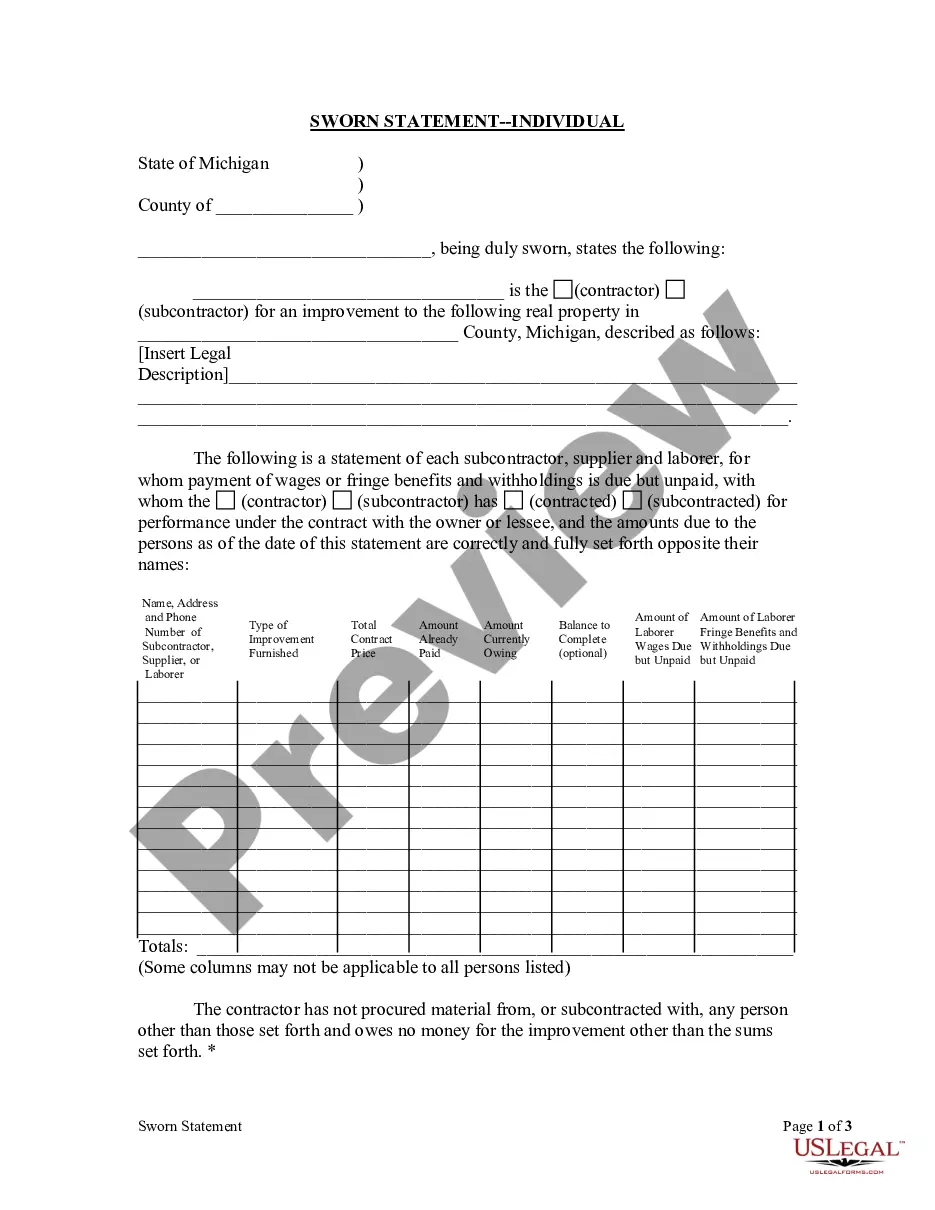

- Log in to your existing US Legal Forms account. Ensure your subscription is active; renew if necessary.

- Navigate to the Preview mode to review the form descriptions. Confirm that the selected template aligns with your needs and complies with your local regulations.

- If the current form isn't suitable, use the Search tab to find an alternative that fulfills your requirements.

- Purchase the chosen document by clicking on the Buy Now button. Select your preferred subscription plan and register an account to gain full access.

- Complete your purchase by entering your credit card information or using PayPal to settle your subscription.

- Download the form to your device, allowing you to complete it as needed. Access this document anytime in the My Forms section of your account.

Utilizing US Legal Forms empowers users by offering a vast collection of legal documents, surpassing competitors in both quantity and price. With over 85,000 editable forms at your fingertips, navigating legal requirements is made straightforward.

In conclusion, US Legal Forms is your go-to resource for accessing essential documents related to FHA financing in Canada. Start exploring today and ensure you have the legal backing you need for a successful mortgage experience!

Form popularity

FAQ

Under FHA financing in Canada, the minimum down payment for a $250,000 house is typically 5% if you have mortgage insurance. This equates to $12,500 upfront. However, total costs may increase with additional fees and closing costs. Utilizing platforms like US Legal Forms can help streamline the document preparation process, ensuring you understand all requirements before making a significant financial commitment.

To buy a $200,000 house using FHA financing in Canada, your income will depend on other factors like your debt-to-income ratio and the interest rate on your mortgage. Generally, you should aim to have a stable income that can support your mortgage payments, which often requires a gross yearly income of around $50,000, although this can vary. Additionally, consider other expenses like property taxes and insurance, as they factor into your overall financial picture. Consulting with a mortgage specialist can help clarify your specific financial situation.

A house may fail an FHA inspection due to various reasons, including safety hazards, structural issues, and necessary repairs not being addressed. Common problems include an unstable foundation, inadequate roofing, and pest infestations. Ensuring compliance with FHA standards before inspection can prevent unnecessary delays. If you're uncertain, consider using platforms like UsLegalForms for guidance on FHA requirements.

Several factors can disqualify a house from FHA financing. For instance, properties with significant structural issues, safety code violations, or those not connected to public sewer or water systems may not qualify. Additionally, homes located in certain commercial zones or those that do not comply with local zoning laws are often excluded. Understanding these aspects can save you time in your property search for Fha financing Canada.

To determine if a house is FHA eligible, check if the property meets the FHA guidelines for safety, security, and livability. You can often find this information through the listing agent or by consulting with a lender who specializes in Fha financing Canada. Inspecting properties for necessary repairs and compliance with FHA standards can also help you make informed decisions. These steps lead you toward a smooth financing experience.

For a house to be FHA approved, it must meet certain criteria set by the Federal Housing Administration. The property should be a primary residence, which means you cannot use it as a vacation home or rental. Additionally, the home must meet safety and security standards, ensuring a safe environment for you and your family. If you're looking into Fha financing Canada, understanding these requirements can guide your home search.

Not everyone qualifies for FHA loans, particularly if they have a recent bankruptcy or foreclosure on their record. Additionally, individuals with a poor credit history may face challenges in securing this type of financing. FHA financing in Canada has specific guidelines that apply to each applicant, so it is crucial to check your individual circumstances before applying.

While there is no direct equivalent of FHA loans in Canada, the term often leads to discussions about government initiatives designed to assist homebuyers. Programs like the First-Time Home Buyer Incentive aim to make homeownership more attainable. Exploring these options can provide you with valuable insights into FHA financing Canada and similar benefits available for prospective buyers.

FHA loans, as understood in the U.S., do not exist in Canada. However, Canadian homebuyers still have access to various financing options that can resemble the benefits of FHA financing. You can explore alternative government-backed loans and programs that make homeownership accessible, similar to what FHA offers in the United States.

In Canada, FHA typically refers to the Federal Housing Administration, the same agency as in the United States. However, the focus may shift towards understanding how FHA financing Canada operates within the Canadian mortgage landscape. Knowing this can aid you in making informed decisions when exploring housing opportunities.