South Carolina Quitclaim Deed for Trustee to Husband and Wife as Joint Tenants with the Right of Survivorship

What is this form?

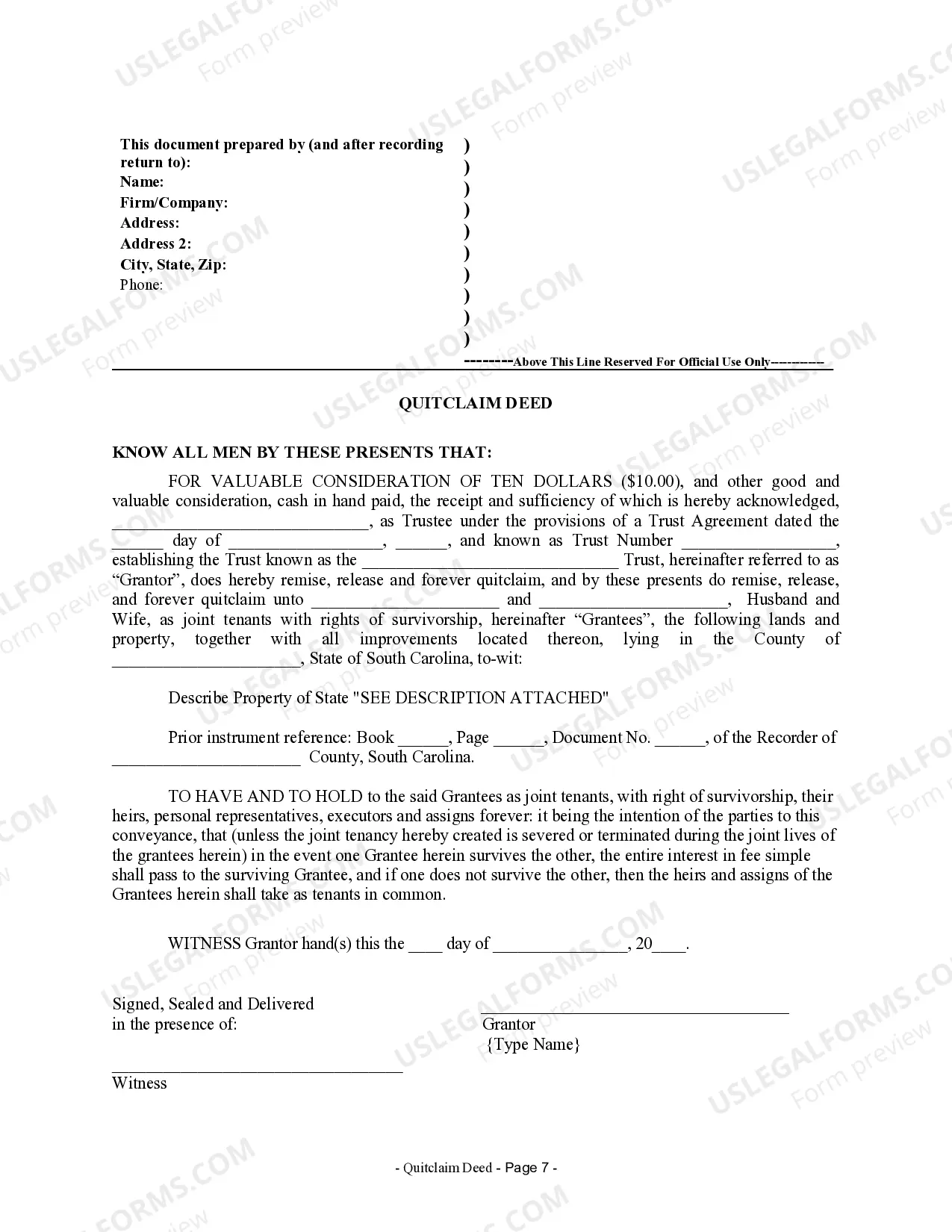

This Quitclaim Deed allows a trustee to convey property to a husband and wife as joint tenants with the right of survivorship. It is unique because it specifically designates the nature of ownership, ensuring that if one spouse passes away, the other automatically inherits the full property interest. This form differs from general deeds as it does not provide any warranty regarding the title, making it a straightforward method for transferring property ownership without guarantees about past ownership claims.

Key parts of this document

- Names of the grantor (trustee) and grantees (husband and wife)

- Legal description of the property being transferred

- Declaration of joint tenancy with right of survivorship

- Signatures of the grantor, witnesses, and notary public

- Date of execution to indicate when the property transfer occurs

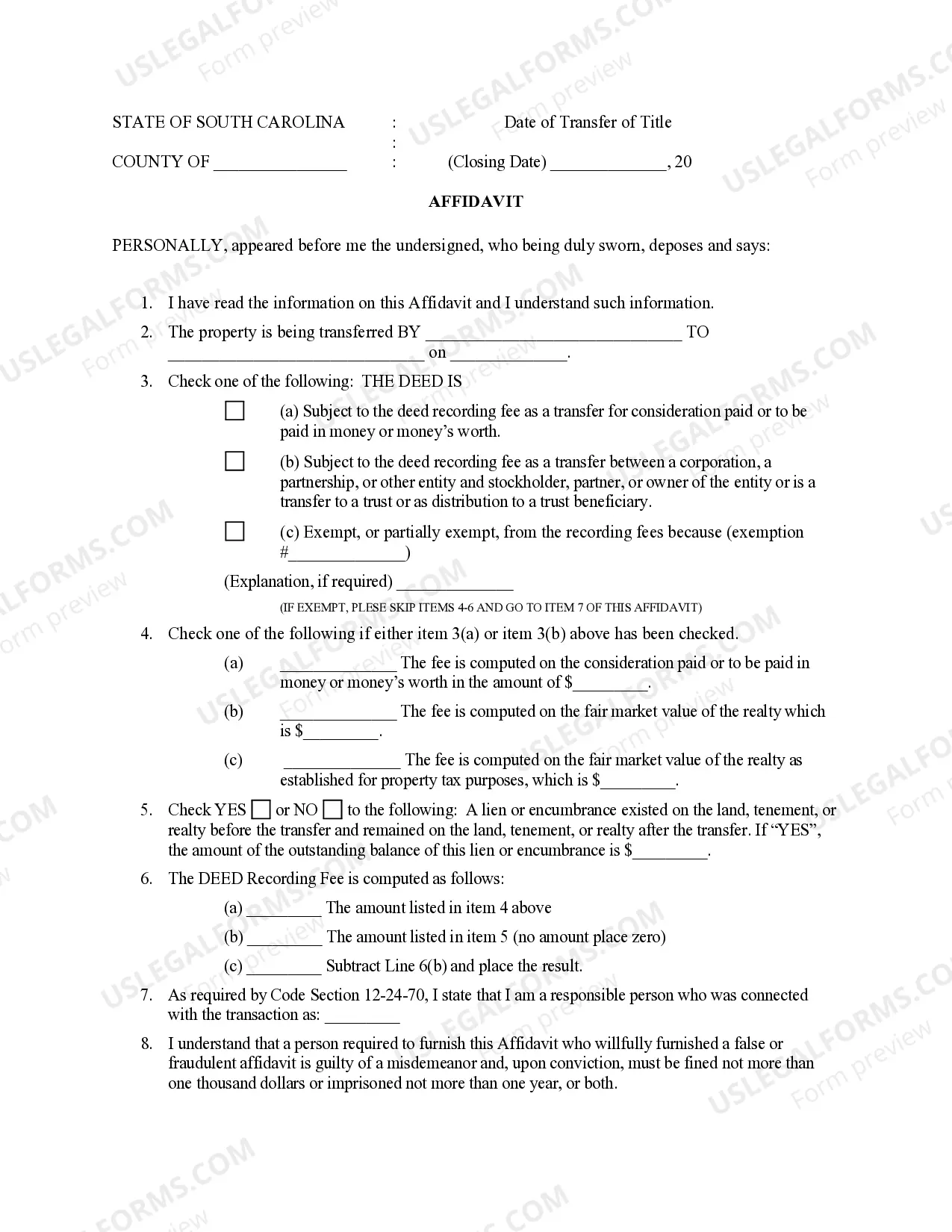

- Affidavit of true consideration for any fees associated with the transfer

When to use this form

This form is typically used when a trustee wishes to transfer property owned by a trust to a married couple, granting them joint ownership. This may occur in scenarios such as estate planning, where the property needs to be moved into joint ownership for beneficial purposes, or to simplify transfer after one spouse's death. It helps avoid probate issues and ensures the surviving spouse retains full ownership without complications.

Intended users of this form

- Trustees acting on behalf of a trust

- Married couples looking to establish joint ownership of property

- Individuals who want to ensure seamless property transfer as part of estate planning

Steps to complete this form

- Identify and enter the names of the grantor (trustee) and grantees (husband and wife).

- Provide a detailed legal description of the property being transferred.

- Include the date on which the deed is executed.

- Have the grantor and two witnesses sign the document, ensuring the names are also printed beneath the signatures.

- Seek notarization from a licensed notary public to validate the deed.

- If applicable, complete the affidavit of true consideration for recording fees.

Does this form need to be notarized?

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to provide a complete legal description of the property.

- Not using original signatures as required for filing.

- Omitting the date of execution or leaving it unclear.

- Not having the required number of witnesses present during signing.

- Neglecting to notarize the deed before submission.

Why complete this form online

- Convenience of completing forms from home without visiting an attorney.

- Immediate access to state-specific legal templates, ensuring compliance with local laws.

- Easy to fill out using Microsoft Word, allowing for flexibility in completing or adjusting the form as needed.

- Secure storage and retrieval options for your legal documents.

- Available guidance and support throughout the document completion process.

Quick recap

- The Quitclaim Deed for Trustee to Husband and Wife as Joint Tenants is crucial for transferring property ownership efficiently.

- It allows for a seamless transfer of ownership upon death, benefiting estate planning considerations.

- Careful completion, including notarization and proper legal descriptions, is essential for the document's validity.

Looking for another form?

Form popularity

FAQ

A quitclaim deed affects ownership and the name on the deed, not the mortgage. Because quitclaim deeds expose the grantee to certain risks, they are most often used between family members and where there is no exchange of money.Quitclaim deeds transfer title but do not affect mortgages.

If you sign a quitclaim deed to release yourself from ownership of the property or a claim to the title, then that doesn't mean you are no longer held accountable for the mortgage payment.Otherwise, you may be held responsible for unpaid payments despite no longer having a claim to the title.

A person who is a party to a deed, and owns it as a joint tenancy with a right of survivorship can create a trust. The party can then transfer his/her share of the property into the trust.

It is also crucial that a spouse know about the loan, even if he or she is not on the mortgage. In general, the spouse must sign a deed of trust, the Truth in Lending and Right to Cancel documents. By signing these documents, they are simply acknowledging the existence of the mortgage.

In order to transfer ownership of the marital home pursuant to a divorce, one spouse is going to need to sign a quitclaim deed, interspousal transfer deed, or a grant deed, in order to convey the title to the property.

In states like California and Florida, the spouses may use a quitclaim deed to transfer the property without warranting title. Other stateslike Texasrecognize a similar type of deed called a deed without warranty.

In order to sever the right of survivorship, a tenant must only record a new deed showing that his or her interest in the title is now held in a Tenancy-in-Common or as Community Property.

A person who signs a quitclaim deed to transfer property they do not own results in no title at all being transferred since there is no actual ownership interest. The quitclaim deed only transfers the type of title you own.