South Carolina Right For Us

Description

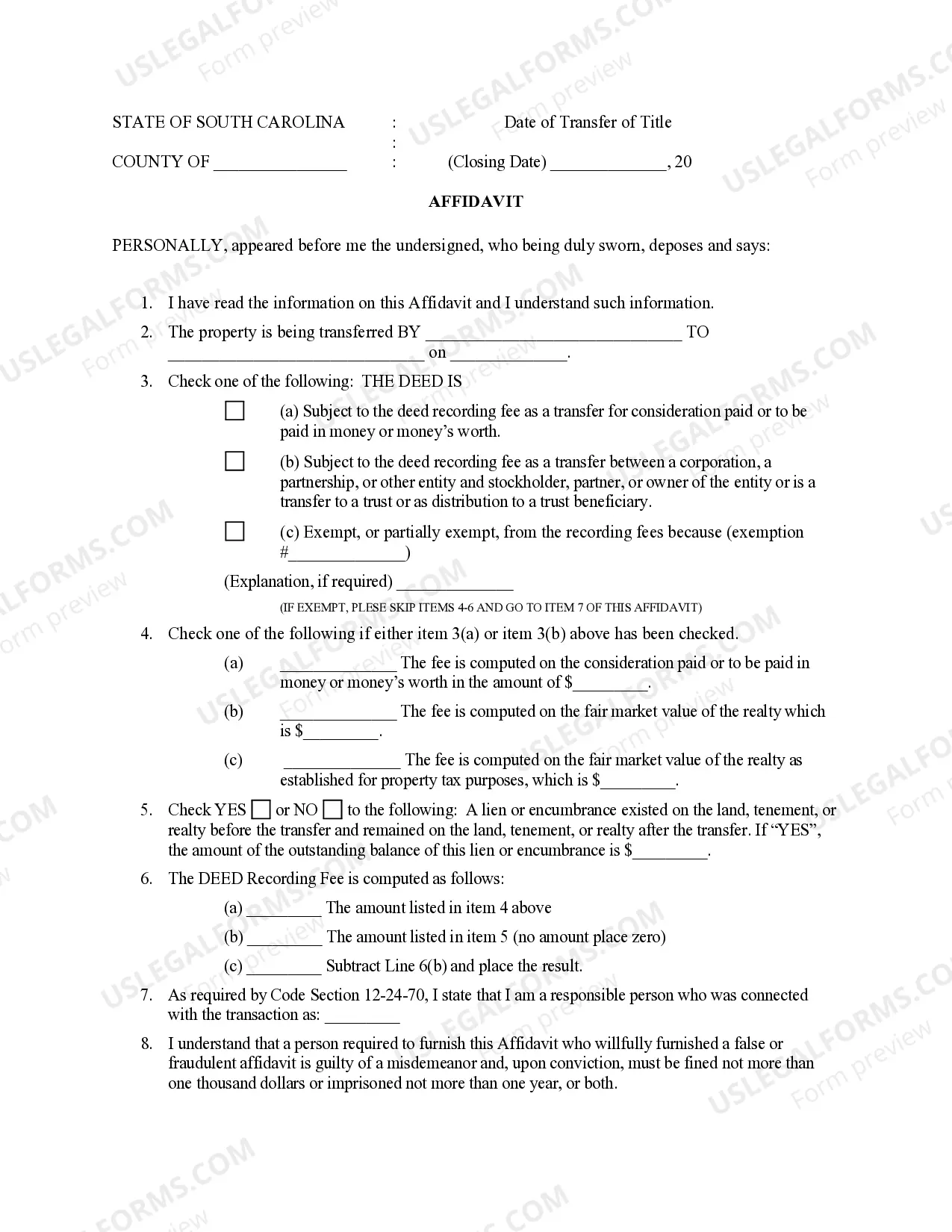

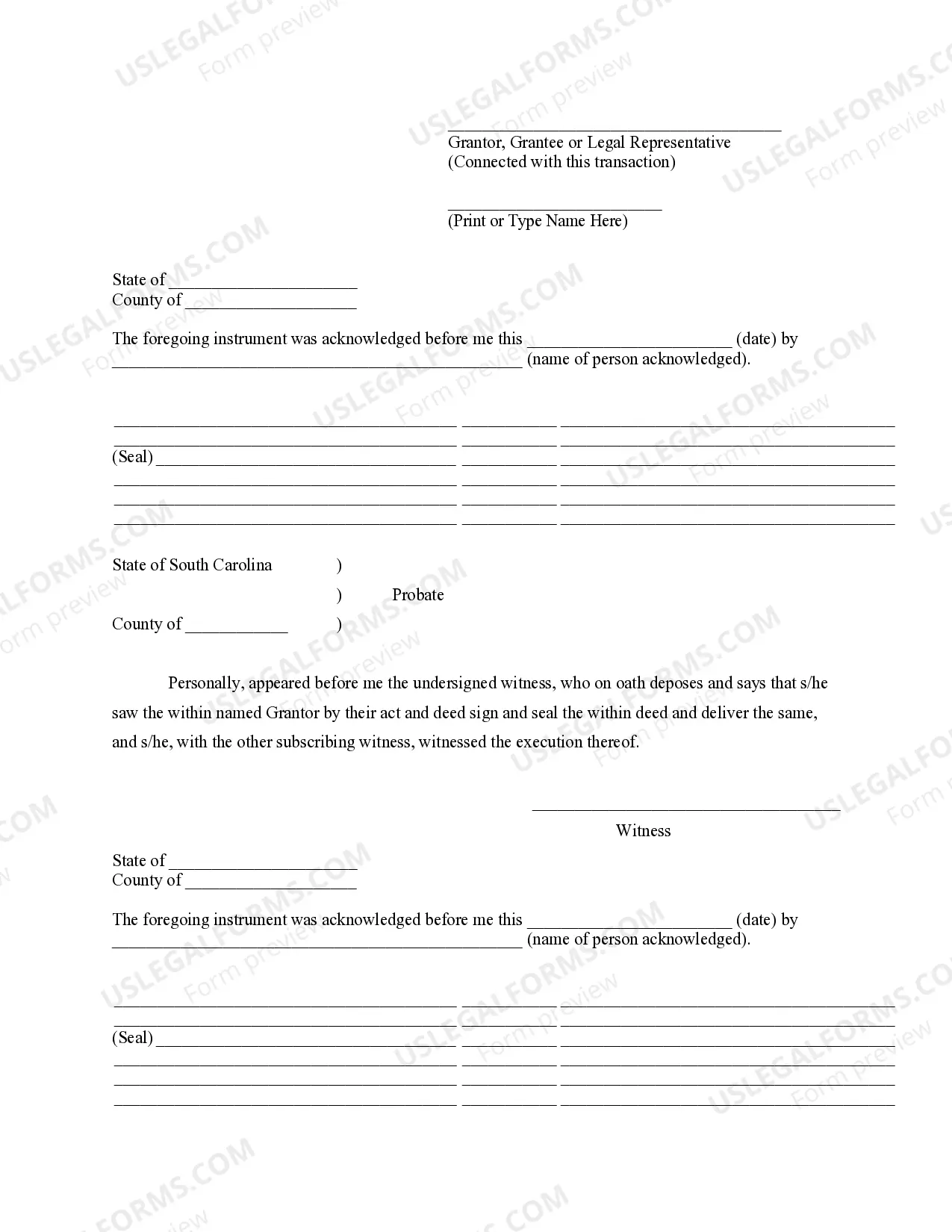

How to fill out South Carolina Quitclaim Deed For Trustee To Husband And Wife As Joint Tenants With The Right Of Survivorship?

- If you're a returning user, log in to your account and select the form template you need. Ensure your subscription is active; if not, renew it according to your plan.

- For first-time users, begin by browsing the vast library to identify the form you require. Review the preview mode and form description to confirm it's suitable.

- Should you need a different document, utilize the Search bar to find the correct form that meets your criteria.

- Once you've settled on the right form, click the Buy Now button and select your preferred subscription plan. You'll need to create an account to unlock the complete resources.

- Complete the purchase by entering your credit card or using your PayPal account for the subscription payment.

- Finally, download your form and save it to your device so you can complete it whenever needed. You can access it later from the My Forms section.

With US Legal Forms, you can confidently navigate your legal document needs. This platform empowers you to complete forms efficiently, ensuring you have access to comprehensive support and expertise.

Start your journey today by exploring the extensive library and obtain the legal forms you need for South Carolina!

Form popularity

FAQ

The split between North and South Carolina was primarily driven by varying economic interests and cultural differences. The north focused on small farms and commerce, while the south emphasized plantation agriculture. These disparities cultivated tensions that eventually led to separation. Recognizing these historical factors enhances your awareness of your South Carolina right for us in the current context.

Carolina split into North and South Carolina in 1712 due to geographic, economic, and political differences. The northern and southern regions had distinct populations, economies, and governance preferences. This division allowed each area to cater better to its unique needs. Understanding this split aids in comprehending how it shapes your South Carolina right for us today.

The United States gained South Carolina following the American Revolution, which led to the formation of a new nation from former British colonies. Initially settled as a colony, South Carolina became one of the original thirteen states to ratify the Constitution. This transition marked a significant step towards American unity and independence. By learning about this history, you can appreciate your South Carolina right for us even more.

South Carolina came to America as part of the broader European exploration and colonization efforts during the 16th and 17th centuries. It offered ideal conditions for agriculture and trade, particularly for crops like rice and indigo. These factors prompted settlers to establish a colony that would flourish economically. Embracing this historical context can deepen your understanding of your South Carolina right for us.

South Carolina was founded in 1663 as part of the proprietary colony established by a group of eight English noblemen. They aimed to expand trade and establish agricultural settlements in the New World. The fertile land attracted settlers seeking economic opportunities. It’s essential to recognize the roots of South Carolina, as they highlight the state’s enduring significance, connecting us to our South Carolina right for us.

In South Carolina, the right of way generally refers to who has the legal authority to proceed first in traffic situations. It is essential for the safety of all road users. Familiarity with right of way rules can help prevent accidents and ensure smooth traffic flow. Understanding these laws is vital, and utilizing resources knows your South Carolina right for us can enhance your knowledge.

Becoming a resident of South Carolina involves meeting certain criteria that demonstrate your intent to live in the state. Housing, employment, and community involvement all contribute to your residency status. For example, if you are employed and live in the state for a significant portion of the year, you may be recognized as a resident. Remember, knowing your South Carolina right for us is crucial in these matters.

To qualify as a resident of South Carolina, you must establish a domicile in the state. This means you need to make South Carolina your primary and permanent home. Factors such as registering to vote, getting a South Carolina driver's license, and filing state taxes can help confirm your status. Understanding your South Carolina right for us can ease this process.

Certain types of retirement income are not subject to South Carolina state taxes, including benefits from Social Security and some pension sources. Understanding what is exempt from state taxation can significantly impact your retirement strategy. This knowledge reinforces the point that South Carolina is the right choice for us, providing opportunities for tax-efficient retirement planning.

South Carolina does tax IRA withdrawals, which is important for residents to keep in mind when planning for retirement. However, you may qualify for deductions or exemptions based on your age and income level. This aspect emphasizes the significance of understanding tax regulations, making South Carolina the right choice for us as we plan our financial future.