Texas Estates Code Probate Of Foreign Will

Description

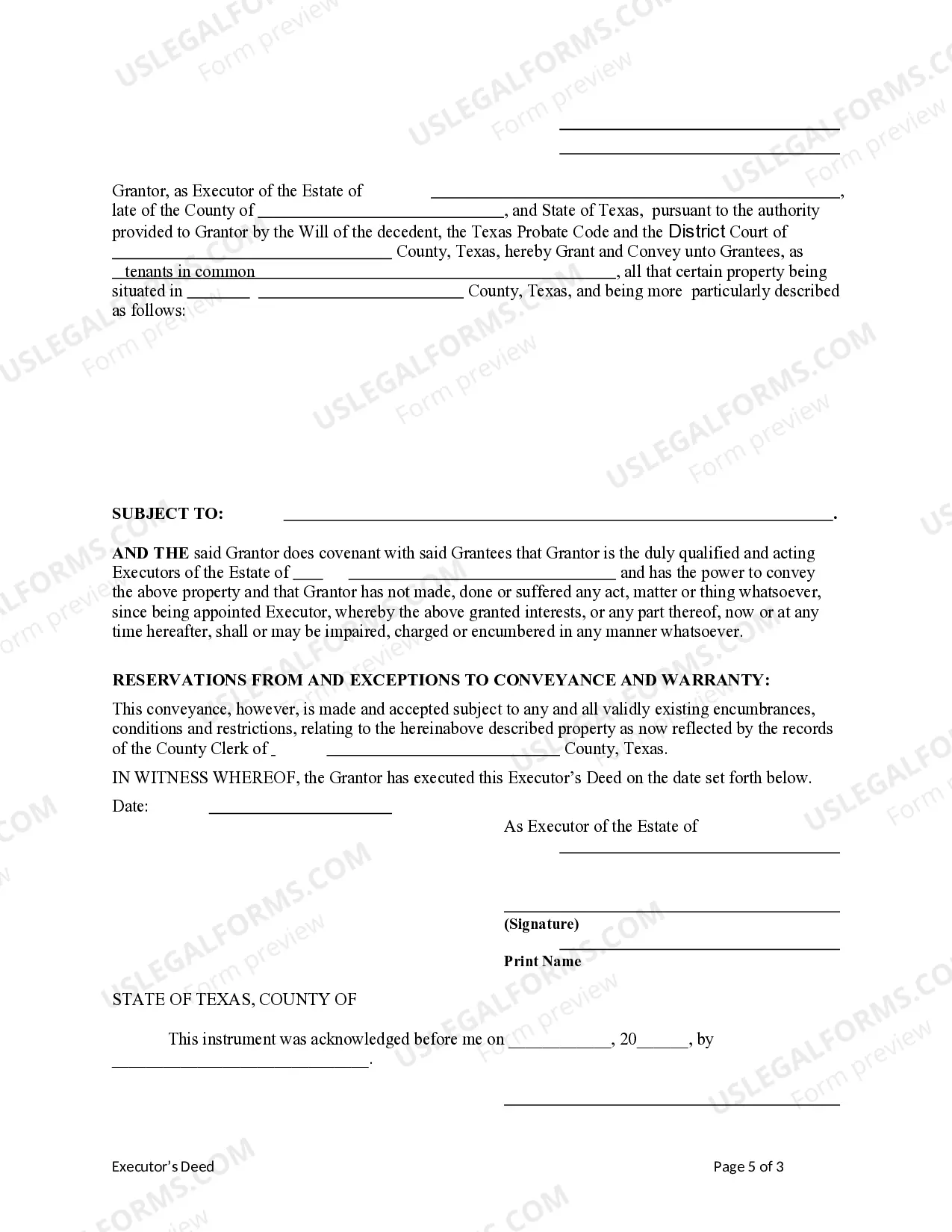

How to fill out Texas Executor's Deed - Estate To Five Beneficiaries?

Accessing legal documents that comply with federal and local laws is essential, and the internet presents numerous choices to choose from.

However, what’s the use in spending time searching for the correct Texas Estates Code Probate Of Foreign Will example online when the US Legal Forms digital library already consolidates such documents in one location.

US Legal Forms is the premier online legal repository featuring over 85,000 editable templates created by legal professionals for various business and personal situations.

Review the template via the Preview option or through the text description to ensure it aligns with your requirements. Search for another example using the search tool at the top of the page if needed. Click Buy Now once you’ve found the suitable form and select a subscription plan. Create an account or Log In and make a payment via PayPal or a credit card. Choose the appropriate format for your Texas Estates Code Probate Of Foreign Will and download it. All documents available through US Legal Forms are reusable. To re-download and complete previously acquired forms, navigate to the My documents section in your account. Take advantage of the most comprehensive and user-friendly legal documentation service!

- They are easy to navigate with all documents categorized by state and intended use.

- Our specialists stay informed about legislative changes, so you can be confident that your documents are current and compliant when obtaining a Texas Estates Code Probate Of Foreign Will from our site.

- Acquiring a Texas Estates Code Probate Of Foreign Will is swift and straightforward for both existing and new users.

- If you already have an account with an active subscription, Log In and download the document sample you need in your preferred format.

- If you are new to our platform, follow the steps below.

Form popularity

FAQ

Follow these five steps to start a Utah LLC and elect Utah S corp designation: Name Your Business. Choose a Registered Agent. File the Utah Certificate of Organization. Create an Operating Agreement. File Form 2553 to Elect Utah S Corp Tax Designation.

Follow these five steps to start a Utah LLC and elect Utah S corp designation: Name Your Business. Choose a Registered Agent. File the Utah Certificate of Organization. Create an Operating Agreement. File Form 2553 to Elect Utah S Corp Tax Designation.

Businesses that have elected S corporation treatment for federal income tax purposes must file Form TC-20S, ?Utah S Corporation Return.? The minimum tax doesn't apply. S corporations don't pay franchise and income taxes. Instead, their members pay individual income tax on their proportionate share of the income.

To register a business as an S corporation, Articles of Incorporation (sometimes called a Certificate of Incorporation or Certificate of Formation), must be filed with the state and the necessary filing fees paid. After incorporation, Form 2553 must be filed with the IRS in order to elect S corporation status.

Can I set up an S corp myself? While it is possible to file articles of incorporation and go through the S corporation election process alone, S corp requirements are both strict and complex. To ensure you're following the rules, we recommend consulting an attorney or tax professional.

To form your LLC or corporation, you will need to file your documents with the Utah Division of Corporations and Commercial Code.