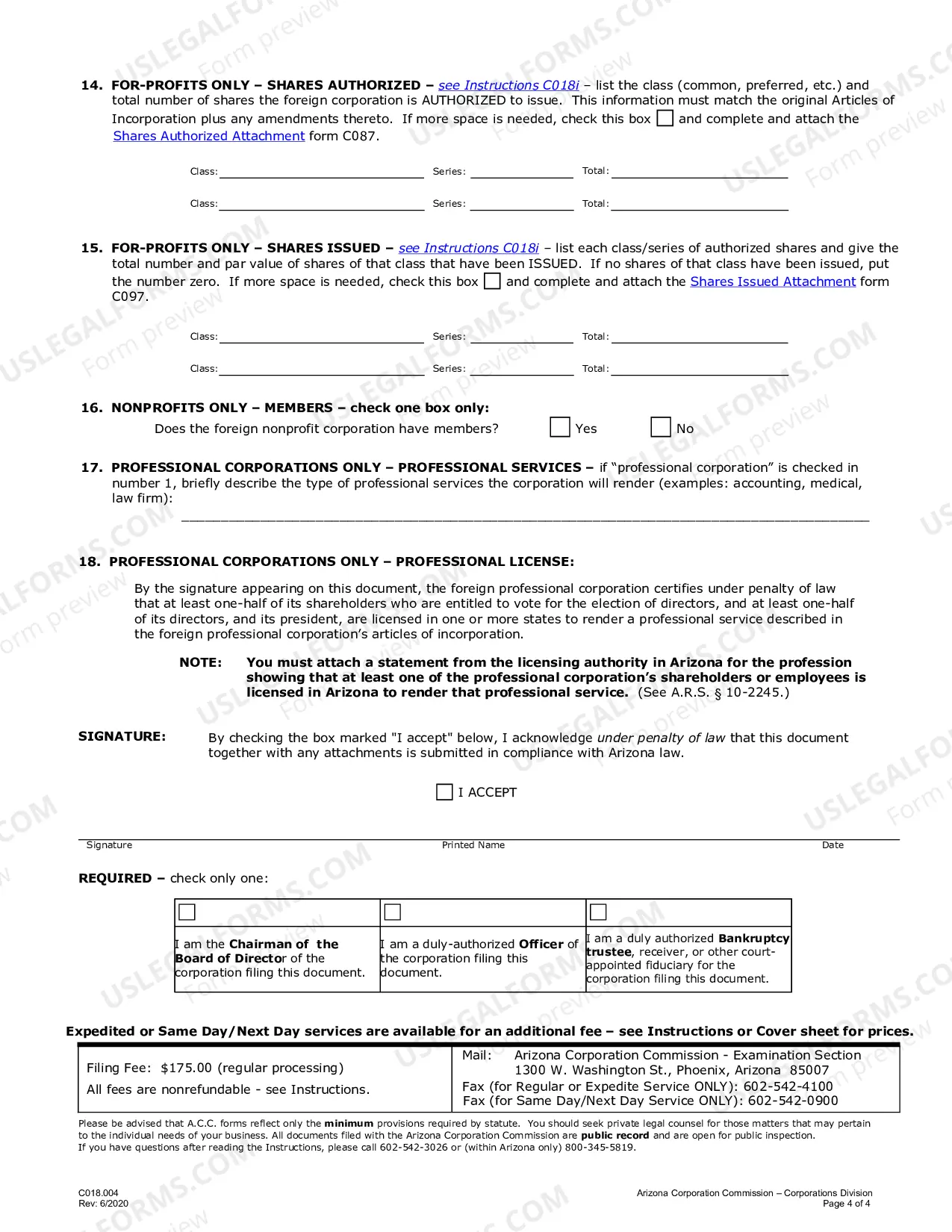

Title: Understanding Arizona Business Registration Fee: A Comprehensive Guide Introduction: The process of setting up a business in Arizona requires entrepreneurs to navigate several legal and administrative requirements. Among This is the Arizona business registration fee, an important consideration for all business entities operating within the state. In this article, we will delve into the details of this fee, its purpose, calculations, and any additional fees that may be applicable. Key phrases: Arizona business registration fee, Arizona business registration, Arizona Secretary of State, types of fees, fee calculation, additional fees, business entity types, compliance fees, processing fees, annual report fee, statutory agent fee. I. What is the Arizona Business Registration Fee? The Arizona business registration fee is a mandatory payment imposed by the Arizona Secretary of State upon entities seeking to register or renew their business's legal presence within the state. This fee is designed to cover administrative costs associated with processing and maintaining business registrations. II. Fee Calculation and Payment: The registration fee amount varies depending on the business entity type as defined by Arizona law. Business registration fees are typically calculated based on the legal structure or formation chosen by the entrepreneur. Here are some examples: 1. Limited Liability Company (LLC) Registration Fee: LCS in Arizona are required to pay an initial filing fee of $50 upon registration. Additionally, an annual report fee of $10 is due each year. 2. Corporation Registration Fee: For corporations, both domestic and foreign, the initial filing fee amounts to $60. Likewise, a $45 annual report fee applies. 3. Partnership Registration Fee: Partnerships, including general partnerships and limited partnerships, must pay an initial filing fee of $50. A $10 annual report fee is also enforced. 4. Trade Name (DBA) Registration Fee: For entrepreneurs operating under a trade name (Doing Business As), the initial filing fee is $10, while the annual report fee is $10. III. Additional Business Registration Fees: Apart from the initial registration and annual report fees, there might be additional fees applicable based on specific circumstances of the business. Here are a few examples: 1. Compliance Fees: Certain industries, such as regulated professions, may require additional compliance fees to ensure adherence to specific regulations. These fees vary based on the type of business activity conducted. 2. Statutory Agent Fee: Business entities in Arizona are required to designate a statutory agent who assists in receiving legal documents on behalf of the business. This service often incurs an annual fee, which varies depending on the statutory agent selected. Conclusion: Understanding the Arizona business registration fee and its various components is crucial for entrepreneurs planning to set up or renew their business presence within the state. By comprehending the fee calculations, entrepreneurs can effectively plan their finances and ensure compliance with the Arizona Secretary of State's requirements. It is always advisable to consult with professional advisors or access the official Arizona Secretary of State website for the most accurate and up-to-date information regarding business registration fees.

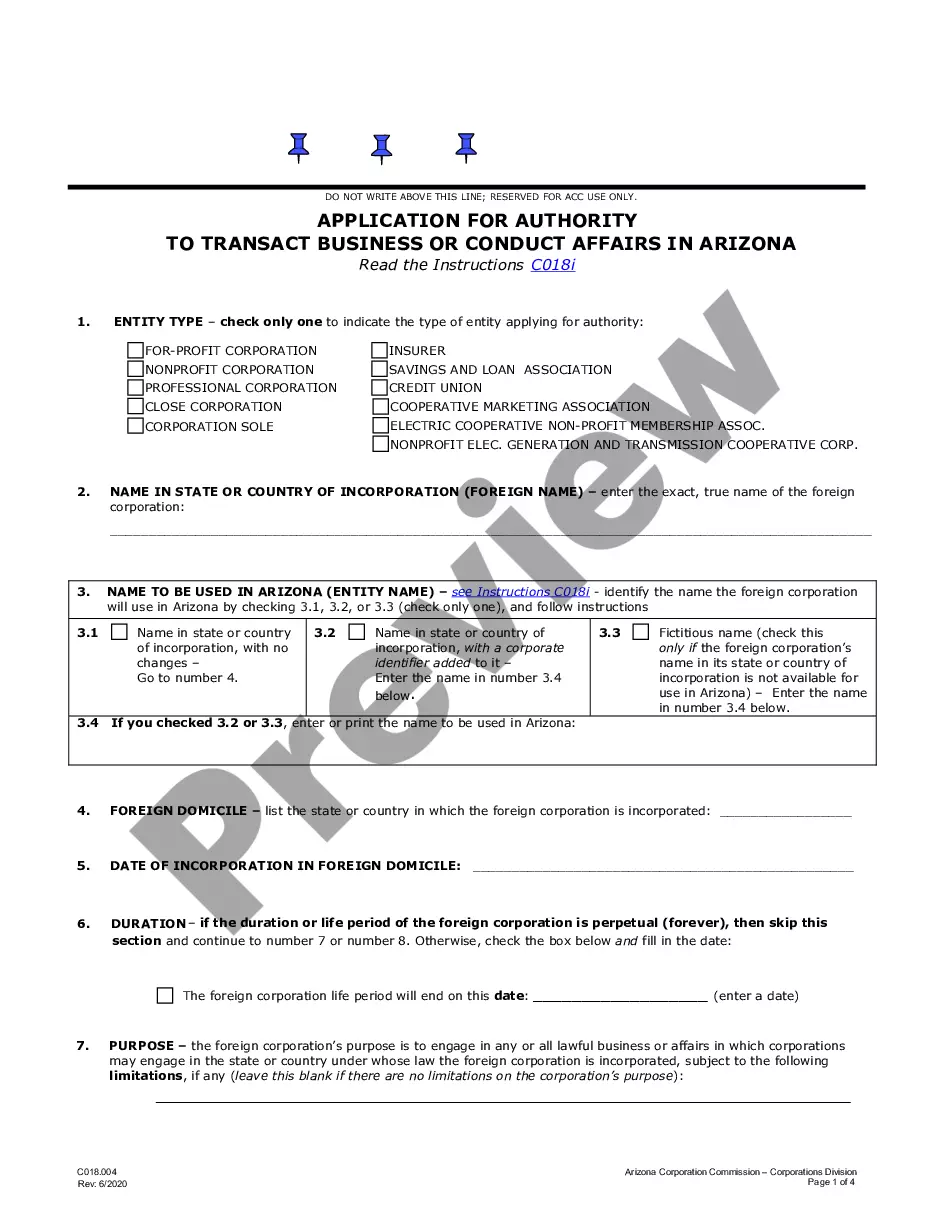

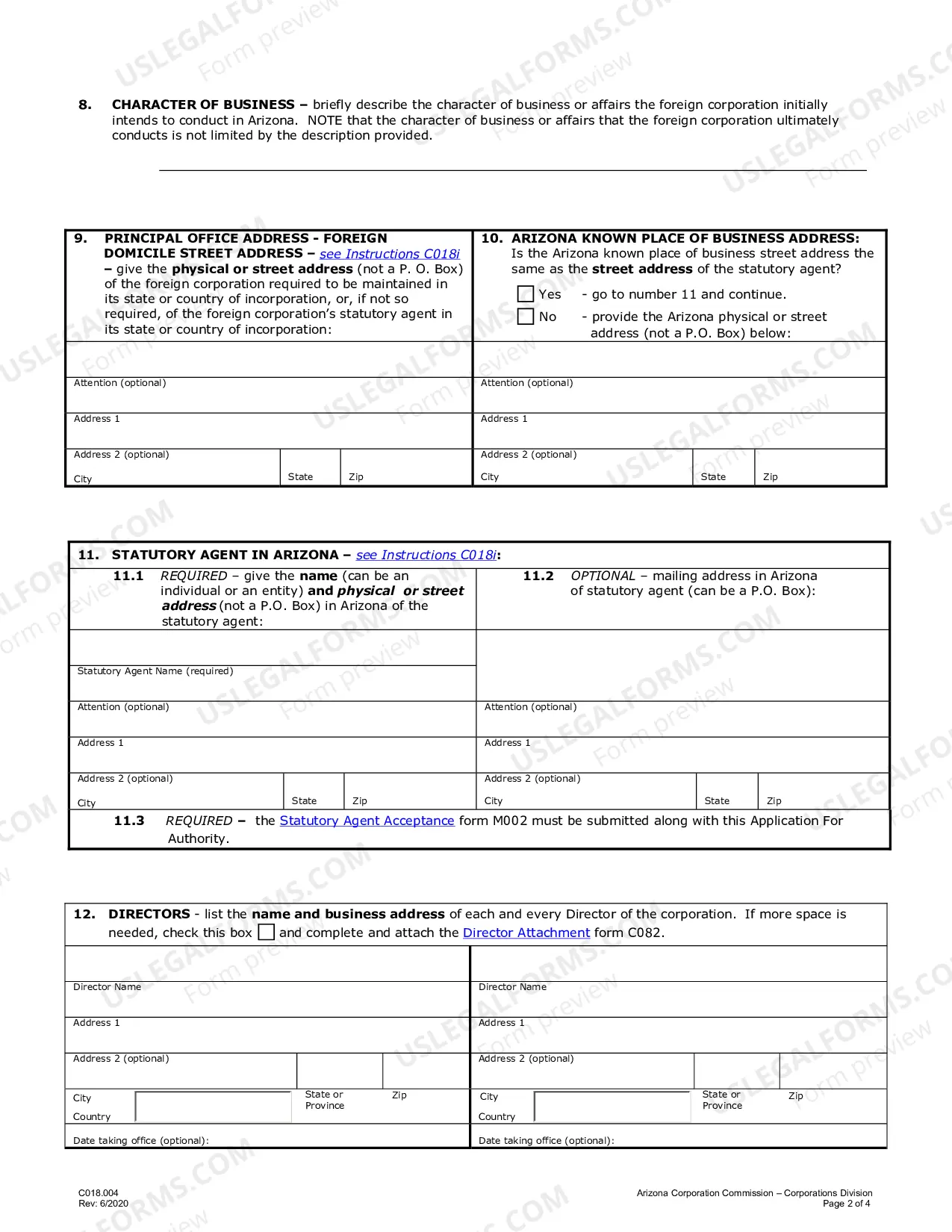

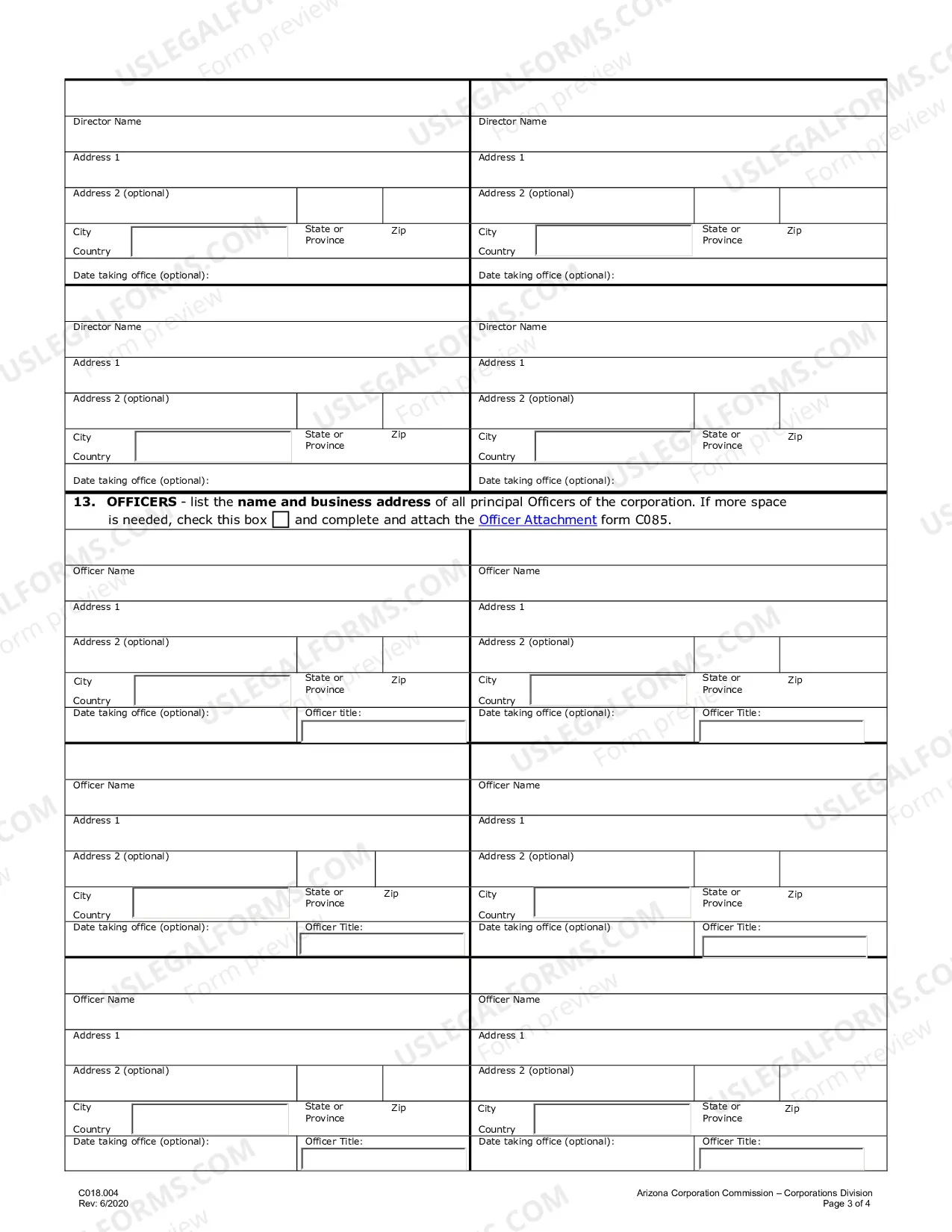

Arizona Foreign Corporation Registration

Description Arizona Foreign Corporation

How to fill out Arizona Registration Of Foreign Corporation?

If you're seeking accurate Arizona Registration of Foreign Corporation samples, US Legal Forms is what exactly you need; find documents created and checked out by state-accredited lawyers. Using US Legal Forms not just saves you from problems concerning rightful papers; in addition, you save time and energy, and money! Downloading, printing, and submitting an expert document is significantly cheaper than inquiring a lawyer to prepare it for you.

To start, complete your enrollment process by giving your electronic mail and creating a password. Follow the guidance below to create your account and find the Arizona Registration of Foreign Corporation exemplar to deal with your issues:

- Make use of the Preview solution or browse the file information (if offered) to ensure that the template is the one you need.

- Check out its applicability in the state you live.

- Click on Buy Now to create your order.

- Go with a preferred pricing plan.

- Make your account and pay with the credit card or PayPal.

- Select a handy formatting and download the record.

And while, that is it. In just a couple of simple actions you own an editable Arizona Registration of Foreign Corporation. When you create your account, all next requests will be processed even simpler. If you have a US Legal Forms subscription, just log in profile and click the Download button you see on the for’s page. Then, when you need to use this sample again, you'll constantly be able to find it in the My Forms menu. Don't squander your time and effort checking hundreds of forms on several platforms. Purchase precise documents from one trusted service!