South Carolina Foreign Llc Dissolution

Description

How to fill out South Carolina Dissolution Package To Dissolve Limited Liability Company LLC?

- If you're an existing US Legal Forms user, log into your account and download the required dissolution form. Ensure your subscription is active and renew it if necessary.

- For first-time users, start by browsing the Preview mode and reading the form descriptions. Confirm that the selected form meets your specific needs and complies with South Carolina's legal requirements.

- If you need to find a different template, enter keywords in the Search tab to locate a suitable form. Select the correct one before proceeding.

- Purchase the document by clicking the Buy Now button. Choose a subscription plan that fits your requirements and create an account to access the full library of forms.

- Complete your purchase by entering your credit card or PayPal information to finalize the subscription.

- Download the dissolution form to your device and complete it as needed. You can also access it later through the My Forms section of your profile.

US Legal Forms provides a user-friendly platform with an extensive library of over 85,000 forms, ensuring you have the resources you need for legal documentation. Their competitive pricing and expert assistance set them apart in the market.

In summary, dissolving your foreign LLC in South Carolina is made easier with US Legal Forms. Start your dissolution process today and ensure your documents are accurately prepared. Act now to simplify your legal needs!

Form popularity

FAQ

A foreign entity refers to a business entity that operates in a state other than where it was formed. An LLC, or Limited Liability Company, is a specific type of business structure that provides limited liability to its owners. When considering South Carolina foreign LLC dissolution, it's essential to recognize that a foreign LLC is simply an LLC registered in a different state. Understanding this distinction will help you navigate the filing and dissolution processes effectively.

Filing a foreign entity in South Carolina involves submitting the Application for Certificate of Authority along with your home state's certificate of good standing. Be mindful of the fees and information required, including your business name and principal address. Utilizing USLegalForms can streamline this journey, guiding you through each step of the South Carolina foreign LLC dissolution process. Once filed and approved, your business can operate legally within the state.

Yes, the CL100 form is generally required for certain business filings related to foreign LLCs. This form can pertain to various business activities and must be filed to confirm your compliance with South Carolina regulations. If you're navigating the South Carolina foreign LLC dissolution process, understanding your filing requirements is essential. Utilize resources such as uslegalforms to ensure you meet all obligations properly.

The CL-1 serves to recognize and authorize a foreign LLC to operate within South Carolina. It provides the state with your LLC’s basic information, including its jurisdiction of formation and business address. Filing this document not only ensures compliance but also protects your business's interests. This is especially crucial if you are considering South Carolina foreign LLC dissolution in the future.

1 is required for foreign LLCs wishing to conduct business in South Carolina. It provides the state with essential information about your LLC and must be filed with the Secretary of State. Not obtaining this certificate can hinder your business operations and complicate the South Carolina foreign LLC dissolution process. Make sure to submit your CL1 to remain compliant.

Yes, filing a CL-1, also known as the Application for a Certificate of Authority, is necessary for foreign LLCs operating in South Carolina. This form allows your foreign LLC to legally transact business in the state. Not filing a CL-1 can lead to fines or your business being unable to operate legally. Ensure compliance to avoid complications during the South Carolina foreign LLC dissolution.

Yes, you must file an annual report for your LLC in South Carolina. This report ensures that your business remains compliant with state regulations. If you fail to submit the report, you risk penalties, including potential dissolution of your LLC. Prioritizing your South Carolina foreign LLC dissolution process begins with staying current on your annual filing.

A Class 1 insured in South Carolina refers to individuals or entities holding an insurance policy that meets specific criteria defined by the state. In the context of South Carolina foreign LLC dissolution, it is essential to understand the implications of such classifications on your business's finances and obligations. Being classified as a Class 1 insured can impact your liability and risk management strategies. For detailed guidance on navigating these requirements, consider using the uslegalforms platform, which offers resources for ensuring compliance while you manage your LLC's dissolution.

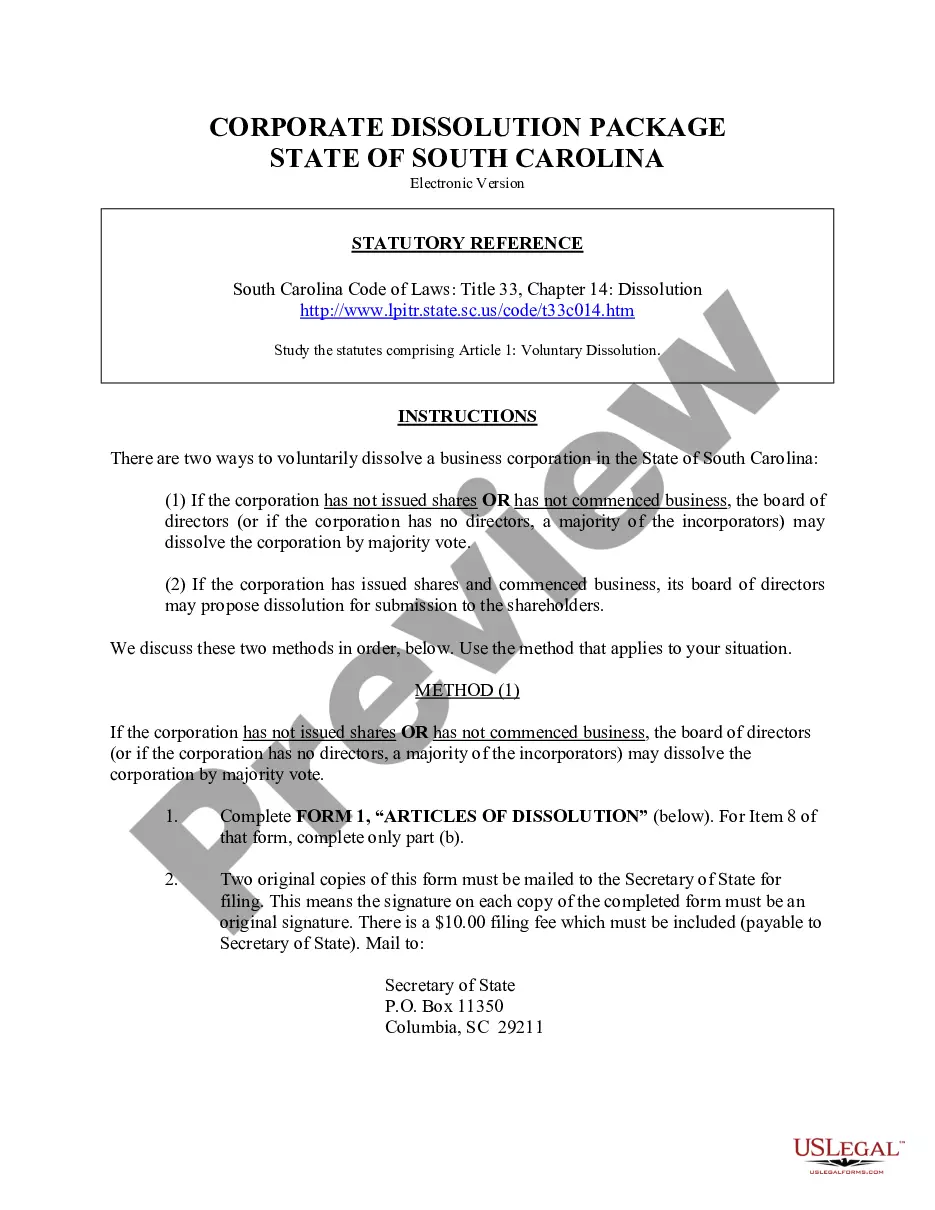

To dissolve your LLC in South Carolina, follow a structured process to ensure compliance. Start by settling any debts and obligations and obtaining member approval for the dissolution. Next, file the Articles of Dissolution with the Secretary of State. This formal process is essential in achieving a smooth South Carolina foreign LLC dissolution, allowing you to close your business responsibly.

Filing a foreign LLC in South Carolina involves submitting the CL-1 form to the Secretary of State along with necessary documentation. Ensure that your home state LLC is in good standing before starting the application. Following this process allows your foreign LLC to legally operate in South Carolina, paving the way for future decisions like a South Carolina foreign LLC dissolution when the time comes.