Living trusts are an integral part of estate planning in South Carolina (SC), designed to help individuals manage and distribute their assets during their lifetime and after their passing. A living trust, also known as a revocable trust, is a legal entity created by an individual (known as the granter or settler) to hold their assets for their own benefit during their lifetime, and subsequently, to transfer those assets to designated beneficiaries upon their death. In SC, there are different types of living trusts, each serving a specific purpose and meeting the varied needs of individuals. These include: 1. Revocable Living Trust: This is the most commonly used trust in SC. It allows the granter to maintain complete control over their assets, making changes or even revoking the trust at any time. With a revocable living trust, the assets titled in the trust avoid probate upon the granter's death, allowing for a smoother and private distribution process to beneficiaries. 2. Irrevocable Living Trust: Unlike a revocable trust, an irrevocable living trust cannot be easily modified or revoked without the consent of all interested parties. By placing assets in an irrevocable trust, the granter effectively removes them from their estate, potentially providing tax advantages and protecting those assets from certain creditors. 3. Special Needs Trust: These trusts are created to benefit individuals with disabilities or special needs. They are designed to hold assets for the benefit of the disabled person without jeopardizing their eligibility for government benefits. Special needs trusts ensure that the beneficiary can continue to receive essential financial assistance while still benefiting from the additional support provided by the trust. 4. Testamentary Trust: While not technically a living trust, a testamentary trust is created through a provision in a person's will. It only comes into effect upon the granter's death, and it allows for asset management and distribution according to the terms outlined in the will. Testamentary trusts can be tailored to meet the specific needs of beneficiaries, such as minors or individuals with special needs. Living trusts in SC offer numerous benefits, including avoiding probate, maintaining privacy, and providing flexibility in managing and distributing assets. Establishing a living trust with the assistance of an experienced estate planning attorney ensures that your assets are protected and efficiently transferred to your intended beneficiaries in accordance with your wishes. If you reside in SC or have significant assets in the state, consulting with a knowledgeable professional for tailored advice is highly recommended.

Living Trust In Sc

Description

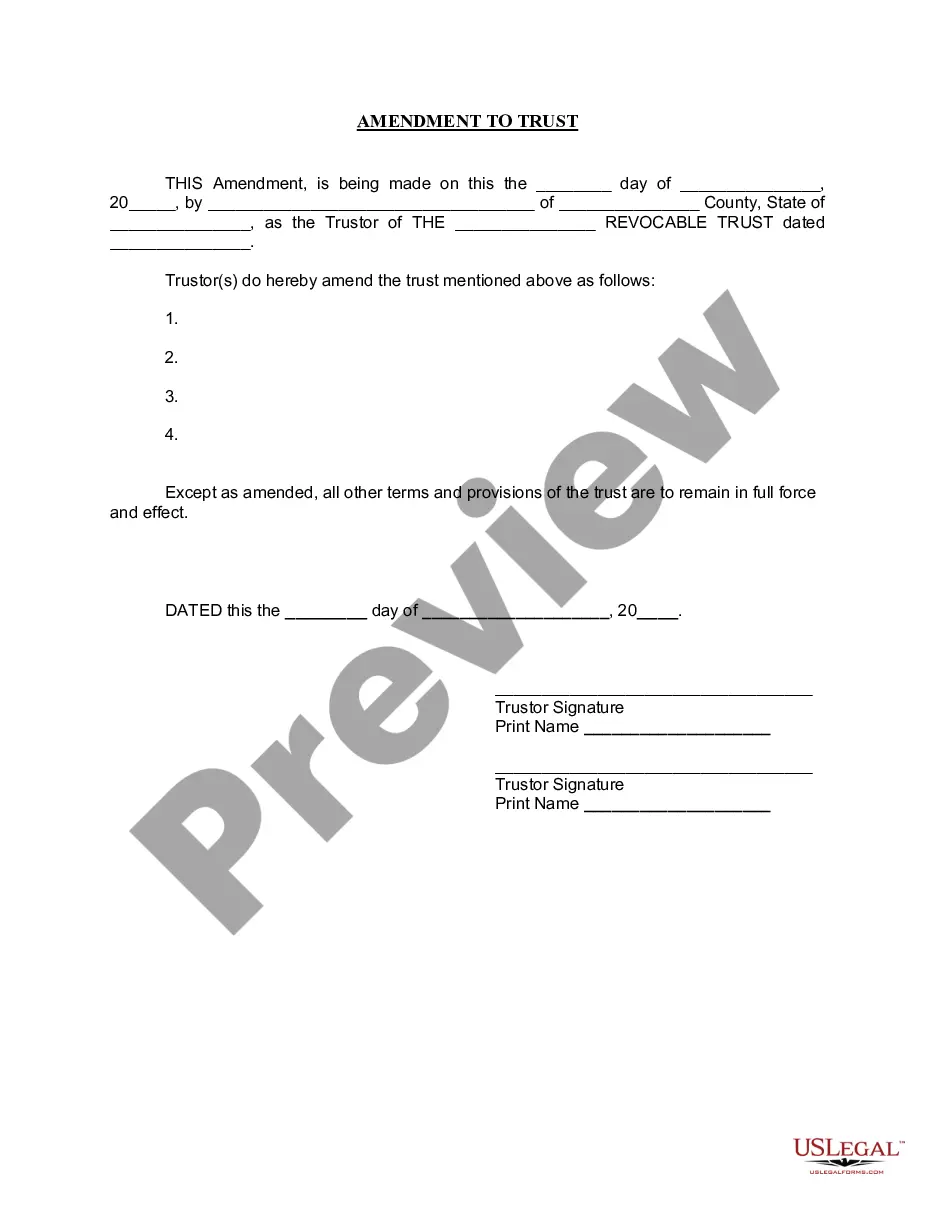

How to fill out Living Trust In Sc?

Handling legal papers and procedures can be a time-consuming addition to your day. Living Trust In Sc and forms like it usually require you to search for them and navigate the way to complete them effectively. As a result, whether you are taking care of financial, legal, or individual matters, using a extensive and convenient web library of forms when you need it will greatly assist.

US Legal Forms is the best web platform of legal templates, featuring over 85,000 state-specific forms and numerous tools that will help you complete your papers effortlessly. Check out the library of pertinent papers available with just one click.

US Legal Forms provides you with state- and county-specific forms available at any moment for downloading. Shield your document managing processes with a high quality service that lets you put together any form in minutes without having additional or hidden charges. Simply log in to your account, locate Living Trust In Sc and download it immediately from the My Forms tab. You can also access formerly saved forms.

Could it be the first time using US Legal Forms? Register and set up up a free account in a few minutes and you will have access to the form library and Living Trust In Sc. Then, follow the steps below to complete your form:

- Ensure you have found the right form by using the Preview feature and looking at the form description.

- Choose Buy Now when ready, and choose the subscription plan that suits you.

- Choose Download then complete, sign, and print the form.

US Legal Forms has twenty five years of expertise helping users deal with their legal papers. Discover the form you require today and improve any operation without having to break a sweat.

Form popularity

FAQ

A living trust is used by individuals with complex estates, to avoid probate. A last will becomes public property after death, but a living trust does not. A living trust allows assets to be redistributed more quickly and with less expense.

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.

Generally, a Living Trust, produced by an attorney, ranges in price from $2,000 to $4,000. The Trust includes all documents required to establish the Trust, powers of attorney, both financial and healthcare-related. In California, a Will typically ranges from $400 to $700.

The cost of setting up a trust in South Carolina varies depending on the complexity of the trust and the attorney's fees. A basic Revocable Living Trust generally ranges from $1,000 to $3,000. More complex trusts can cost several thousand dollars more.

The South Carolina living trust is a legal instrument used to avoid probate during the disposition of an estate. The Settlor will place their property into the trust and assign a Trustee to manage it (the Settlor can put themselves as Trustee during their lifetime).