Quit Deed Form With Power Of Attorney

Description

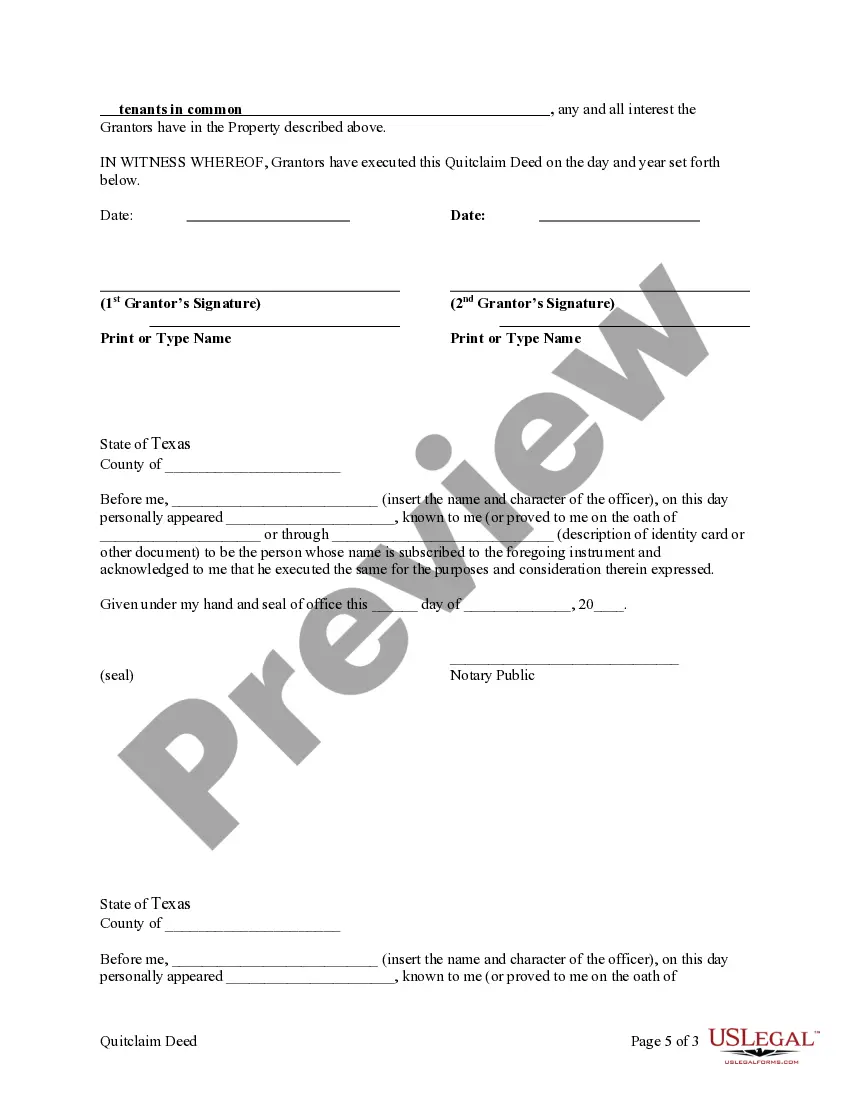

How to fill out Texas Quitclaim Deed From Two (2) Individuals To Two (2) Individuals?

Individuals commonly link legal documentation with something intricate that solely a specialist can manage.

In a sense, this is accurate, as drafting a Quit Deed Form With Power Of Attorney requires considerable knowledge in relevant areas, including state and local laws.

However, with US Legal Forms, the process has become simpler: ready-to-use legal documents for any life and business situation specific to state regulations are compiled in a single online library and are now accessible to everyone.

Select a subscription plan that aligns with your needs and financial situation.

- US Legal Forms provides over 85,000 current forms categorized by state and area of application, allowing the search for a Quit Deed Form With Power Of Attorney or any other specific template to only take a few minutes.

- Previously registered users with an active subscription must Log In to their account and click Download to acquire the form.

- New users of the service will need to set up an account and subscribe before they can download any documentation.

- Here is the step-by-step instruction on how to obtain the Quit Deed Form With Power Of Attorney.

- Review the page content carefully to ensure it satisfies your requirements.

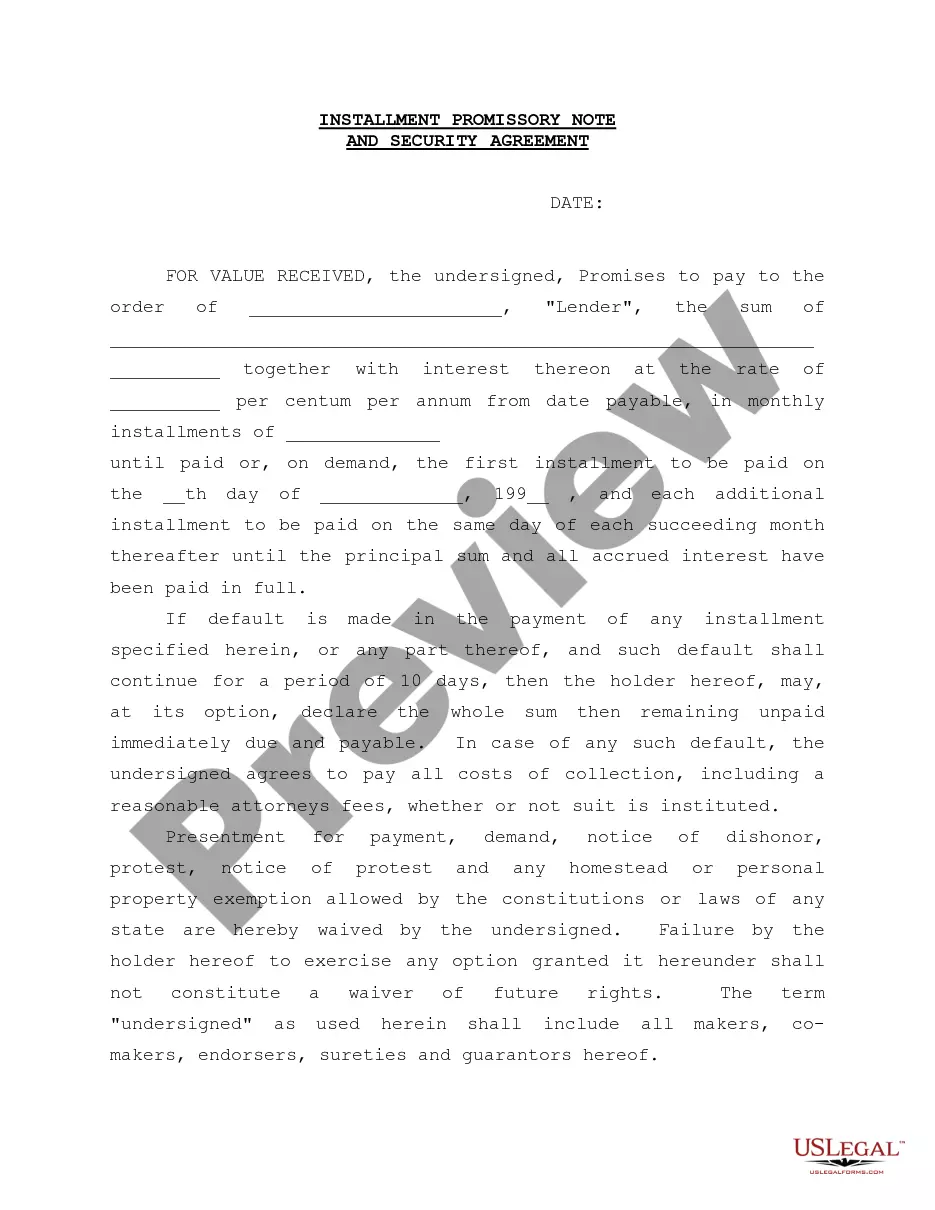

- Consult the form description or examine it through the Preview option.

- Find another template using the Search bar in the header if the previous one does not meet your needs.

- Hit Buy Now once you locate the correct Quit Deed Form With Power Of Attorney.

Form popularity

FAQ

Yes, a power of attorney can certainly legally inherit assets from the person they have the power over.

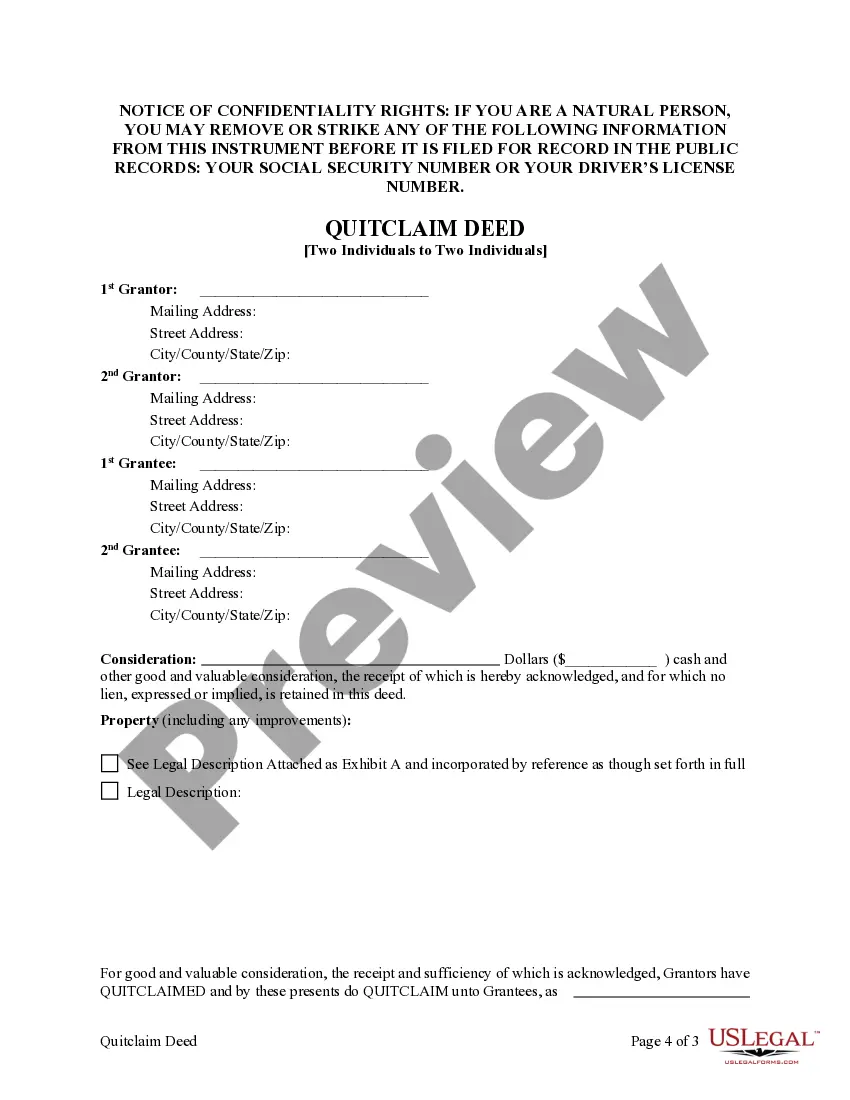

To write a Colorado quitclaim deed, you will need to provide the following information: Name and address of the preparer. Name and address of the party that will receive tax notices. Amount of consideration given for the property. Grantor's (person selling or gifting the property) name, marital status, and address.

As a general rule, a power of attorney cannot transfer money, personal property, real estate or any other assets from the grantee to himself.

There is no statutory requirement that the power of attorney be recorded with the County Recorder in the county where the real property is located.

How to Write a Texas Quitclaim Deed Preparer's name and address. Full name and mailing address of the person to whom recorded deed should be sent. The consideration paid for the real property. Grantor's name and status (single, married, or legal entity type) Grantor's mailing address.