Distribution Deed Texas With A Will

Description

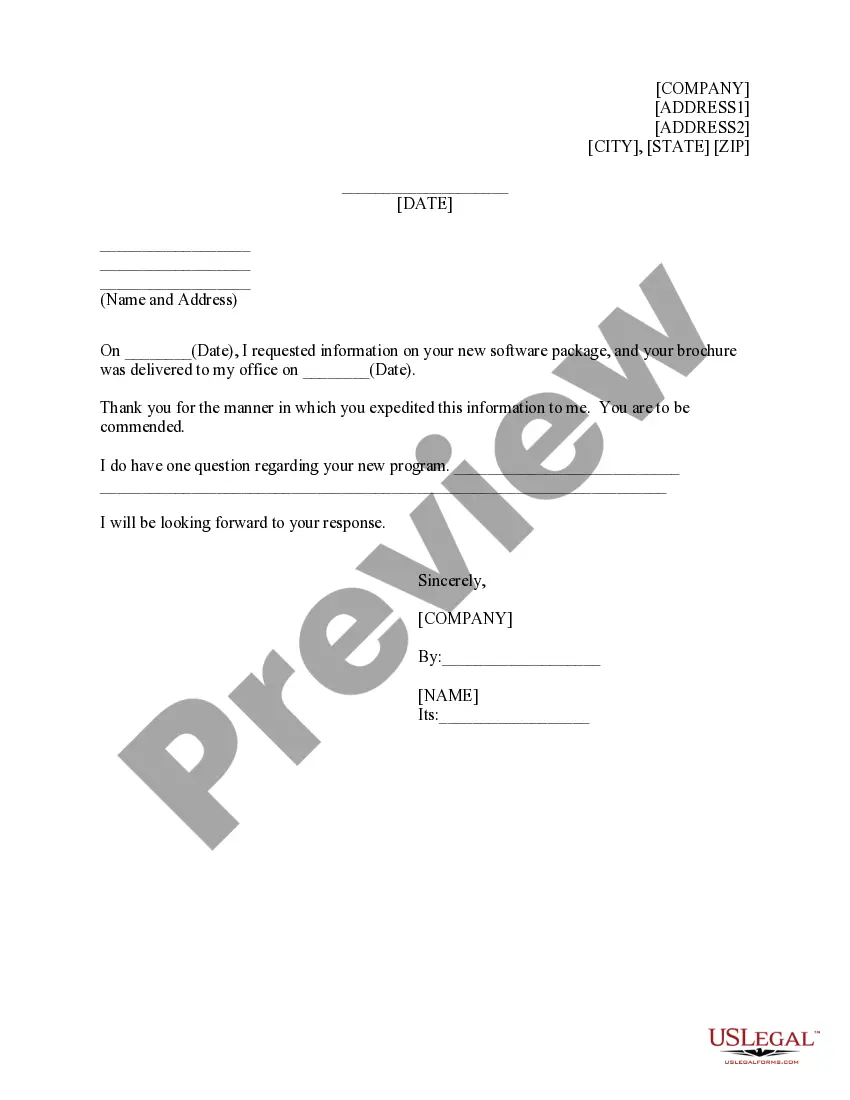

How to fill out Texas Distribution Deed - Joint Independent Executors To An Individual Beneficiary?

- If you are a returning user, log into your account and navigate to your forms library. Confirm that your subscription is active; if it's not, promptly renew it based on your chosen plan.

- For first-time users, start by exploring the preview mode and form descriptions to identify the correct distribution deed that fits your needs and complies with Texas regulations.

- If adjustments are needed, utilize the search feature to find an alternate template that suits your requirements. Once confirmed, proceed to the next step.

- Purchase the necessary document by selecting the 'Buy Now' button and opting for your preferred subscription plan. You will need to create an account to unlock access to their extensive resources.

- Complete your payment using a credit card or PayPal to finalize your subscription.

- Download your selected form to your device for immediate use. You can also find it later in the My Forms section of your account.

Acquiring a distribution deed in Texas is simplified with US Legal Forms, allowing users to easily access over 85,000 editable legal forms. Their robust library ensures you find exactly what you need, while expert assistance is just a click away.

Don’t delay in securing your legal rights—visit US Legal Forms today and empower yourself with the right documentation!

Form popularity

FAQ

Generally, a deed takes precedence over a will when it comes to property ownership. If there is a conflict between what a deed states and what a will says, the information in the deed will prevail. Therefore, if you plan to create a distribution deed in Texas with a will, carefully consider how they interact. Consulting with legal experts can enhance your understanding and ensure your wishes are respected.

Typically, a will does not override a property deed. If the deed specifies a certain beneficiary, that designation usually stands regardless of what the will states. This is why having a clear distribution deed in Texas with a will is crucial for ensuring your intentions come to fruition. Speak to a legal professional to help you navigate these documents effectively.

Yes, it is possible to refuse property under a will, a choice known as disclaiming an inheritance. By disclaiming, you can elect not to accept the property, which may benefit your tax situation or provide advantages to other heirs. If you possess a distribution deed in Texas with a will, be mindful of the implications on how the property is handled. Consulting a legal expert may provide further insights.

Yes, a house deed can supersede a will when it comes to the ownership of property. If the deed names a beneficiary for the property, that designation generally takes precedence over the will. This means that the distribution deed in Texas with a will may lead to different outcomes, depending on how the deed is structured. Always seek legal advice to clarify these complexities.

In most cases, a trust supersedes a will. A trust allows you to manage and distribute your assets outside the probate process. If you have a distribution deed in Texas with a will, the deed can dictate how property is transferred, potentially overriding the instructions in the will. Make sure to consult with a legal professional to understand your unique situation.

Yes, heirs are entitled to a copy of the will in Texas once it has been validated in the probate court. The law mandates that the executor or personal representative must provide a copy of the will to all beneficiaries and any heirs interested in the estate. This access helps ensure transparency during the estate distribution process. For clear instructions and necessary forms, check out US Legal Forms, where you can find resources related to distribution deeds Texas with a will.

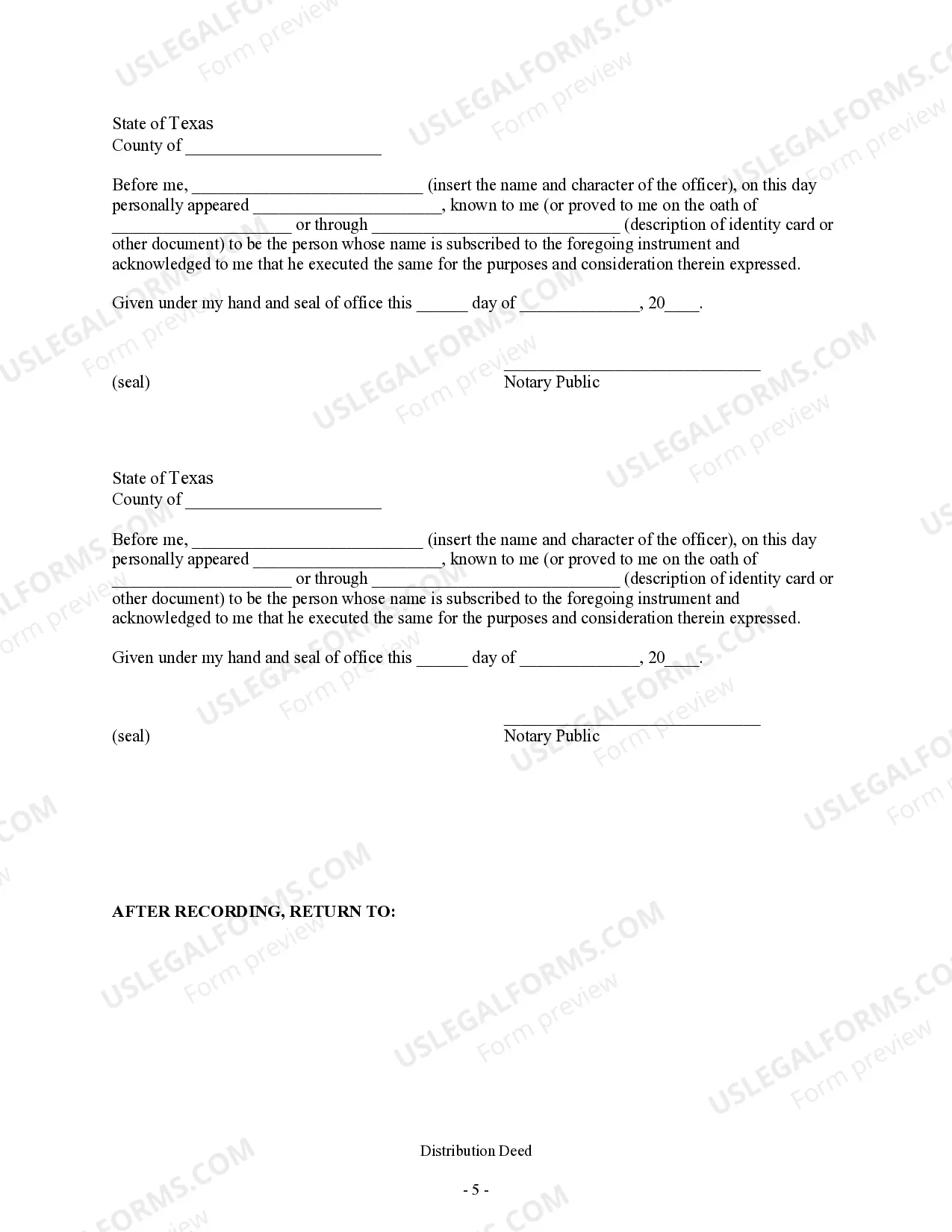

To transfer ownership from a deceased owner in Texas, you typically need a distribution deed that complies with state laws and the will of the deceased. This document should clearly outline how property is to be divided among heirs based on the specifics of the will. Additionally, you may need a certified copy of the death certificate and any probate documents. Using a comprehensive resource like US Legal Forms can simplify this process by providing the necessary templates for a distribution deed Texas with a will.

A transfer on death deed can supersede a will in Texas. This type of deed allows property to transfer directly upon death, regardless of other instructions in a will. If your distribution deed Texas with a will specifies a different approach to property transfer, conflicts may arise. Always consult with a legal professional to navigate these regulations effectively and ensure your property goals are met.

Yes, in Texas, a deed can override a will if the deed is properly executed and compliant with state laws. Specifically, a distribution deed Texas with a will clearly directs how the property is to be handled after death, potentially conflicting with the will's directives. It's important to clarify the intentions in both documents to reduce chances of disputes. Legal advice can ensure your wishes are accurately reflected.

In Texas, the name on a deed typically takes precedence over a will. If you have a distribution deed Texas with a will, the deed's terms dictate who owns the property. If the beneficiaries named in the deed differ from those in the will, the deed will usually govern the transfer. Regularly review your estate planning documents to ensure they align.