Correction Deed Form Texas For Elderly Parent

Description

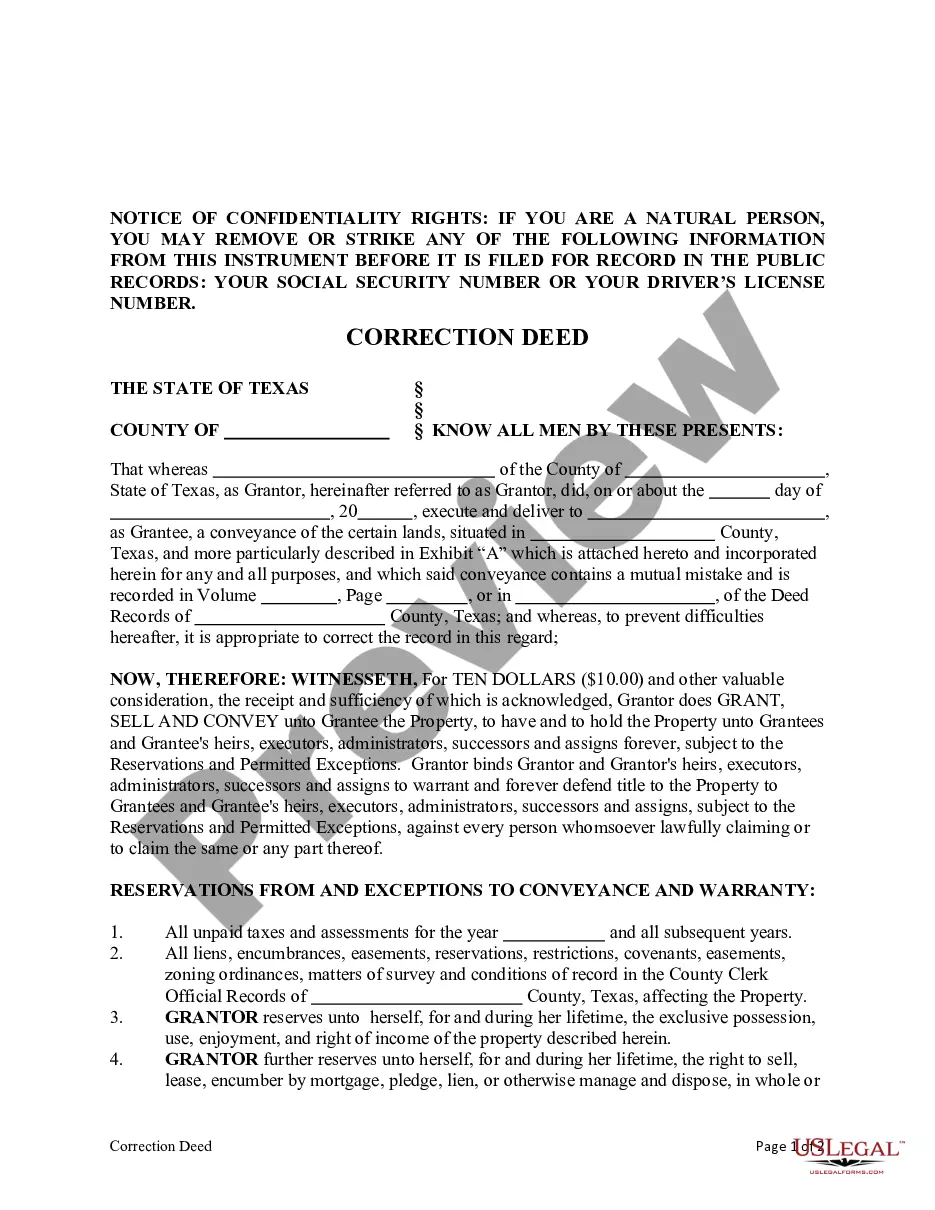

How to fill out Texas Correction Deed - Prior Deed From An Individual To An Individual?

Managing legal documents and processes can be a lengthy addition to your schedule.

Correction Deed Form Texas For Elderly Parent and similar documents frequently require you to search for them and figure out the optimal way to fill them out correctly.

Thus, whether you are handling financial, legal, or personal issues, utilizing a comprehensive and practical online directory of forms when necessary will be tremendously beneficial.

US Legal Forms is the premier online platform for legal templates, boasting over 85,000 state-specific forms and various tools to help you complete your documents effortlessly.

Is this your first time using US Legal Forms? Sign up and create your account in just a few minutes, granting you access to the forms catalog and Correction Deed Form Texas For Elderly Parent. Then, follow the steps below to complete your form: Make sure you locate the correct form using the Preview feature and reviewing the form description. Select Buy Now when ready, and pick the monthly subscription plan that suits you best. Select Download, then fill out, eSign, and print the form. US Legal Forms has 25 years of expertise helping clients manage their legal documents. Obtain the form you need today and simplify any process without stress.

- Explore the collection of relevant documents available to you with a single click.

- US Legal Forms provides state- and county-specific forms accessible at any time for download.

- Safeguard your document management processes with a high-quality service that allows you to prepare any form in minutes without any additional or concealed fees.

- Simply Log In to your account, locate Correction Deed Form Texas For Elderly Parent and download it immediately from the My documents section.

- You can also access forms you have previously downloaded.

Form popularity

FAQ

To get a deed correction, you will need to complete a correction deed form specific to Texas. This form allows you to rectify any errors or inaccuracies in the original deed. You can find a reliable correction deed form Texas for elderly parent on platforms like US Legal Forms, which provides easy access to legally compliant templates. After completing the form, ensure you have it signed and notarized, then file it with the appropriate county clerk's office to make the correction official.

Making corrections in a sale deed involves completing the correction deed form Texas for elderly parent. Identify the specific areas that need correction, such as names or property descriptions, and fill in the accurate information. Once you have prepared the document, file it with the county clerk to officially update the sale deed. This ensures that all records reflect the correct information.

To correct a name on a deed in Texas, you will need to fill out the correction deed form Texas for elderly parent, specifying the incorrect and correct names. Ensure that you provide supporting documents, such as identification or prior deeds, to validate the change. After completing the form, file it with your county clerk's office. This process helps clarify ownership and avoid future disputes.

In Texas, any party with an interest in the property can file a correction deed. This includes property owners or their legal representatives. If you are assisting an elderly parent, you can help them file the necessary correction deed form Texas for elderly parent. It's important to ensure that all parties involved are in agreement regarding the corrections.

Yes, a correction deed typically needs to be notarized in Texas to ensure its validity. This step authenticates the signatures involved in the correction deed form Texas for elderly parent. After notarization, you can then file the document with the appropriate county office. Notarization adds an extra layer of legal assurance to your corrections.

To prepare a corrective deed, start by obtaining the correction deed form Texas for elderly parent. Fill in the necessary details, including the original deed information and the corrections you wish to make. Double-check for accuracy, as mistakes can delay the process. Once completed, you can then file the deed with your county clerk.

A General Warranty Deed or Special Warranty Deed may be used, however, the most common deed used after a divorce is a Special Warranty Deed. The spouse whose name is to be removed from the title will need to sign the deed in front of any notary. This can be done anywhere in the world. Remove a Name From a Deed After Divorce in Texas texaspropertydeeds.com ? removing-name-f... texaspropertydeeds.com ? removing-name-f...

Transfers of real property must be in writing and notarized. Deeds should be recorded in the county where the property is located. To ensure a legal change to the property title, you'll want the services of an attorney. A qualified attorney will prepare and file the real estate transfer deed.