Texas Squatters Rights With Someone

Description

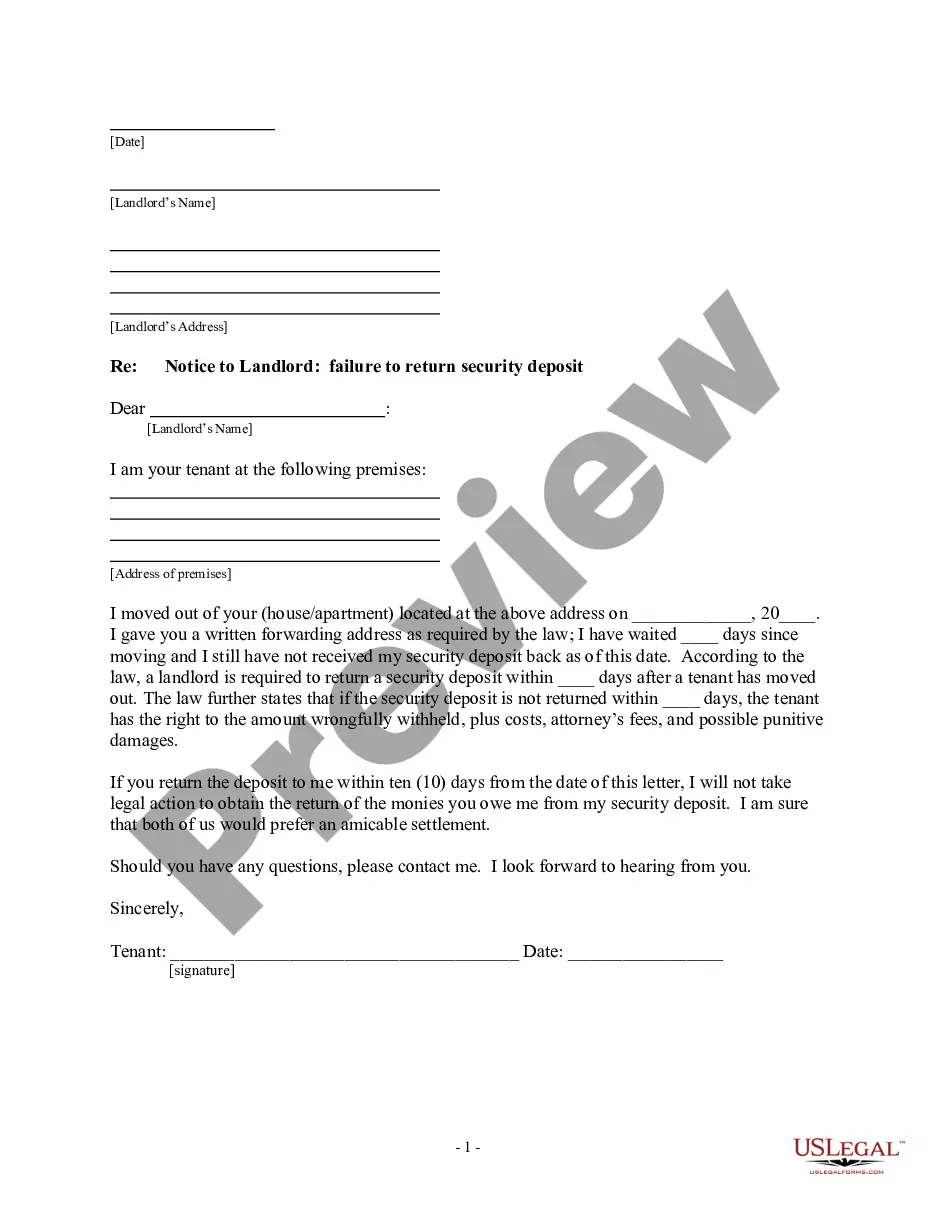

How to fill out Texas Adverse Possession Affidavit - Squatters Rights?

Legal management can be cumbersome, even for the most adept professionals.

When you seek assistance with Texas Squatters Rights With Someone and lack the time to adequately search for the correct and current version, the processes can become taxing.

Access a valuable collection of articles, guidelines, manuals, and resources pertinent to your circumstances and requirements.

Save time and energy searching for the forms you require, and take advantage of US Legal Forms’ sophisticated search and Review function to obtain Texas Squatters Rights With Someone.

Leverage the US Legal Forms online directory, supported by 25 years of industry knowledge and reliability. Streamline your everyday document management into a smooth and user-friendly procedure today.

- If you possess a monthly subscription, Log In to your US Legal Forms account, search for the form, and retrieve it.

- Visit the My documents section to review the forms you have previously saved and to organize your folders as you prefer.

- If this is your first instance using US Legal Forms, create an account and enjoy unrestricted access to all platform benefits.

- Here are the steps to follow after acquiring the form you need.

- Confirm it is the correct form by previewing and reviewing its description.

- Ensure that the template is valid in your state or county.

- Click Buy Now once you are prepared.

- Select a subscription tier.

- Choose the format you prefer, and Download, fill out, sign, print, and send your document.

- A comprehensive web form directory can significantly benefit anyone who aims to address these matters effectively.

- US Legal Forms stands as a leading provider in online legal forms, offering more than 85,000 state-specific legal documents available at any time.

- Utilize advanced tools to complete and manage your Texas Squatters Rights With Someone.

Form popularity

FAQ

Single tax filers can expect a rebate of $500 while married couples who filed jointly, heads of household and surviving spouses can expect $1,000. People have until to file their 2021 New Mexico Personal Income Tax return and still qualify for the rebates, ing to the TRD.

To check the status of your refund for the current taxable year visit the Taxation and Revenue Department's online service the Taxpayer Access Point (TAP). Once you are on the TAP website go to the ?Personal Income? tile and select the ?Where's My Refund?? link.

Public Access to Court Records As provided by the New Mexico Supreme Court Order and the Case Access Policy for Online Court Records, there are three ways to access New Mexico public court records: Case Lookup for the general public. Secured Odyssey Public Access (SOPA) for registered users.

If you haven't received your rebate after several weeks or have other questions, email the New Mexico Taxation and Revenue Department at nm.rebates@tax.nm.gov or call 1-866-285-2996.

Thanks to a bill passed by lawmakers during the 2023 legislative session, New Mexicans who have previously filed taxes will get another round of rebates. Single tax filers will get $500. Married couples, heads of households, and surviving spouses will get $1,000.

A refundable income tax rebate of $1000 for married couples filing joint returns, heads of household and surviving spouses and $500 for single filers and married individuals filing separately.

No application is required. Rebate checks will be printed and mailed at least through the end of June 2023. Those receiving direct deposits should receive them the week of June 19. Eligible residents have until to file the 2021 PIT return if they have not already done so.