Executor Of Estate Foreclosure

Description

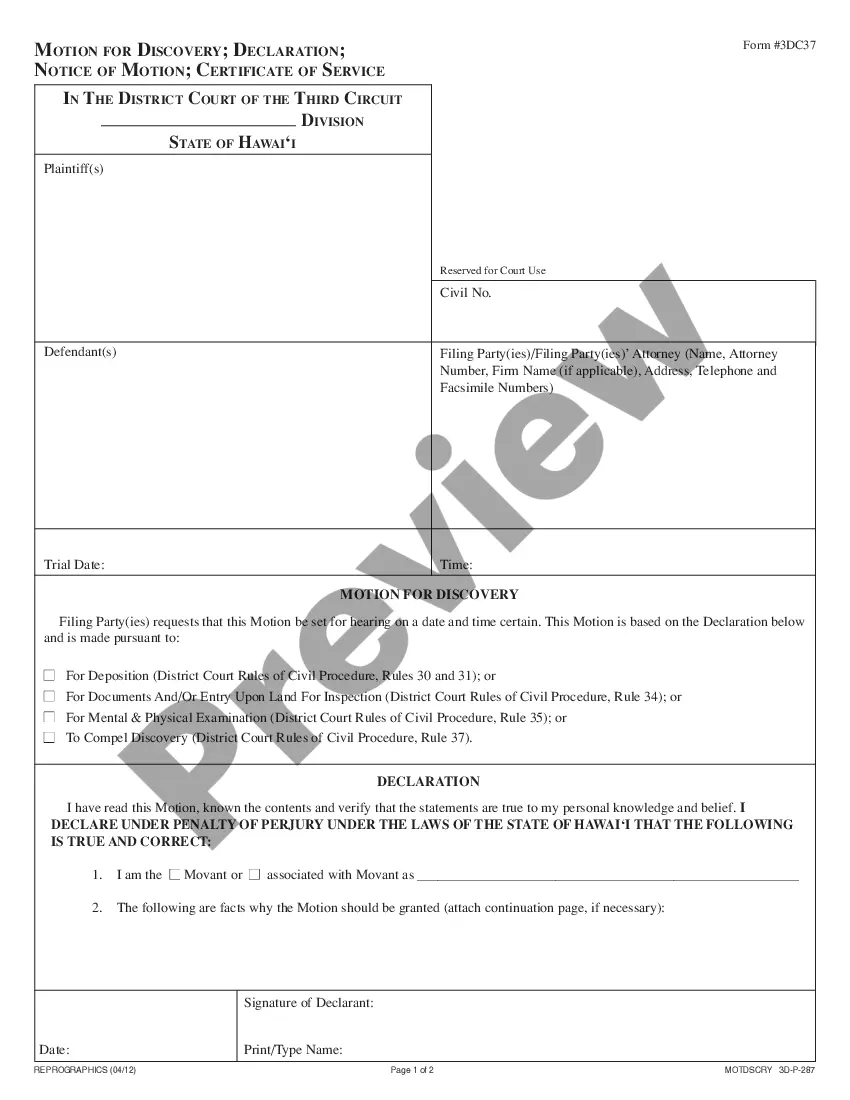

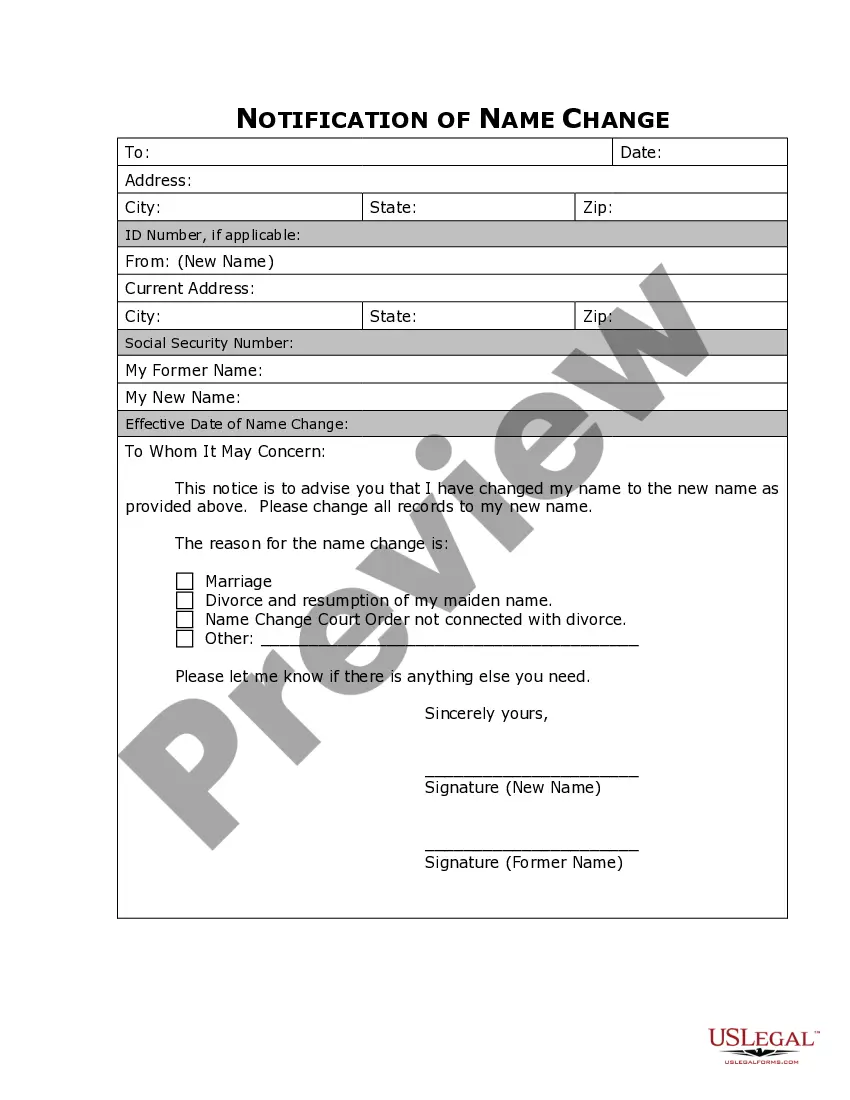

How to fill out Texas Executor's Deed - Estate To Five Beneficiaries?

Regardless of whether for commercial aims or personal matters, everyone must face legal circumstances at some point in their life.

Completing legal documents demands meticulous care, starting with selecting the correct form example.

Select the file format you prefer and download the Executor Of Estate Foreclosure. Once saved, you can complete the form using editing software or print it out and fill it in manually. With an extensive US Legal Forms catalog available, there’s no need to waste time searching for the correct template online. Utilize the library’s straightforward navigation to find the suitable template for any situation.

- For example, if you select an incorrect version of an Executor Of Estate Foreclosure, it will be rejected once submitted.

- Thus, it's vital to have a trustworthy source of legal documents like US Legal Forms.

- If you need to obtain an Executor Of Estate Foreclosure template, follow these straightforward steps.

- Acquire the template you require using the search box or catalog navigation.

- Review the form’s details to ensure it aligns with your situation, state, and county.

- Click on the form’s preview to examine it.

- If it is the incorrect form, return to the search feature to find the Executor Of Estate Foreclosure template you need.

- Download the file if it meets your requirements.

- If you possess a US Legal Forms account, simply click Log in to access previously stored documents in My documents.

- If you don’t have an account yet, you can acquire the form by clicking Buy now.

- Choose the appropriate pricing option.

- Fill out the account registration form.

- Select your payment method: use a credit card or PayPal account.

Form popularity

FAQ

Chapter 7 bankruptcy is generally the cheapest type of bankruptcy to file. Attorney fees for this type of bankruptcy are usually far lower than those for a Chapter 13 bankruptcy.

While it can be a fresh start, filing for bankruptcy comes with costs, depending on the size, type and complexity of your debt. Filing Chapter 7 bankruptcy typically costs between $1,800 and $2,300 while a Chapter 13 filing can cost between $4,500 and $5,300.

What Steps Are Involved in a New Hampshire Bankruptcy? learn about Chapters 7 and 13. check whether bankruptcy will erase debt. find out if you can keep property. determine whether you qualify. consider hiring a bankruptcy lawyer. stop paying qualifying debts. gather necessary financial documents.

Get Your Filing Fee It costs $338 to file Chapter 7 bankruptcy in any U.S. Bankruptcy Court. If you make less than 150% of the federal poverty guidelines, you may be eligible to apply for a fee waiver. Even then, it's up to the court to decide whether to waive the fee or have you pay it in installments.

$90.00 filing fee for claims of $5,000 or less. fee varies based on travel distance and the number of attempts required to serve the defendant.

Register Your New Hampshire LLC There is a $100 fee to complete the form ($102 for online filing), and you will receive a file-stamped copy of your certificate within 30 days. Checks should be made payable to the ?State of New Hampshire.?