Accounting For Executory Contracts

Description

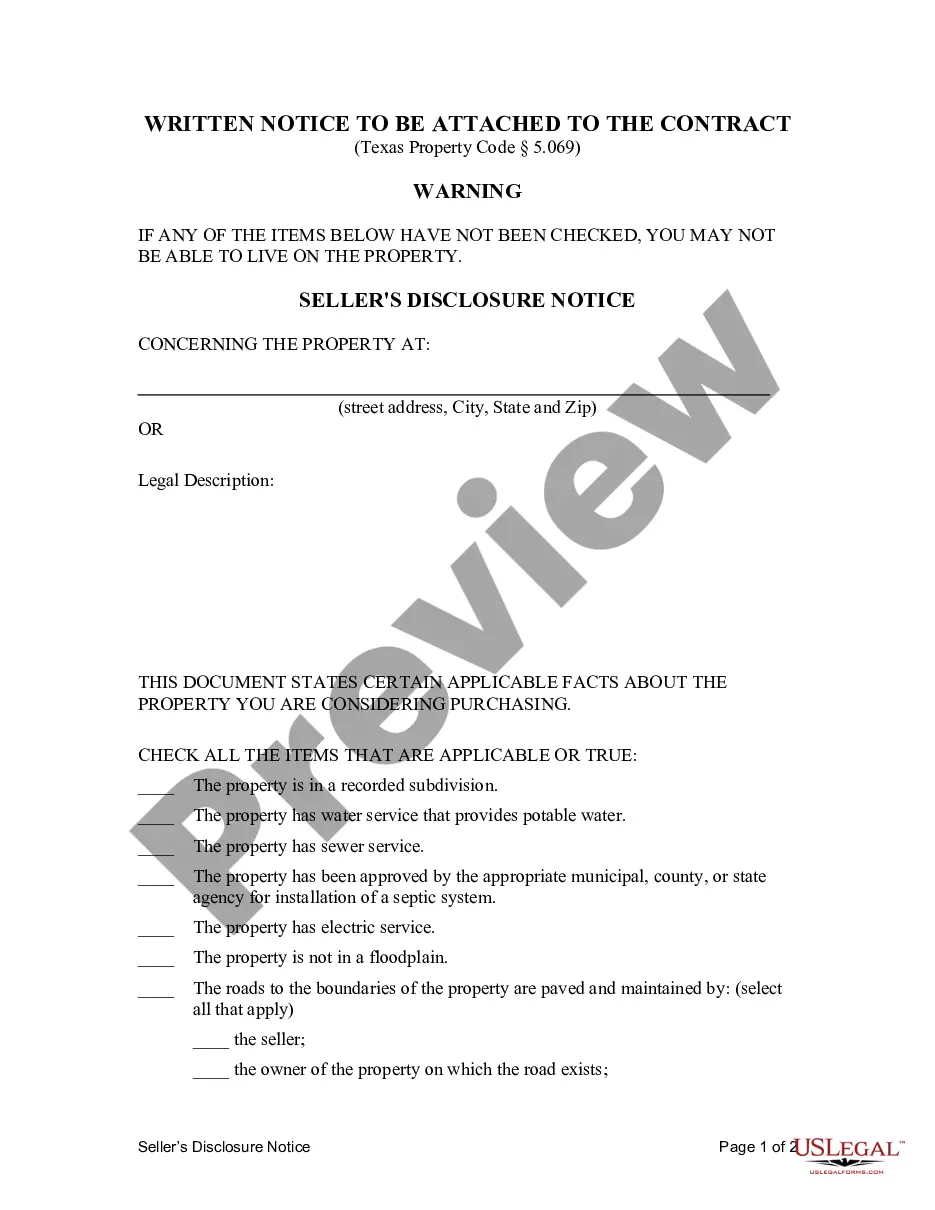

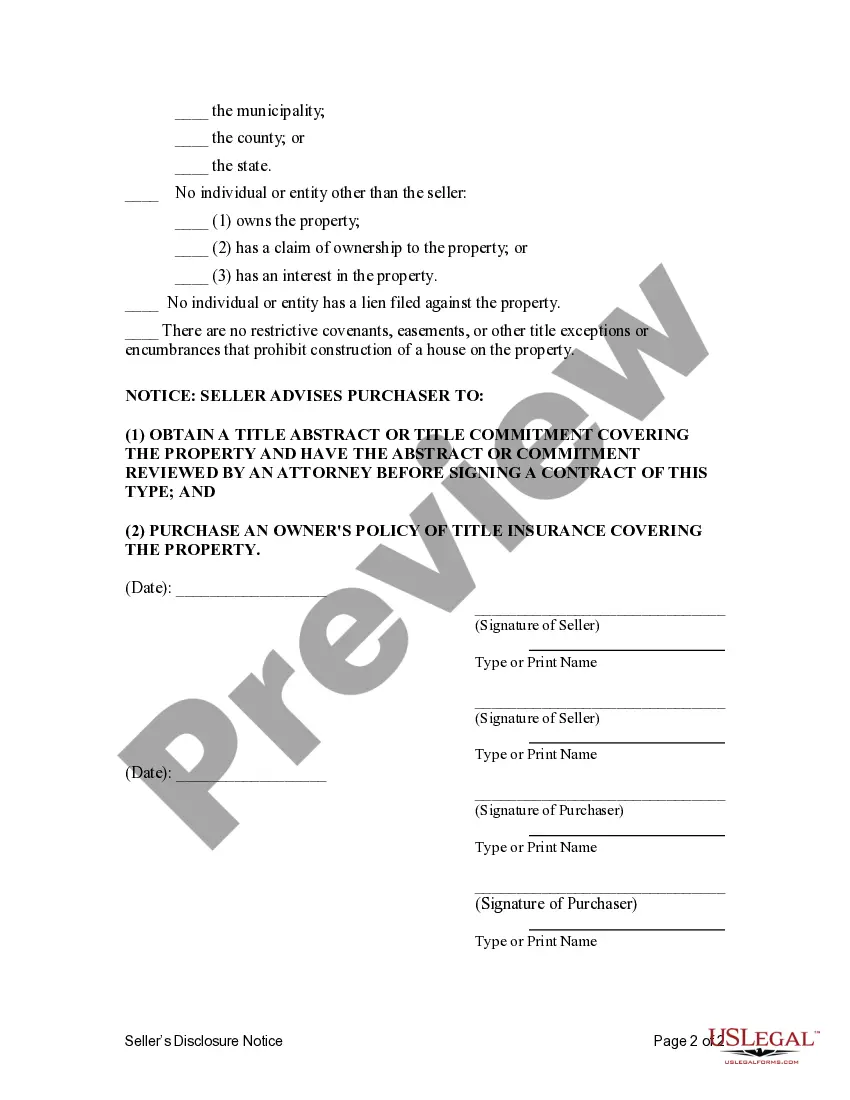

How to fill out Texas Contract For Deed Disclosure Of Property Condition - Residential - Land Contract, Executory Contract?

- Log in to your US Legal Forms account, ensuring your subscription is active. If needed, renew it based on your chosen payment plan.

- For first-time users, start by exploring the form descriptions and preview mode. Make sure you select a template that aligns with your specific requirements.

- If you need a different form, use the Search feature at the top to find an alternative that suits your needs.

- Once you've found the right document, click 'Buy Now' and select a subscription plan that works for you. You’ll need to create an account to access the form library.

- Complete your purchase using credit card or PayPal, and securely finalize the transaction.

- Download the selected form directly to your device and access it anytime in the 'My Forms' section of your profile.

In conclusion, leveraging US Legal Forms can greatly simplify the process of managing executory contracts. Their vast library and expert assistance ensure you have the right tools for effective legal compliance.

Start streamlining your legal documentation today by visiting US Legal Forms!

Form popularity

FAQ

Yes, an executory contract is generally considered binding as long as it meets the legal requirements for a contract. Both parties are obligated to fulfill their respective duties as outlined in the agreement. In terms of accounting for executory contracts, it is crucial to properly document obligations to maintain legal and financial accountability. Tools available through US Legal Forms can assist you in creating robust executory contracts that adhere to legal standards.

An executory contract is an agreement where both parties have obligations yet to be fulfilled. This type of contract is common in various situations, such as real estate transactions or service agreements. In the context of accounting for executory contracts, it is essential to understand how to properly recognize revenue and expenses associated with these agreements. Using platforms like US Legal Forms can help streamline the documentation and management of such contracts.

The accounting standard for contracts is primarily governed by the Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB). Specifically, ASC 606 and IFRS 15 provide guidelines for recognizing revenue from contracts. These standards include specific rules for accounting for executory contracts, ensuring that you capture the financial essence of contractual arrangements correctly. Utilizing reliable resources like US Legal Forms aids in navigating these standards effectively.

In accounting, a contract itself is not inherently classified as a debit or credit. Instead, contracts represent future obligations that can lead to either debits or credits depending on the transactions involved. For instance, when you fulfill an obligation under an executory contract, you may recognize revenue, which can be credited. Understanding the implications of accounting for executory contracts helps clarify these financial movements.

The process of contract accounting involves tracking the financial commitments associated with executory contracts. This includes recognizing revenue and expenses as the contract progresses. By following the guidelines for accounting for executory contracts, you ensure that your financial reporting is accurate and compliant. Tools and platforms, like US Legal Forms, can help streamline this process, making it easier for you to manage and document contract-related transactions.

A common example of an executory contract is a lease agreement, where one party agrees to rent property from another. The lease may involve future payments and obligations from both parties until the contract is fulfilled. Effectively managing these agreements is vital in accounting for executory contracts, as it impacts financial assessments and operational planning.

Accounting for contracts involves recognizing revenue and expenses at the appropriate times based on the fulfillment of obligations. For executory contracts, this means monitoring when goods or services are delivered and updating financial records accordingly. Using a reliable platform like USLegalForms can streamline this process and ensure accurate reporting in accounting for executory contracts.

Yes, executory contracts are recorded in the accounting books, but the treatment may vary based on the nature of the contract and the accounting framework used. It’s important to recognize the obligations and rights associated with these agreements when preparing financial statements. The method of accounting for executory contracts can help ensure compliance and clarity in financial reporting.

An executory contract is not typically classified as an asset in the traditional sense. However, it represents future economic benefits or obligations between parties. Accounting for executory contracts involves tracking these potential benefits and the commitments involved, which can impact financial statements.

In accounting, an executory contract is a commitment made by parties that have not yet completed their contractual duties. This type of contract may include future services or deliverables, showing how companies plan their financial obligations. Proper accounting for executory contracts is essential for accurate financial reporting and liability management.