Texas Petition For Release Of Excess Proceeds Form

Description

How to fill out Texas Petition For Release Of Excess Proceeds And Notice Of Hearing?

There’s no longer a justification to invest time searching for legal documents to satisfy your local state stipulations.

US Legal Forms has gathered all of them in one location and made them easier to access.

Our website offers over 85k templates for any commercial and personal legal matters organized by state and usage area.

Utilize the search bar above to find another template if the previous one was unsuitable. Click Buy Now next to the template title once you identify the correct one. Choose the most appropriate subscription plan and create an account or Log In. Complete your payment for the subscription using a credit card or PayPal to continue. Select the file format for your Texas Petition For Release Of Excess Proceeds Form and download it to your device. Print your form to fill it out manually or upload the sample if you prefer to use an online editor. Preparing legal documents under federal and state statutes and regulations is quick and simple with our collection. Experience US Legal Forms today to keep your paperwork organized!

- All forms are expertly designed and validated for authenticity, ensuring you receive an up-to-date Texas Petition For Release Of Excess Proceeds Form.

- If you are acquainted with our platform and already possess an account, make sure your subscription is active before acquiring any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit any obtained documentation whenever necessary by accessing the My documents tab in your profile.

- If this is your first time using our platform, the procedure will require a few additional steps to finalize.

- Here’s how new users can acquire the Texas Petition For Release Of Excess Proceeds Form from our library.

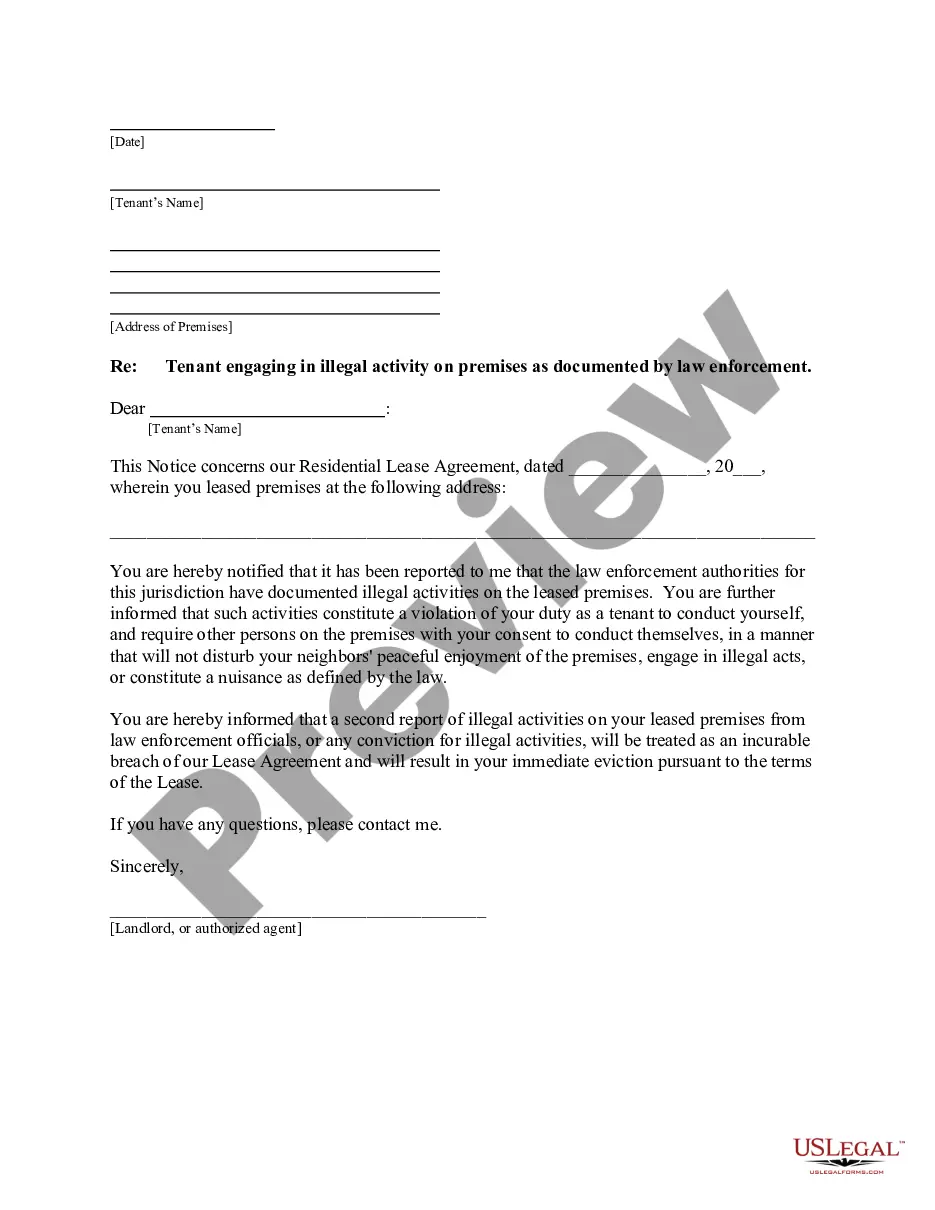

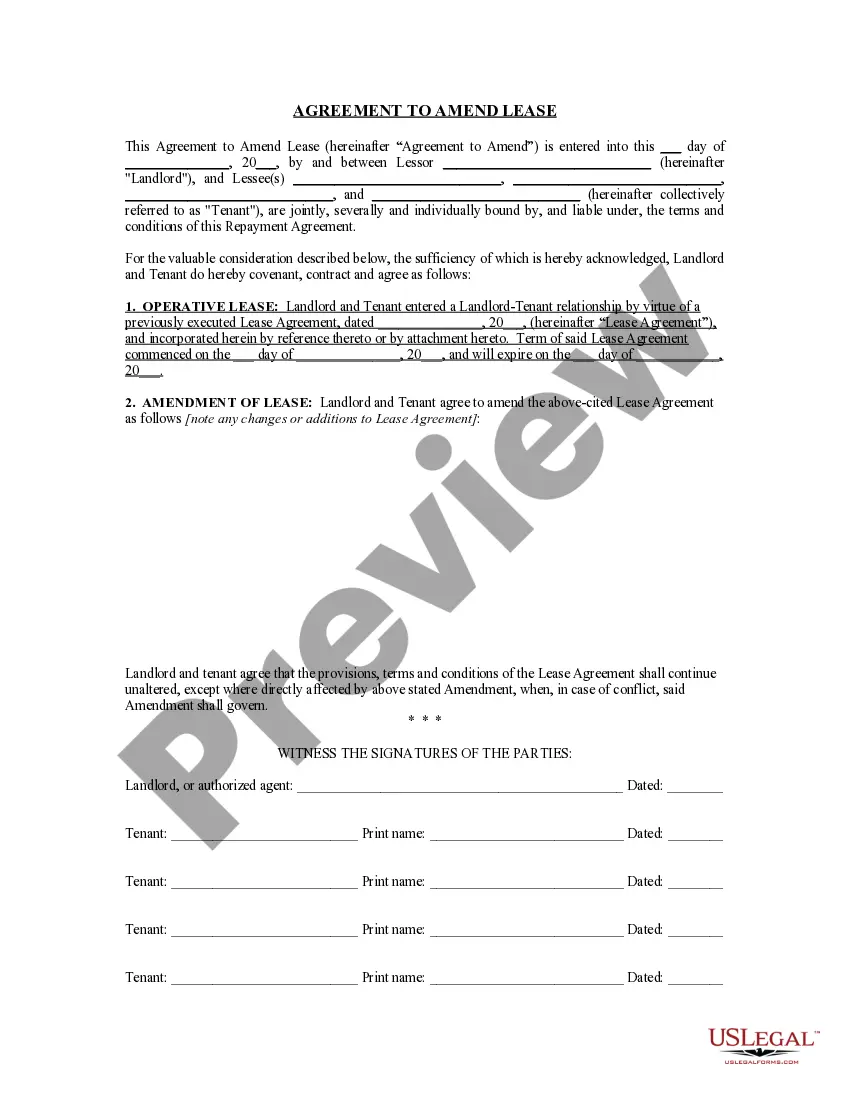

- Examine the page content thoroughly to ensure it contains the sample you require.

- To assist with this, use the form description and preview options if available.

Form popularity

FAQ

After the foreclosure sale, if the property sells for a higher price than what is owed, the excess funds would then be used to pay off any additional liens that may be on the property.

After the foreclosure sale, if the property sells for a higher price than what is owed, the excess funds would then be used to pay off any additional liens that may be on the property.

To recover surplus money from a foreclosure sale, claimants must act quickly. There will be a limited window for you to recover the funds. You'll also need to provide proof of prior ownership to the trustee or the court. You may also have to complete and submit a claim form and/or attend a court hearing.

(a) A person, including a taxing unit, may file a petition in the court that ordered the seizure or sale setting forth a claim to the excess proceeds. The petition must be filed before the second anniversary of the date of the sale of the property.