What Is Third Party Financing

Description

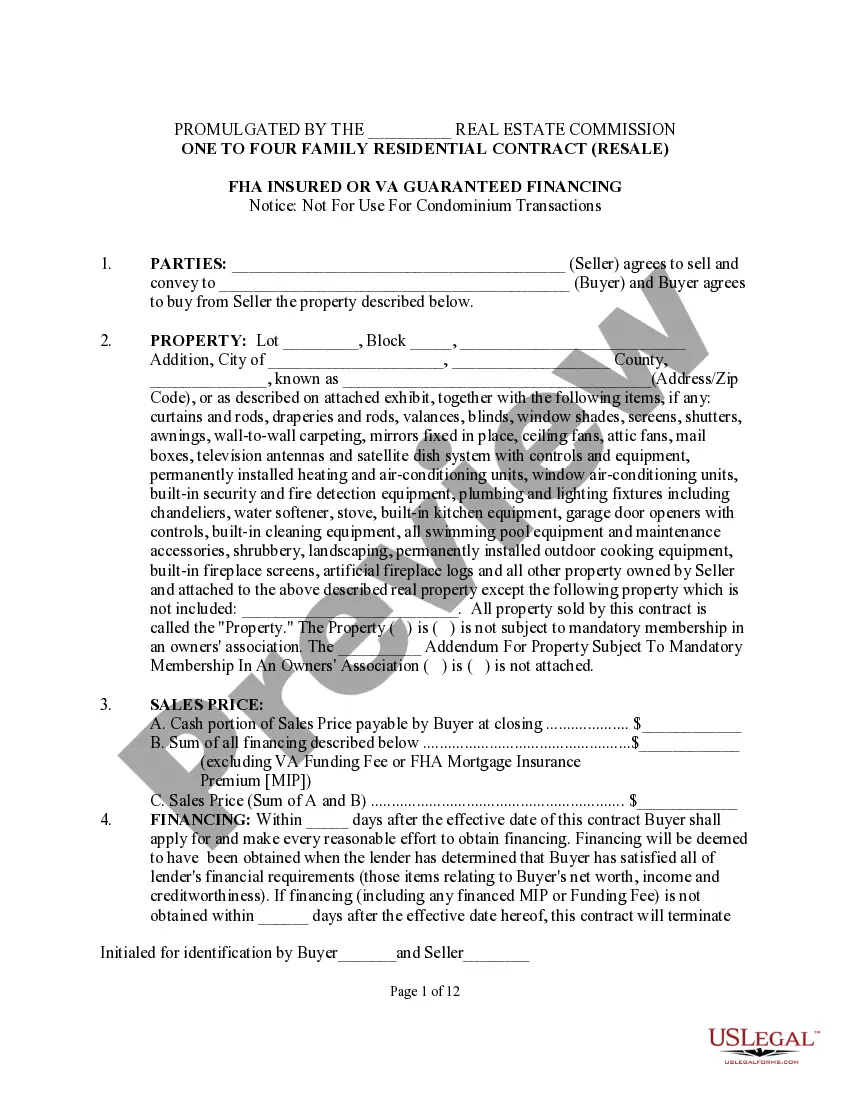

How to fill out Texas One To Four Family Residential Contract - Resale - All Cash, Assumption, Third Party Conventional Or Seller Financing?

- Log into your US Legal Forms account if you're a returning user, ensuring your subscription is active for a seamless experience.

- For first-time users, start by exploring the preview mode and description to select the right form tailored to your local jurisdiction.

- If you find inconsistencies or require a different template, utilize the search function to locate the perfect document.

- Once you've identified the correct form, click on the 'Buy Now' button and choose your preferred subscription plan.

- Complete your purchase by entering your payment details through credit card or PayPal.

- Finally, download your selected form and save it to your device for easy access and completion later.

US Legal Forms empowers both individuals and attorneys by providing an extensive library of over 85,000 editable legal forms. This robust collection ensures that you can quickly find and execute the necessary legal documents.

Take advantage of this powerful resource today and streamline your legal document needs with US Legal Forms. Sign up now to experience hassle-free form management!

Form popularity

FAQ

Third party financing refers to funding provided by an external source rather than the primary parties involved in a transaction. This type of financing can include loans, grants, or investments that support a specific financial need. When exploring the question of what is third party financing, it's crucial to understand how it can facilitate transactions in various industries, including real estate, education, and business ventures. Platforms like USLegalForms can guide you in navigating the legal documents required when engaging in third party financing agreements.

One example of a third party is an escrow service that temporarily holds funds during a transaction process. This service ensures that both parties fulfill their contractual obligations before funds are released. When you understand what is third party financing, you can appreciate how escrow services help manage risk in transactions.

A third party company refers to an organization that is not directly involved in a transaction but plays a role in facilitating it. Common examples include payment processors or logistics companies that help to complete a business transaction. Understanding what is third party financing helps clarify the roles these entities play in transactions.

Third party lenders are financial institutions or individuals that provide loans to borrowers who may not qualify for traditional financing. These lenders include credit unions, online lenders, and peer-to-peer lending platforms. Knowing what is third party financing is key when considering these options for funding your projects or investments.

A third party agency is an organization that operates independently from the primary parties involved in a transaction. For instance, an insurance company that provides coverage for both a client and a service provider serves as a third party agency. Understanding what is third party financing can help you navigate relationships with these agencies, facilitating smoother transactions.

The responsibility of filling out the third-party financing addendum generally falls on the buyer or their real estate professional. This ensures that all financing terms are clearly documented and agreed upon by both parties. The goal is to avoid any confusion as the transaction progresses. Utilizing a user-friendly platform like USLegalForms can assist you in creating this document easily.

A financing addendum is a document that outlines the financing conditions in a real estate contract. It specifies the details surrounding third-party financing arrangements and assures that the sale hinges on the buyer securing funds. This addendum often includes timeframes and contingencies, protecting both buyers and sellers in the transaction. Understanding what a financing addendum entails can simplify your real estate dealings.

Third-party funding encompasses any financial aid that comes from sources other than those directly involved in a project. This includes loans, donations, and investment from external stakeholders or organizations. Recognizing what counts as third-party funding allows you to utilize diverse resources effectively. Being aware of these opportunities is fundamental when considering what is third party financing.

An example of a third party could be a lending institution, such as a bank, providing funds for a business venture. In this case, the business is the primary party, while the bank acts as the external entity supplying the necessary capital. Including third parties in your financial strategies can enhance your funding options. Understanding this relationship plays a key role in what is third party financing.

A third party fund can be any financial support that does not originate from the primary parties in a transaction. This could include loans from a bank, investments from venture capitalists, or even grants from organizations. Grasping the concept of what is third party financing empowers you to leverage various funding avenues to achieve your goals. Knowing these details is crucial when seeking to finance a project.