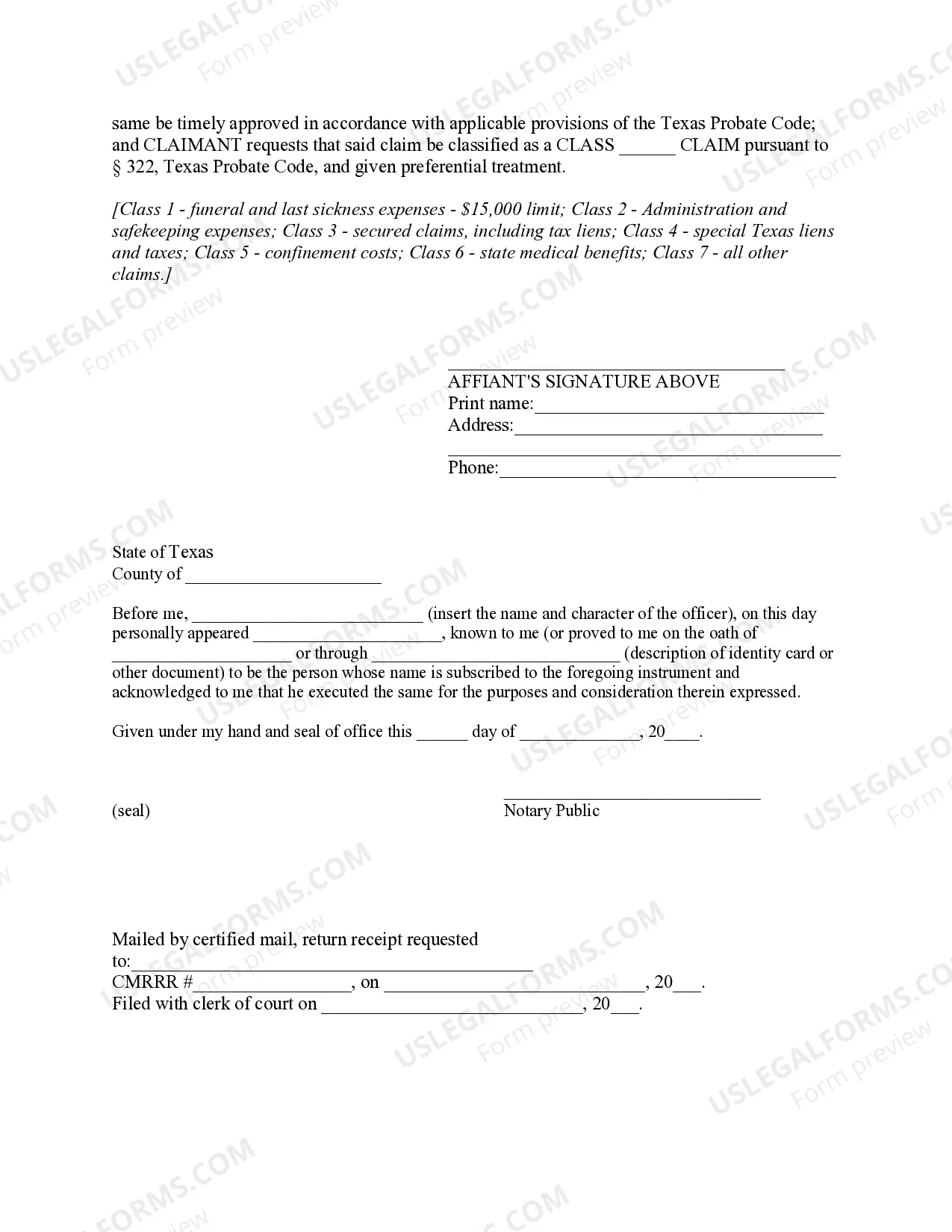

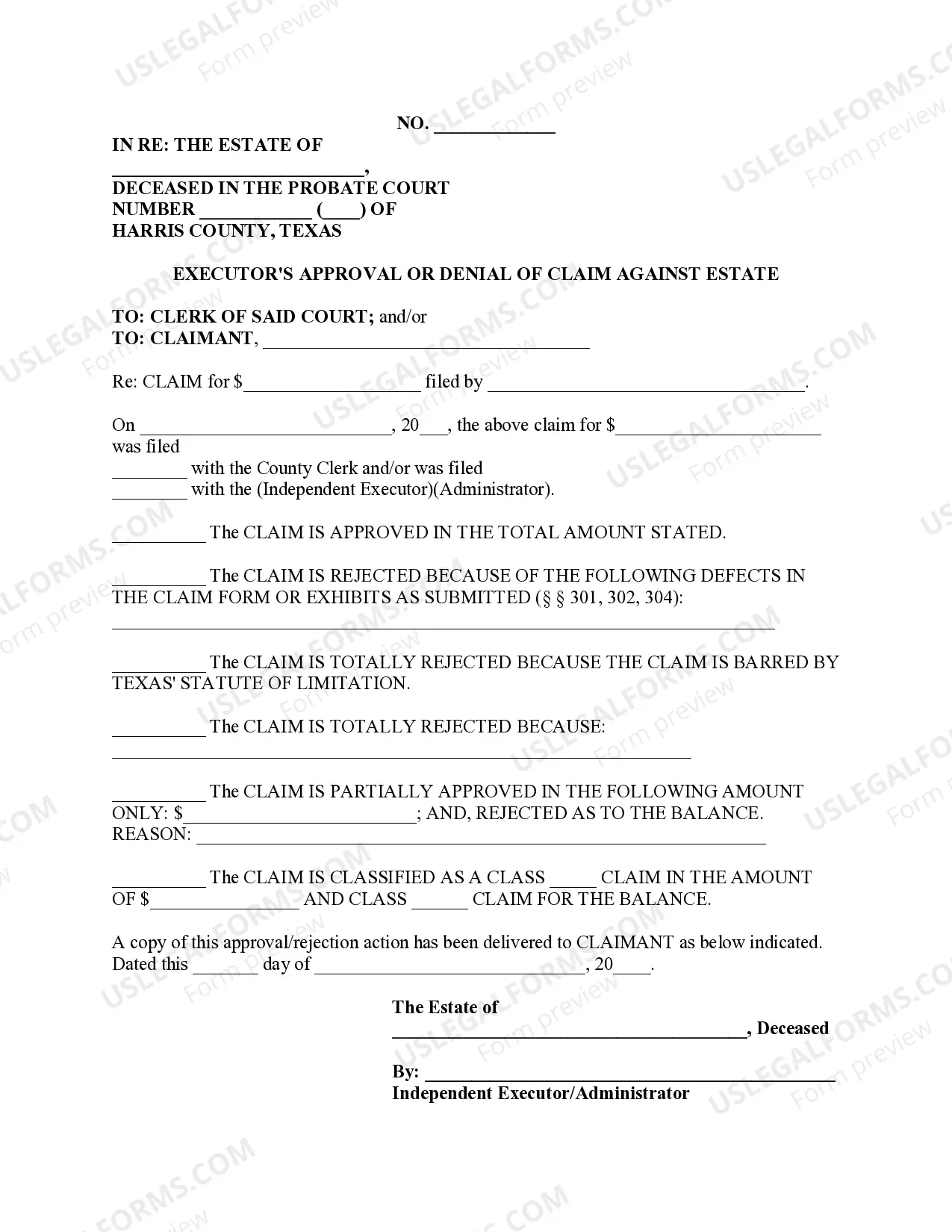

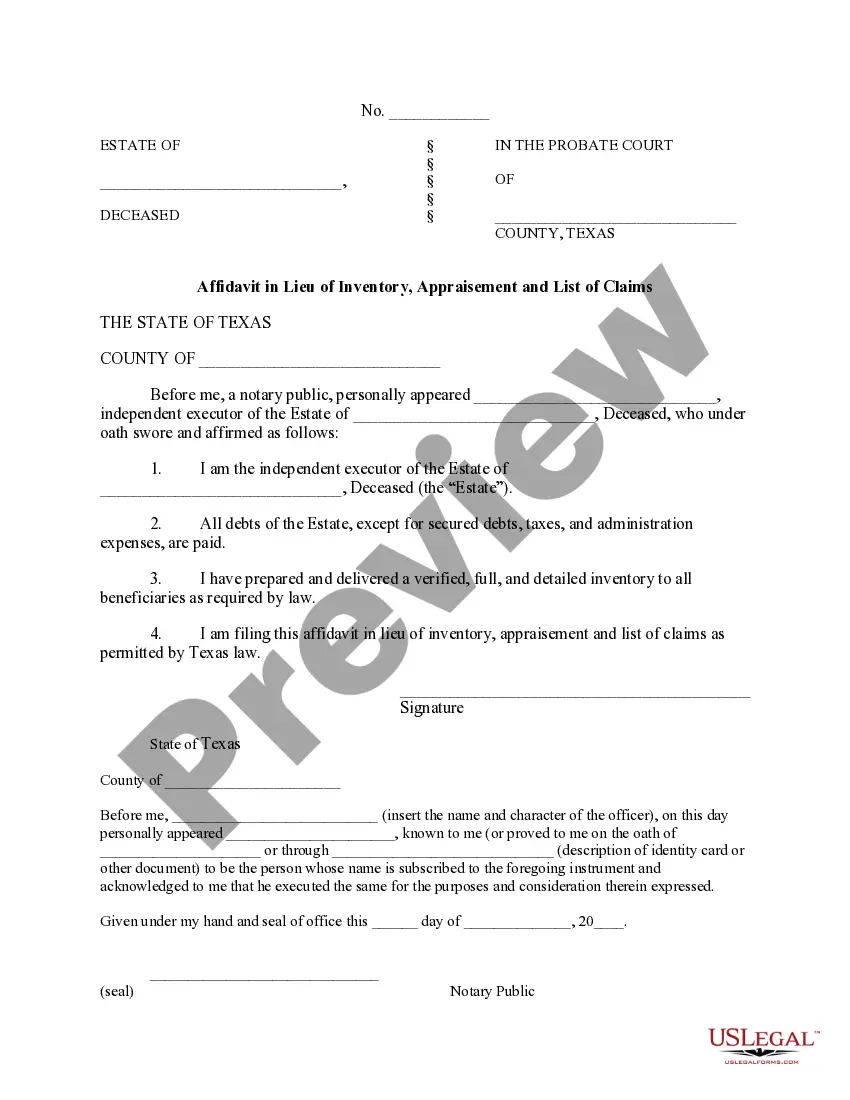

Sworn Form With Tax Clearance

Description

How to fill out Texas Sworn Statement Supporting Claim Against Estate?

Legal document managing may be overpowering, even for knowledgeable experts. When you are looking for a Sworn Form With Tax Clearance and do not have the a chance to commit trying to find the right and updated version, the operations might be stressful. A strong web form catalogue might be a gamechanger for anyone who wants to handle these situations effectively. US Legal Forms is a industry leader in web legal forms, with over 85,000 state-specific legal forms available anytime.

With US Legal Forms, you can:

- Access state- or county-specific legal and business forms. US Legal Forms covers any demands you may have, from individual to enterprise paperwork, all-in-one place.

- Make use of innovative tools to accomplish and handle your Sworn Form With Tax Clearance

- Access a resource base of articles, instructions and handbooks and materials highly relevant to your situation and needs

Help save time and effort trying to find the paperwork you will need, and employ US Legal Forms’ advanced search and Review feature to discover Sworn Form With Tax Clearance and get it. For those who have a membership, log in in your US Legal Forms account, look for the form, and get it. Review your My Forms tab to find out the paperwork you previously downloaded and also to handle your folders as you can see fit.

Should it be the first time with US Legal Forms, create a free account and get limitless access to all advantages of the platform. Here are the steps for taking after getting the form you need:

- Verify it is the right form by previewing it and reading through its information.

- Be sure that the sample is recognized in your state or county.

- Pick Buy Now once you are ready.

- Choose a subscription plan.

- Find the file format you need, and Download, complete, eSign, print out and send your papers.

Benefit from the US Legal Forms web catalogue, supported with 25 years of experience and reliability. Change your day-to-day papers management into a smooth and intuitive process right now.

Form popularity

FAQ

To process and generate the eTCC, a taxpayer must meet the following requirements: Updated profile on the platform with a recent passport photograph and address information. Filed annual income tax returns (also the employer must have submitted the annual tax returns) for the last three years.

Applications for General tax clearances should be made in TAMIS. Go to the Account tab and select Tax Clearance Certificate from the dropdown list. On the Tax Clearance Certificate Page > Select Request Certificate. Follow the prompts and upload any required documentation.

We highly recommend attaining the Tax Clearance Certificate as this document typically takes a few weeks to acquire and is usually valid for a six-month period. The reissuing of certificates (if necessary) is a simple process.

You are here Login to RAMIS. Click Request for Tax Clearance Certificate. Select the income period. Select the purpose for your tax clearance certificate. Select the type of certificate. Click Save.

To apply for CFA a person must submit to the Commissioner for Customs and Excise Department the following documents; Taxpayer Identification Number (TIN) Certificate for the Company (for new applicants only) Taxpayer Identification Number (TIN) Certificate for each Director (for new applicants only)