Tennessee Utma Age Of Majority Withdrawal

Description

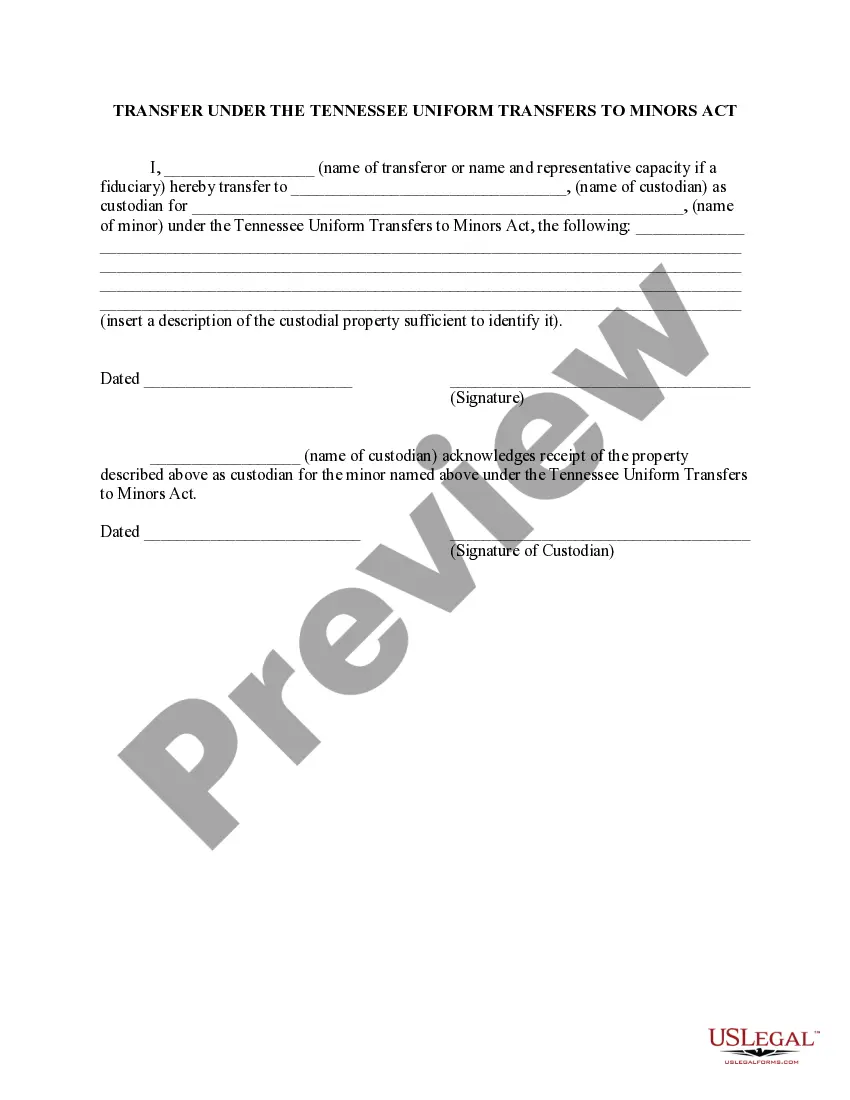

How to fill out Transfer Under The Tennessee Uniform Transfers To Minors Act?

Obtaining legal templates that comply with federal and local laws is essential, and the internet offers numerous options to pick from. But what’s the point in wasting time looking for the appropriate Tennessee Utma Age Of Majority Withdrawal sample on the web if the US Legal Forms online library already has such templates accumulated in one place?

US Legal Forms is the biggest online legal library with over 85,000 fillable templates drafted by attorneys for any business and life case. They are simple to browse with all files arranged by state and purpose of use. Our professionals stay up with legislative updates, so you can always be confident your form is up to date and compliant when acquiring a Tennessee Utma Age Of Majority Withdrawal from our website.

Obtaining a Tennessee Utma Age Of Majority Withdrawal is fast and simple for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you need in the preferred format. If you are new to our website, adhere to the steps below:

- Analyze the template using the Preview feature or through the text outline to ensure it meets your requirements.

- Browse for a different sample using the search tool at the top of the page if necessary.

- Click Buy Now when you’ve found the correct form and choose a subscription plan.

- Register for an account or log in and make a payment with PayPal or a credit card.

- Pick the format for your Tennessee Utma Age Of Majority Withdrawal and download it.

All documents you find through US Legal Forms are reusable. To re-download and complete previously obtained forms, open the My Forms tab in your profile. Take advantage of the most extensive and straightforward-to-use legal paperwork service!

Form popularity

FAQ

Depending on the state a UTMA account is handed over to a child when they reach either age 18 or age 21. In some jurisdictions, at age 18 a UTMA account can only be handed over with the custodian's permission, and at 21 is transferred automatically.

If a minor has reached the age of twenty-one (21) and seeks to withdraw the funds from the UTMA account of which he/she is the beneficiary, the minor must contact the custodian, as the custodian is the only person authorized to make withdrawals or close the account.

Age of Majority and Trust Termination StateUGMAUTMATennessee1821Texas1821Utah2121Vermont21N/A49 more rows

The first $1,100 in earnings in the UTMA account are tax-free. This earnings figure includes dividends, interest income, and any capital gains. The next $1,100 in earnings is taxable at the child's tax rate. Because your child probably doesn't earn much income, their tax rate is typically 10%.

B or 1099DIV should be received at the end of the tax year from the financial institution handling the UGMA/UTMA account to report any interest or earnings on the account.