Gift Deed Form Blank Form 114

Description

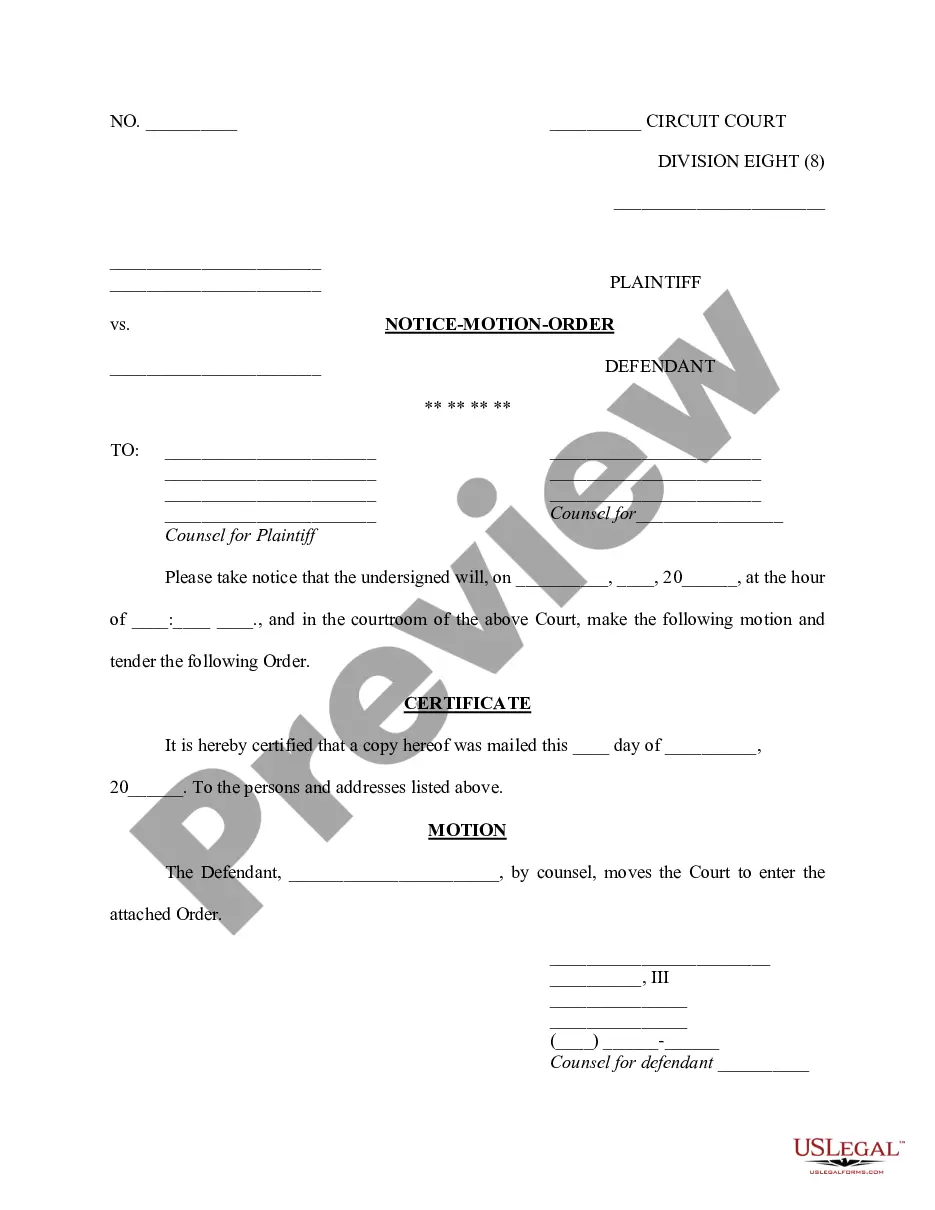

How to fill out Texas Gift Deed For Individual To Individual?

The Gift Deed Form Blank Form 114 you see on this page is a reusable legal template drafted by professional lawyers in compliance with federal and local laws and regulations. For more than 25 years, US Legal Forms has provided people, organizations, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal occasion. It’s the quickest, easiest and most reliable way to obtain the paperwork you need, as the service guarantees bank-level data security and anti-malware protection.

Acquiring this Gift Deed Form Blank Form 114 will take you just a few simple steps:

- Search for the document you need and check it. Look through the file you searched and preview it or check the form description to verify it suits your requirements. If it does not, make use of the search bar to find the appropriate one. Click Buy Now when you have located the template you need.

- Subscribe and log in. Select the pricing plan that suits you and create an account. Use PayPal or a credit card to make a prompt payment. If you already have an account, log in and check your subscription to continue.

- Obtain the fillable template. Choose the format you want for your Gift Deed Form Blank Form 114 (PDF, Word, RTF) and save the sample on your device.

- Complete and sign the document. Print out the template to complete it manually. Alternatively, use an online multi-functional PDF editor to quickly and accurately fill out and sign your form with a legally-binding] {electronic signature.

- Download your papers again. Make use of the same document once again whenever needed. Open the My Forms tab in your profile to redownload any earlier saved forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s situations at your disposal.

Form popularity

FAQ

FBAR is another name for FinCEN Form 114 (formerly called the Report of Foreign Bank and Financial Accounts), and is used to report foreign financial accounts that held a combined amount of $10,000 or more at any point during the calendar year.

Completing the Form 114a with both spouses signing the form completes the necessary requirement that will permit one spouse to electronically sign (PIN) a single report for both parties instead of filing two FBARs. The Form 114a is available on the FinCEN (under the forms tab) and BSA E-File websites.

The FinCEN Report 114 documents a taxpayer's foreign financial accounts when the aggregate value in those accounts exceeds $10,000. The Financial Crimes and Enforcement Network (FinCEN) requires you provide this information as part of your reporting obligations as an expat.

Who Must File FinCEN Form 114? Any US person who has an interest in or signature authority over a foreign financial account will be impacted. If the cumulative value of ALL of your foreign accounts is $10,000 or more at any point during the year you will need to file the FBAR.

Open the Federal Information Worksheet. Scroll down to Part VI, Electronic Filing of Tax Return Information. Mark the checkbox labeled Electronic Filing of Form 114: File Form 114 Report of Foreign Bank and Financial Accounts (FBAR) electronically. From File menu, select Go to Foreign Bank Reporting Form 114.