Petition Release Excess Order For The Execution

Description

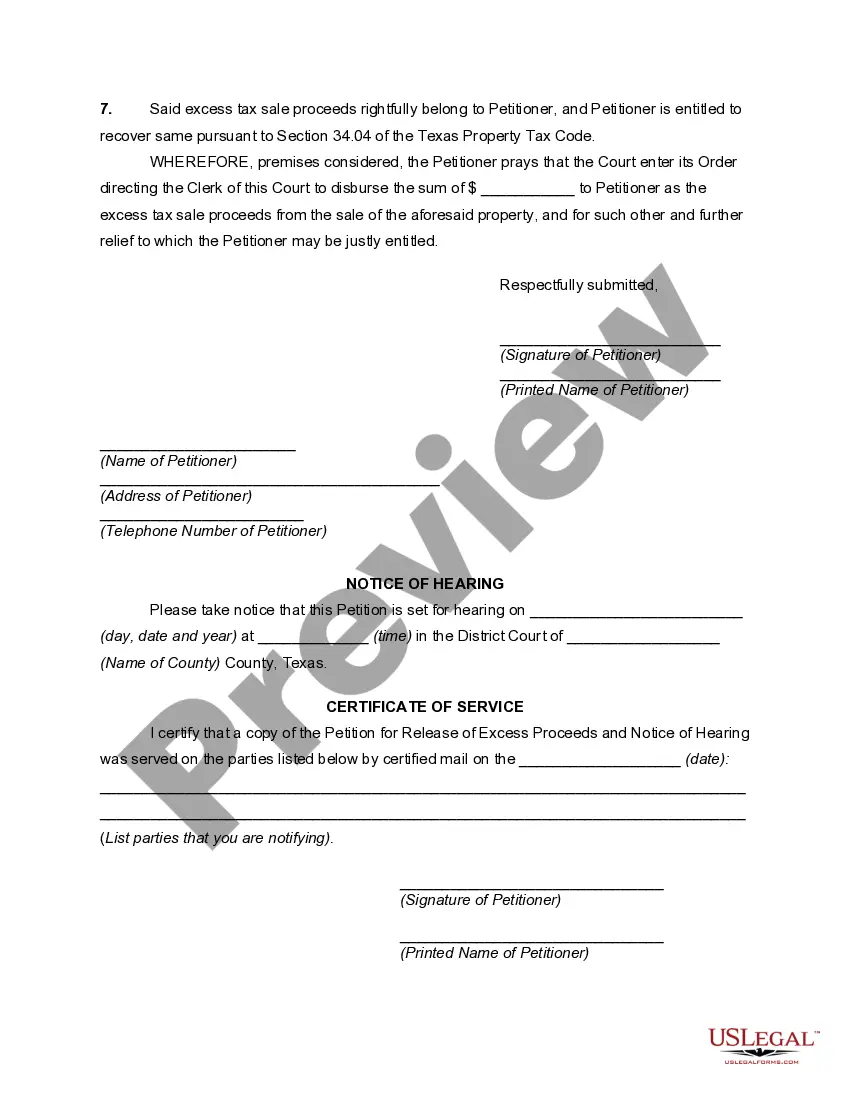

How to fill out Texas Petition For Release Of Excess Proceeds And Notice Of Hearing?

- Begin by logging into your US Legal Forms account. If you’re a new user, create an account to explore our vast library of legal forms.

- Search for 'petition release excess order for the execution' using the search feature. Review the form description to ensure it fits your exact legal requirements.

- Take advantage of our preview mode to visually confirm the form meets your local jurisdiction's standards.

- Purchase the document by selecting the 'Buy Now' option and choosing your preferred subscription plan. If you’re renewing, ensure your payment plan is current.

- Complete the payment process by entering your credit card information or using PayPal for a swift transaction.

- Once your purchase is successful, download the form to your device. You can also access it later from the 'My Forms' section in your profile.

By following these steps, you can easily access the petition release excess order for execution you need. With US Legal Forms, legal document preparation is simplified and accessible.

Start today to take control of your legal needs—explore the benefits of US Legal Forms and ensure your documents are precise and legally sound!

Form popularity

FAQ

Excess funds obtained from a foreclosure sale may indeed be subject to taxes, depending on the overall financial situation of the homeowner. The IRS views these proceeds as taxable income, so it is essential to report them on your tax return. Consulting with a tax professional after recovering your excess funds and filing a Petition release excess order for the execution can help clarify your tax obligations. This approach ensures you manage your finances responsibly post-foreclosure.

Excess proceeds from a foreclosure sale in Texas generally go to the homeowner after the property is sold, but only if there is a surplus. After the sale, the lender must notify the homeowner of their right to claim these funds. Filing a Petition release excess order for the execution is necessary to access these proceeds. If the process is done correctly, homeowners can reclaim their financial assets effectively.

Recovering surplus funds after a foreclosure sale may take several weeks to a few months, depending on the specific circumstances of the case. After submitting a Petition release excess order for the execution, the court will schedule a hearing to review your claim. Once approved, it may take additional time to receive the funds. Therefore, it's advisable to follow the process carefully and possibly consult with a legal professional for guidance.

In Texas, the law regarding excess proceeds states that if a property sells for more than the amount owed on the mortgage during a foreclosure, the surplus funds belong to the homeowner. To claim these funds, the homeowner must file a Petition release excess order for the execution. This legal process ensures homeowners receive any remaining balance after the debts are settled. It is crucial to understand and navigate these laws to protect your financial interests.

Stopping a sheriff eviction in California involves taking immediate action. You can file a motion to challenge the eviction, and you may also consider submitting a Petition release excess order for the execution if applicable. Connecting with a legal platform like UsLegalForms can provide valuable resources and guidance throughout this process.

In many cases, tenants can stop an eviction by paying the overdue rent before the eviction hearing. It’s important to communicate with your landlord and resolve the situation amicably. If necessary, consider filing a Petition release excess order for the execution to address any related financial concerns linked to the eviction process.

To stop a writ of execution in California, you typically need to file a motion with the court that issued the writ. This motion can outline your reasons and may include a Petition release excess order for the execution if applicable. It’s essential to act quickly and gather relevant documentation to present your case effectively.

In California, excess proceeds from foreclosure sales are generally held by the county where the sale occurred. Homeowners can file a claim to recover these funds, especially if they submit a Petition release excess order for the execution. These proceeds can be vital for former homeowners, so knowing how to access them is important.

Excess proceeds refer to the funds that remain after a foreclosure sale exceeds the total debts owed on the property. When a property is sold, any amount collected that surpasses these debts can be considered excess proceeds. Understanding this is crucial, especially when considering a Petition release excess order for the execution.

In Georgia, excess funds can be claimed by parties entitled to payments from a property auction's surplus, such as former property owners and lien holders. To initiate the claim, you must file a Petition for Release Excess Order for the Execution in the relevant court. Ensure that you have accurate documents proving your entitlement, as this will facilitate the claims process. USLegalForms can help by providing the necessary templates and instructions to streamline this task.