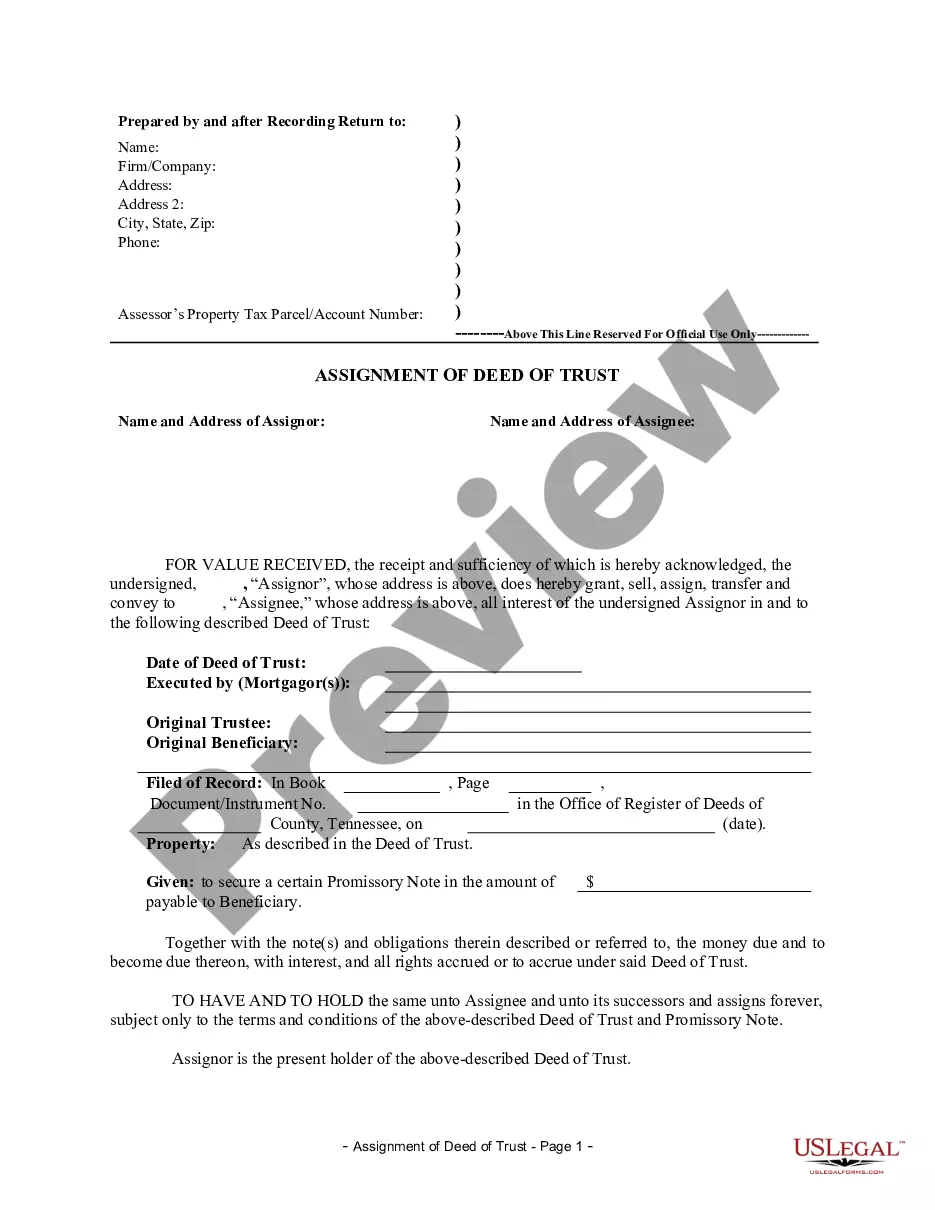

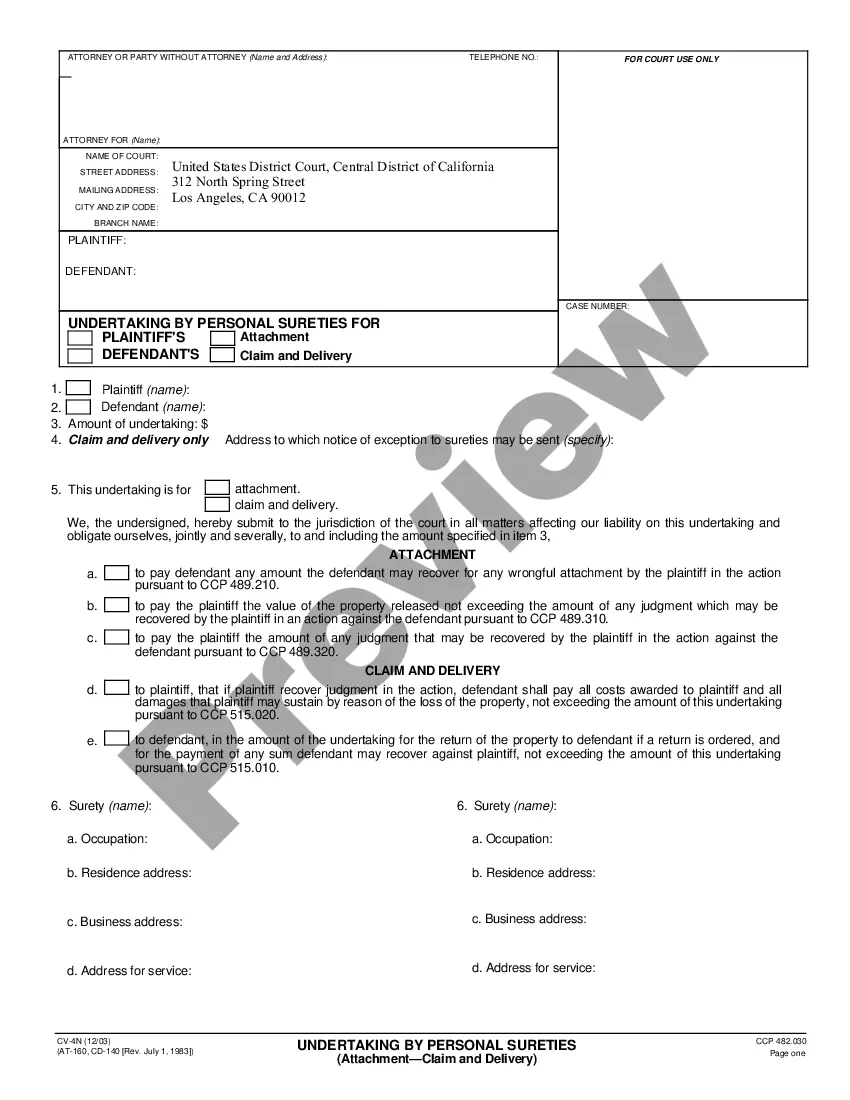

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is an individual(s).

Tennessee Deed In Lieu Of Foreclosure Form

Description

How to fill out Tennessee Deed In Lieu Of Foreclosure Form?

How to locate professional legal templates that adhere to your state regulations and create the Tennessee Deed In Lieu Of Foreclosure document without hiring an attorney.

Numerous online services provide templates to address different legal scenarios and requirements. However, it may require time to ascertain which of the available examples satisfy both your use case and legal standards.

US Legal Forms is a reliable platform that assists you in locating formal documents crafted according to the most recent updates in state laws while helping you save on legal fees.

If you lack a US Legal Forms account, follow the instructions below: Review the webpage you've opened and determine if the form meets your requirements. To assist with this, utilize the form description and preview options if available. Search for another template in the header by entering your state if necessary. Click the Buy Now button once you locate the correct document. Select the most appropriate pricing plan, then Log In or register for an account. Choose your payment method (via credit card or PayPal). Alter the file format for your Tennessee Deed In Lieu Of Foreclosure Form and click Download. The purchased templates are yours to keep; you can revisit them anytime in the My documents section of your profile. Join our platform and create legal documents independently like a skilled legal professional!

- US Legal Forms is not just a typical web repository.

- It comprises over 85,000 validated templates catering to various business and personal situations.

- All documents are categorized by area and state for a quicker and more user-friendly search experience.

- Furthermore, it connects with robust solutions for PDF editing and eSignature, allowing users with a Premium subscription to easily complete their forms online.

- It requires minimal effort and time to obtain the necessary documents.

- If you already possess an account, Log In and verify your subscription status.

- Download the Tennessee Deed In Lieu Of Foreclosure Form using the button next to the file name.

Form popularity

FAQ

One practical option to avoid foreclosure is to pursue a Tennessee deed in lieu of foreclosure form. This form allows you to relinquish the property to the lender, thereby sidestepping the lengthy process of foreclosure. It often leads to quicker resolution and may protect your credit from further damage. The uslegalforms platform can provide you with the necessary resources and guidance to effectively navigate this option.

A process similar to foreclosure is a deed in lieu of foreclosure, which can provide a more favorable outcome for homeowners. This option involves voluntarily handing over the property to the lender, avoiding the formal foreclosure process. This method may help mitigate the financial impact and legal hassles commonly associated with foreclosure. Understanding the Tennessee deed in lieu of foreclosure form will guide you through this alternative.

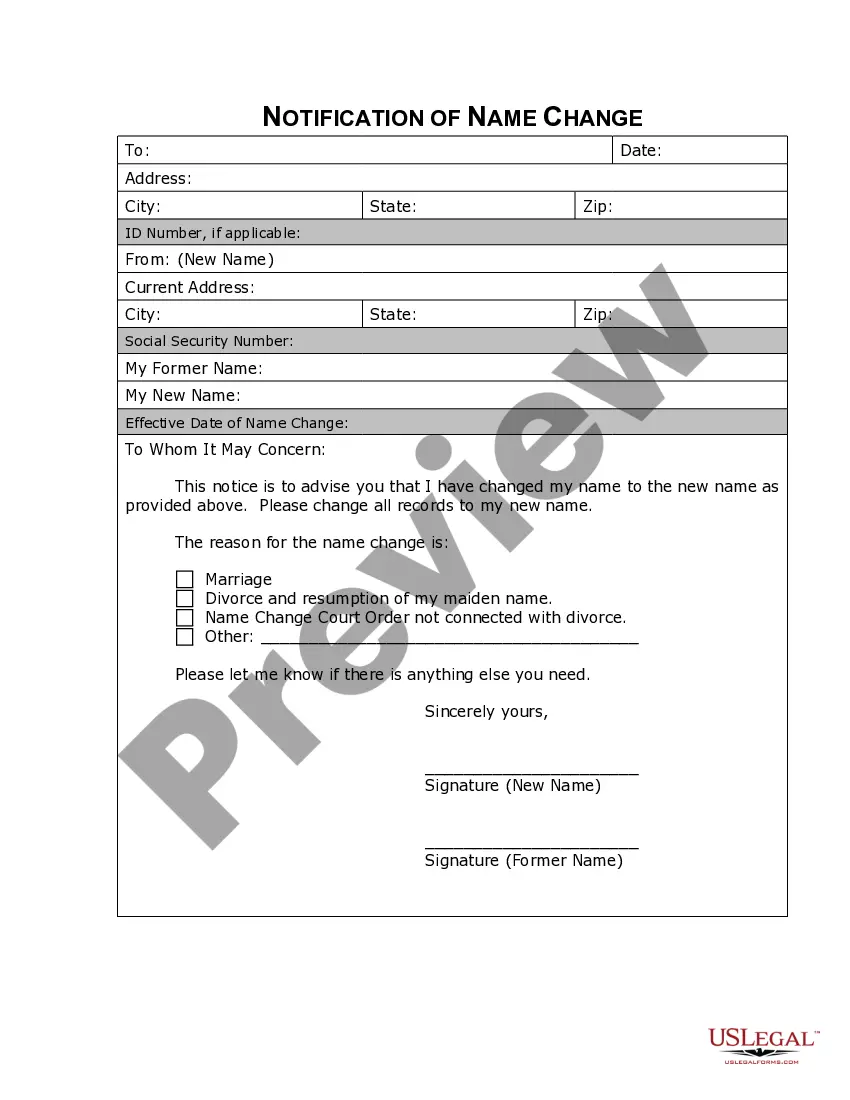

To obtain the deed to your house in Tennessee, you need to complete the Tennessee deed in lieu of foreclosure form if you are considering transferring ownership to your lender. It's essential to work with your lender to ensure you follow their specific requirements for the process. Moreover, after successfully submitting the form, your lender will manage the rest, and you will receive confirmation of the deed transfer.

One effective alternative to foreclosure is executing a Tennessee deed in lieu of foreclosure form. This option allows homeowners to transfer the property title back to the lender voluntarily. By doing so, you can avoid the lengthy and stressful foreclosure process. Additionally, it may help preserve your credit score better than foreclosure.

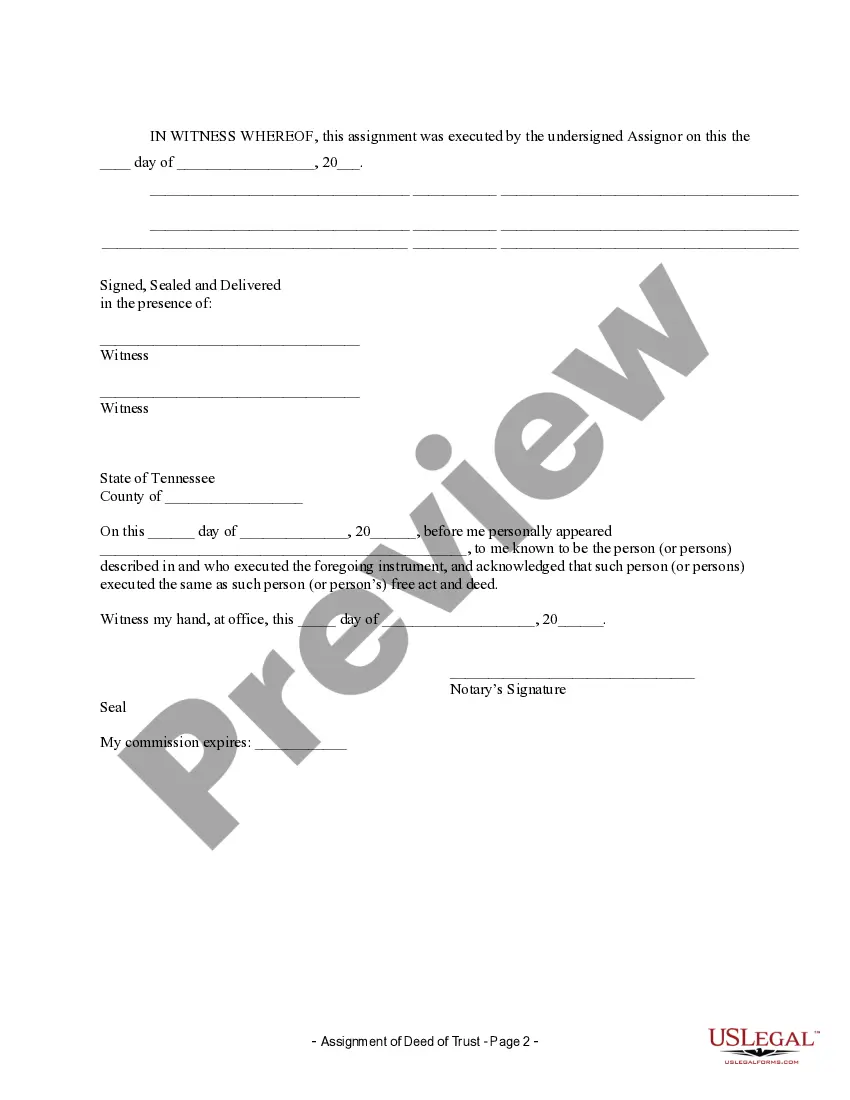

To fill out a quit claim deed in Tennessee, start by obtaining the correct form, often available on platforms like US Legal Forms. Next, insert the grantor's name, the recipient's name, and a legal description of the property. Ensure you properly sign and date the form in front of a notary public, which is essential for its validity. Once completed, you can record the quit claim deed with your local county recorder, which is an important step in the Tennessee deed in lieu of foreclosure form process.

To transfer a property deed in Tennessee, you must complete a formal deed document that clearly states the intent of the transfer. You also need to have it signed and notarized in the presence of a notary public. Finally, file the deed with the local county register's office to make it legally binding. For assistance in navigating this process efficiently, consider utilizing the necessary Tennessee deed in lieu of foreclosure form available through platforms like USLegalForms.

The biggest disadvantage for a lender in accepting a deed in lieu of foreclosure is the potential loss of recovery on their investment. If property values have declined, the lender may not be able to recoup the full amount owed through selling the property. Moreover, accepting a deed can result in increased operational costs for the lender, including maintenance and re-sale efforts. Therefore, before proceeding, lenders thoroughly evaluate the merits of accepting a Tennessee deed in lieu of foreclosure form.

A deed in lieu of foreclosure has certain drawbacks that homeowners should weigh carefully. Primarily, it can severely impact your credit score and may be seen unfavorably by future lenders. Furthermore, the lender generally retains the right to pursue any deficiency judgment if the property's value is below the mortgage amount. Using a Tennessee deed in lieu of foreclosure form can minimize complications, but understanding the potential pitfalls is crucial.

While a deed can provide a solution for overwhelmed homeowners, it does come with disadvantages. First, it may not release the borrower from all associated debts, especially if the property value is less than the mortgage owed. Additionally, homeowners must consider potential tax ramifications, as forgiven debt could be taxable. Therefore, a Tennessee deed in lieu of foreclosure form should be approached with caution and full awareness of its implications.

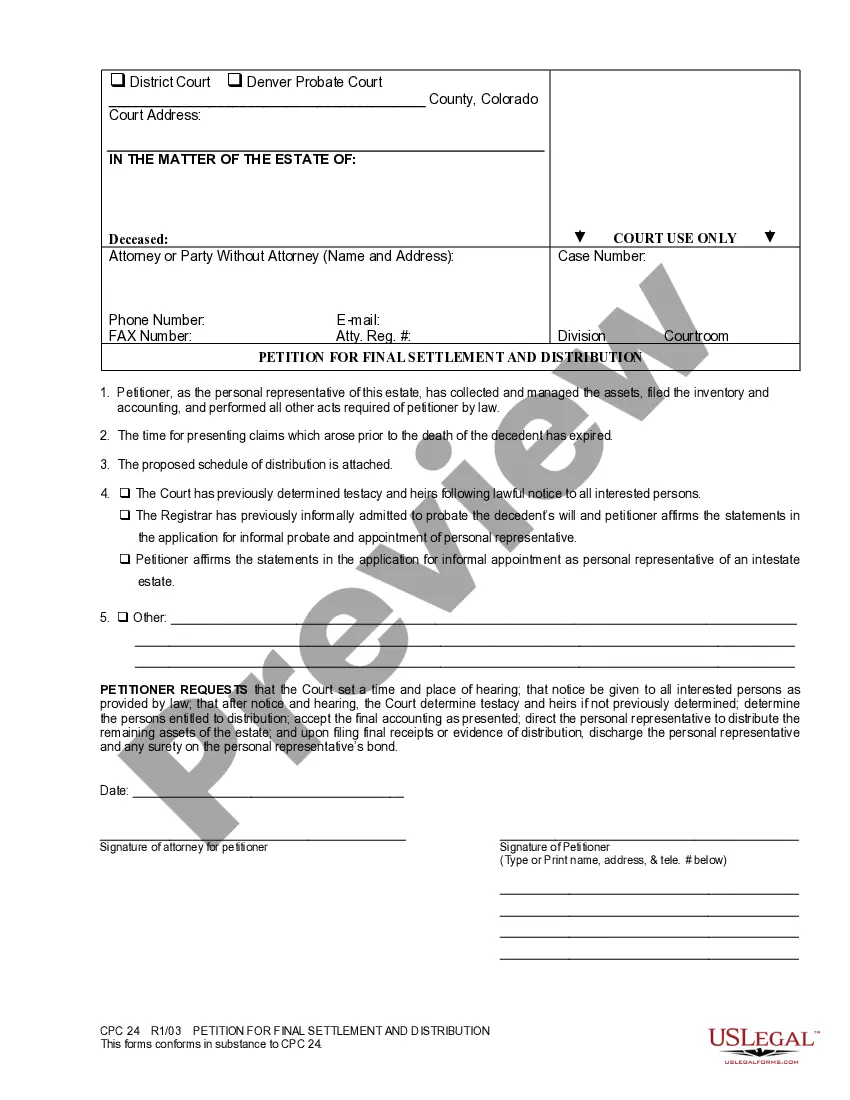

In Tennessee, foreclosure laws dictate a specific process lenders must follow to reclaim a property when the borrower defaults. Generally, lenders must provide notice and allow a period for borrowers to remedy their mortgage defaults before initiating foreclosure. The process can be non-judicial, which means it does not involve court, making it quicker for lenders. Familiarizing yourself with these rules can help you understand options like the Tennessee deed in lieu of foreclosure form.