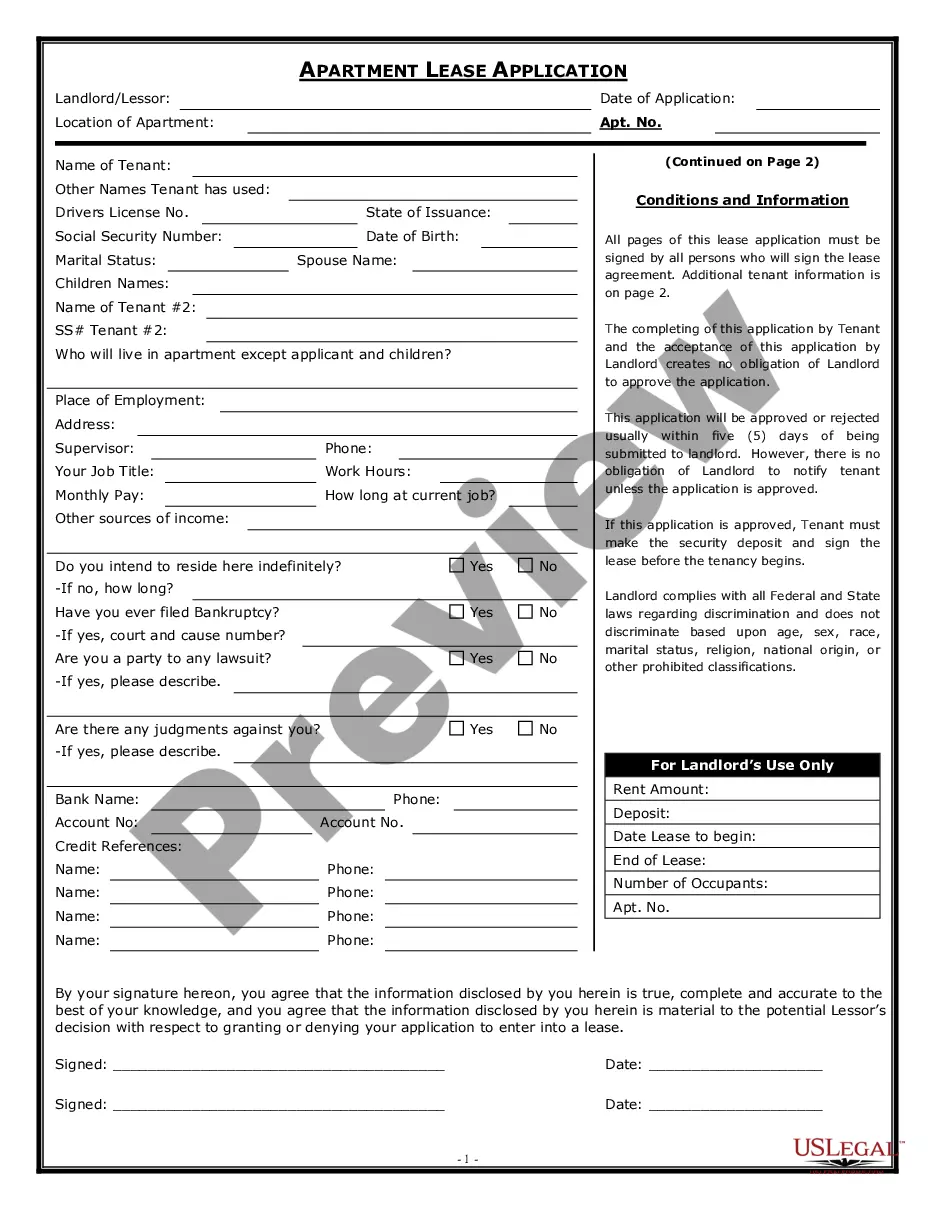

Mississippi Installment Agreement With Franchise Tax Board

Description

How to fill out Mississippi Installment Promissory Note And Security Agreement?

What is the most dependable service to obtain the Mississippi Installment Agreement With Franchise Tax Board and other recent versions of legal documents? US Legal Forms is the solution! It boasts the largest collection of legal templates for any situation.

Each document is expertly crafted and verified for adherence to federal and local laws. They are categorized by area and state of utilization, making it easy to find the one you require.

US Legal Forms is an ideal choice for anyone needing to handle legal documents. Premium users gain even more benefits, as they can fill out and sign saved documents electronically at any time using the included PDF editing tool. Explore it now!

- Experienced users of the platform just need to Log In to the system, verify their subscription status, and click the Download button next to the Mississippi Installment Agreement With Franchise Tax Board to receive it.

- Once saved, the document is accessible for future use within the My documents section of your account.

- If you don’t have an account yet, follow these steps to create one.

- Form compliance review. Prior to obtaining any document, ensure it aligns with your use case requirements and complies with your state or county regulations. Examine the form summary and utilize the Preview feature if it's available.

Form popularity

FAQ

If you can't pay your tax bill in 90 days and want to get on a payment plan, you can apply for an installment agreement. It may take up to 60 days to process your request. Typically, you will have up to 12 months to pay off your balance.

How do I apply for an installment agreement electronically or by mail? To request an installment agreement, the taxpayer must complete Form 9465. Form 9465 can be included electronically with an e-filed return or paper-filed.

BusinessesInclude a copy of your notice, bill, or payment voucher.Make your check, money order, or cashier's check payable to Franchise Tax Board.Write the business name, FTB ID/Business Entity ID, and tax year on your payment.Mail to: Franchise Tax Board PO Box 942857. Sacramento CA 94257-0501.

Apply online for a payment plan Installment agreement - individualsPay a $34 setup fee that will be added to my balance due.Make monthly payments until my tax bill is paid in full.Pay by automatic withdrawal from my bank account.Keep enough money in my bank account to make my payment.More items...?

If you can't pay your tax bill in 90 days and want to get on a payment plan, you can apply for an installment agreement. It may take up to 60 days to process your request. Typically, you will have up to 12 months to pay off your balance.