Texas Spousal Tax Form 2018

Description

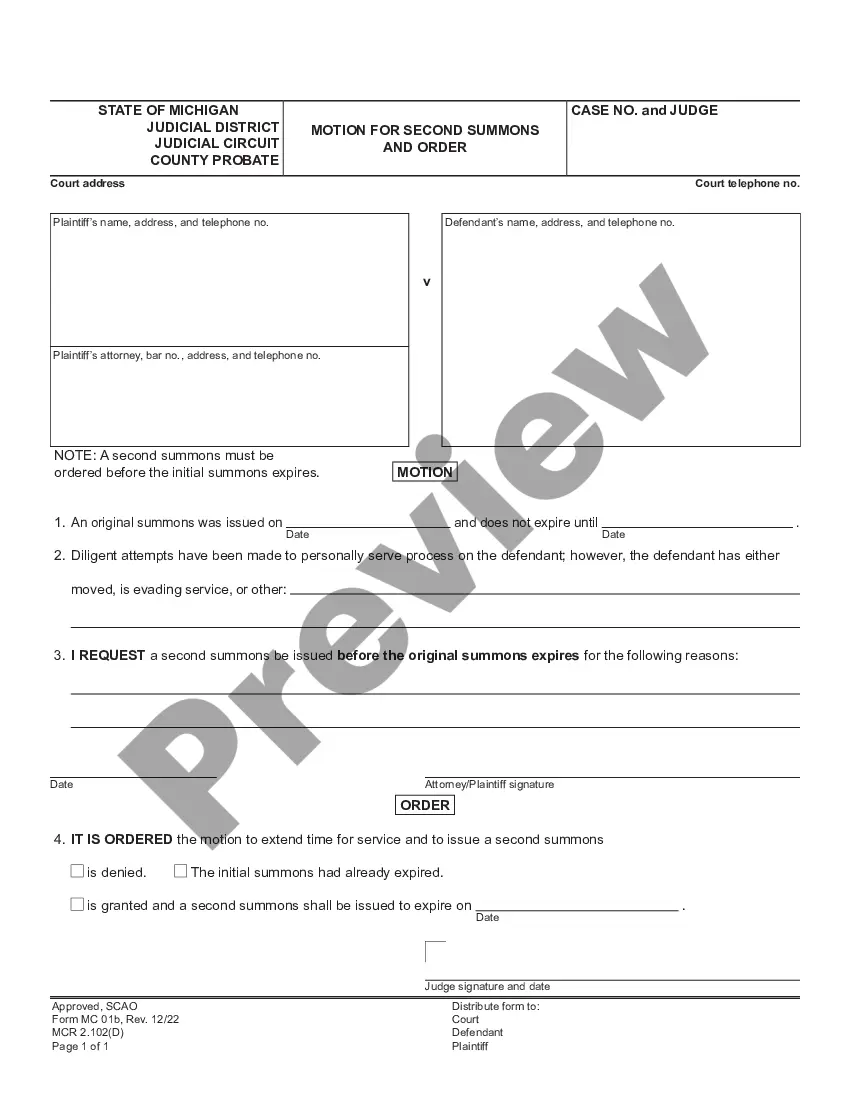

How to fill out Texas Motion For Order Of Contempt For Failure To Pay Spousal Maintenance?

Obtaining legal document samples that comply with federal and local laws is essential, and the internet offers numerous options to pick from. But what’s the point in wasting time looking for the appropriate Texas Spousal Tax Form 2018 sample on the web if the US Legal Forms online library already has such templates accumulated in one place?

US Legal Forms is the biggest online legal library with over 85,000 fillable templates drafted by attorneys for any professional and personal scenario. They are simple to browse with all files organized by state and purpose of use. Our specialists keep up with legislative changes, so you can always be confident your paperwork is up to date and compliant when acquiring a Texas Spousal Tax Form 2018 from our website.

Getting a Texas Spousal Tax Form 2018 is simple and fast for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you need in the right format. If you are new to our website, follow the steps below:

- Analyze the template utilizing the Preview feature or via the text description to ensure it meets your needs.

- Browse for another sample utilizing the search function at the top of the page if necessary.

- Click Buy Now when you’ve located the correct form and opt for a subscription plan.

- Create an account or sign in and make a payment with PayPal or a credit card.

- Pick the format for your Texas Spousal Tax Form 2018 and download it.

All templates you locate through US Legal Forms are multi-usable. To re-download and complete previously obtained forms, open the My Forms tab in your profile. Enjoy the most extensive and straightforward-to-use legal paperwork service!

Form popularity

FAQ

Taxpayers have until April 18, 2022, to file their 2018 return and get their refund. If a taxpayer doesn't file their return, they usually have three years to file and claim their tax refund. If they don't file within three years, the money becomes the property of the U.S. Treasury.

How do I allocate my income on Form 8379? The wages should be allocated to each spouse as shown on their W-2 forms. ... The Standard or Itemized deductions must be allocated so that the non-injured spouse would be able to file as if they were single. ... At least one exemption must be left to the spouse with the debt.

Can I file my return electronically even though I am filing a Form 8379, Injured Spouse Allocation? Yes, you can file Form 8379 electronically with your tax return. Generally: If you file Form 8379 with a joint return electronically, the time needed to process it is about 11 weeks.

Do not file Form 8857 with your tax return or the Tax Court. Instead, mail it to one of the following addresses. Alternatively, you can fax the form and attachments to the IRS at 855-233-8558.

Download Individual Federal Tax Forms Form (click to download)Title1040Individual Income Tax ReturnSchedule 1Additional Income and Adjustments to IncomeSchedule 2TaxSchedule 3Nonrefundable Credits71 more rows