Texas Corporations With The Highest Taxes

Description

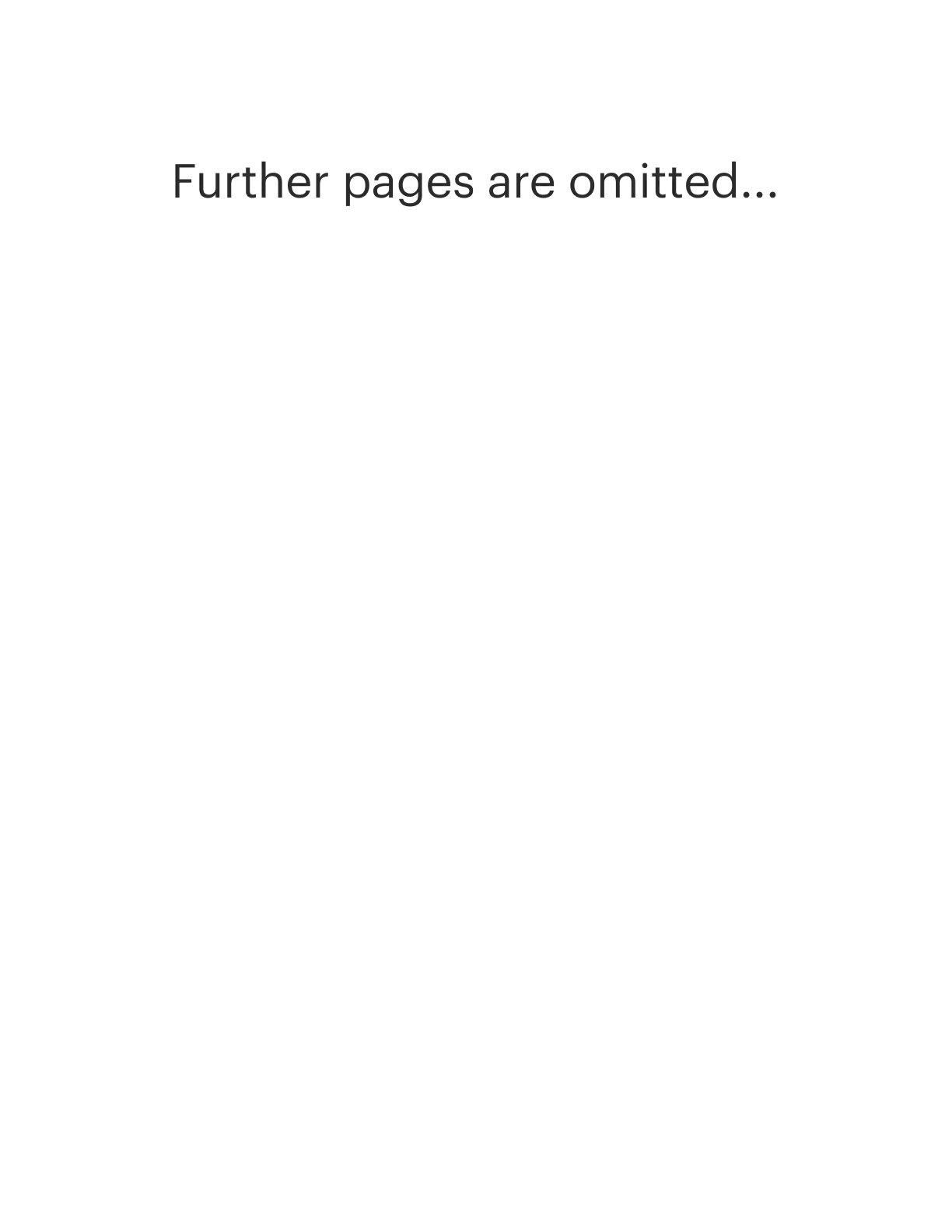

How to fill out Texas Corporate Records Maintenance Package For Existing Corporations?

- If you’re a returning user, log in to access your account and click on 'Download' to retrieve the relevant template. Ensure your subscription is current; if not, renew it per your payment plan.

- For first-time users, start by reviewing the Preview mode and form descriptions to confirm the template you select meets your needs and adheres to local jurisdiction requirements.

- If the first template doesn’t suffice, utilize the Search tab to find a more suitable option before moving forward.

- Proceed to purchase the desired document by clicking the 'Buy Now' button, where you’ll need to choose a subscription plan and register an account for access.

- Complete your payment using credit card details or your PayPal account to finalize your subscription.

- Once purchased, download your form to complete it and access it anytime from the My Forms section of your profile.

US Legal Forms enables individuals and attorneys to swiftly execute vital legal documents with a diverse and user-friendly library. With more than 85,000 easily fillable and editable legal forms available, you can ensure accuracy and compliance in your documents.

Discover the convenience and reliability of US Legal Forms. Start your journey today to access comprehensive legal solutions tailored for Texas corporations!

Form popularity

FAQ

Texas does not have a corporate income tax, but it does impose a franchise tax on certain corporations, calculated on revenue. The rate can range from 0.375% to 0.75%, depending on your revenue tier, which may impact Texas corporations with the highest taxes differently. Understanding these rates is crucial for accurate financial planning and tax obligations for your corporation.

When budgeting for taxes in your LLC, it is wise to set aside around 25% to 30% of your income. This estimate takes into account federal income taxes alongside any potential state taxes, which can be influenced by Texas corporations with the highest taxes. While this percentage can vary based on your specific situation and deductions, preparing ahead will help you avoid surprises during tax season.

Forming an LLC in Texas can provide various benefits for your business. By limiting personal liability, you protect your assets from business debts and lawsuits. Additionally, an LLC can offer flexibility in management and taxation compared to Texas corporations with the highest taxes. Overall, if you're aiming for a simpler structure with fewer formalities, an LLC might be worth considering.

In Texas, the wealthiest individuals and profitable corporations shoulder the highest tax burdens. While the lack of a state income tax is attractive, other taxes, such as property and franchise taxes, can be significant. Companies classified as Texas corporations with the highest taxes typically contribute substantially to local tax revenue, reflecting their business size and profitability.

As of now, cities like Houston and Dallas have some of the highest property tax rates in Texas due to rising home values and local budget requirements. In these metropolitan areas, residents and businesses alike can feel the impact of these taxes. Texas corporations with the highest taxes often navigate these complexities as they plan their financial strategies.

Property taxes in Texas can be particularly high for homeowners and commercial property owners in certain areas. Large cities and booming markets frequently have elevated property tax rates. This can especially burden Texas corporations with the highest taxes, as property ownership costs rise along with market demand.

The state with the highest corporate tax rate is often cited as New Jersey, with rates exceeding 11%. In Texas, while the corporate tax rate is lower, companies generating substantial revenue can still face high taxes. This aspect is crucial for Texas corporations with the highest taxes, especially in industries like oil and gas, which are significant contributors to Texas's economy.

The top rate of corporation tax for Texas corporations with the highest taxes is typically $0.75 for every $100 of gross receipts, which can significantly impact total liabilities. Additionally, federal taxes apply, with a maximum rate of 21%. Companies must consider these rates to make educated financial decisions. Using services like US Legal Forms can assist in understanding and managing these tax obligations effectively.

For Texas corporations with the highest taxes, the maximum tax rate for an S Corporation is generally tied to individual tax rates, which can reach up to 37%. However, S Corps may avoid double taxation on income at the corporate level. This tax structure can be advantageous for business owners who want to minimize their overall tax burdens. Always consult a tax professional or use platforms like US Legal Forms to ensure compliance with state and federal regulations.

A large corporation's taxable income includes all revenues minus allowable deductions, which can involve various expenses such as salaries and operating costs. For Texas corporations with the highest taxes, understanding taxable income is crucial because it determines their tax liabilities. Accurately calculating this figure allows businesses to plan for the tax implications on their profits. Utilizing resources such as US Legal Forms can simplify this process.