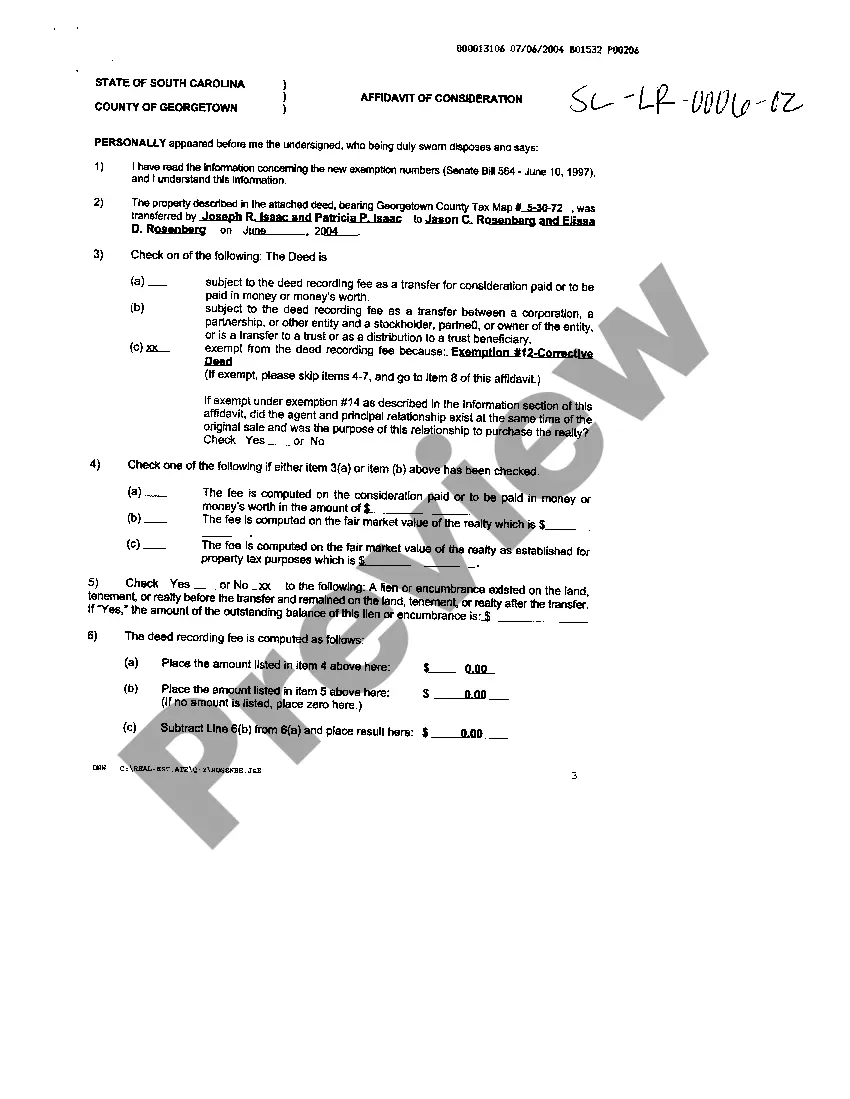

South Carolina Affidavit Of Consideration For Use By Seller

Description

How to fill out South Carolina Affidavit Of Consideration?

How can you obtain professional legal forms that adhere to your state regulations and prepare the South Carolina Affidavit Of Consideration For Use By Seller without hiring a lawyer.

Numerous online services provide templates for various legal situations and formalities. However, it may require some time to determine which of the accessible samples align with both your needs and legal standards.

US Legal Forms is a trustworthy service that assists you in finding official documents created in accordance with the most recent state law updates, helping you save on legal fees.

If you lack a US Legal Forms account, follow the guide below: View the webpage you've accessed and check whether the form meets your requirements. Utilize the form description and preview options if available. If necessary, search for another sample in the header that includes your state. When you locate the correct document, click the Buy Now button. Select the most appropriate pricing plan, then Log In or create an account. Choose your method of payment (by credit card or through PayPal). Decide on the file format for your South Carolina Affidavit Of Consideration For Use By Seller and click Download. The downloaded templates will remain yours: you can always revisit them in the My documents section of your profile. Join our library and create legal documents independently like a seasoned legal professional!

- US Legal Forms is not a traditional web library.

- It is a compilation of over 85k verified templates for a wide array of business and personal scenarios.

- All documents are categorized by field and state to streamline your search process and reduce inconvenience.

- It also connects with robust solutions for PDF editing and electronic signatures, allowing users with a Premium subscription to efficiently finalize their paperwork online.

- Acquiring the required documents takes minimal time and effort.

- If you already possess an account, Log In and confirm your subscription status.

- Download the South Carolina Affidavit Of Consideration For Use By Seller by clicking the related button next to the file name.

Form popularity

FAQ

1- That I am owner in possession of . 2- That I purchased , measuring Sq. Yards situated within from S/o resident of vide sale deed bearing its document No. dated registered in the office of .

How to Transfer Real Estate in South CarolinaReview the property title to see who is officially listed on it.Sign the title over to the new owner in the place that is noted.Complete a general warranty deed to show the transfer of ownership from you to another.More items...

It is customary for the seller of the property to pay all real estate transfer taxes in South Carolina. The transfer taxes are usually due at the time of closing, alongside other fees such as appraisal fees or agent fees.

The fee is $1.85 on realty value of $100-$500 and $1.85 ($1.30 for state portion and $0.55 for county portion) for each $500 increment afterwards.