Appointment Of Successor Trustee Form Form

Description

Form popularity

FAQ

An example of a successor trustee could be a family member, such as an adult child or sibling, who you trust to handle your affairs when you're no longer able to do so. Alternatively, you may choose a friend or a professional, like an attorney, who specializes in estate management. Each option has distinct advantages, depending on your comfort level and the complexity of your estate. To document your choice, consider using our Appointment of successor trustee form form for clarity.

A successor trustee is the individual or entity designated to manage the assets of a trust after the original trustee can no longer fulfill their duties. This role involves the administration of the trust according to your instructions, ensuring the smooth transfer of assets to beneficiaries. It's crucial to select someone who comprehends your wishes and can act on your behalf. You can simplify the process by utilizing our Appointment of successor trustee form form.

When considering whom to name as your successor trustee, think about individuals who are responsible, trustworthy, and willing to take on the responsibilities of managing your trust after your passing. It's often wise to choose someone who understands your values and financial situation. Additionally, you can also consider appointing a professional trustee or a trust company if you prefer a more neutral party. Using our Appointment of successor trustee form form can help you formalize this decision effectively.

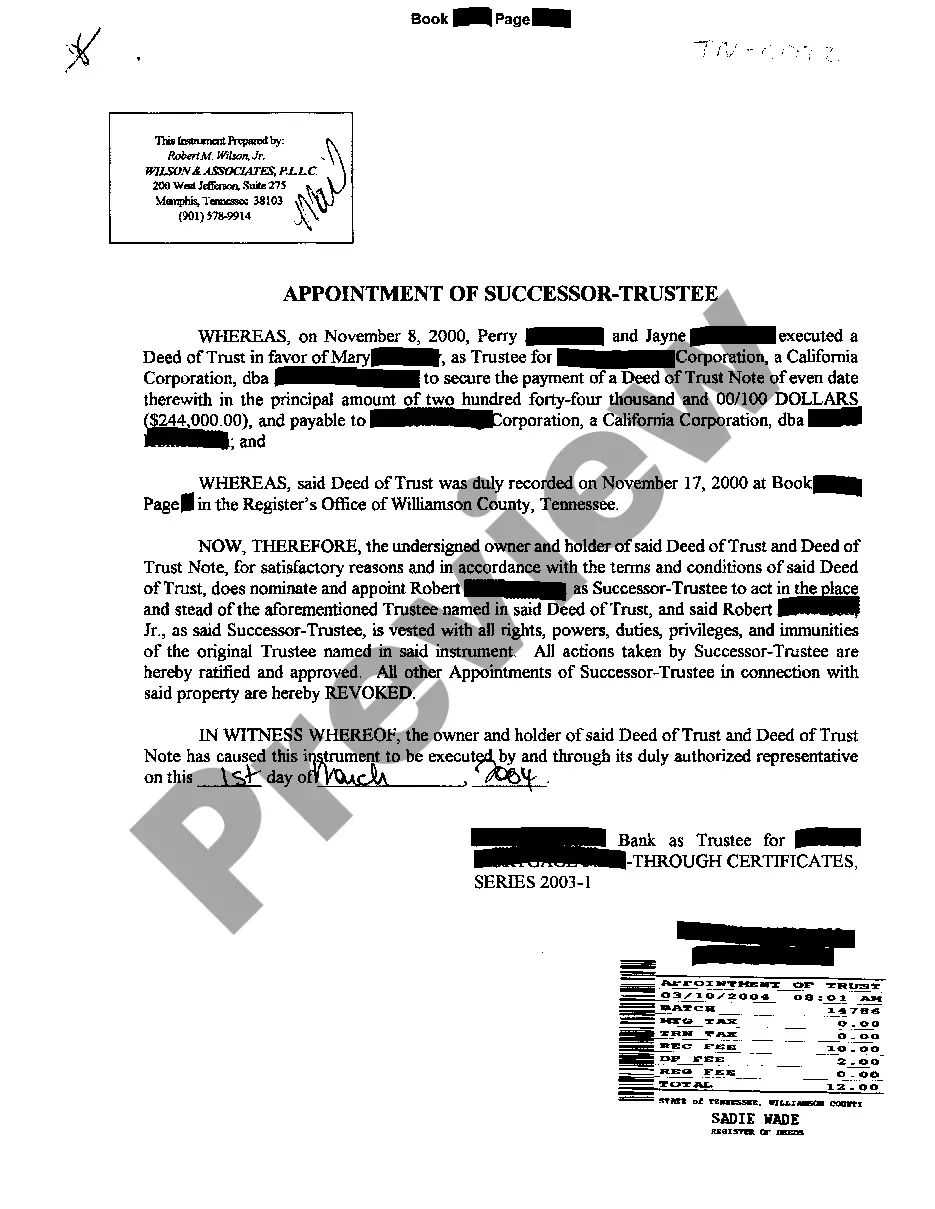

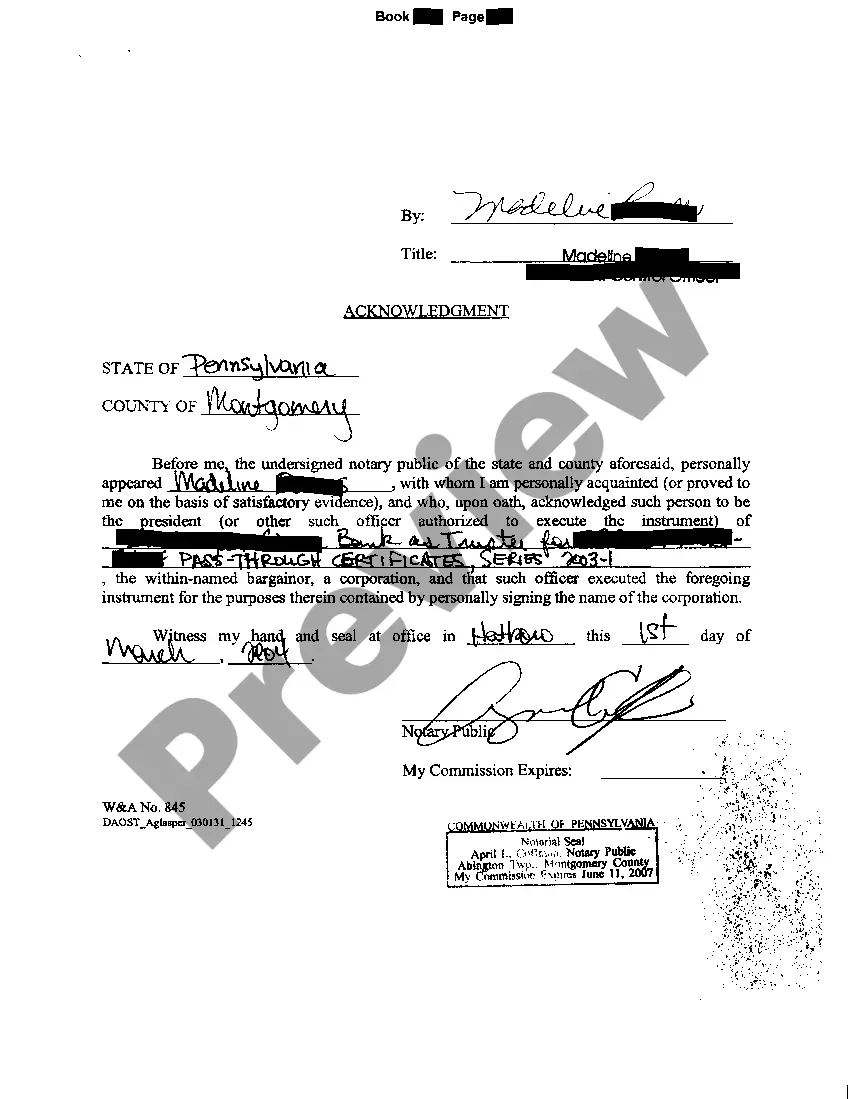

The affidavit of successor trustee form is a document that provides evidence of the successor trustee's authority and responsibilities under the trust agreement. This form often includes details about the trust, the original trustee's passing or resignation, and confirms the successor trustee's role. By completing the Appointment of Successor Trustee Form form, you can ease the administrative burden and clarify the successor trustee's obligations to all relevant parties.

A successor trustee is responsible for managing the trust and ensuring that the trust's terms are followed. This role involves handling assets, paying taxes, and distributing property to beneficiaries as outlined in the trust document. To streamline this process, you may need to complete the Appointment of Successor Trustee Form form, which formally designates the successor trustee and provides them with the legal authority to act on behalf of the trust.

A successor trustee may need to obtain a new Employer Identification Number (EIN) depending on the trust's structure and circumstances. If the trust becomes irrevocable upon the original trustee's passing, filing the Appointment of successor trustee form form will likely require a new EIN. However, consulting with a tax professional can clarify your specific situation. Uslegalforms offers resources to guide you through this process effectively.

Yes, whenever a trustee takes over, that individual must file the Appointment of successor trustee form form. This form acts as a formal notification to the IRS about changes in the trust’s management. Failing to file can result in complications related to trust taxation and administration. Thus, addressing this requirement promptly is essential for compliance.

The paperwork for a successor trustee includes various documents, with the Appointment of successor trustee form form being essential. This form notifies relevant parties, including the IRS, of the change in trusteeship. In addition, you may need to prepare trust accountings, tax filings, and possibly other legal paperwork depending on your jurisdiction. Clear documentation is key to a smooth transition.

To appoint a successor trustee, you typically need to follow the guidelines set in the original trust document. This often involves filling out the Appointment of successor trustee form form and having it signed per legal requirements. It is also wise to inform all interested parties, including beneficiaries, about the new appointment to ensure clear communication. Utilizing a reliable platform like uslegalforms can help simplify this process significantly.

If you do not file the Appointment of successor trustee form form, you may face legal complications regarding the trust administration. The IRS relies on Form 56 to ensure that the right individuals are handling the trust's taxes. This means you could delay important processes and potentially incur penalties. It is crucial to complete and file the form on time to avoid these issues.