South Carolina Living Trust With Beneficiaries

Description

How to fill out South Carolina Living Trust For Husband And Wife With One Child?

Whether for business purposes or for individual matters, everybody has to deal with legal situations at some point in their life. Filling out legal paperwork requires careful attention, starting with selecting the correct form sample. For instance, when you select a wrong edition of the South Carolina Living Trust With Beneficiaries, it will be turned down when you send it. It is therefore essential to have a trustworthy source of legal documents like US Legal Forms.

If you have to get a South Carolina Living Trust With Beneficiaries sample, stick to these simple steps:

- Find the sample you need by utilizing the search field or catalog navigation.

- Check out the form’s description to ensure it matches your situation, state, and county.

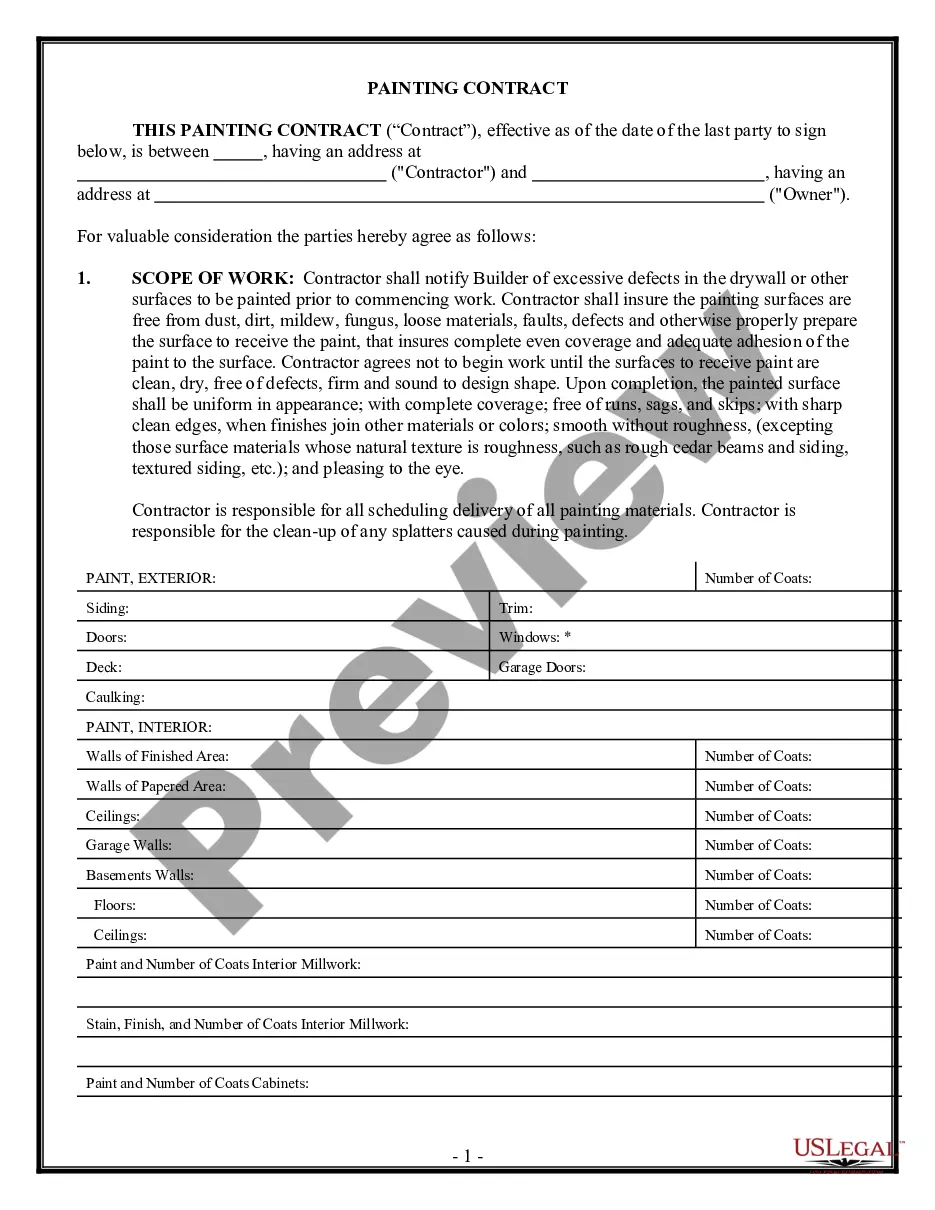

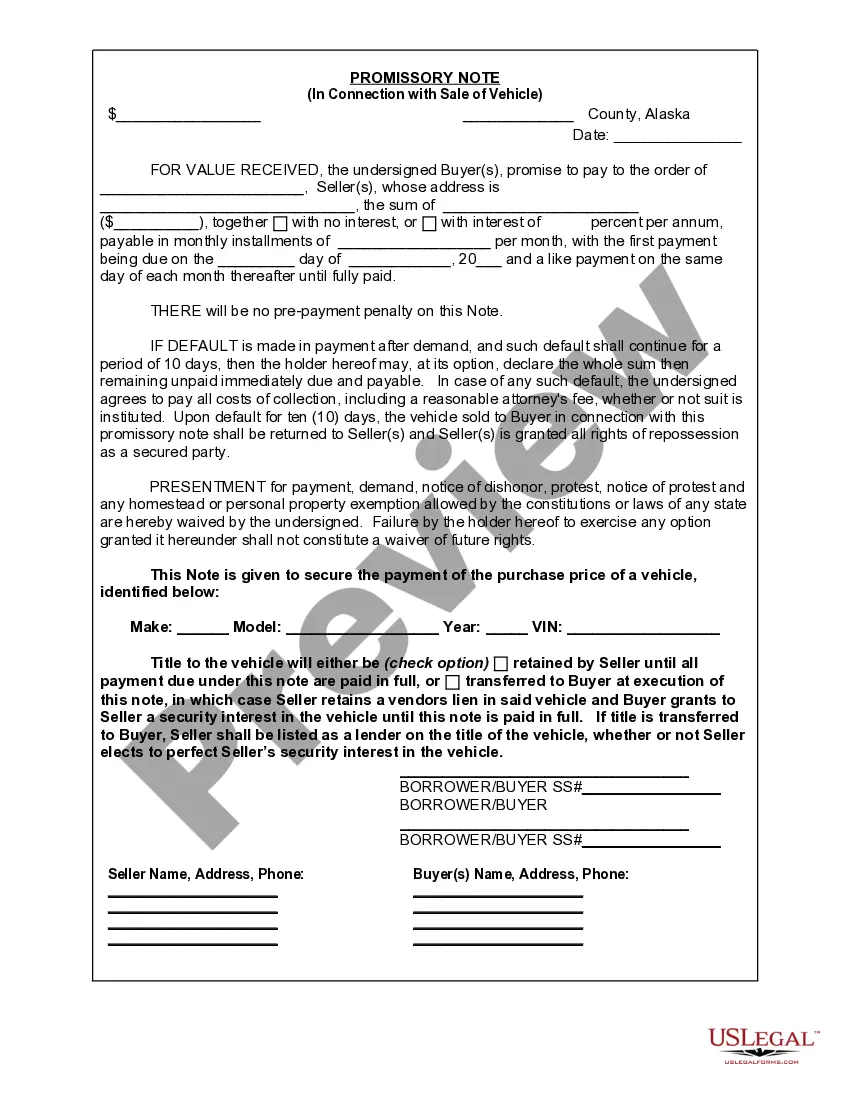

- Click on the form’s preview to examine it.

- If it is the wrong document, go back to the search function to locate the South Carolina Living Trust With Beneficiaries sample you need.

- Download the template if it matches your requirements.

- If you have a US Legal Forms account, simply click Log in to access previously saved files in My Forms.

- In the event you do not have an account yet, you can download the form by clicking Buy now.

- Pick the correct pricing option.

- Finish the account registration form.

- Choose your payment method: use a credit card or PayPal account.

- Pick the file format you want and download the South Carolina Living Trust With Beneficiaries.

- After it is saved, you can fill out the form by using editing applications or print it and complete it manually.

With a large US Legal Forms catalog at hand, you never need to spend time seeking for the appropriate sample across the web. Make use of the library’s straightforward navigation to get the correct form for any occasion.

Form popularity

FAQ

To leave property to your living trust, name your trust as beneficiary for that property, using the trustee's name and the name of the trust. For example: John Doe as trustee of the John Doe Living Trust, dated January 1, 20xx.

The cost of setting up a trust in South Carolina varies depending on the complexity of the trust and the attorney's fees. A basic Revocable Living Trust generally ranges from $1,000 to $3,000. More complex trusts can cost several thousand dollars more.

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.

Outright Trust Distributions They consist of the trustee releasing each beneficiary's inheritance without any restrictions. Outright distributions can either be made as a single lump sum, or periodically. Prior to making outright trust distributions, the trustee will need to pay the trust's debts and taxes.

The cost of setting up a trust in South Carolina varies depending on the complexity of the trust and the attorney's fees. A basic Revocable Living Trust generally ranges from $1,000 to $3,000. More complex trusts can cost several thousand dollars more.