Transfer Deed To Llc For Bike

Description

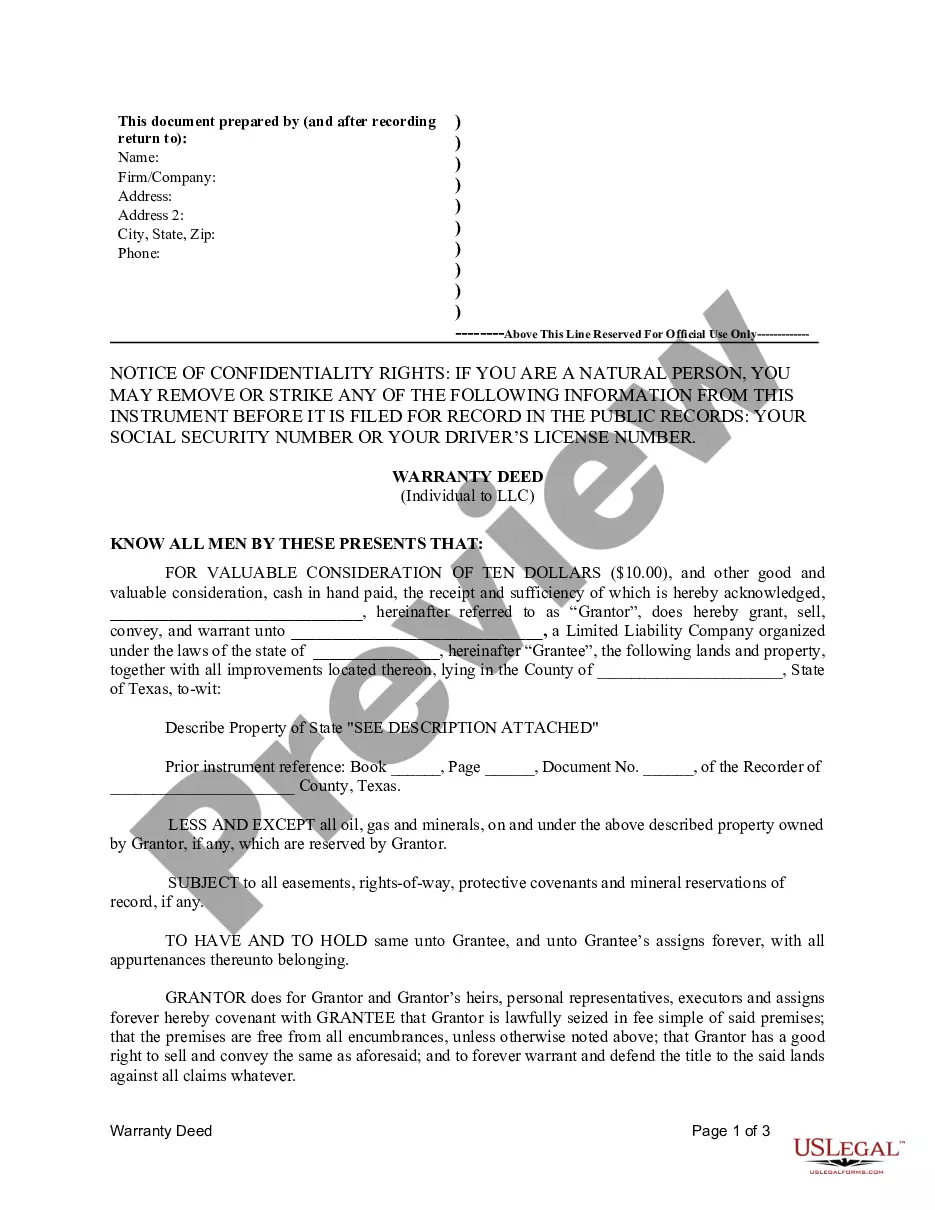

How to fill out Texas Warranty Deed From Individual To LLC?

What is the most reliable service to acquire the Transfer Deed To Llc For Bike and other current iterations of legal documents? US Legal Forms is the solution!

It boasts the most extensive collection of legal papers for any purpose. Each example is professionally created and verified for adherence to federal and state regulations. They are organized by field and jurisdiction, making it straightforward to find the one you require.

US Legal Forms is a fantastic resource for anyone needing to manage legal documentation. Premium users enjoy additional benefits as they can complete and approve previously saved documents electronically at any time using the integrated PDF editing tool. Try it out today!

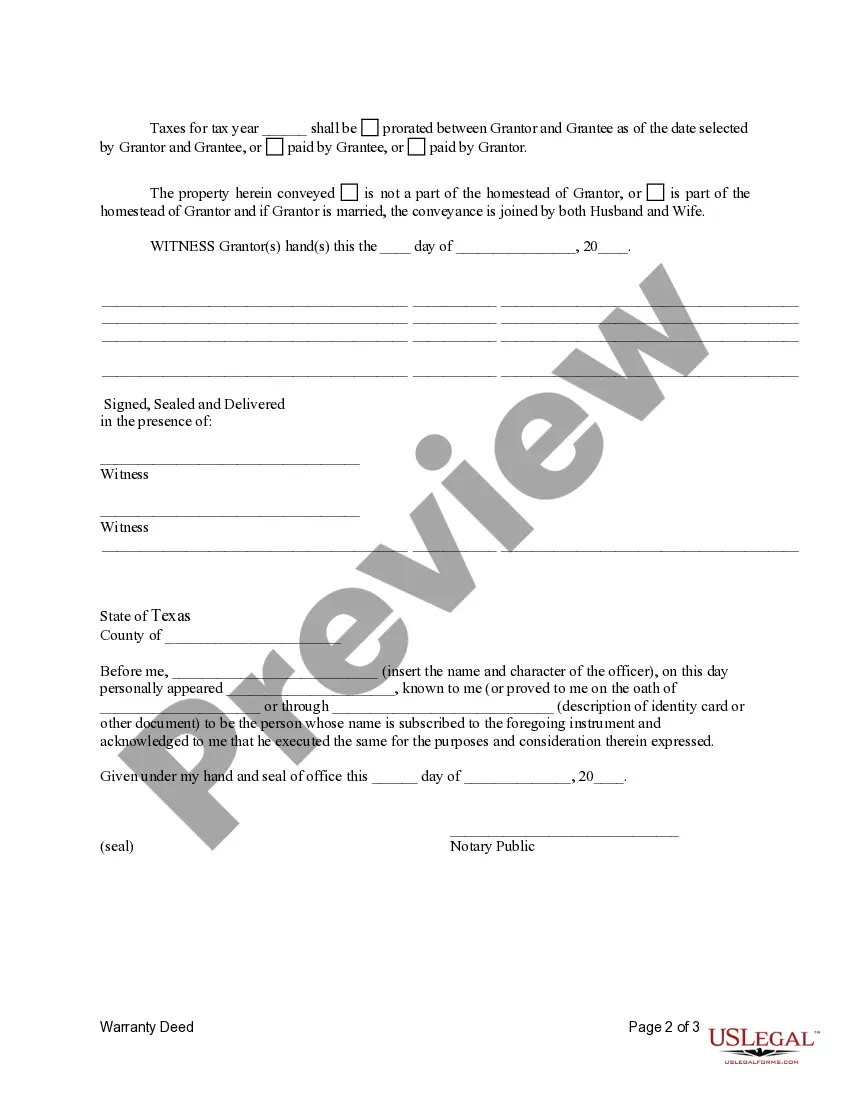

- Experienced users of the website simply need to Log In to the system, confirm if their subscription is active, and click the Download button adjacent to the Transfer Deed To Llc For Bike to obtain it.

- Once downloaded, the document is available for future reference in the My documents section of your profile.

- If you do not yet have an account with our library, here are the steps you should follow to create one.

- Form compliance verification. Before obtaining any template, ensure it satisfies your use case requirements and the regulations of your state or county. Review the form description and utilize the Preview if available.

Form popularity

FAQ

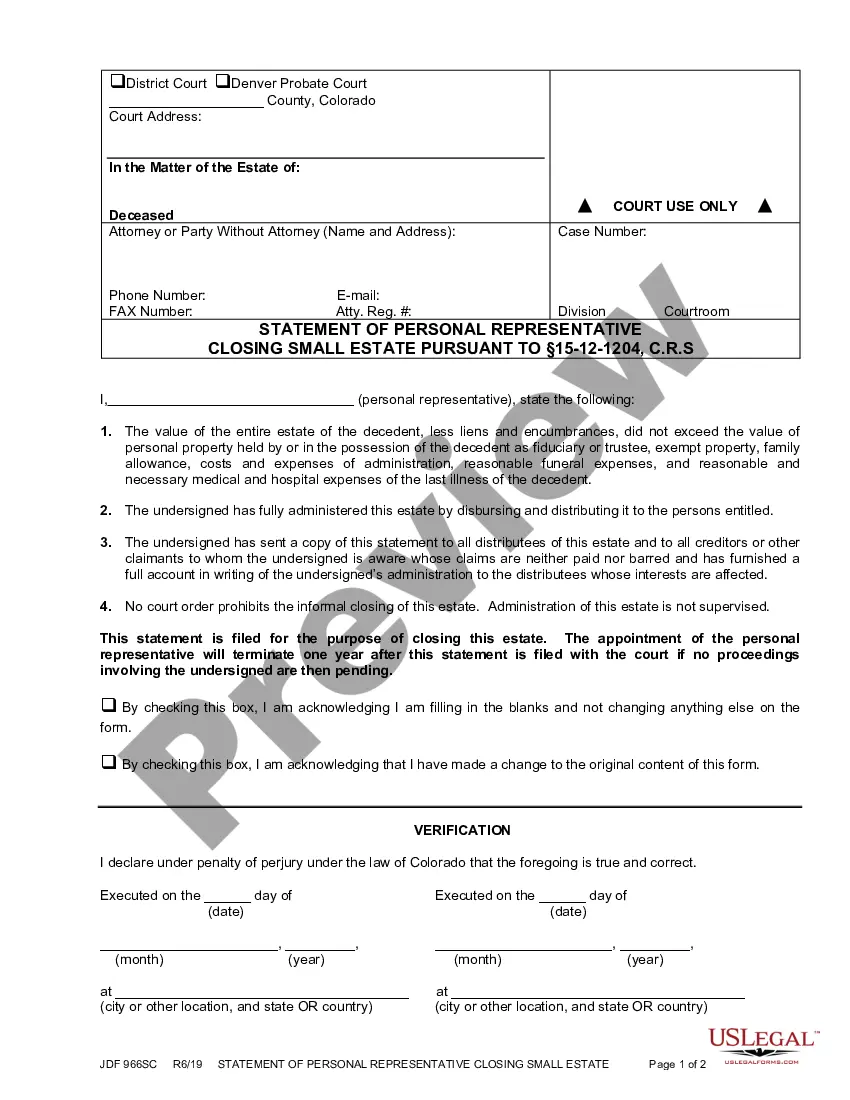

Yes, California imposes a property transfer tax on the sale of real estate, generally charged at the county level. When you transfer a property to an LLC, this tax may apply depending on how the transfer is conducted. Be prepared for this added expense when planning to transfer deed to LLC for bike. It's always a good idea to consult with a professional for assistance with any potential taxes.

To avoid LLC tax in California, consider structures that may exempt your LLC from the minimum franchise tax. One option is to ensure your LLC does not earn income by keeping it inactive. Alternatively, you might explore business structures that do not incur franchise tax. Understanding how to transfer deed to LLC for bike accurately may aid in your long-term strategy.

Transferring property to an LLC may have several tax implications in California. Generally, the transfer may trigger a reassessment of the property's value for property tax purposes. Additionally, if the transfer involves a sale, the LLC might incur capital gains taxes. It's wise to consult a tax professional to understand how to transfer deed to LLC for bike while minimizing tax consequences.

To transfer a property title to an LLC in California, you first need to prepare a deed, such as a grant deed. Ensure that the deed lists your LLC as the new owner. After completing the deed, file it with the county recorder's office. This process effectively allows you to transfer the deed to LLC for bike ownership.