South Dakota Agreement With Cities

Description

How to fill out South Dakota Postnuptial Property Agreement?

Individuals frequently link legal documentation with a task that is intricate and only manageable by an expert.

In a particular sense, this is accurate, since formulating the South Dakota Agreement With Cities requires considerable knowledge of subject-specific criteria, including both state and county laws.

Nonetheless, with US Legal Forms, the process has become simpler: pre-prepared legal templates for any personal and business circumstance tailored to state legislation are gathered in one digital repository and are now accessible to all.

All templates in our collection are reusable: after purchase, they remain saved in your account. You can access them anytime through the My documents tab. Discover all the advantages of using the US Legal Forms service. Sign up today!

- Ensure the page content is thoroughly reviewed to confirm it suits your requirements.

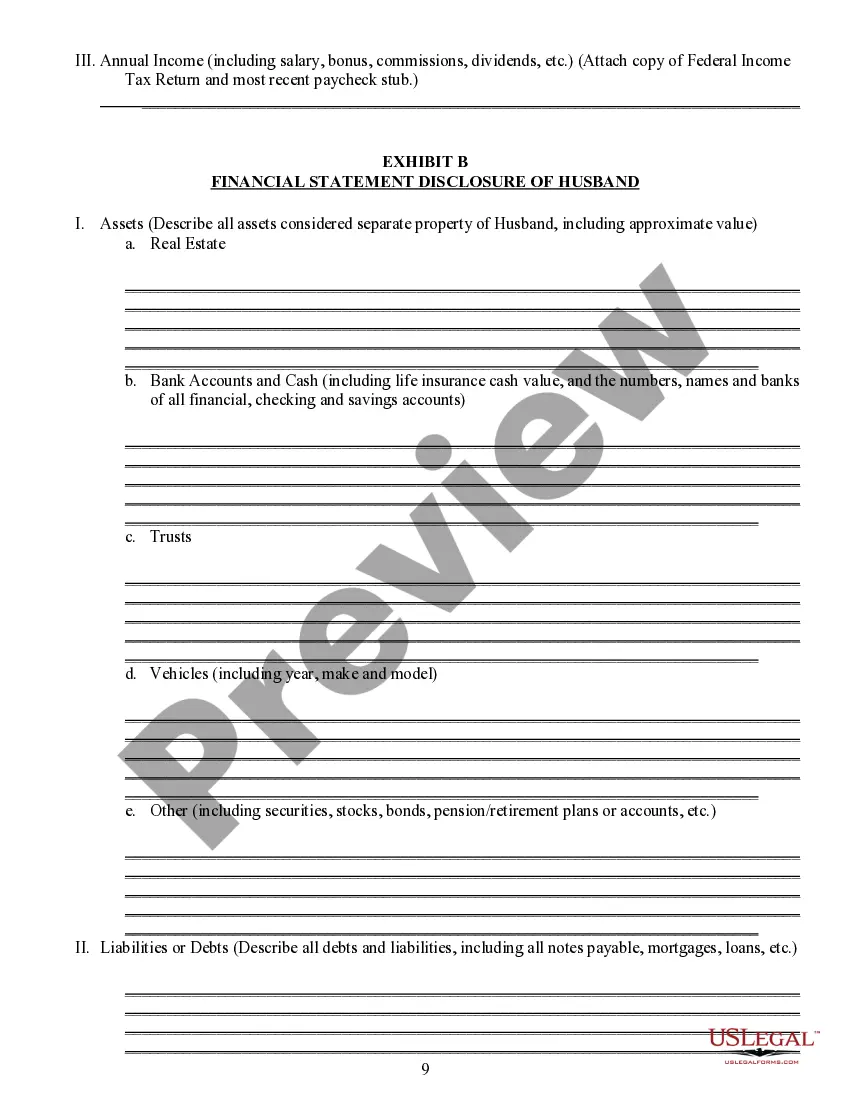

- Examine the form's description or assess it using the Preview option.

- Search for another template using the Search bar above if the initial one is not suitable.

- Click Buy Now when you identify the appropriate South Dakota Agreement With Cities.

- Choose a pricing plan that aligns with your needs and financial capability.

- Create an account or Log In to continue to the payment page.

- Make your subscription payment via PayPal or with your credit card.

- Choose the file format and click Download.

- Print your document or upload it to an online editor for a faster completion.

Form popularity

FAQ

Whether your car is brand new or used, you'll pay the same in sales tax. Vehicles in South Dakota are subject to the 4% statewide sales tax, plus any local or county taxes.

In the United States, statewide sales taxes range between 2.9 percent in Colorado to 7.5 percent in California. Montana's surrounding states have sales tax rates of 4 percent in Wyoming and South Dakota, 5 percent in North Dakota and 6 percent in Idaho.

South Dakota is unique in the fact that almost all services are taxable. The only major service that is exempt from being taxed is construction.

Contractor's Excise Tax Bid Factor Calculator Because contractor's excise tax is owed on your gross receipts, which include any taxes collected from the customer, a bid factor of 2.041% may be used to calculate the excise tax when preparing a bid or bill. This allows you to collect the full amount of excise tax due.

You have two options for filing and paying your South Dakota sales tax: File online File online at the South Dakota Department of Revenue. You can remit your payment through their online system. AutoFile Let TaxJar file your sales tax for you.