Tennessee Intestate Succession Formula

Description

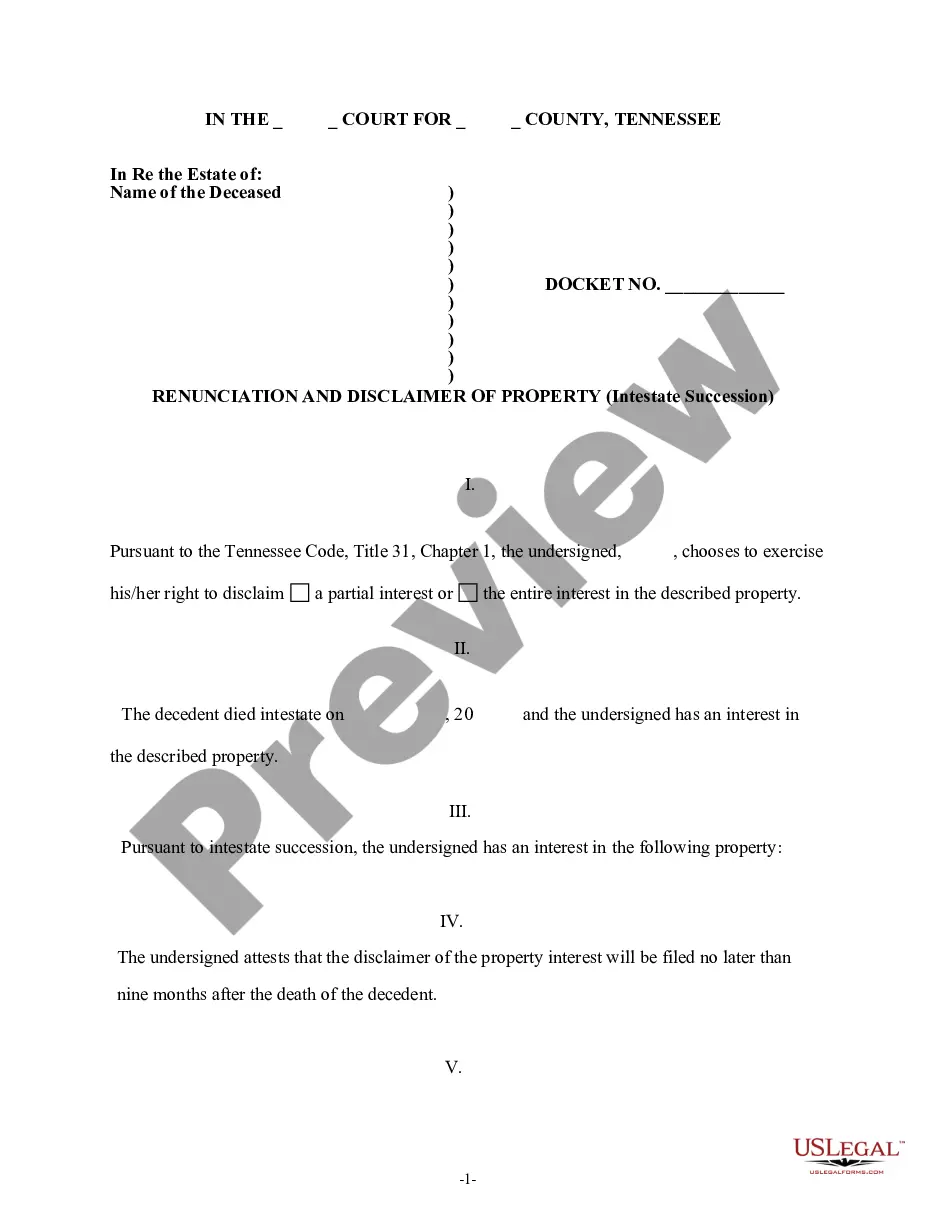

How to fill out Tennessee Renunciation And Disclaimer Of Property Received By Intestate Succession?

When you must submit the Tennessee Intestate Succession Formula in line with your local state's statutes, there may be countless options to select from.

There's no justification to check each form to confirm it meets all the legal requirements if you are a US Legal Forms member.

It is a reliable service that can assist you in acquiring a reusable and current template on any subject.

Using the US Legal Forms, obtaining professionally crafted official documents becomes simple. Additionally, Premium users can enjoy advanced integrated solutions for online PDF editing and signing. Give it a try today!

- US Legal Forms is the largest online repository with a compilation of over 85k ready-to-use documents for business and personal legal situations.

- All templates are verified to comply with each state's laws.

- Thus, when downloading the Tennessee Intestate Succession Formula from our platform, you can be assured that you possess a legitimate and up-to-date document.

- Accessing the necessary sample from our platform is quite simple.

- If you already have an account, just Log In to the system, ensure your subscription is active, and save the chosen file.

- Later, you can navigate to the My documents section in your profile and access the Tennessee Intestate Succession Formula at any time.

- If this is your first time using our website, please follow the guide below.

- Browse through the suggested page and verify it meets your needs.

Form popularity

FAQ

In cases where a person passes away intestate, the court appoints an administrator to handle the estate, rather than an executor, as there is no will. This administrator is typically a close family member or an interested party who petitions for the role. The appointed administrator manages asset distribution according to the Tennessee intestate succession formula. To learn more about navigating this process, you can explore resources available on the US Legal Forms platform.

The Tennessee intestate succession formula outlines how a deceased person's assets are distributed when they die without a will. This formula prioritizes family members, beginning with the closest relatives such as a spouse and children. If no immediate family exists, the distribution extends to parents, siblings, and so forth. Understanding this formula ensures that loved ones receive their rightful inheritance according to Tennessee law.

Probate without a will in Tennessee starts with filing a petition in the appropriate court. The court will appoint a personal representative to manage the estate, adhering strictly to the Tennessee intestate succession formula for asset distribution. This legal framework ensures that your loved ones receive what they are entitled to. Using US Legal Forms can streamline this process, providing templates and information tailored for your needs.

Probating an estate without a will in Tennessee involves filing a petition in the local probate court. The court will then apply the Tennessee intestate succession formula to determine how the estate's assets are distributed among heirs. It's crucial to gather all necessary documentation and consider using services like US Legal Forms for guidance. This platform offers valuable resources to simplify the probate process for you.

In Tennessee, estates valued over $50,000 typically require probate. This process allows the court to oversee the estate's distribution according to the Tennessee intestate succession formula when no will exists. If the estate value is $50,000 or less, you may not need to initiate probate. However, consulting with a legal professional ensures compliance with local laws.

Heirs at law in Tennessee are those individuals who are legally recognized to inherit under the state’s intestate succession laws. This typically includes spouses, children, parents, and possibly more distant relatives depending on existing familial connections. Understanding who qualifies as heirs at law according to the Tennessee intestate succession formula is crucial for families managing an estate without a will.

The Heirs Property Act in Tennessee addresses the unique challenges faced by heirs to property that has not gone through probate. This law allows heirs to sell or partition property without requiring every heir's consent, which can simplify the division process. Utilizing the Tennessee intestate succession formula, this act helps protect the rights of heirs and encourages effective property management.

The hierarchy of intestate succession in Tennessee starts with immediate relatives, following the Tennessee intestate succession formula. First, a surviving spouse and children inherit, followed by parents, siblings, and more distant relatives in descending order of relationship. This system ensures that those closest to the deceased receive priority in asset distribution, creating a fair environment for inheritance.

An intestate estate is divided according to the Tennessee intestate succession formula, which dictates specific share allocations based on the deceased's family structure. For example, a surviving spouse may receive a significant portion alongside children, while other relatives may inherit lesser amounts. It’s important for families to understand these rules to prevent disputes and ensure fair distribution during a challenging time.

The order of intestate succession in Tennessee follows a specific hierarchy according to the Tennessee intestate succession formula. Spouses and children hold the highest priority, followed by parents, siblings, and more distant relatives. If no relatives exist, the estate will escheat, or return, to the state. This clear outline helps distribute assets fairly according to familial ties.