Residential Seller Financing For Dummies

Description

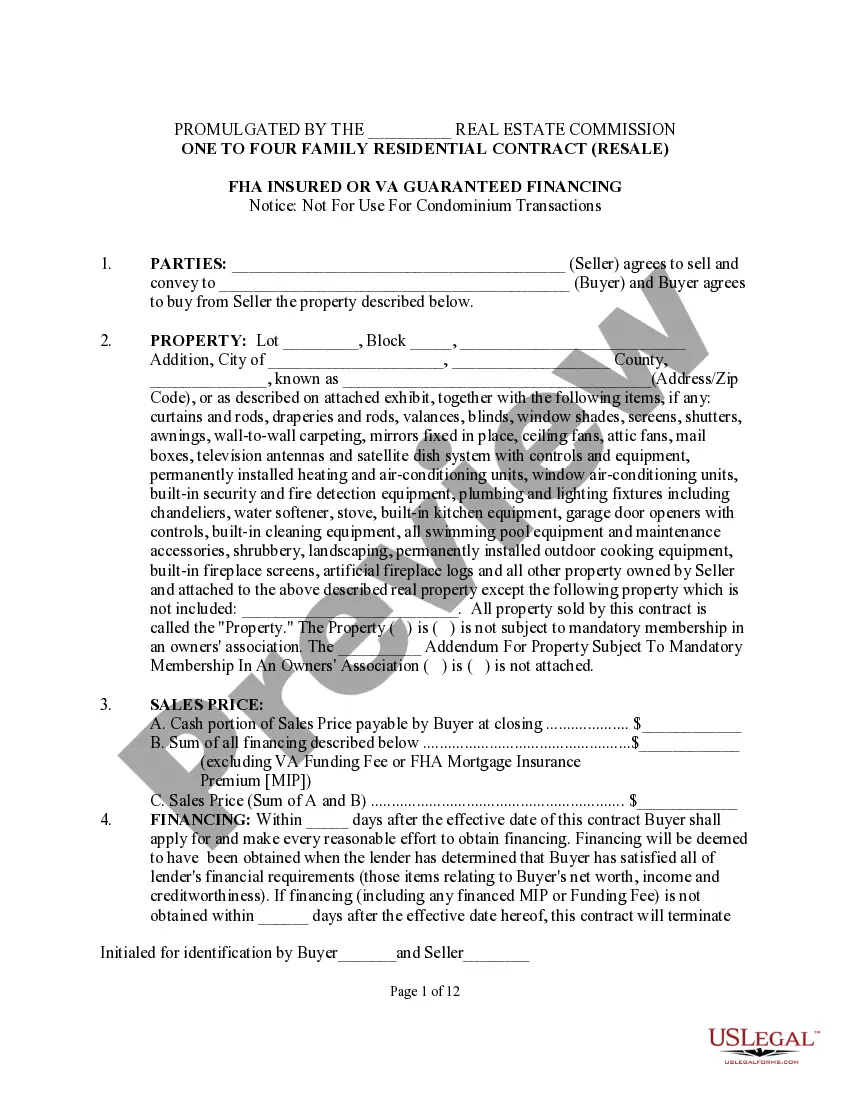

How to fill out Texas One To Four Family Residential Contract - Resale - All Cash, Assumption, Third Party Conventional Or Seller Financing?

Managing legal documents can be overwhelming, even for experienced professionals.

If you are looking for a Residential Seller Financing For Dummies and lack the time to search for the suitable and current version, the procedures can be burdensome.

US Legal Forms addresses any needs you might have, from personal to business documents, all in one location.

Utilize advanced tools to fill out and manage your Residential Seller Financing For Dummies.

Here are the steps to follow after downloading the form you require: Confirm this is the correct form by previewing it and reviewing its description, ensure that the template is accepted in your state or county, click Buy Now when you are prepared, select a subscription plan, find the format you prefer, and Download, fill out, eSign, print, and send your document. Take advantage of the US Legal Forms online catalog, backed by 25 years of expertise and reliability. Streamline your daily document management into a straightforward and user-friendly process today.

- Access a repository of articles, guides, and resources relevant to your situation and requirements.

- Save time and effort searching for the documents you need, and utilize US Legal Forms’ sophisticated search and Preview feature to locate Residential Seller Financing For Dummies and download it.

- If you have a subscription, Log In to your US Legal Forms account, search for the form, and download it.

- Visit the My documents tab to review the documents you’ve previously saved and organize your folders as desired.

- If it's your first experience with US Legal Forms, create an account and gain unlimited access to all the library's benefits.

- An effective online form catalog could be transformative for anyone wanting to handle these matters efficiently.

- US Legal Forms is a frontrunner in online legal forms, offering over 85,000 state-specific legal forms at your disposal anytime.

- With US Legal Forms, you can access state- or county-specific legal and business forms.

Form popularity

FAQ

Here are three main ways to structure a seller-financed deal: Use a Promissory Note and Mortgage or Deed of Trust. If you're familiar with traditional mortgages, this model will sound familiar. ... Draft a Contract for Deed. ... Create a Lease-purchase Agreement.

For example, if a seller-financed loan is for $100,000 at an interest rate of 8%, you would calculate that $100,000 x 0.08, which means $8,000 in interest for the year. In this scenario, a $100,000 loan at 8% would look like $666.67 in a monthly interest-only payment.

The seller's financing typically runs only for a fairly short term, such as five years. At the end of that period, a balloon payment is due. The expectation is usually that the initial seller-financed purchase will improve the buyer's creditworthiness and allow them to accumulate equity in the home.

Seller financing is a type of real estate agreement that allows the buyer to pay the seller in installments rather than using a traditional mortgage from a bank, credit union or other financial institution.

Most seller notes are characterized by a maturity term of around 3 to 7 years, with an interest rate ranging from 6% to 10%. Because of the fact that seller notes are unsecured debt instruments, the interest rate tends to be higher to reflect the greater risk.