Texas Petition For Release Of Excess Proceeds With Anti Addition

Description

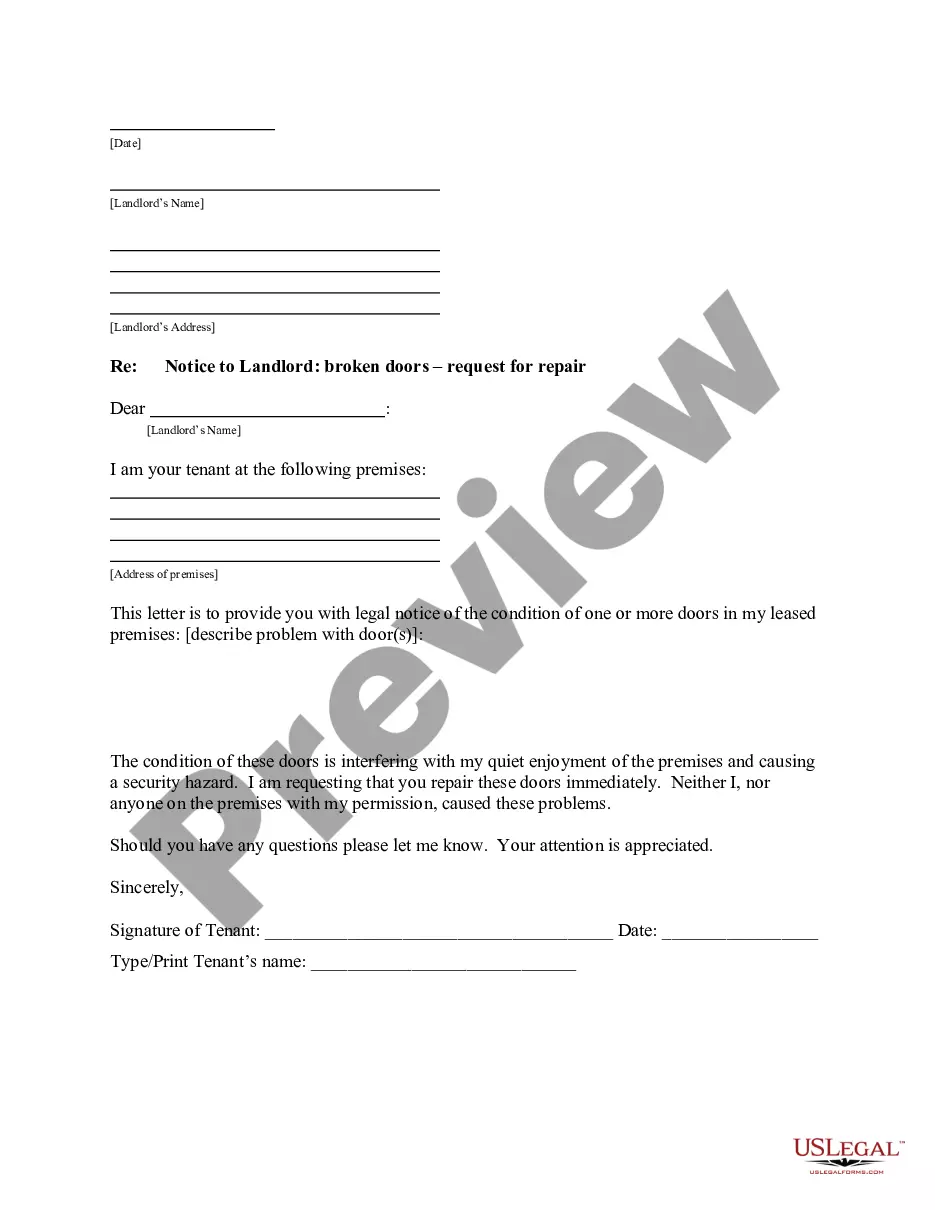

How to fill out Texas Petition For Release Of Excess Proceeds And Notice Of Hearing?

Bureaucracy requires exactness and precision.

If you do not manage the completion of documents such as the Texas Petition For Release Of Excess Proceeds With Anti Addition on a daily basis, it may result in some misunderstandings.

Choosing the right template from the outset will guarantee that your document submission proceeds smoothly and avoid any issues of having to re-submit a document or redo the entire work from the beginning.

Locating the accurate and updated samples for your paperwork takes just a few moments with an account at US Legal Forms. Eliminate the bureaucratic worries and streamline your form-filling process.

- Acquire the appropriate template by utilizing the search feature.

- Ensure that the Texas Petition For Release Of Excess Proceeds With Anti Addition you have found applies to your state or locality.

- Review the overview or examine the description that provides information on the template's usage.

- If the outcome aligns with your search, click the Buy Now button.

- Select the appropriate alternative among the suggested pricing plans.

- Log In to your account or sign up for a new one.

- Finalize the purchase using a credit card or PayPal.

- Download the form in the desired file format.

Form popularity

FAQ

(a) A person, including a taxing unit, may file a petition in the court that ordered the seizure or sale setting forth a claim to the excess proceeds. The petition must be filed before the second anniversary of the date of the sale of the property.

After the foreclosure sale, if the property sells for a higher price than what is owed, the excess funds would then be used to pay off any additional liens that may be on the property.

In Texas, the redemption period is generally two years. This redemption period applies to residential homestead properties and land designated for agricultural use when the suit was filed. Other types of properties have a 180-day redemption period. (Tex.

To recover surplus money from a foreclosure sale, claimants must act quickly. There will be a limited window for you to recover the funds. You'll also need to provide proof of prior ownership to the trustee or the court. You may also have to complete and submit a claim form and/or attend a court hearing.